JB chemicals conducted their conference call today at 3:30 PM

"Mgmt expects to deliver market beating growth & consistent margin growth in future."

Here are the key takeaways 😀

"Mgmt expects to deliver market beating growth & consistent margin growth in future."

Here are the key takeaways 😀

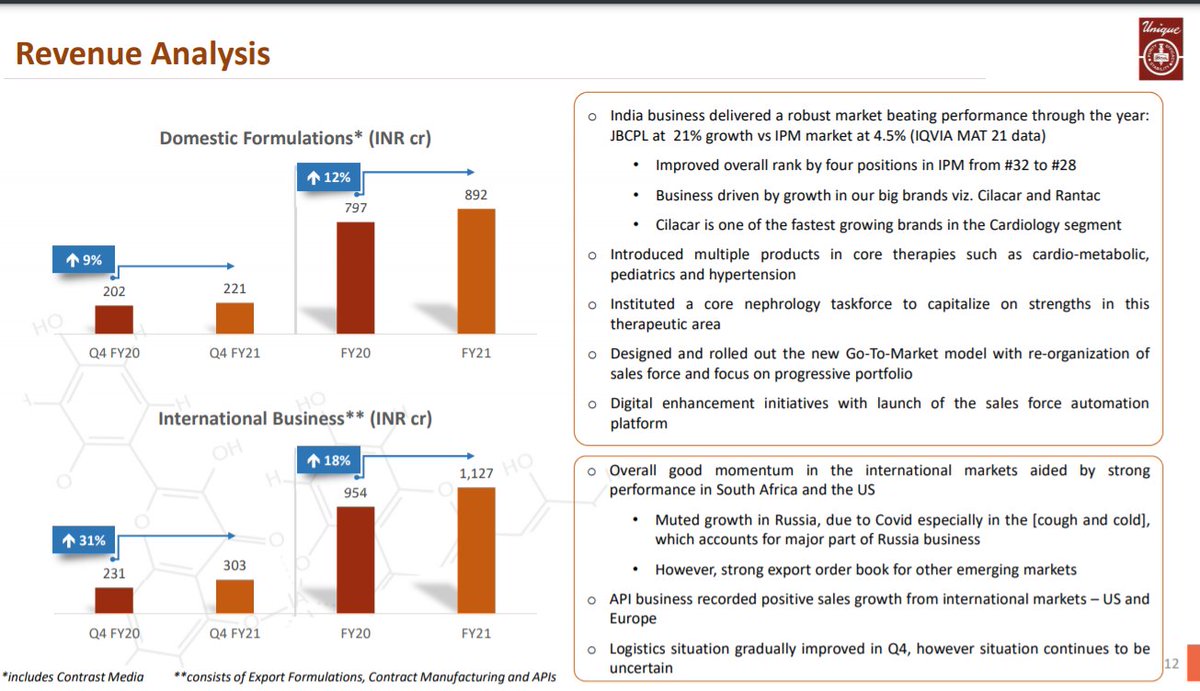

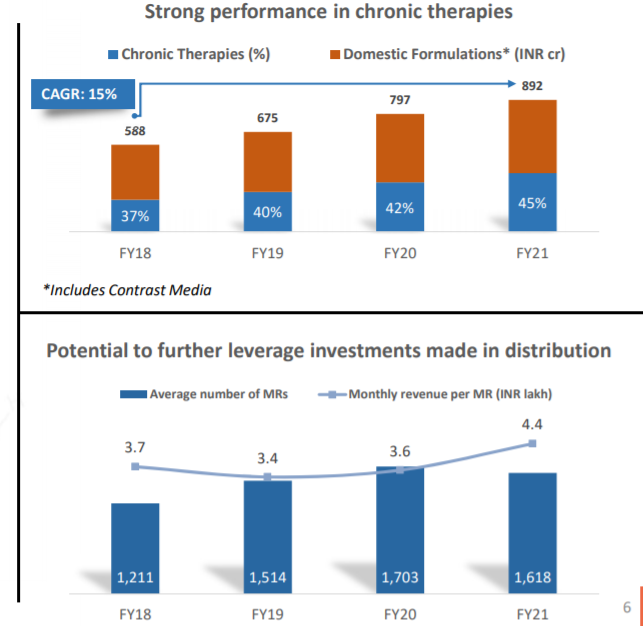

India Business:

• CAGR till now has been market beating.

• Focus remains on the cost efficiency in the India business with increasing go-to-market strategy.

• With current product in line mgmt expected to delivery growth more than industry average.

• CAGR till now has been market beating.

• Focus remains on the cost efficiency in the India business with increasing go-to-market strategy.

• With current product in line mgmt expected to delivery growth more than industry average.

Inorganic expansion:

In-organic business remains the focus of company for India business. As in when if company gets good opportunity for inorganic expansion, co. would be surely look for at it.

In-organic business remains the focus of company for India business. As in when if company gets good opportunity for inorganic expansion, co. would be surely look for at it.

Export Business:

• In Russia, co. is planning to have couple of launches, however waiting for right time (Sept is expected for launch).

• South Africa business has grown well, majorly in public segment. Both public and private expected to kick in growth in business

• In Russia, co. is planning to have couple of launches, however waiting for right time (Sept is expected for launch).

• South Africa business has grown well, majorly in public segment. Both public and private expected to kick in growth in business

Q&A from @AdityaKhemka5 sir on travelling cost:

• 135 cr was travelling expense (155cr last year). Expense was less in H1, however post H1 expenses were back and there is no significant reduction in cost.

• With increase in over all volume power cost has gone up.

• 135 cr was travelling expense (155cr last year). Expense was less in H1, however post H1 expenses were back and there is no significant reduction in cost.

• With increase in over all volume power cost has gone up.

Export Incentive

• Export incentive had less challenge. Current question remains of new export scheme of RoDTeP where incentive margins is not defined.

Capacity Utilization:

• Average utilization is around 60-65%.

• Export incentive had less challenge. Current question remains of new export scheme of RoDTeP where incentive margins is not defined.

Capacity Utilization:

• Average utilization is around 60-65%.

CAPEX:

• Maintenance capex would same as of historic (~50cr).

• There is no incremental capex plan as of now. Post 2-3 months JB will look, if there is need or not.

• With current cash co. is looking for acquiring inorganic asset.

• Maintenance capex would same as of historic (~50cr).

• There is no incremental capex plan as of now. Post 2-3 months JB will look, if there is need or not.

• With current cash co. is looking for acquiring inorganic asset.

New Launches:

• Cardio-metabolic segment is in focus.

• Nephrology- 6 products to be launched in the segment.

• Pediatrics and Respiratory segment growing and and new launches are made. Cough and cold also expected to have new launches.

• 8-10 product launch is expected.

• Cardio-metabolic segment is in focus.

• Nephrology- 6 products to be launched in the segment.

• Pediatrics and Respiratory segment growing and and new launches are made. Cough and cold also expected to have new launches.

• 8-10 product launch is expected.

Margins:

• Margins are expected to deliver from topline growth.

• Production efficiency and Cost efficiency will lead to increase in margin.

• While R&D facility also will help to encourage the profits in the business.

• Margins are expected to deliver from topline growth.

• Production efficiency and Cost efficiency will lead to increase in margin.

• While R&D facility also will help to encourage the profits in the business.

Working Capital:

• WC is quite dynamic in current scenario.

• It has come down to mgmt expectation. However coming forward, it would depend on the market scenario of international business.

• There is no significant reduction on working capital left as of now.

• WC is quite dynamic in current scenario.

• It has come down to mgmt expectation. However coming forward, it would depend on the market scenario of international business.

• There is no significant reduction on working capital left as of now.

Guidance:

• For mid term growth expected to be 20+%.

• Market beating performance, big brand products, sustaining the margin is the major focus for the company.

• For mid term growth expected to be 20+%.

• Market beating performance, big brand products, sustaining the margin is the major focus for the company.

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com

Loading suggestions...