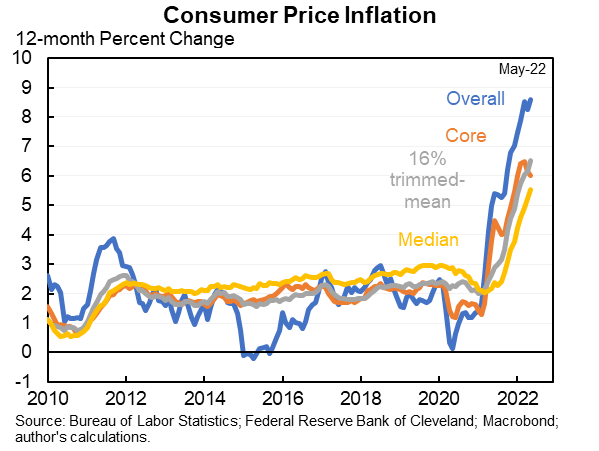

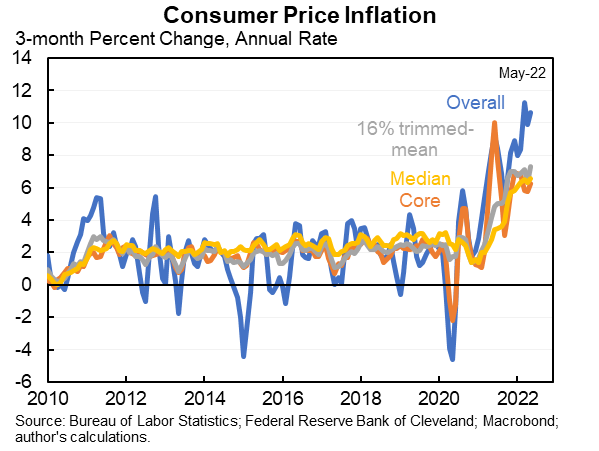

Note, the CPI is not a good predictor of future inflation because volatile food and energy inflation tends not to carry forward.

Economists tend to look at core CPI and it's still my favorite. But it also has a lot of volatility around goods prices, especially for cars.

Economists tend to look at core CPI and it's still my favorite. But it also has a lot of volatility around goods prices, especially for cars.

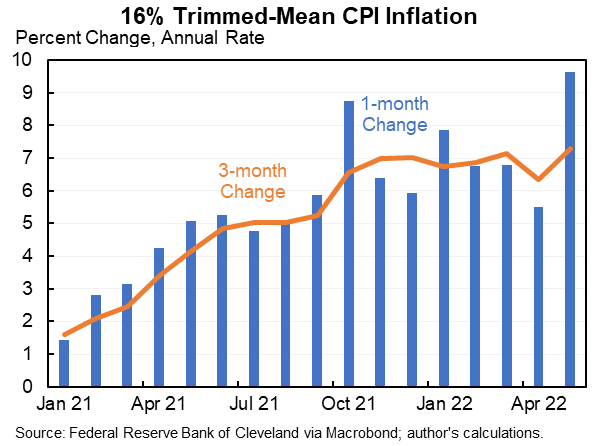

Some have argued we should be looking at trimmed mean and median CPI because they don't just strip out an arbitrary pre-determined set of things (like core) but actually drop the most volatile.

They were more reassuring for much of 2021.

Not any longer.

They were more reassuring for much of 2021.

Not any longer.

You can find all of these data here. They all look somewhat different for the PCE (which the Fed targets), we'll see what that is like for May in a few weeks.

clevelandfed.org

clevelandfed.org

P.S. My preferred measure of core inflation is still nominal wage growth minus 1.5 (to account for productivity growth). That is running at about 4%. So I do think underlying inflation is much lower than what we're seeing but much higher than the Fed is expecting.

P.P.S. But if all I had to go on was the data in the CPI report (and you couldn't look at wages or anything else), you would think the underlying rate of inflation was 6%+.

P.P.P.S. One more measure I could have included (I was just showing the full set of Cleveland ones).

Loading suggestions...