3/ Consider an investor who imitates Warren Buffett.

He follows his trades, reads his letters, and watches YouTube videos.

He does not have Buffett's research, backup plans or temperament.

But he can copy only WHAT HE SEES. This is important.

Then the market crashes.

He follows his trades, reads his letters, and watches YouTube videos.

He does not have Buffett's research, backup plans or temperament.

But he can copy only WHAT HE SEES. This is important.

Then the market crashes.

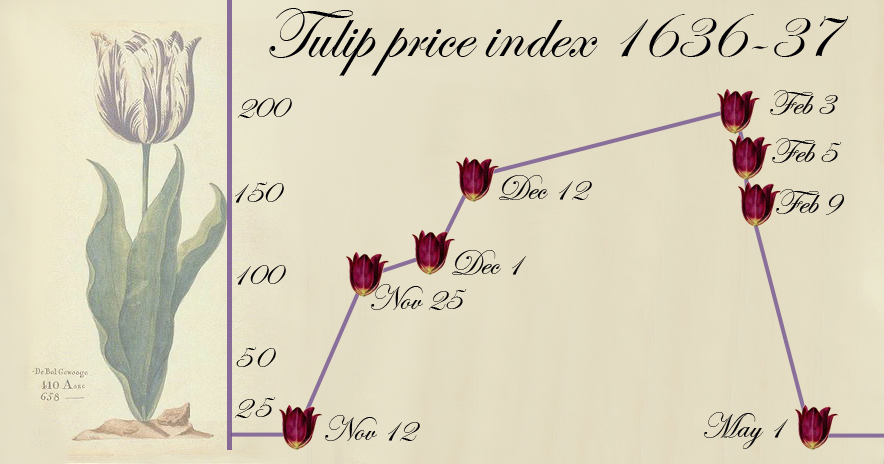

5/ A bubble starts with an idea - but no ordinary idea.

The idea has to change something fundamental about the world.

It cannot co-exist with how the world is now.

e.g

Railroads - Connectivity like never before

The internet - Revolutionized business

The hype starts to grow.

The idea has to change something fundamental about the world.

It cannot co-exist with how the world is now.

e.g

Railroads - Connectivity like never before

The internet - Revolutionized business

The hype starts to grow.

6/ Two people hear the hype.

One buys it, imitating the believers.

One avoids it, imitating cynics.

These are not mindless folks!

They have their own "reasons" for making their bets.

The defining quality of the bet is that it will pay off much MUCH later.

One buys it, imitating the believers.

One avoids it, imitating cynics.

These are not mindless folks!

They have their own "reasons" for making their bets.

The defining quality of the bet is that it will pay off much MUCH later.

8/ Because the promise is so novel and high stakes, the bet becomes do-or-die.

The world has no place for both the status quo and the new idea.

Hype starts to build, and everyone starts to pick a side.

The other side isn't just mistaken, they are "delusional" or "stupid".

The world has no place for both the status quo and the new idea.

Hype starts to build, and everyone starts to pick a side.

The other side isn't just mistaken, they are "delusional" or "stupid".

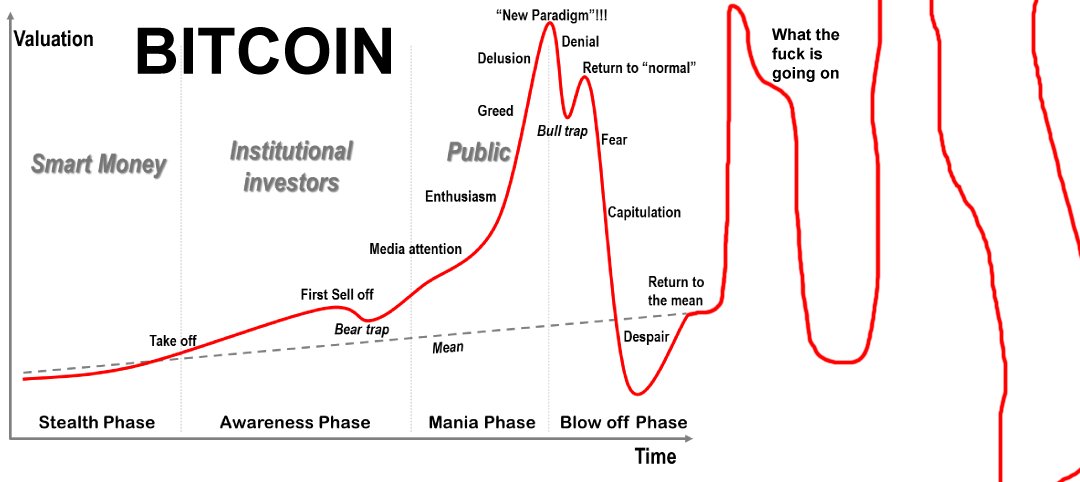

10/ As the hype reaches a point of no-return, the mimics look around.

They realise there's no one waiting in the wings to whom they can sell. And the future isn't here yet.

They panic, they sell, the bubble bursts.

And that's the end of a bubble. Unless...

They realise there's no one waiting in the wings to whom they can sell. And the future isn't here yet.

They panic, they sell, the bubble bursts.

And that's the end of a bubble. Unless...

12/ Bubbles DO change the world.

Maybe not in the way that people want.

The 1840s British railroad bubble led to connectivity.

The 1920s electricity bubble led to industrialisation.

You are reading this because of the dot-com bubble.

But investors burnt their hands.

Maybe not in the way that people want.

The 1840s British railroad bubble led to connectivity.

The 1920s electricity bubble led to industrialisation.

You are reading this because of the dot-com bubble.

But investors burnt their hands.

14/ There are many ideas in the market now that can potentially change humanity.

Pharma.

Electric cars.

Crypto.

NFTs?

And seeing so many people on the bandwagon creates FOMO. What if we are ngmi?

Pharma.

Electric cars.

Crypto.

NFTs?

And seeing so many people on the bandwagon creates FOMO. What if we are ngmi?

15/ Mimesis is dangerous when it can affect your finances. FOMO and envy are strong motivators.

Remember, strong belief is not the same as wishful thinking looking at superficial indicators.

If you're investing because of FOMO, don't. You won't miss out on much.

There's time.

Remember, strong belief is not the same as wishful thinking looking at superficial indicators.

If you're investing because of FOMO, don't. You won't miss out on much.

There's time.

16/ This thread was inspired by the paper "Manias and Mimesis" by Tobias Huber and Byrne Hobart, and @kylascan's excellent article on narratives.

Do check it out!

cc: @Jack_Raines

Do check it out!

cc: @Jack_Raines

17/ Follow for interesting threads on investing and finance 2-3x a week.

If you enjoyed reading, please like and retweet the first tweet in the thread!

If you enjoyed reading, please like and retweet the first tweet in the thread!

Loading suggestions...