2/ At 25, Foley made the jump to tech.

In ‘96 amid the dot com boom, he joined Citysearch.

A stark contrast to making candy in Waco, he loved working w/talented people on challenging, motivating projects.

After two years, he went on to Harvard Business School.

In ‘96 amid the dot com boom, he joined Citysearch.

A stark contrast to making candy in Waco, he loved working w/talented people on challenging, motivating projects.

After two years, he went on to Harvard Business School.

3/ Post HBS, Foley accepted a job at BMG Music, signing a lease in NYC.

It was 2001. The recession and Napster crushed the music industry.

His role at BMG was eliminated before he started.

Jobless for months, Foley’s brother-in-law hired him at Ticketmaster.

It was 2001. The recession and Napster crushed the music industry.

His role at BMG was eliminated before he started.

Jobless for months, Foley’s brother-in-law hired him at Ticketmaster.

4/ Fast forward to 2010, Foley joined Barnes & Nobel.

Trying to compete with Amazon proved to be futile.

He’s 40 years old. Anxious. Wanting to prove himself.

Fortunately, he had an idea.

Trying to compete with Amazon proved to be futile.

He’s 40 years old. Anxious. Wanting to prove himself.

Fortunately, he had an idea.

7/ Friends & family

With his wife’s blessing, Foley recruited cofounders and raised Peloton’s seed round.

A friends and family round, Foley raised $400K @ $2M post from 8 angels.

The plan: combine an off-the-shelf tablet w/an exercise bike.

If only it were that simple...

With his wife’s blessing, Foley recruited cofounders and raised Peloton’s seed round.

A friends and family round, Foley raised $400K @ $2M post from 8 angels.

The plan: combine an off-the-shelf tablet w/an exercise bike.

If only it were that simple...

9/ New plan!

Peloton’s bike would be scratch-built.

But that’s expensive. They needed more money.

Foley was in his mid-40s. Had two kids.

He hit the fundraising trail to keep his business afloat.

Peloton’s bike would be scratch-built.

But that’s expensive. They needed more money.

Foley was in his mid-40s. Had two kids.

He hit the fundraising trail to keep his business afloat.

10/ NO!

From 2011-14 Foley pitched 3,000 angels & 400 firms.

Almost everyone said no.

Eventually, he raised $10M from 100 angels.

Tiger Global was the first institutional investor earning $1.4B at IPO.

From 2011-14 Foley pitched 3,000 angels & 400 firms.

Almost everyone said no.

Eventually, he raised $10M from 100 angels.

Tiger Global was the first institutional investor earning $1.4B at IPO.

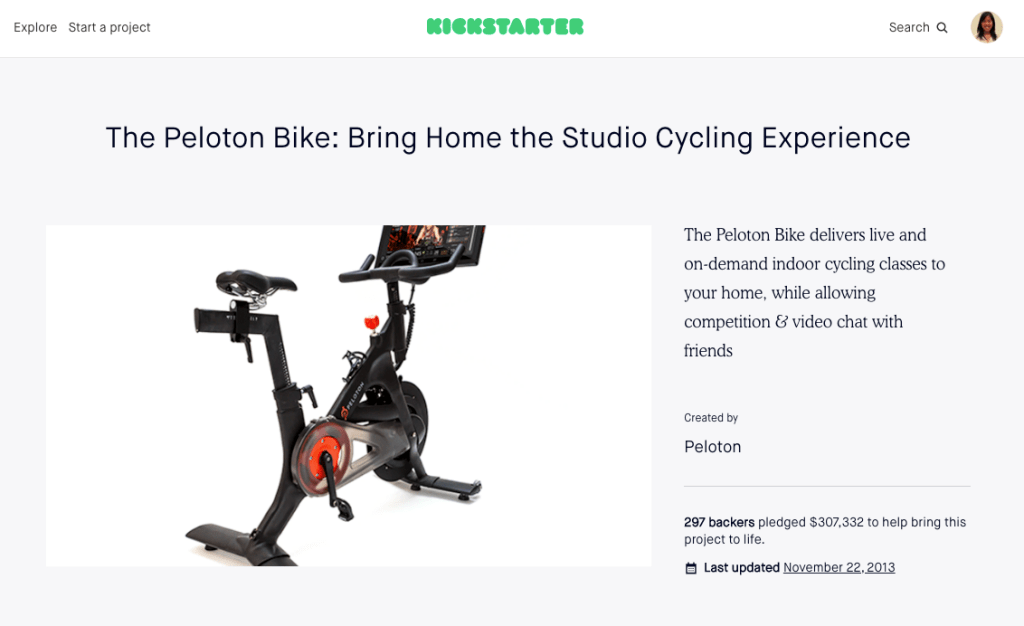

12/ The price is right!

Post-Kickstarter, $PTON launched a website.

The bike was priced at $1200.

Now, the product looked cheap.

They increased the price and sales increased!

Post-Kickstarter, $PTON launched a website.

The bike was priced at $1200.

Now, the product looked cheap.

They increased the price and sales increased!

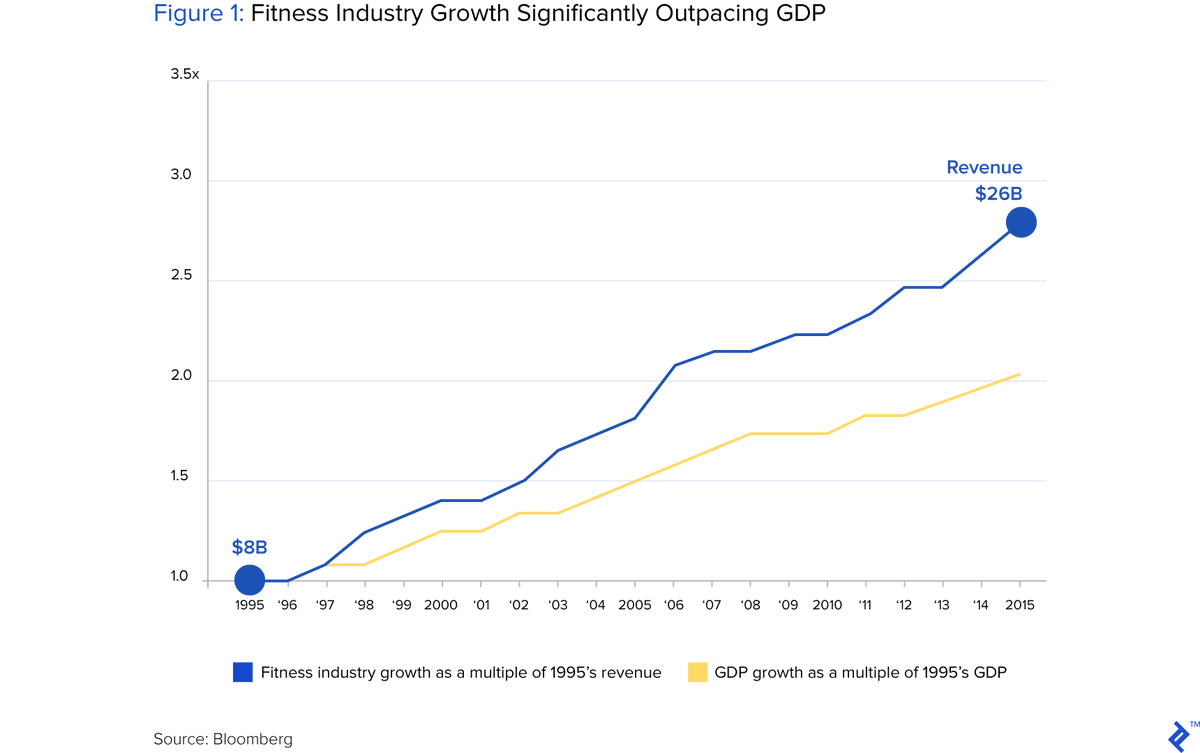

14/ By 2015, things were looking up.

That year, Foley raised $100M+ in funding.

More classes led to more engagement and more sales.

More traction = more investment.

The company raised nearly $1B in all by 2018.

That year, Foley raised $100M+ in funding.

More classes led to more engagement and more sales.

More traction = more investment.

The company raised nearly $1B in all by 2018.

For more content like this, subscribe to Fitt Insider — a free weekly newsletter and podcast dedicated to the business of fitness and wellness.

Join readers from companies like Peloton, Apple, Nike, and Goldman Sachs here:

insider.fitt.co

Join readers from companies like Peloton, Apple, Nike, and Goldman Sachs here:

insider.fitt.co

Inspired by incredible threads from:

@kevinleeme @JoePompliano @tobydoyhowell @mariodgabriele @theSamParr @APompliano

@kevinleeme @JoePompliano @tobydoyhowell @mariodgabriele @theSamParr @APompliano

Loading suggestions...