Sep 2017: Googled "How do rich people get rich". Search results lead me to

1. Recommendation to read Robert Kiyosaki's "Rich Dad, Poor Dad"

2. Use the power of compounding to create wealth.

1. Recommendation to read Robert Kiyosaki's "Rich Dad, Poor Dad"

2. Use the power of compounding to create wealth.

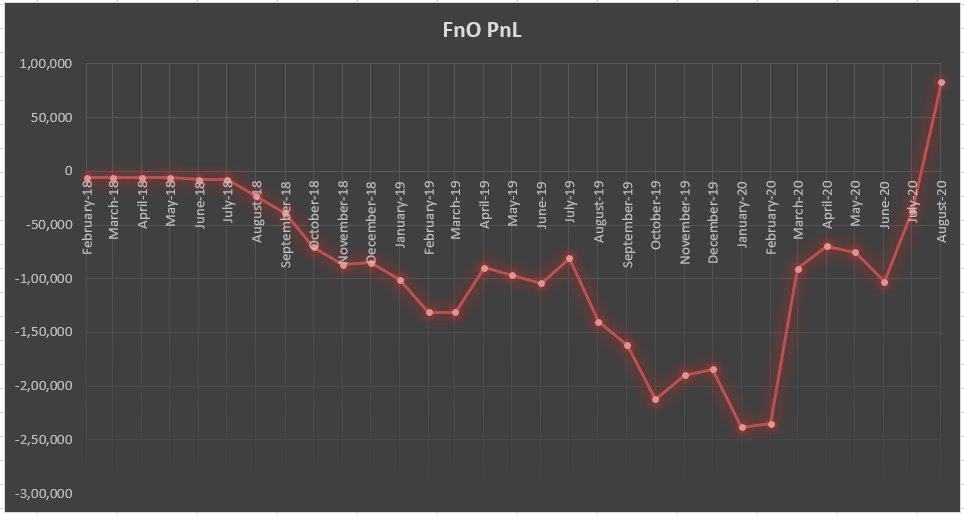

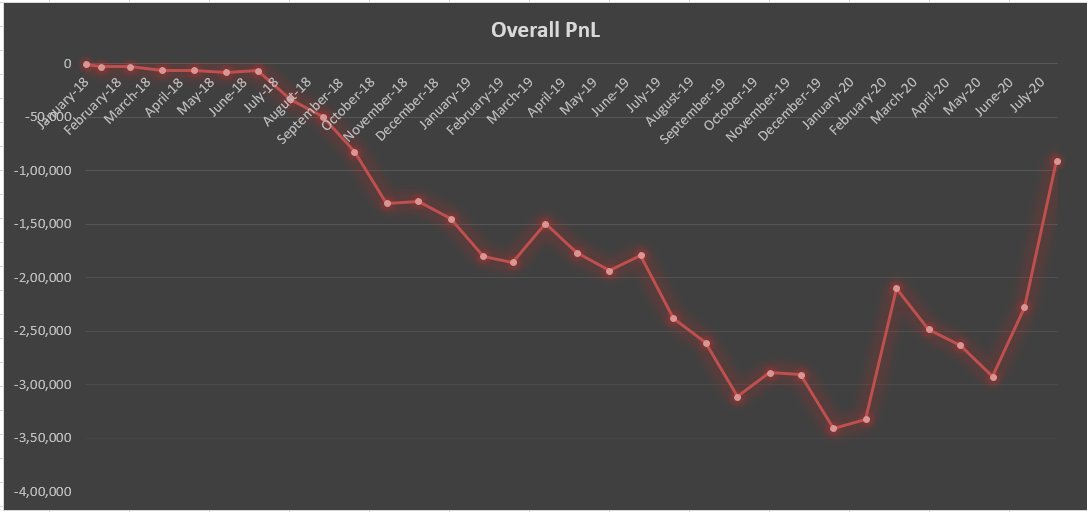

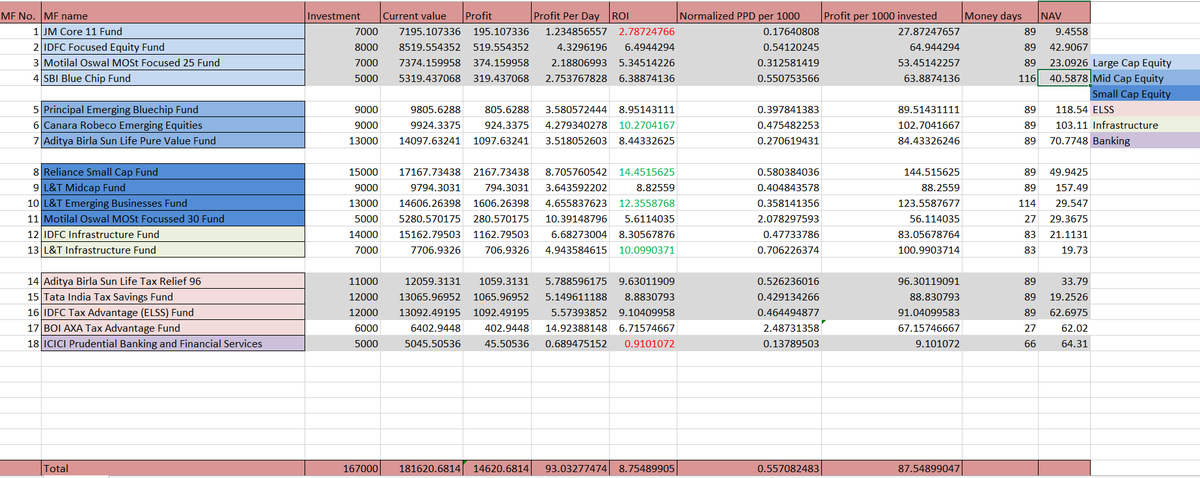

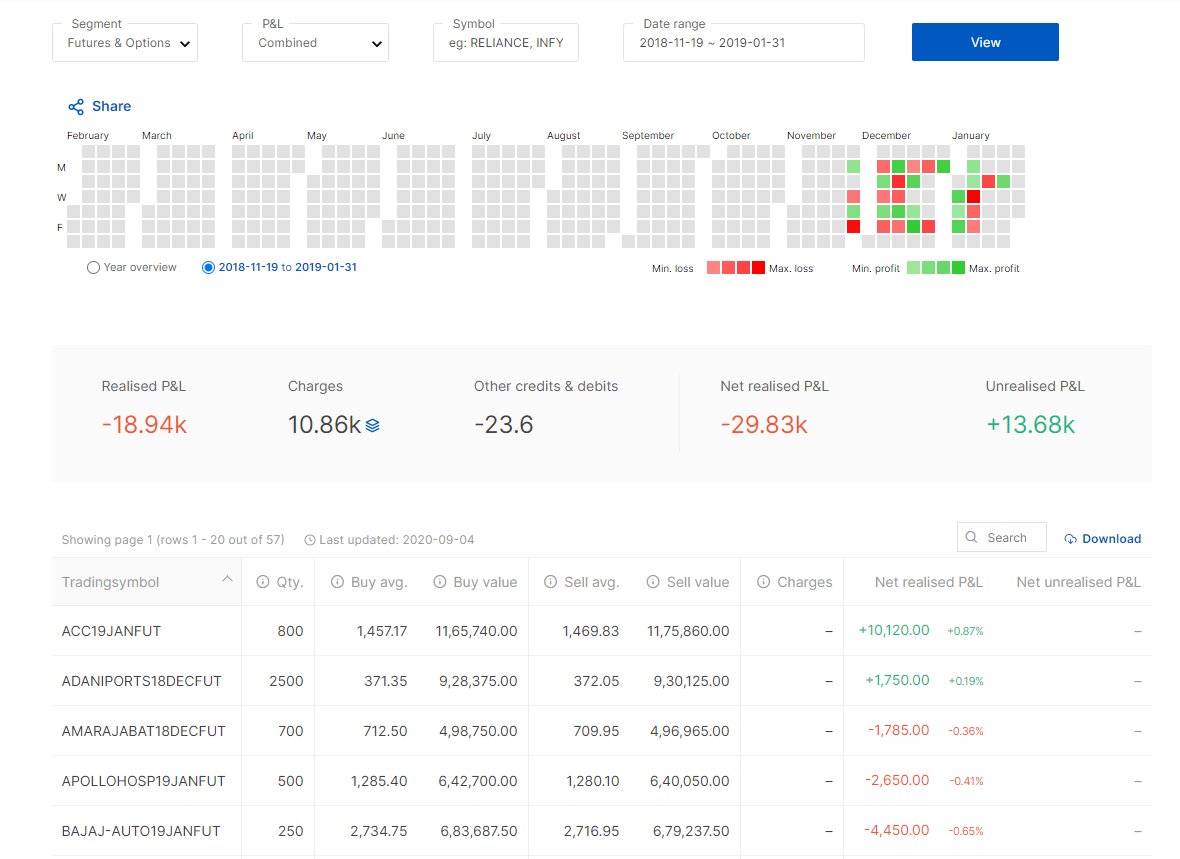

Feb 2018: Market corrected. I chickened out of most of my MFs in Mar 2018. This was my first brush with volatility. Earlier had thought I had the stomach to absorb it. Realized I haven't understood myself well enough. Anyway, now I had graduated to reading up on stocks.

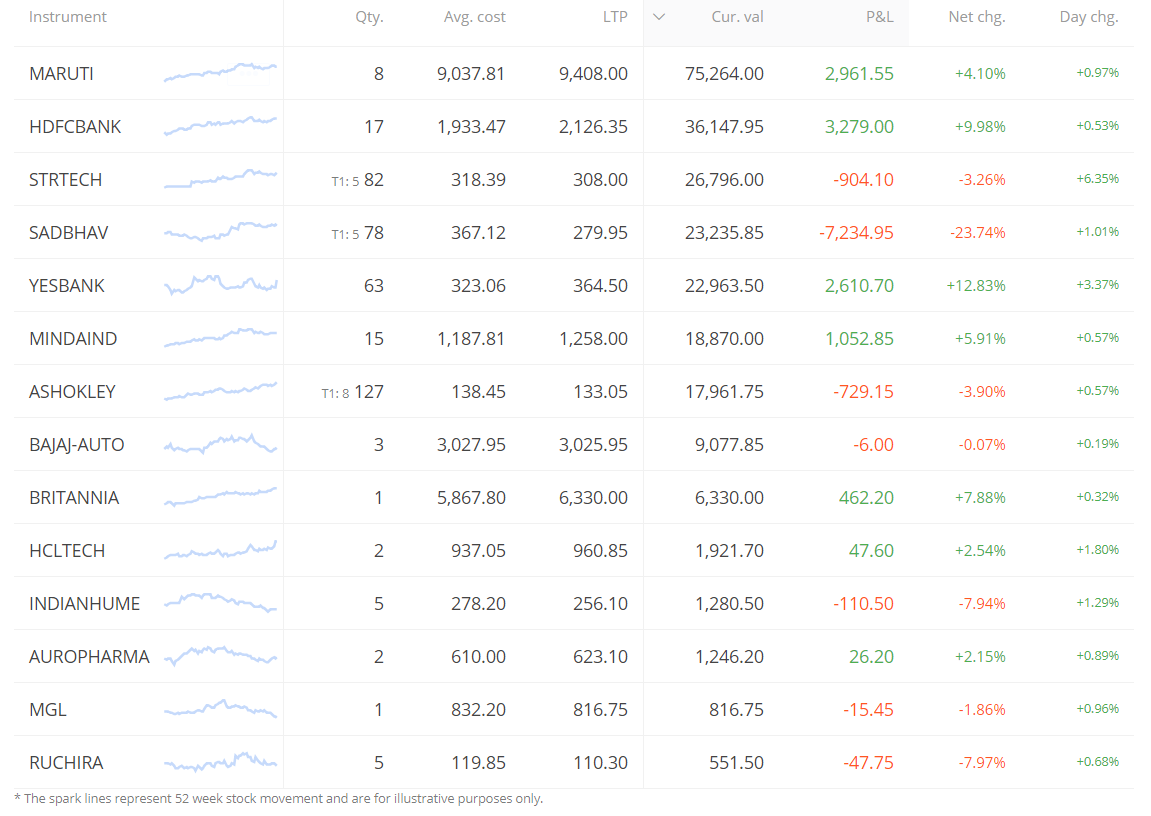

Sep 2018: The NBFC correction happened. Chickened out once more. Exited majority of my stock and remaining MF holdings. I consider myself lucky though that I exited stocks like Sadbhav (at ~270) and Yes Bank (at ~340). Felt investing is not my cup of tea. Improvement needed.

Sep 2018: After 2 corrections in 9 months, I doubted whether one can get rich in stock market. Realized to make a living out of the markets, I need to make money even when market falls. Felt the jargons used in moneycontrol articles having price charts could predict market moves.

Realized it is called Technical Analysis. Bought Ashwani Gujral's "How to make money trading candlesticks". Super excited after reading about price patterns, I felt I finally found the secret sauce of profitable traders - find patterns and trade it.

Realized the importance of risk management (RM) and position sizing. Read the RM chapter in AG's book I had earlier skipped thinking it to be unimportant.

By this time, started to realize backtesting is important. Started to manually backtest an intraday strategy based on NR7.

By this time, started to realize backtesting is important. Started to manually backtest an intraday strategy based on NR7.

Jan 2019: Felt I need a strategy that I backtest for a lot of years. Built a supertrend based positional trading strategy in Nifty after manually backtesting it for 4 years (~140 trades). Felt on top of the world that this strategy had an "edge". Started trading 1 lot.

Mar 2019: Exited a trending long trade early trying to time the top and missed the big profit. Months of frustration (whipsaws) followed. Felt if I have tighter TSL I would not be tempted to time the top. Got whipsawed even more. Went back to wider TSL.

June 2019: Results were not bad. But this strategy wouldn't generate monthly income I dreamed of. Started deploying this strategy on BNF, USDINR and Crude. Realized tracking multiple instruments along with job is not feasible. Missed entry/exit used to emotionally drain me out.

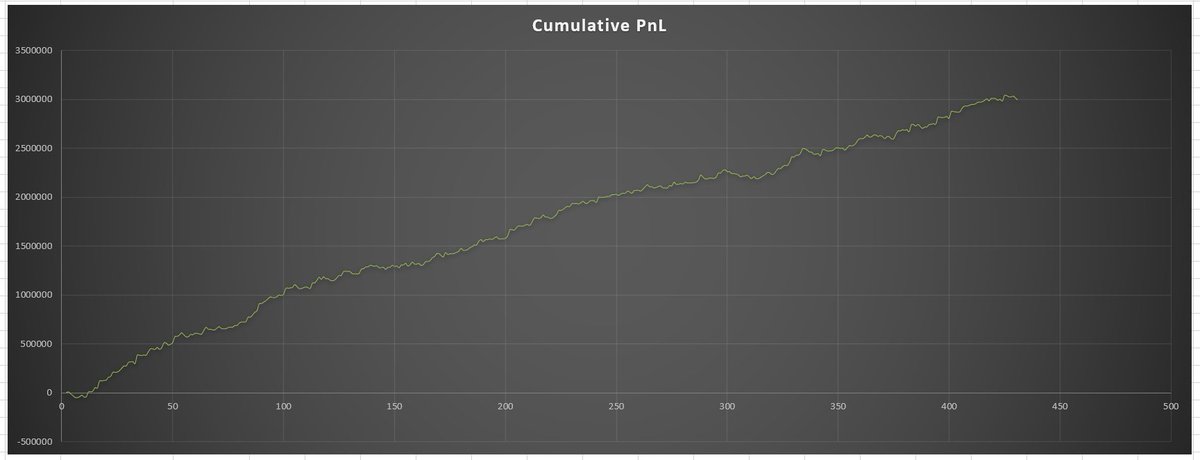

Dec 2019: While continuing trading the Nifty ST73 strategy, managed time to learn Python to backtest and auto-trade. Discovered couple of strategies that had an edge (post charges) and deployed. Realized that expectancy is not all that matters. Drawdown figures matter as well.

March 2020: Turning point of my trading journey. My trend following strategy gave windfall returns. ~30% on my total trading capital.

PERSEVERANCE PAYS OFF.

GRIT PAYS OFF.

DETERMINATION PAYS OFF.

PATIENCE PAYS OFF.

Joined Twitter! Stopped feeling trading is a lonely journey.

PERSEVERANCE PAYS OFF.

GRIT PAYS OFF.

DETERMINATION PAYS OFF.

PATIENCE PAYS OFF.

Joined Twitter! Stopped feeling trading is a lonely journey.

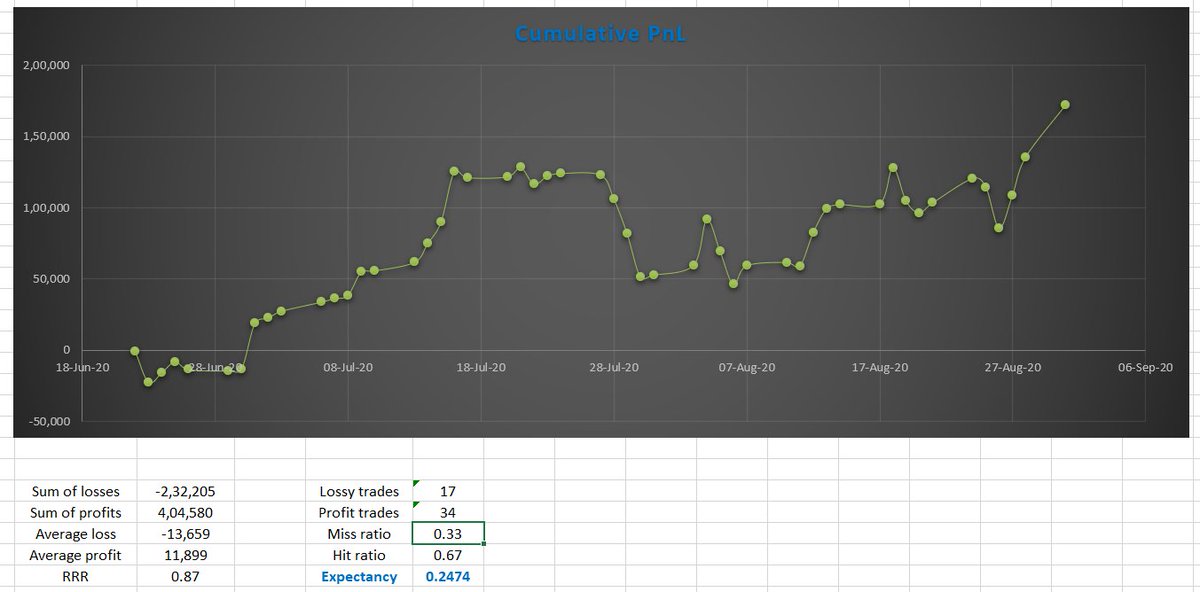

May-Jun 2020: Kept my search for regular monthly income strategy going. Realized most traders on twitter who made it big are into options selling. Realized positional trading in index FUT is no lesser risk than index options selling (atleast intraday with SL).

Loading suggestions...