If countries are stocks, which ones should you long & which to short?

I used machine learning to grade the industrial health of 190 countries over 30 years. Here’re results on China, US, India & more.

See which countries I’m bullish & bearish about for the next decade 👇

I used machine learning to grade the industrial health of 190 countries over 30 years. Here’re results on China, US, India & more.

See which countries I’m bullish & bearish about for the next decade 👇

First, a word on how this is done.

My coauthor (Xuege Zhang of Carnegie Mellon) & I used ML algorithm to figure out which products each country should export, given the country’s unique combo of traits. (full paper linked at the end if you’re curious).

My coauthor (Xuege Zhang of Carnegie Mellon) & I used ML algorithm to figure out which products each country should export, given the country’s unique combo of traits. (full paper linked at the end if you’re curious).

We then check if a country is indeed exporting what it should. Each country gets a “health score” of their export portfolio every year. It measures the similarity btw actual exports and algorithm’s recommendations:

higher score = healthier economy.

higher score = healthier economy.

Why so?

It’s just like your personal health. You can get energy by drinking a lot of coffee, or by having an exercise & diet regime tailored to your unique needs.

The former is a short term fix. The latter gives you sustained vitality in the long term.

It’s just like your personal health. You can get energy by drinking a lot of coffee, or by having an exercise & diet regime tailored to your unique needs.

The former is a short term fix. The latter gives you sustained vitality in the long term.

For an economy, the short-term fixes are things like monetary easing, fiscal stimulus & export price increase.

But for growth to last, the economy needs to be “structurally sound”— its industrial structure needs to tailor to the country’s true fundamentals.

But for growth to last, the economy needs to be “structurally sound”— its industrial structure needs to tailor to the country’s true fundamentals.

The export health score is a measure of this “structural soundness”.

What does this look like for actual countries?

Let’s check out a few.

What does this look like for actual countries?

Let’s check out a few.

Say what you want about China’s recent tech crackdown. It’s the CCP’s way to trim off excesses so that the economy remains structurally sound for the long run.

The CCP has done that before and will do it again. This is not “walking back from market economy” as most American pundits made it to be. (I promised to write a thread on the crackdown and I will. It’s coming!)

There’ll be more short term pain for investors from recent regulatory actions. But overall I’m highly bullish on the Chines economy. The structural soundness of its tradable sector is a big part of my confidence.

But you say, what about the real estate bubble, the insolvent banking sector, the over investments, the high corporate debts, the demographic change & (insert other million problems of China)?

This is where you need to think in relative importance of different factors. The health of industrial sector is of 1st order importance & a reliable long-run predictor. If a country gets this right, it can afford to make many other mistakes and still do ok.

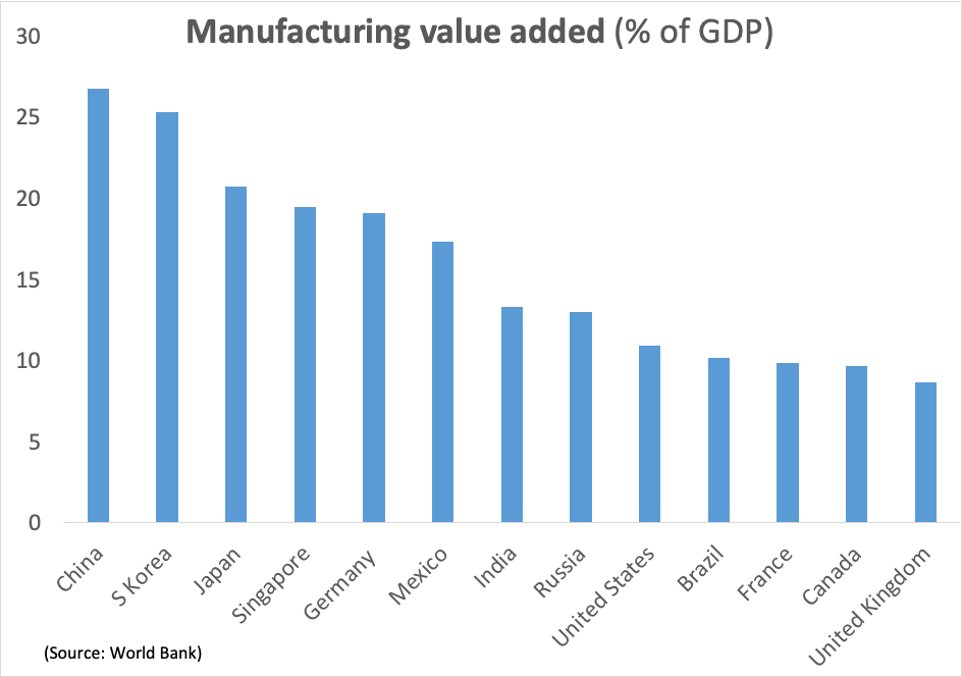

A large part of this is because of the hollowing out of industrial sector. It has many causes, among which, the Dutch Disease from the “USD export” trade that I wrote about before.

Ignoring the industrial sector for over 2 decades was a big mistake. This is the sector that creates:

1) 95% of patents & technology progress

2) huge productivity spillover to rest of economy

3) lots of employment that in turn supports middle class & creates domestic demand

1) 95% of patents & technology progress

2) huge productivity spillover to rest of economy

3) lots of employment that in turn supports middle class & creates domestic demand

But notice in the US chart that the health score has turned up a bit in the last couple years. So my hope is not lost yet.

US industries urgently need a “Build Back Better” agenda and this decade is a crucial turning point for that to happen…or not.

US industries urgently need a “Build Back Better” agenda and this decade is a crucial turning point for that to happen…or not.

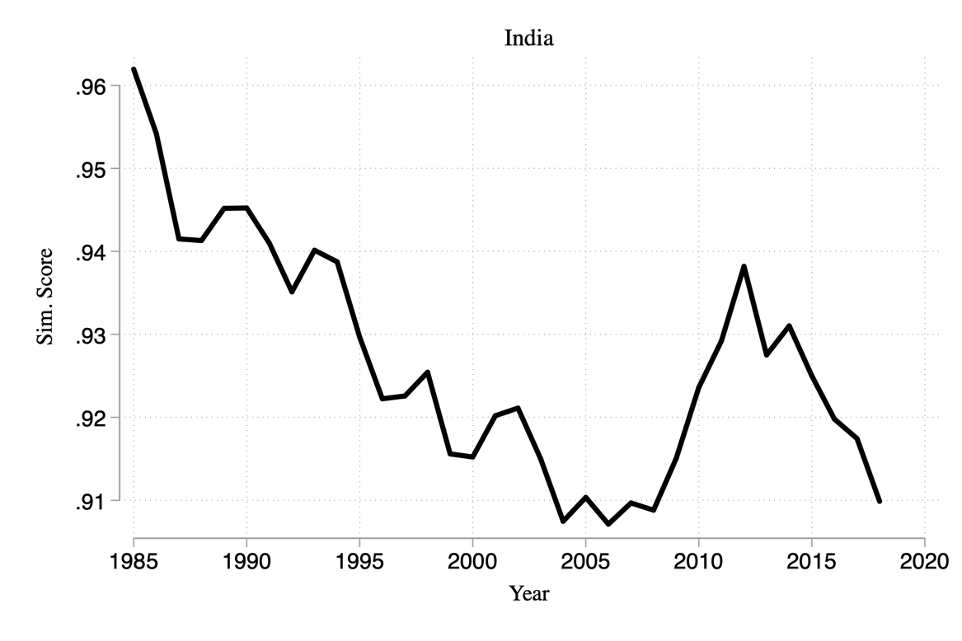

The problem with that strategy is it requires lots of human capital, and doesn’t help the vast majority of the population, which is poorly educated.

Instead of growing the middle class and building lasting domestic demand, it aggravates the gaping inequality even more.

BRAZIL

Charles de Gaulle said: “Brazil is the country of the future and always will be.”

60 years later he’s still right. The country is a forever over-promise-and-under-deliver. After a hopeful rise in export health score in the 90s, industrialization stalled.

Charles de Gaulle said: “Brazil is the country of the future and always will be.”

60 years later he’s still right. The country is a forever over-promise-and-under-deliver. After a hopeful rise in export health score in the 90s, industrialization stalled.

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com)

Let’s also look at a few smaller economies.

SOUTH KOREA

The health score has dropped somewhat in the last 20 yrs but is still in the top 20 of the world, which tells you how high it was in the past.

SOUTH KOREA

The health score has dropped somewhat in the last 20 yrs but is still in the top 20 of the world, which tells you how high it was in the past.

SINGAPORE

This country is the poster child of Asian stereotype— well-adjusted, clever, productive and reliably boring.

This country is the poster child of Asian stereotype— well-adjusted, clever, productive and reliably boring.

HONG KONG

It was transferred back to China in 1997 and health score has been dropping since. China opened up & mainland economy boomed, while Hong Kong lost some of its value prop as trade/finance bridge to China and is struggling to find a new one.

It was transferred back to China in 1997 and health score has been dropping since. China opened up & mainland economy boomed, while Hong Kong lost some of its value prop as trade/finance bridge to China and is struggling to find a new one.

PANAMA

Since the Panamanians took over the canal (1999), the economy has been on a tear. With logistics, tourism, oil, copper, gold, finTech & manufacturing, the little central American country is surprisingly diversified and has many blessings to count.

Since the Panamanians took over the canal (1999), the economy has been on a tear. With logistics, tourism, oil, copper, gold, finTech & manufacturing, the little central American country is surprisingly diversified and has many blessings to count.

The paper is still work in progress. But here’s a rough draft (pardon the construction dust 🛠) if you want to check out the nitty gritties. I’ll also push the source code to GitHub once it’s finalized.

taschalabs.com

taschalabs.com

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

BTW, if you want to see the score of your country, ask in comment. I'll try to find it.

Loading suggestions...