A thread on Memos of SageOne Investments written by @SamitVartak

I have only included part which gave insights on business analysis.

For more detailed version I would recommend reading full memos from their site.

For more detailed version I would recommend reading full memos from their site.

Aug 2012:

The fund measures its performance with Nifty 50 with minimum of 2 year period.

Qualities they look for:

1. Superior Business

Long term competitive edge + Stable Industry + Huge & Growing Market + 20% + ROCE + no/less debt + less investment needed to fund growth.

The fund measures its performance with Nifty 50 with minimum of 2 year period.

Qualities they look for:

1. Superior Business

Long term competitive edge + Stable Industry + Huge & Growing Market + 20% + ROCE + no/less debt + less investment needed to fund growth.

They don't look at inferior businesses even if the stock price might interest others.

One should get a feeling “I wish I owned this business”.

2. Competent/Genuine Management

They have 'zero' tolerance policy here and meeting the management is must for them.

One should get a feeling “I wish I owned this business”.

2. Competent/Genuine Management

They have 'zero' tolerance policy here and meeting the management is must for them.

When the ethical standard is passed, they look for management's competence and capital allocation skills.

3. Reasonable Price

They wait for price to fall below intrinsic value and buy only with margin of safety.

3. Reasonable Price

They wait for price to fall below intrinsic value and buy only with margin of safety.

They would rather hold the money and return it to clients, than make a bad investment for the sake of it.

Nov 2012:

Power of Compounding and Opportunity Cost:

Explains power of compounding:

Nov 2012:

Power of Compounding and Opportunity Cost:

Explains power of compounding:

He is constantly on the look for businesses which can grow their earnings at more than 25% annually.

"Let your money also work for the great entrepreneurs while providing you the returns."

"Let your money also work for the great entrepreneurs while providing you the returns."

Feb 2013:

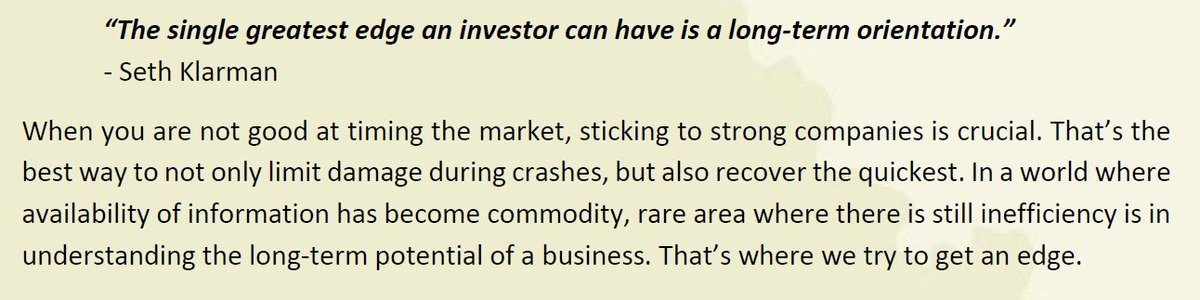

The fund does not believe in predicting what the future hold and just continues holding businesses which grow at 20%+

Mar 2014:

Majority of their time is spend on analyzing businesses and trends.

They do not strive for brilliance but for consistency.

The fund does not believe in predicting what the future hold and just continues holding businesses which grow at 20%+

Mar 2014:

Majority of their time is spend on analyzing businesses and trends.

They do not strive for brilliance but for consistency.

Qualities they look for:

1. Superior Business: This time ROCE & ROE they mention should be above 20 but preferably 30+

2. Competent Management: Same as mentioned at the start.

3. Reasonable Price: A company which has no competitive edge and cannot sustain returns...

1. Superior Business: This time ROCE & ROE they mention should be above 20 but preferably 30+

2. Competent Management: Same as mentioned at the start.

3. Reasonable Price: A company which has no competitive edge and cannot sustain returns...

...above cost of capital is no good to them at any valuations.

Most important factor for them is the duration of their competitive edge.

->How are they different?

1. They focus on downside protection over upside potential.

Most important factor for them is the duration of their competitive edge.

->How are they different?

1. They focus on downside protection over upside potential.

2. Always going for the quality with factors like, brands, low cost,etc.

3. If one can avoid bad bets or even overpay for good businesses, the winners will take care of themselves.

"Best option to get rich is by running a successful business. Second best to buy pieces of them."

3. If one can avoid bad bets or even overpay for good businesses, the winners will take care of themselves.

"Best option to get rich is by running a successful business. Second best to buy pieces of them."

Oct 2015:

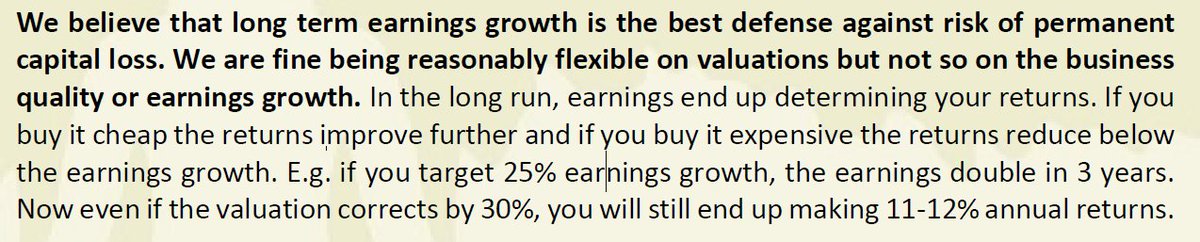

On Valuation:

If return expectations are below long term historical average, valuation is expensive and vice versa.

3 factors affecting returns viz. topline growth, margin expansion and PE rerating

On Valuation:

If return expectations are below long term historical average, valuation is expensive and vice versa.

3 factors affecting returns viz. topline growth, margin expansion and PE rerating

April 2017:

When you experience the missing out feeling few times, even many experienced investors start investing first and analyzing later.

If one is comfortable with the absolute valuation of the businesses which they holding then one should not sell.

When you experience the missing out feeling few times, even many experienced investors start investing first and analyzing later.

If one is comfortable with the absolute valuation of the businesses which they holding then one should not sell.

When your goal is to create significant alpha over the market, you have to think independently and differently.

Nov 2017:

When stocks start moving very quickly people start buying first and analyzing the company later. So, that not to miss the rally.

Nov 2017:

When stocks start moving very quickly people start buying first and analyzing the company later. So, that not to miss the rally.

Feb 2018:

There are many ways to make superior returns in the market: Timing the markets, dealing in commodities market, analyzing businesses with long term view, etc.

There are many ways to make superior returns in the market: Timing the markets, dealing in commodities market, analyzing businesses with long term view, etc.

The problem lies in finding such companies.

In favorable environment people assume that most of the companies can benefit from an external action.

Ex: GST implantation would shift unorganized to organized but only the top 10 or most efficient players get benefited from it.

In favorable environment people assume that most of the companies can benefit from an external action.

Ex: GST implantation would shift unorganized to organized but only the top 10 or most efficient players get benefited from it.

May 2018:

(This memo was amazing to read, so I have added snapshot of the letters)

There has been over use of terms like 'Moat', quality companies, huge market potential, etc. by people.

“You won’t get the returns Buffett and I got by doing what we did” – Charlie Munger

(This memo was amazing to read, so I have added snapshot of the letters)

There has been over use of terms like 'Moat', quality companies, huge market potential, etc. by people.

“You won’t get the returns Buffett and I got by doing what we did” – Charlie Munger

USA was one of the most successful industrial nations when Buffett was very active.

Moat business were plenty and cheap.

One has to customize their strategy and find non-crowed places for themselves.

Moat business were plenty and cheap.

One has to customize their strategy and find non-crowed places for themselves.

If you are interested in valuation listen to his two talks he gave:

indianinvestingconclave.com

indianinvestingconclave.com

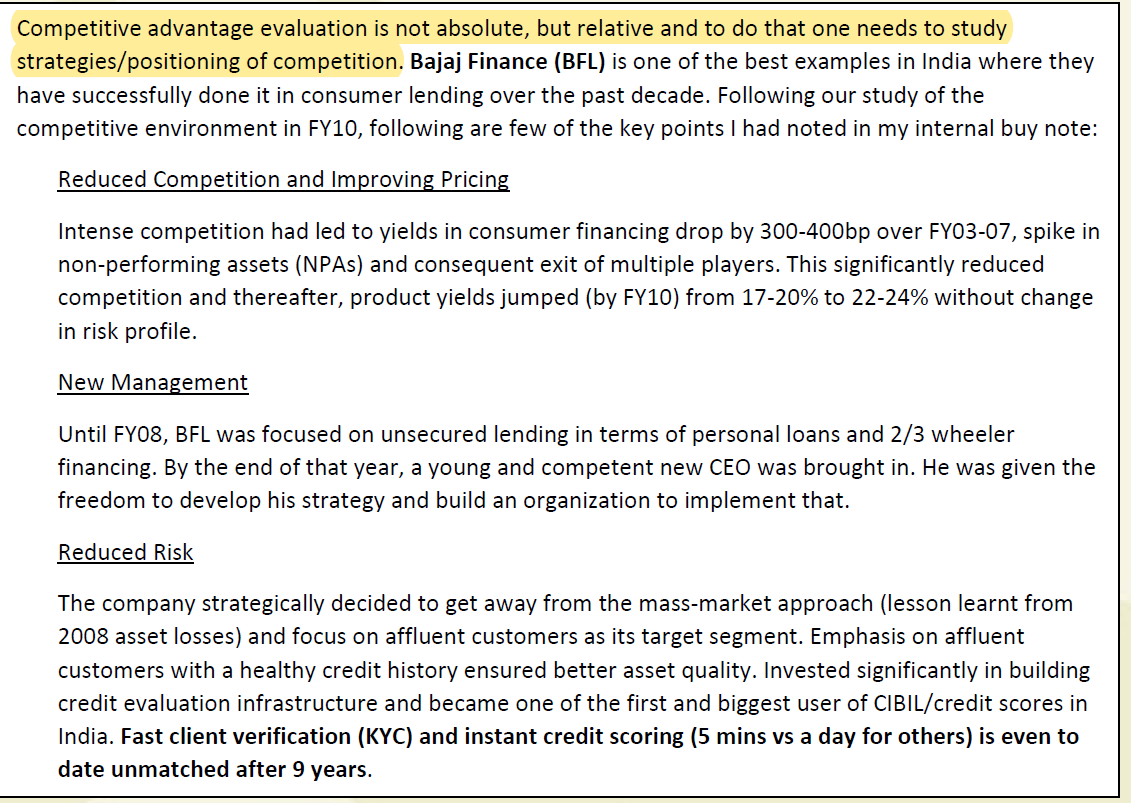

What do we look for in companies?

1. A company should be strategically well positioned to gain market share rom the competition without diluting profitability (and at ROCE > 20%).

2. One must understand how the company developed the edge which they have.

1. A company should be strategically well positioned to gain market share rom the competition without diluting profitability (and at ROCE > 20%).

2. One must understand how the company developed the edge which they have.

Plus you must not depend on one driver, there has to be multiple.

3. They look for 20+ earning growth but it is possible only when companies either gain market share from competition or enter new market segments or create new market segments.

3. They look for 20+ earning growth but it is possible only when companies either gain market share from competition or enter new market segments or create new market segments.

4. When a company increases its market share from 2% to 2.5%, it adds 25% incremental topline growth over the industry growth.

If the company can further achieve operating leverage, incremental earnings growth can be substantial.

If the company can further achieve operating leverage, incremental earnings growth can be substantial.

Differentiating nature of growth

Growth can still come in a cyclical company if they demand they cater to is not cyclical.

Like Solar Industries caters to two cyclical industries (Mining and Infrastructure) but the demand for dynamites is not cyclical.

Growth can still come in a cyclical company if they demand they cater to is not cyclical.

Like Solar Industries caters to two cyclical industries (Mining and Infrastructure) but the demand for dynamites is not cyclical.

Another example of Balkrishna Industries:

Here is the link to his talk: indianinvestingconclave.com

Balkrishna kept growing at 20% when the market was going down at 30%.

Here is the link to his talk: indianinvestingconclave.com

Balkrishna kept growing at 20% when the market was going down at 30%.

"A company with sustainable competitive advantage can grow even in the toughest of environments because many weak players can’t survive during such phases and give away market share."

Few other examples: Amara raja vs Excide, Hawkins losing to TTK (even after better products)

Few other examples: Amara raja vs Excide, Hawkins losing to TTK (even after better products)

Moats are good but if a company can't consistently gain market share then it shows that even the competition might be having some Moat.

Having strong moat is a necessary but not sufficient condition for us in an investment.

Having strong moat is a necessary but not sufficient condition for us in an investment.

Differential in competitive advantage is more important. How management leverages the moat and positions the company against the competition is critical in creating value for shareholders.

Knowing value drivers is good but one must also know what can take away value.

Knowing value drivers is good but one must also know what can take away value.

Examples:

Market share gain can also be a negative: Inferior growth that is growth by lowering prices gets hidden behind the averages and the investor might get blinded with topline growth but that growth might have no true economic value.

Market share gain can also be a negative: Inferior growth that is growth by lowering prices gets hidden behind the averages and the investor might get blinded with topline growth but that growth might have no true economic value.

He covered this topic in his valuation talk:

indianinvestingconclave.com

Promoters can themselves be enemies of growth: If the lower management is not given power to take decision it becomes very difficult for a business to scale.

indianinvestingconclave.com

Promoters can themselves be enemies of growth: If the lower management is not given power to take decision it becomes very difficult for a business to scale.

Jan 2019:

Mistakes are made when investors extrapolate the trends/profitability at troughs or peaks of the cycles by assuming that they are sustainable.

Lengths of cycles may vary, but the values typically do oscillate around the mean.

Mistakes are made when investors extrapolate the trends/profitability at troughs or peaks of the cycles by assuming that they are sustainable.

Lengths of cycles may vary, but the values typically do oscillate around the mean.

Why the quality stocks are always over valued?

1. Avoiding “landmines” key to avoiding pain.

2. Many decision makers may lose their job by looking foolish after committing mistakes.

3. Many managers value “not going wrong” much highly vs. missing out on extra returns

1. Avoiding “landmines” key to avoiding pain.

2. Many decision makers may lose their job by looking foolish after committing mistakes.

3. Many managers value “not going wrong” much highly vs. missing out on extra returns

4. For FIIs, emerging markets itself are riskier asset class.

5. Consistency pays off by being much resilient during rough markets.

"Longer one stretches his holding period, lesser impact

high valuation has on returns."

5. Consistency pays off by being much resilient during rough markets.

"Longer one stretches his holding period, lesser impact

high valuation has on returns."

June 2019:

Rising stock price can blind the investor and instill false confidence in the business, while falling stock price can completely shatter confidence and conviction in a business inducing further volatility in prices.

Rising stock price can blind the investor and instill false confidence in the business, while falling stock price can completely shatter confidence and conviction in a business inducing further volatility in prices.

Investors tend to be late to the party as they feel that the safest time to invest is when everyone around them is also invested/investing in the same asset class.

In reality, the safer one feels the riskier is the time to start investing.

In reality, the safer one feels the riskier is the time to start investing.

Dec 2019:

As Warren Buffet has noted numerous times, I can’t stress enough the importance of this.

Compared to really high ROE with very little room for

reinvestment, a reasonable ROE (20-30%) with very high and prolonged reinvestment opportunity creates tremendous wealth.

As Warren Buffet has noted numerous times, I can’t stress enough the importance of this.

Compared to really high ROE with very little room for

reinvestment, a reasonable ROE (20-30%) with very high and prolonged reinvestment opportunity creates tremendous wealth.

Aug 2020:

Whenever extreme fear grips the market and enough investors exit, it doesn’t take much liquidity for the markets to rebound as very few sellers exist for the buyers to buy from. March end this year was a recent

example.

The reverse works during times of euphoria.

Whenever extreme fear grips the market and enough investors exit, it doesn’t take much liquidity for the markets to rebound as very few sellers exist for the buyers to buy from. March end this year was a recent

example.

The reverse works during times of euphoria.

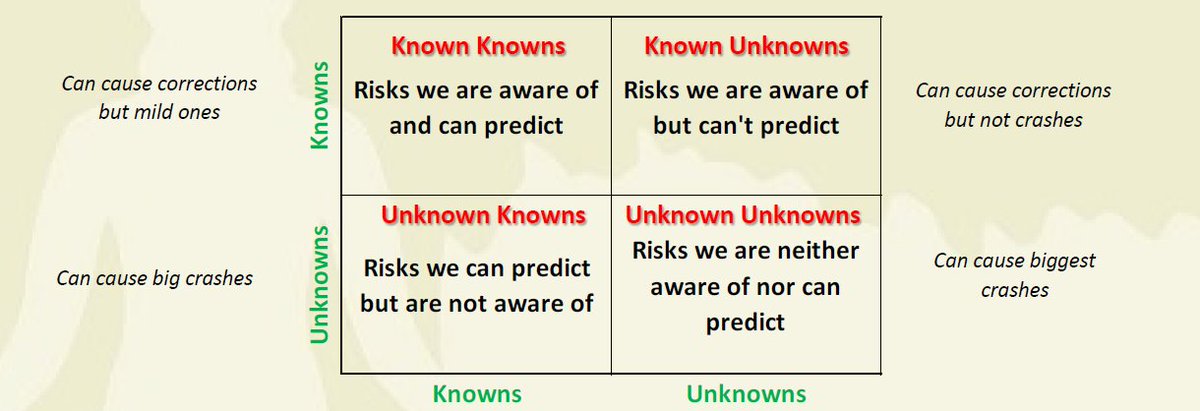

Since 2011, many legendary investors have been warning of crashes because of central banks driven liquidity artificially holding up asset prices.

It may happen one day, but when and what triggers it is difficult to know.

It may happen one day, but when and what triggers it is difficult to know.

Unfortunately many investors try to indulge in market timing in the upper two quadrant scenarios and end up missing out on big rallies.

---THE END---

If you liked the thread then please RT for further reach. :)

If you liked the thread then please RT for further reach. :)

Loading suggestions...