1/26 Today's shallow dive will focus on $V Visa, part of the duopoly in payments along with $MA.

We will focus on the biz model, moat, capital allocation, mgmt, and valuation.

All fun money stuff courtesy of @stratosphere_io, along with mgmt commentary @Quartr_App 🧵⬇️⬇️

We will focus on the biz model, moat, capital allocation, mgmt, and valuation.

All fun money stuff courtesy of @stratosphere_io, along with mgmt commentary @Quartr_App 🧵⬇️⬇️

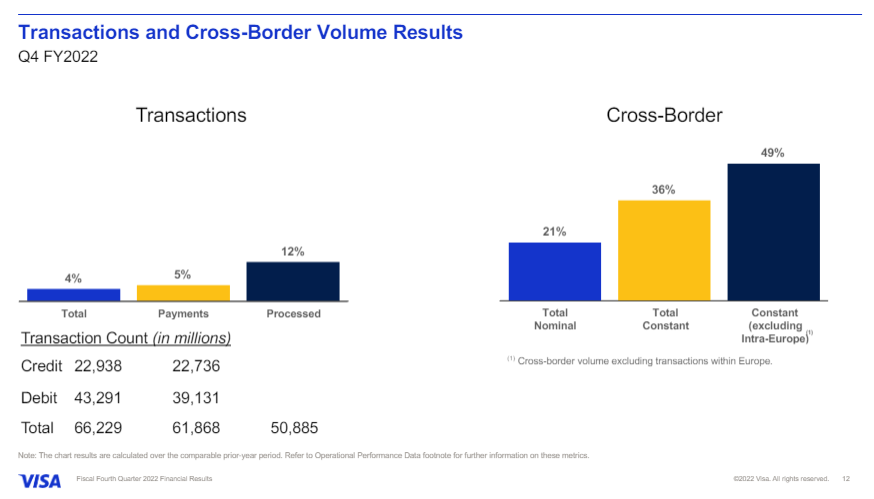

2/26 $V is one of the leading payment brands globally, as is its cousin $MA. Visa provides payment services to over 200 countries, ranging from individual consumers, merchants, financials, and governments.

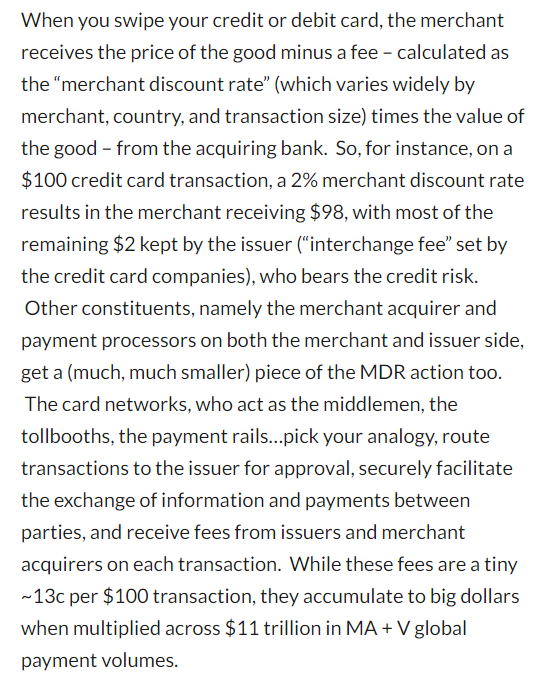

4/26 @scuttleblurb does a better job than I at describing how $V makes money, so below is an excerpt from his amazing blog, side note, subscribe, it's well worth your time and money.

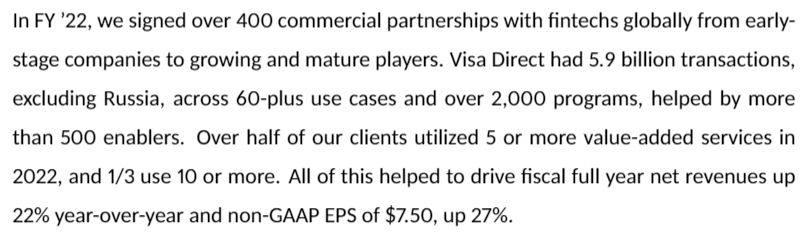

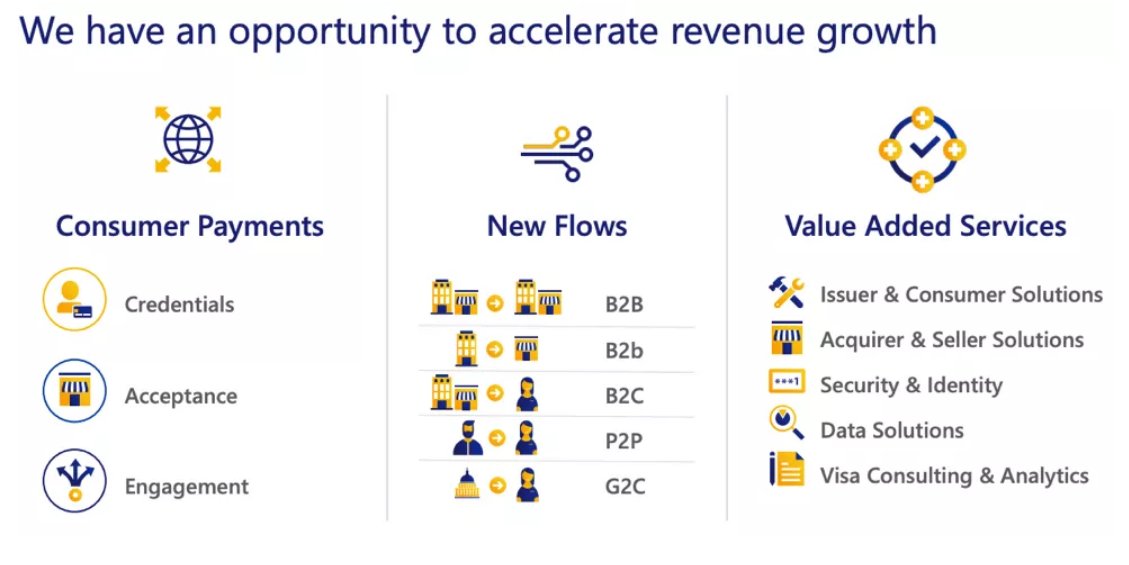

6/26 To achieve this vision, V works through the many different mediums of payment, such as:

📲 Contactless payments

💻E-commerce

🪙Digital wallets

V is the perfect example of a “multi-sided platform.”

📲 Contactless payments

💻E-commerce

🪙Digital wallets

V is the perfect example of a “multi-sided platform.”

7/26 $V’s platform creates cross-side network effects by enticing V cardholders more usage, which encourages more acceptance by merchants and round and round the flywheel goes. We can consider the merchants on the money side, and the consumer on the subsidy side of the equation.

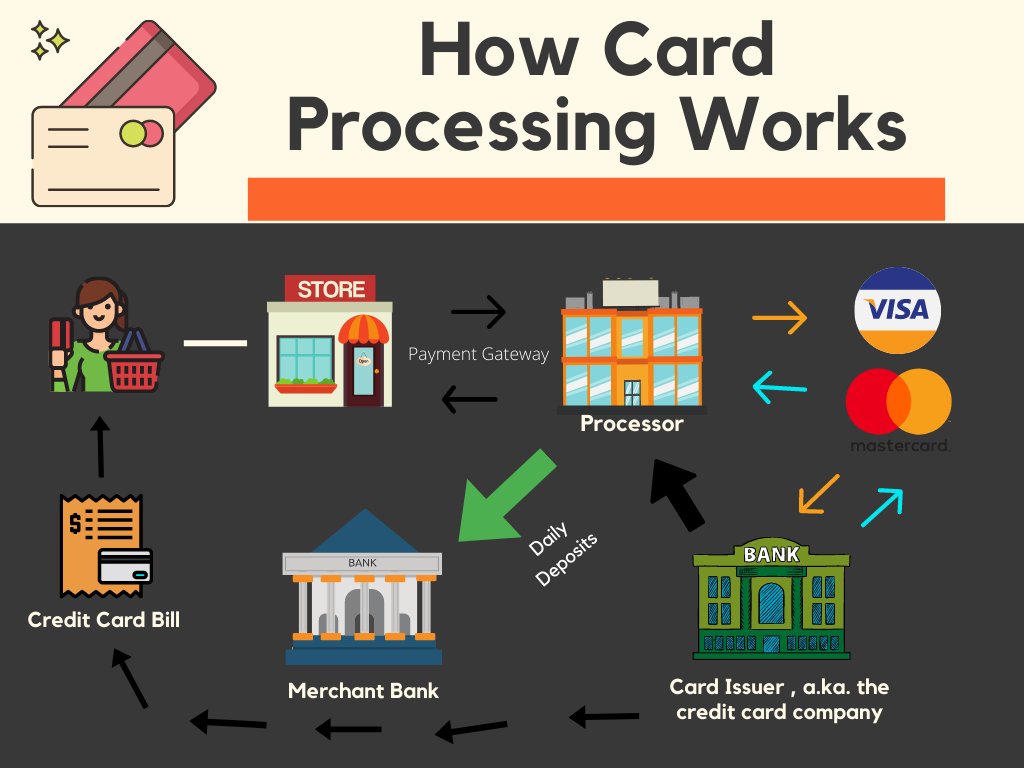

9/26 Banks use Visa Net’s payment processing protocol to develop and create credit card and debit card programs for their customers. As I mentioned before, Visa doesn’t issue credit cards or offer any credit on their own; that is done on the banking side.

10/26 Instead, Visa operates an open-loop payments network to help manage the flow of payment information between merchants and financial institutions like JP Morgan.

11/26 New players on the scene like $SQ and $PYPL also offer both sides of the equation, acquirers and issuers, with their Cash App Cards and Cash Card. For example, others in the payment processing space or payfacs, such as Stripe, $ADYEY, $FISV, and $FIS, are merchant acquirers

12/26 Strong corporate moats are costly to replace and make it challenging to get the same outcome. $V is a prime example of a company with a business model that is very resistant to disruption because of what is known as a two-sided network effect. @Quartr_App transcript.

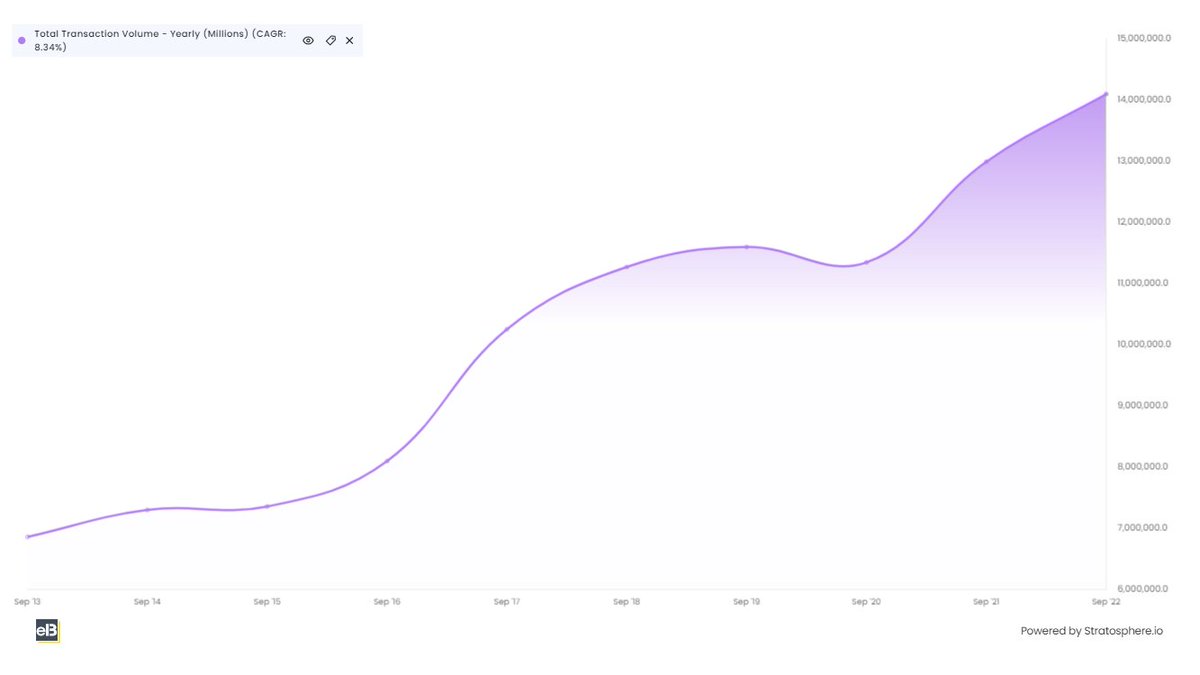

15/26 $V + $MA own around 95% of the payments market, excluding China, measured by purchase transaction amounts, with V controlling over 50%! The duopoly position V enjoys allows it to benefit from pricing power from the high barriers to entry.

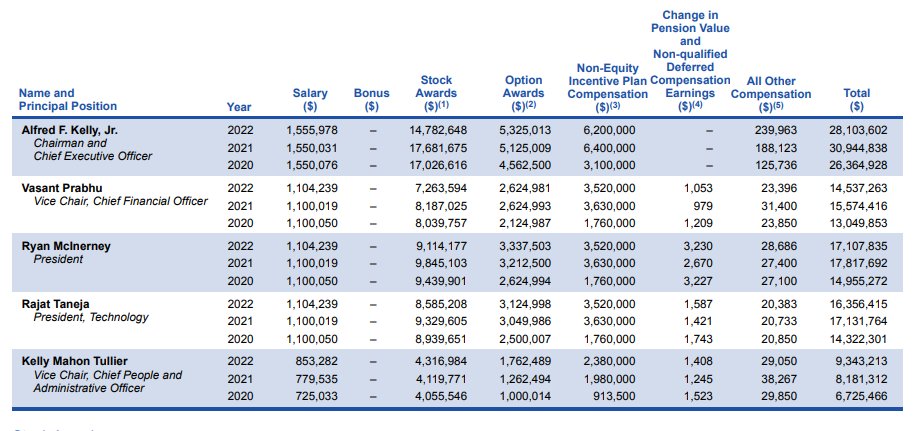

20/26 $V currently has 0% of insiders owning shares, with the largest counted among the usuals, Vanguard, Blackrock, and State Street owning 17% of shares and not much insider action lately.

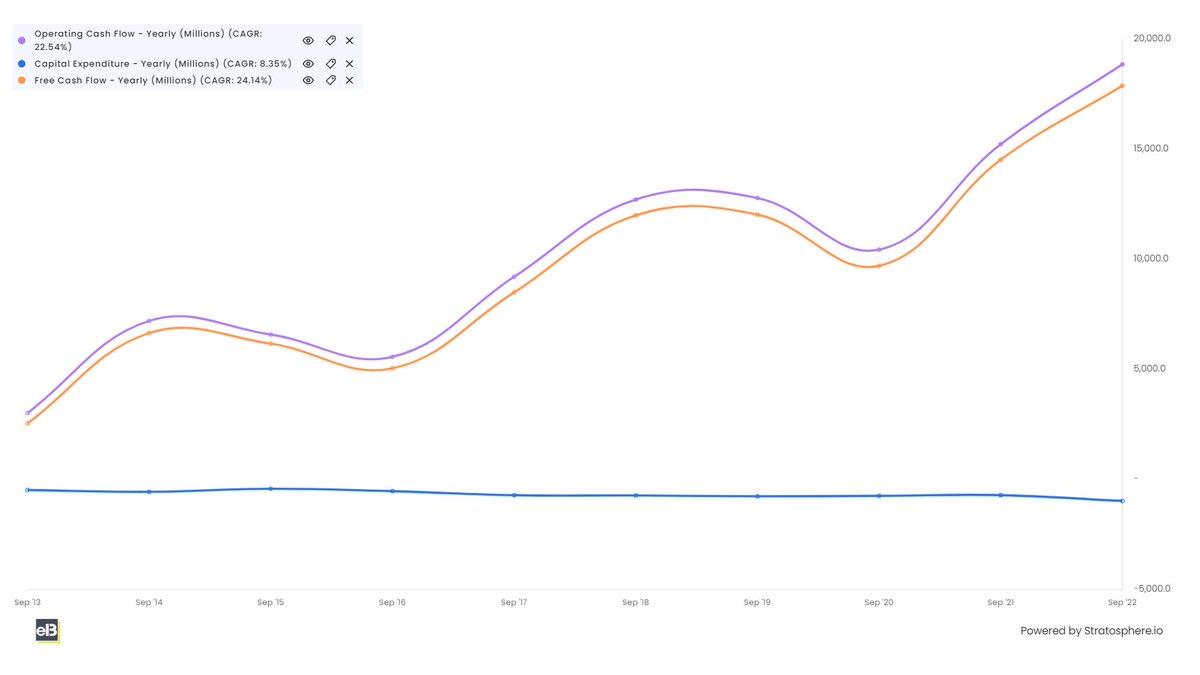

22/26 Now, Valuation using a DCF model to value $V. All inputs mine into a FCFF model:

Rev = 10%

Op margin = 64.2%

WACC = 8.81%

Sales to Cap ratio = 0.63

All of which gives us a fair value of $168 < price of $220. Reverse DCF with 15% gives us current price, all else equal.

Rev = 10%

Op margin = 64.2%

WACC = 8.81%

Sales to Cap ratio = 0.63

All of which gives us a fair value of $168 < price of $220. Reverse DCF with 15% gives us current price, all else equal.

23/26 I am long $V, and it is one of my biggest positions. To me, V falls into the great company at a fair price, great returns on capital, should do well over the long-run. Not investment advice here. When thinking about definition of moat, V should be the icon included.

24/26 Tried to be a little briefer here, for conciseness stake, if you would like longer, or more in depth going forward please let me know below. I could talk for hours about $V biz model, but if you want more info than explained here, please check out the article below.

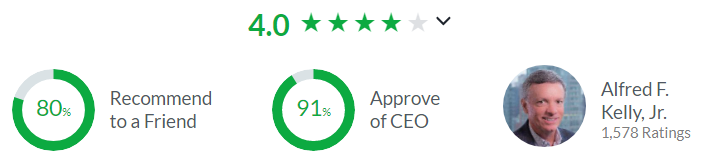

26/26 If you are still reading, thank you and I hope you find something of value here. Remember, I have only scratched the surface here, lots to uncover including risks, growth initiatives, and new CEO.

If you enjoyed this shallow dive, please consider following @IFB_podcast

If you enjoyed this shallow dive, please consider following @IFB_podcast

Loading suggestions...