2/ At the beginning I have to accept 2 facts:

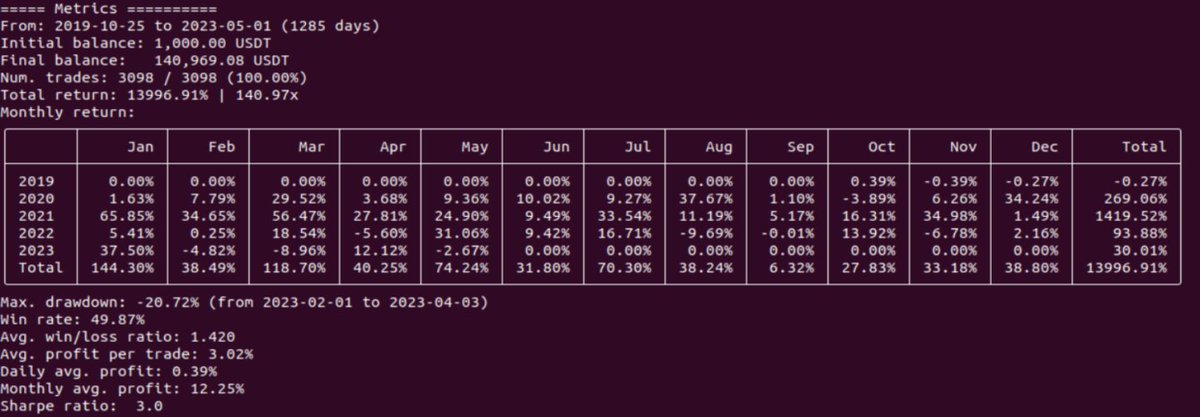

a) I will have losses. And the losses will be frequent. 50% of all trades in this portfolio end in a loss.

b) I will make the most money when the market itself offers you opportunities.

What next?

a) I will have losses. And the losses will be frequent. 50% of all trades in this portfolio end in a loss.

b) I will make the most money when the market itself offers you opportunities.

What next?

3/ I need to build a diversified portfolio.

Portfolio means that you put several strategies together and trade them in one account.

Diversified means that the strategies complement each other.

How?

Portfolio means that you put several strategies together and trade them in one account.

Diversified means that the strategies complement each other.

How?

4/ No single strategy has excellent results in all phases of the market.

a) Trend strategies do well when markets are rising.

b) Mean Reversion strategies are suited to volatile markets that go sideways.

c) Breakout strategies like markets that are making new long-term highs.

a) Trend strategies do well when markets are rising.

b) Mean Reversion strategies are suited to volatile markets that go sideways.

c) Breakout strategies like markets that are making new long-term highs.

5/ If I want stable results, you should have all 3 types of strategies represented in your portfolio.

But that's still not enough.

Crypto markets are not just skyrocketing. They can also fall hard.

That's why short strategies are an integral part of a stable portfolio.

But that's still not enough.

Crypto markets are not just skyrocketing. They can also fall hard.

That's why short strategies are an integral part of a stable portfolio.

6/ Do you make as much money on shorts as you do on longs?

Probably not. But they'll smooth out your equity in the bear markets nicely.

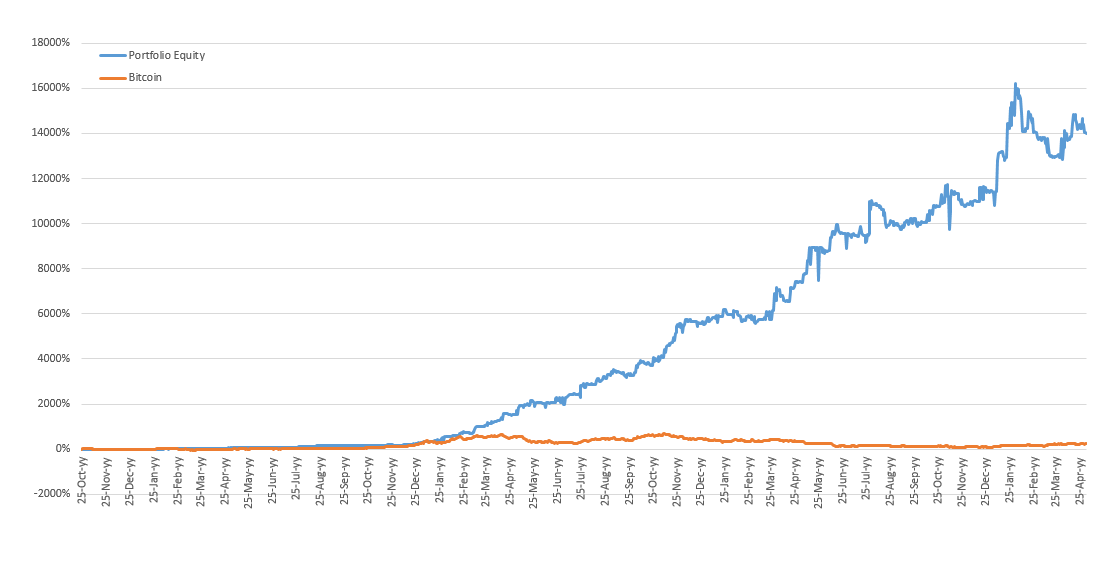

Without short strategies, the portfolio would not have made 90% in 2022...

Probably not. But they'll smooth out your equity in the bear markets nicely.

Without short strategies, the portfolio would not have made 90% in 2022...

9/ How do I create the individual strategies that make up the portfolio?

Basic condition: the strategy must be robust! This means it has to withstand the world of real trading. It must have the premise of long-term profitability.

How to create such a strategy?

Basic condition: the strategy must be robust! This means it has to withstand the world of real trading. It must have the premise of long-term profitability.

How to create such a strategy?

10/ The following conditions must be met:

a) It can be traded profitably on a wide universe of cryptocurrencies. Not just on one or two coins.

b) You have to build it in an idea first way - know what you want to build and why, and then build the strategy.

a) It can be traded profitably on a wide universe of cryptocurrencies. Not just on one or two coins.

b) You have to build it in an idea first way - know what you want to build and why, and then build the strategy.

11/ The procedure is a bit more complicated. I wrote a 20-page document on this. If you want to read it, you can download it here:

robuxio.com

You will find a complete description of one of our trend strategies.

robuxio.com

You will find a complete description of one of our trend strategies.

12/ Once you have the strategies in place, you need to allocate capital to them correctly.

For example, if you want the most stable portfolio and you trade with $10,000, the strategies that are the least volatile will get each $2,000 and the most volatile will only get $500.

For example, if you want the most stable portfolio and you trade with $10,000, the strategies that are the least volatile will get each $2,000 and the most volatile will only get $500.

13/ That's starting to look like a lot of work, right? And it is.

You need to gain experience in how to build such a strategy robustly.

You need to know which strategies work together.

You need to know how to build a portfolio with logical weights.

You need to gain experience in how to build such a strategy robustly.

You need to know which strategies work together.

You need to know how to build a portfolio with logical weights.

14/ Finally, you need to know how to test and automate everything, for example in Python, which is what we use.

There are thousands of hours of work behind everything if you want to be profitable in live trading.

If you want to embark on this journey, prepare for it.

There are thousands of hours of work behind everything if you want to be profitable in live trading.

If you want to embark on this journey, prepare for it.

15/ If you want to do some serious trading but don't have that much time, you can use our service, Robuxio, where we will do the whole process for you.

You can find more information here:

robuxio.com

The launch is in Q3 2023.

You can find more information here:

robuxio.com

The launch is in Q3 2023.

Loading suggestions...