1/🧵

As unprecedented liquidity injections take place globally, talks of inflation are picking up.

In this thread, we'll take a look at why #INFLATION matters, especially if your investment thesis starts with “FED has my back whatever happens”

Best served with a cup of tea 🫖

As unprecedented liquidity injections take place globally, talks of inflation are picking up.

In this thread, we'll take a look at why #INFLATION matters, especially if your investment thesis starts with “FED has my back whatever happens”

Best served with a cup of tea 🫖

2/🧵

Since the Financial Crisis, trillions have been injected into the economy to boost activity and growth.

Broader set of financial assets held principally by households (aka M2 Money Stock):

+ $12,000 BUSD since 2008

+ of which $4,000 BUSD from 2020

fred.stlouisfed.org

Since the Financial Crisis, trillions have been injected into the economy to boost activity and growth.

Broader set of financial assets held principally by households (aka M2 Money Stock):

+ $12,000 BUSD since 2008

+ of which $4,000 BUSD from 2020

fred.stlouisfed.org

3/🧵

During the last 10 years or so, these liquidity injections have NOT caused rampant inflation as velocity of money has collapsed.

But few things changed with covid; a lot of funds have been given directly to individuals in form of stimulus checks.

fred.stlouisfed.org

During the last 10 years or so, these liquidity injections have NOT caused rampant inflation as velocity of money has collapsed.

But few things changed with covid; a lot of funds have been given directly to individuals in form of stimulus checks.

fred.stlouisfed.org

4/🧵

Stimulus checks, among other factors, have increased the amount of money people have for consumption.

More precisely, funds readily accessible for spending (aka M1 Money Stock):

+ $5,000 BUSD since 2008

+ of which $3,000 BUSD from 2020

fred.stlouisfed.org

Stimulus checks, among other factors, have increased the amount of money people have for consumption.

More precisely, funds readily accessible for spending (aka M1 Money Stock):

+ $5,000 BUSD since 2008

+ of which $3,000 BUSD from 2020

fred.stlouisfed.org

5/🧵

Money flowing directly to consumers’ hands waiting to buy things increases the demand for various products.

Increased demand leads to widespread price increases, in other words inflation.

Money flowing directly to consumers’ hands waiting to buy things increases the demand for various products.

Increased demand leads to widespread price increases, in other words inflation.

6/🧵

Due to these changing dynamics, 5-year inflation expectations (2.4%) have recently risen to their highest level since 2012.

But why should investors care?

fred.stlouisfed.org

Due to these changing dynamics, 5-year inflation expectations (2.4%) have recently risen to their highest level since 2012.

But why should investors care?

fred.stlouisfed.org

8/🧵

How FED controls long-term (LT) yields?

It could use a tool not in use since WWII: yield curve control, or YCC.

FED would publicly assign a LT yield target and hope market to set there. If not, FED would buy LT bonds for yields to reach the target.

But there’s a problem.

How FED controls long-term (LT) yields?

It could use a tool not in use since WWII: yield curve control, or YCC.

FED would publicly assign a LT yield target and hope market to set there. If not, FED would buy LT bonds for yields to reach the target.

But there’s a problem.

9/🧵

By buying a lot of bonds, FED would exchange bonds for cash, thus creating even more dollars to the system.

This would only boost inflation since increasing money supply was the problem in the first place.

Good article on the topic by @Noahpinion:

bloomberg.com

By buying a lot of bonds, FED would exchange bonds for cash, thus creating even more dollars to the system.

This would only boost inflation since increasing money supply was the problem in the first place.

Good article on the topic by @Noahpinion:

bloomberg.com

10/🧵

In other words, FED could lose control.

If inflation would exceed, say 4%, investors would lose money by owning bonds yielding less than that – hence they would sell their bonds.

When bonds are sold, price goes down and yield goes up - just like with stocks and dividends

In other words, FED could lose control.

If inflation would exceed, say 4%, investors would lose money by owning bonds yielding less than that – hence they would sell their bonds.

When bonds are sold, price goes down and yield goes up - just like with stocks and dividends

11/🧵

To clarify, think a company (Uncle Sam) paying a stable dividend (bond yield).

Starting point:

Company price $100

Dividend $5

Yield 5%

Price down:

Company price $50 (-50%)

Dividend $5

Yield 10% (+100%)

Price up:

Company price $200 (+100%)

Dividend $5

Yield 2.5% (-50%)

To clarify, think a company (Uncle Sam) paying a stable dividend (bond yield).

Starting point:

Company price $100

Dividend $5

Yield 5%

Price down:

Company price $50 (-50%)

Dividend $5

Yield 10% (+100%)

Price up:

Company price $200 (+100%)

Dividend $5

Yield 2.5% (-50%)

12/🧵

Rationally, yields would eventually set to a level that would exceed inflation, thus giving investors de-facto reason to own bonds.

In other words, there would be real return in owning bonds (not just nominal).

fred.stlouisfed.org

Rationally, yields would eventually set to a level that would exceed inflation, thus giving investors de-facto reason to own bonds.

In other words, there would be real return in owning bonds (not just nominal).

fred.stlouisfed.org

13/🧵

In 1977 with inflation 6-7%, Warren Buffett elaborated:

- "stocks, like bonds, do poorly in an inflationary environment"

- “the central problem in the stock market is that the return on capital hasn’t risen with inflation" (stuck at 12 percent)

hollandadvisors.co.uk

In 1977 with inflation 6-7%, Warren Buffett elaborated:

- "stocks, like bonds, do poorly in an inflationary environment"

- “the central problem in the stock market is that the return on capital hasn’t risen with inflation" (stuck at 12 percent)

hollandadvisors.co.uk

15/🧵

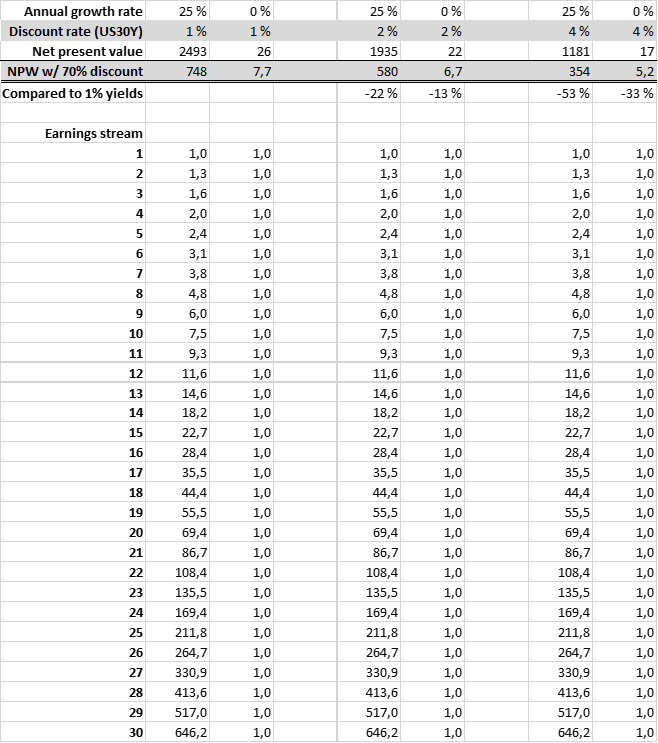

But the biggest problem with inflation comes from discounted cash flow (DCF) models using ultra-low discount rates to ultra-high growth companies.

We already concluded that inflation will raise bond yields – let’s see its impact on DCF.

But the biggest problem with inflation comes from discounted cash flow (DCF) models using ultra-low discount rates to ultra-high growth companies.

We already concluded that inflation will raise bond yields – let’s see its impact on DCF.

17/🧵

As we have learnt by now, higher inflation would lead to higher interest rates.

This, in turn, would punish growth stocks relatively more than more stagnant performers, as we can see in our simplified example.

As we have learnt by now, higher inflation would lead to higher interest rates.

This, in turn, would punish growth stocks relatively more than more stagnant performers, as we can see in our simplified example.

18/🧵

E.g., interest rates going from 1% to 2%, growers would decline nearly double (-22%) that of stalwarts (-13%).

As many things in the market, growth stocks have likely gotten ahead of themselves even further, resulting in even worse relative performance than indicated here

E.g., interest rates going from 1% to 2%, growers would decline nearly double (-22%) that of stalwarts (-13%).

As many things in the market, growth stocks have likely gotten ahead of themselves even further, resulting in even worse relative performance than indicated here

20/🧵

As broader markets have become more reliant on the performance of high-growth companies paired with ever-increasing multiples, the negative impact of this dynamic would be highlighted in the current market environment.

As broader markets have become more reliant on the performance of high-growth companies paired with ever-increasing multiples, the negative impact of this dynamic would be highlighted in the current market environment.

21/🧵

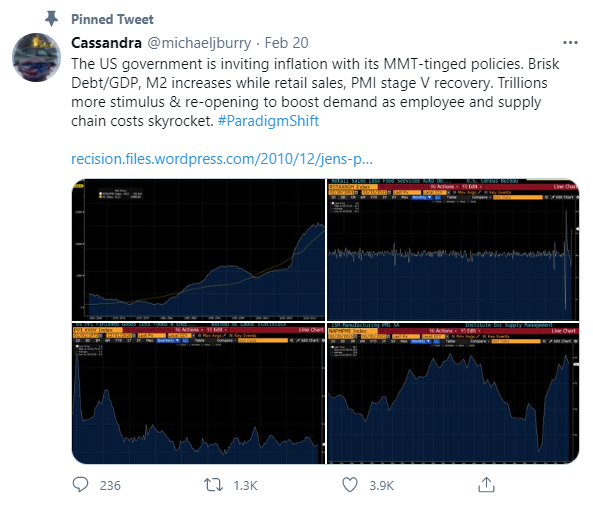

If you liked @michaeljburry for his “Big Short” in the financial crisis, or for his GameStop long, he's now out calling risks regarding inflation.

(he has a habit of removing tweets, hence caption instead of tweet link)

If you liked @michaeljburry for his “Big Short” in the financial crisis, or for his GameStop long, he's now out calling risks regarding inflation.

(he has a habit of removing tweets, hence caption instead of tweet link)

22/🧵

Simultaneously, market participants' positioning on the market may be - just may be - changing to something that it hasn't been in years and years:

value outperforming growth

Simultaneously, market participants' positioning on the market may be - just may be - changing to something that it hasn't been in years and years:

value outperforming growth

23/🧵

That's inflation’s impact on the stock market in a nutshell!

For high-quality tweets in the business domain, pls give a follow:

🇺🇸@ChrisBloomstran

🇺🇸@10kdiver

🇺🇸@tanayj

🇺🇸@quisitiveinvest

🇫🇮@Hemingwayz

🇫🇮@Ollikopo

🇫🇮@JukkaLepikko

Thank you for your kind attention! 🙏🙂

That's inflation’s impact on the stock market in a nutshell!

For high-quality tweets in the business domain, pls give a follow:

🇺🇸@ChrisBloomstran

🇺🇸@10kdiver

🇺🇸@tanayj

🇺🇸@quisitiveinvest

🇫🇮@Hemingwayz

🇫🇮@Ollikopo

🇫🇮@JukkaLepikko

Thank you for your kind attention! 🙏🙂

Loading suggestions...