Most threads on Tokenomics stop at beginner level.

And you're going to get WRECKED if you don't know the details.

If you want to go deep...

Here's a step-by-step guide to understanding Tokenomics completely 🧵

(+ Free resource )

And you're going to get WRECKED if you don't know the details.

If you want to go deep...

Here's a step-by-step guide to understanding Tokenomics completely 🧵

(+ Free resource )

I lost over $3,417 because I didn't understand Tokenomics.

But you don't have to.

Here's what I'll cover:

• What is Tokenomics

• Supply, Demand, and Incentives

• Memes and narratives

• Tokenomics examples

• Conclusion

Lets level up🤾♂️

But you don't have to.

Here's what I'll cover:

• What is Tokenomics

• Supply, Demand, and Incentives

• Memes and narratives

• Tokenomics examples

• Conclusion

Lets level up🤾♂️

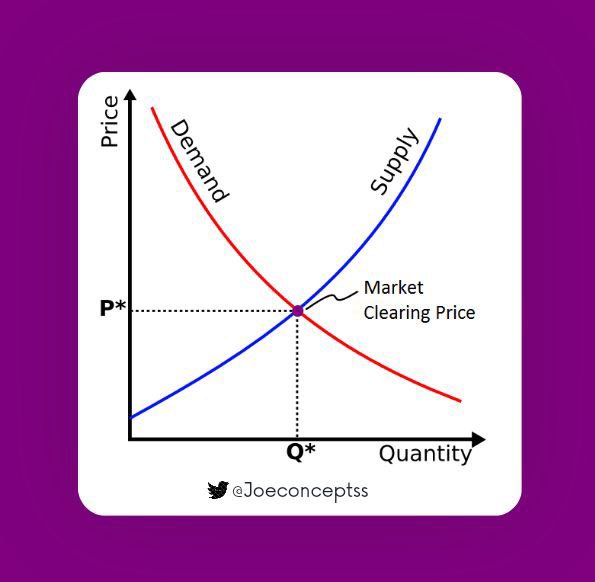

The simplest lens to see tokenomics it through demand and supply.

● Supply

The Nigerian government stopped printing money

The demand was there, but the supply crashed

So the value of "cash" went out of control.

That's the power of scarcity.

But there's more...

● Supply

The Nigerian government stopped printing money

The demand was there, but the supply crashed

So the value of "cash" went out of control.

That's the power of scarcity.

But there's more...

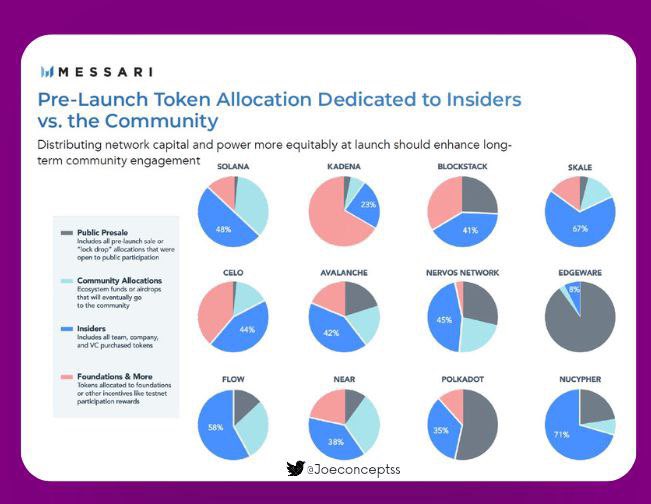

Here's what you should watch out for in tokenomics:

• The number of tokens in existence.

• How many tokens can ever exist?

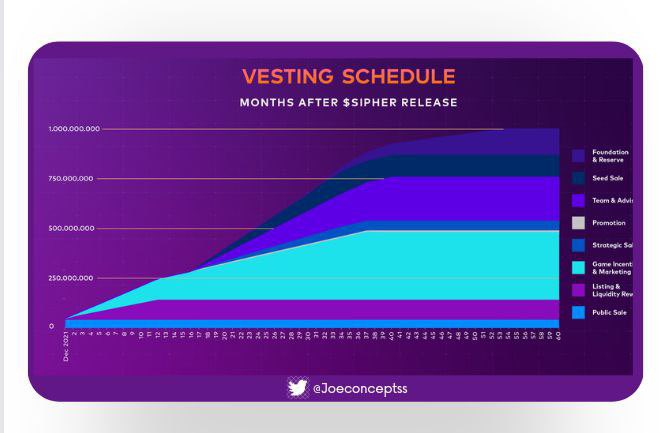

• Who has the initial token supply? When can they sell?

• How will the supply change over time?

• What are their policies for changing?

Also...

• The number of tokens in existence.

• How many tokens can ever exist?

• Who has the initial token supply? When can they sell?

• How will the supply change over time?

• What are their policies for changing?

Also...

Supply metrics you must know

• Supply: Number of tokens existing right NOW

• Max supply: Maximum number of tokens that can exist

• Market cap: Current price of one token * Circulating supply

• Fully diluted MC: Price of one token * Max supply

But why must you know them?

• Supply: Number of tokens existing right NOW

• Max supply: Maximum number of tokens that can exist

• Market cap: Current price of one token * Circulating supply

• Fully diluted MC: Price of one token * Max supply

But why must you know them?

They help predict future supply and scarcity.

For example...

Imagine that the circulating supply of a token is at 40%.

I won't feel great because there will be a later increase by 60%

And increased supply will dump the token's price.

Here are other examples...

For example...

Imagine that the circulating supply of a token is at 40%.

I won't feel great because there will be a later increase by 60%

And increased supply will dump the token's price.

Here are other examples...

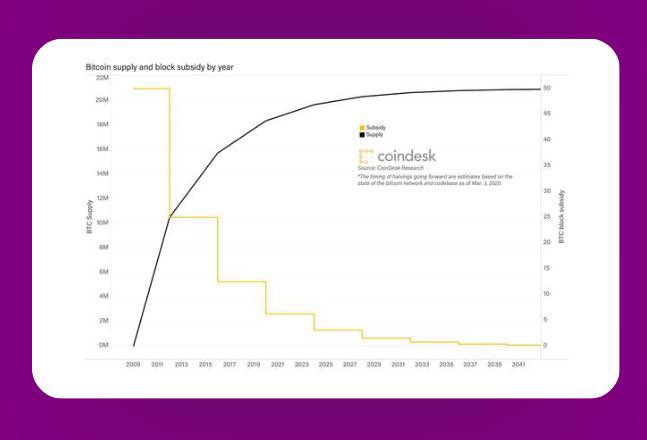

→ Bitcoin

There'll only be 21 Million Bitcoin in existence.

Once the cap it reached, no one can mine any more Bitcoin.

• Bitcoin's supply I limited

• Demand is rising

• This means the price should increase.

But here's another reason...

There'll only be 21 Million Bitcoin in existence.

Once the cap it reached, no one can mine any more Bitcoin.

• Bitcoin's supply I limited

• Demand is rising

• This means the price should increase.

But here's another reason...

→ Inflationary token—Dogecoin.

Dogecoin's supply is increasing every year with no cap to the supply.

This is bad for Tokenomics as there's no scarcity.

PS: The price of Dogecoin still went up in 2021 despite its bad Tokenomics.

(I'll explain why later, keep reading ↓)

Dogecoin's supply is increasing every year with no cap to the supply.

This is bad for Tokenomics as there's no scarcity.

PS: The price of Dogecoin still went up in 2021 despite its bad Tokenomics.

(I'll explain why later, keep reading ↓)

• The merge to proof of stake reduces the supply of ETH.

• EIP - 1,559 collects a portion of the transaction fees and burns it.

• High demand for ETH

A combination of the above means Ethereum will become deflationary despite that there's unlimited supply.

• EIP - 1,559 collects a portion of the transaction fees and burns it.

• High demand for ETH

A combination of the above means Ethereum will become deflationary despite that there's unlimited supply.

• The merge to proof of stake reduces the supply of ETH.

• EIP - 1,559 collects a portion of the transaction fees and burns it.

• High demand for ETH

A combination of the above means Ethereum will become deflationary despite that it has an unlimited supply.

• EIP - 1,559 collects a portion of the transaction fees and burns it.

• High demand for ETH

A combination of the above means Ethereum will become deflationary despite that it has an unlimited supply.

● Demand

These are the factors that make people want to buy, as well as the price they're willing to pay.

Demand is powerful.

With the current inflation, the U.S. Dollar is in high demand because of its Usefulness—Its UTILITY.

But what factors drive the demand for tokens?🤔

These are the factors that make people want to buy, as well as the price they're willing to pay.

Demand is powerful.

With the current inflation, the U.S. Dollar is in high demand because of its Usefulness—Its UTILITY.

But what factors drive the demand for tokens?🤔

We'll divide them into 3 categories...

1. Utility

2. Value Accrual

3. Memes and narratives

Should we break down each?

1. Utility

2. Value Accrual

3. Memes and narratives

Should we break down each?

Whew...Still here?

Cool 🏄🏾♀️

/1 UTILITY

Here are 2 examples...

→ Adoption

As crypto adds more real-world use cases, the increase in demand is INSANE.

• Bitcoin exploded when TSLA added it to its balance

• Dogecoin spiked up when AMC accepted it

And many more...

Cool 🏄🏾♀️

/1 UTILITY

Here are 2 examples...

→ Adoption

As crypto adds more real-world use cases, the increase in demand is INSANE.

• Bitcoin exploded when TSLA added it to its balance

• Dogecoin spiked up when AMC accepted it

And many more...

→ Gas fees

This is the payment for using a blockchain network.

•If you want to buy a token on Ethereum, you'll need ETH for gas fees.

• If you want to carry out any transaction on @optimismFND , you'll need Op to pay for gas.

Increased popularity = Increased demand

This is the payment for using a blockchain network.

•If you want to buy a token on Ethereum, you'll need ETH for gas fees.

• If you want to carry out any transaction on @optimismFND , you'll need Op to pay for gas.

Increased popularity = Increased demand

/2 VALUE ACCRUAL

→ Staking

There has been a rise if xTokens from 2021 to date.

I.e Staking the token will earn you a % of the platform's revenue.

• swapz @swapzDAO

• xstella @stellaswap

• sMare @MareFinance

This increased the value of the tokens.

Then we have...

→ Staking

There has been a rise if xTokens from 2021 to date.

I.e Staking the token will earn you a % of the platform's revenue.

• swapz @swapzDAO

• xstella @stellaswap

• sMare @MareFinance

This increased the value of the tokens.

Then we have...

→Governance

In DeFi 1.0, there were a lot of protocols that print tokens without a utility other than governance.

People usually farmed the APRs and sold the tokens.

But the APRs drop over time, and you might go to a farm with more percentage.

So how do protocols...

In DeFi 1.0, there were a lot of protocols that print tokens without a utility other than governance.

People usually farmed the APRs and sold the tokens.

But the APRs drop over time, and you might go to a farm with more percentage.

So how do protocols...

2/ Holding veTokens (Curve)

@CurveFinance had a big innovation when it brought the veTokens

Ve = Vote Escrow

• Locking your tokens gives you voting power

• The longer the lock time, the more the voting power.

But that's not all...

@CurveFinance had a big innovation when it brought the veTokens

Ve = Vote Escrow

• Locking your tokens gives you voting power

• The longer the lock time, the more the voting power.

But that's not all...

3/ Holding - Farm boosting.

Many AMMs like @harvest_finance, @beethoven_x, and @Yieldz_protocol adopted this model of farm boosting.

I.e Locking your tokens enables you to vote for pools.

Protocols are fighting for governance power to benefit themselves.

Many AMMs like @harvest_finance, @beethoven_x, and @Yieldz_protocol adopted this model of farm boosting.

I.e Locking your tokens enables you to vote for pools.

Protocols are fighting for governance power to benefit themselves.

/4 Holding—Unstake, and you lose it.

@Platypusdefi Finance introduced this interesting Ve mechanism.

Staking $PTP gets you $vePTP which offers you a higher APR on your stablecoin yields.

If you unstake your $vePTP, all your $vePTP will be lost.

Selling made hard 💀

@Platypusdefi Finance introduced this interesting Ve mechanism.

Staking $PTP gets you $vePTP which offers you a higher APR on your stablecoin yields.

If you unstake your $vePTP, all your $vePTP will be lost.

Selling made hard 💀

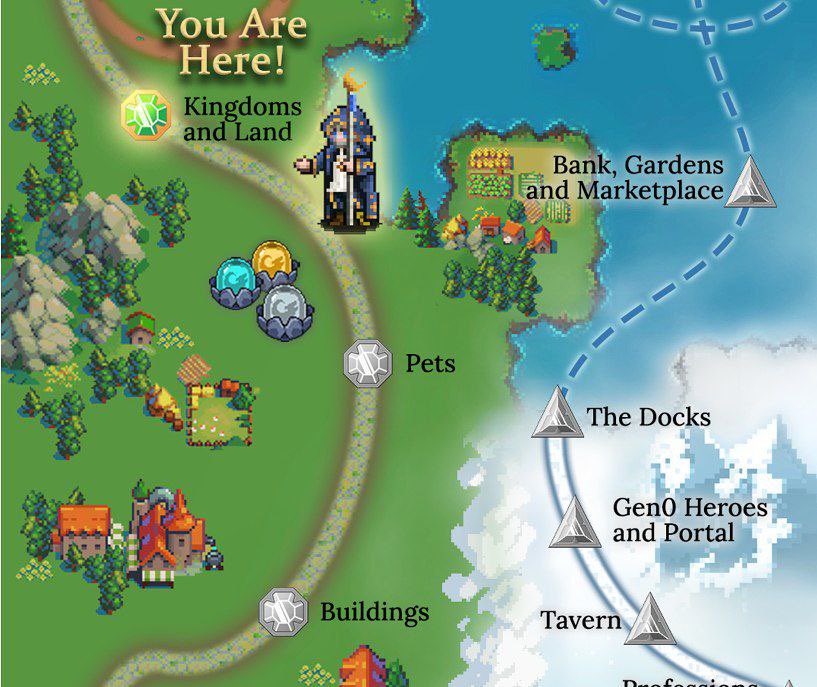

/5 Holding – Unlock / lock rates.

@DeFiKingdoms prevent people from dumping the game tokens by automatically locking part of it.

Does everything dump during unlock periods?

No.

Here's why...

• Once tokens are unlocked, everything is not unlocked at once. It's vested out.

@DeFiKingdoms prevent people from dumping the game tokens by automatically locking part of it.

Does everything dump during unlock periods?

No.

Here's why...

• Once tokens are unlocked, everything is not unlocked at once. It's vested out.

Memes & Narratives

Coins can pump despite HORRIBLE Tokenomics

Elon musk was strangely obsessed with Dogecoin which exploded the coin's price.

People bought hoping that he'll keep pumping the price.

The thing is...

People just buy what they think will make them money 💁♂️

Coins can pump despite HORRIBLE Tokenomics

Elon musk was strangely obsessed with Dogecoin which exploded the coin's price.

People bought hoping that he'll keep pumping the price.

The thing is...

People just buy what they think will make them money 💁♂️

Some protocols also have great Tokenomics but useless prices.

This may be caused by

• Poor marketing

• Unfavorable narrative

• Or looking like a rug 😏😂

This may be caused by

• Poor marketing

• Unfavorable narrative

• Or looking like a rug 😏😂

In summary...

• Master Tokenomics fundamentals. It'll help you as things get complicated

• See tokenomics through supply, demand, and incentives

• Tokenomics is not the end. Hype and narratives are much stronger forces

• Master Tokenomics fundamentals. It'll help you as things get complicated

• See tokenomics through supply, demand, and incentives

• Tokenomics is not the end. Hype and narratives are much stronger forces

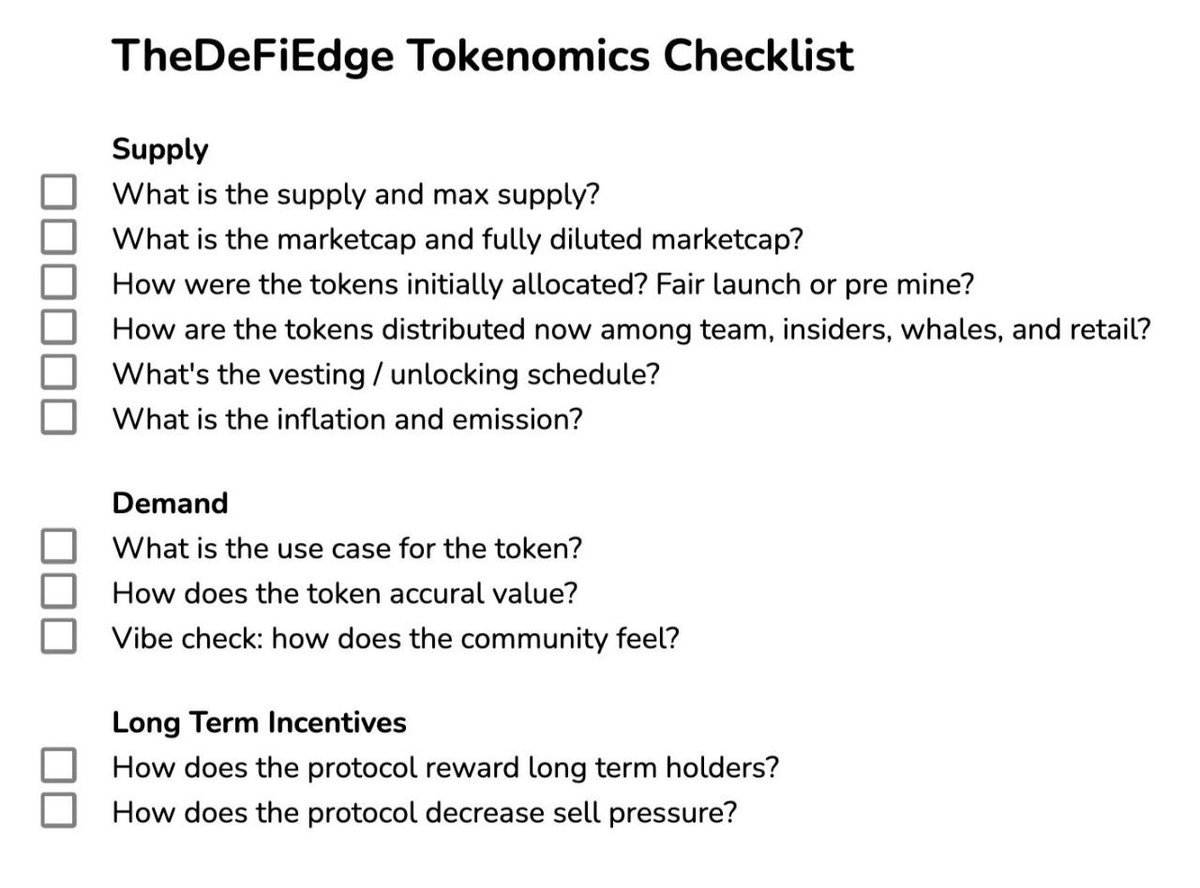

Free resource from @thedefiedge to keep your decisions in check

If you love this thread...

• Bookmark for later

• Follow @Joeconceptss for more content

• COMMENT to share this with your audience 😉┌

• Bookmark for later

• Follow @Joeconceptss for more content

• COMMENT to share this with your audience 😉┌

Loading suggestions...