Business

Health

Finance

Healthcare

Market Analysis

Pharmaceuticals

Business Analysis

Pharmaceutical Industry

Why Indoco Remedies looks Interesting and why FY22-24 growth is likely to be stellar here?

Time for a thread🧵🧵🧵🧵

(Source for ophthalmics data:Nirmal Bang and rest is own work)

Time for a thread🧵🧵🧵🧵

(Source for ophthalmics data:Nirmal Bang and rest is own work)

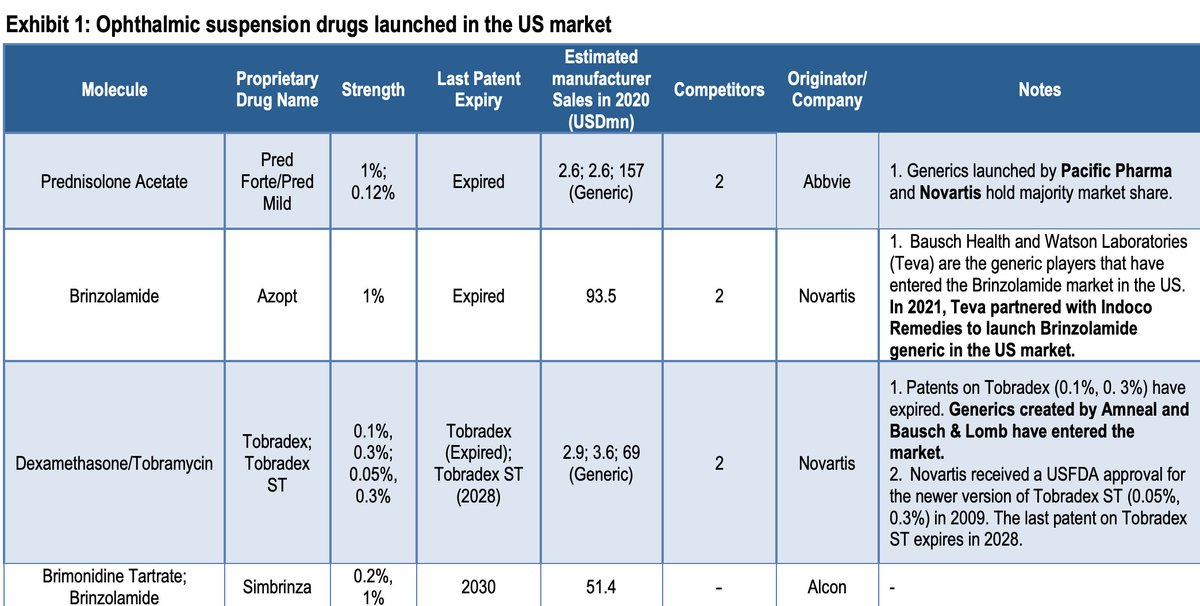

As per the USFDA’s orange book, for Ophthalmic suspension drugs, only 3 out of 17 molecules have an active patent. Among the 14 molecules that are patent expired, 8 molecules are yet to see generic

competition.

competition.

Even for the one’s which have seen generic competition, the competitive intensity is very low and there is space for an additional entrant.. Entrenched players like Novartis, Bausch & Lomb and Abbvie have dominated this market with legacy products for decades.

Indoco Remedies and Sun Pharma are the only Indian generic manufacturers to have successfully won approvals for generic version of Ophthalmic suspensions in the US market. Indoco Remedies has recently launched generic version of Azopt (brinozolamide)

Thesis entails:

1. Strong recovery in Domestic Heavy Acute Portfolio.

2. Hiring a Chief Marketing officer which indicates to something+Changing the logo (signalling)

3. UK & US exports will show disproportionate growth this year due to regulatory issues being solved

1. Strong recovery in Domestic Heavy Acute Portfolio.

2. Hiring a Chief Marketing officer which indicates to something+Changing the logo (signalling)

3. UK & US exports will show disproportionate growth this year due to regulatory issues being solved

4. MR productivity is horribly low, 2.7 lakhs. This can easily go above 3-3.5 Lakhs.

5. Indoco is the fastest growing domestic pharma business this year and they are targeting Sub-Chronic therapy launches.

6. Un-utlised gross block as the company

5. Indoco is the fastest growing domestic pharma business this year and they are targeting Sub-Chronic therapy launches.

6. Un-utlised gross block as the company

did capex but couldn't utilize it due to regulatory issues b/w 2017-2019.

7. Co is sitting on substantial operating leverage, and has the potential to do 24%+ ebitda margins in my view. First Q this year they already did 22%.

8. Management guiding to double the Ebitda in next 3

7. Co is sitting on substantial operating leverage, and has the potential to do 24%+ ebitda margins in my view. First Q this year they already did 22%.

8. Management guiding to double the Ebitda in next 3

years and tax rate reducing to normal corporate tax rate (26%).

Conclusion-co is changing the ROCE and the earnings profile going forward. Hope this thread adds value 🙏

Disc: invested from lower levels.

Watch our video to learn more🔗: youtube.com

Conclusion-co is changing the ROCE and the earnings profile going forward. Hope this thread adds value 🙏

Disc: invested from lower levels.

Watch our video to learn more🔗: youtube.com

Q2FY22: Export biz performance

European business suffered QoQ due to container issues. These dispatches would get bunched up and delivered in next 2 quarters.

US Business is very healthy, we will recover in Q3 & Q4. Profit share comes on receipt, its a long cycle (will come)

European business suffered QoQ due to container issues. These dispatches would get bunched up and delivered in next 2 quarters.

US Business is very healthy, we will recover in Q3 & Q4. Profit share comes on receipt, its a long cycle (will come)

India Business:- growth aided by strong season and subdued base last year. Seeing upside on Opthal basket as we focused on this during the lockdown.

Selling 10 products in US, and going to launch 3-4 more from ophthalmics basket.

On track in my view. Scarcity of containers

Selling 10 products in US, and going to launch 3-4 more from ophthalmics basket.

On track in my view. Scarcity of containers

From next year tax base will go from 36% to 25%.

Loading suggestions...