TLDR

Solidly is @andrecronje’s new DEX on Fantom, with experimental ve(3,3) mechanics.

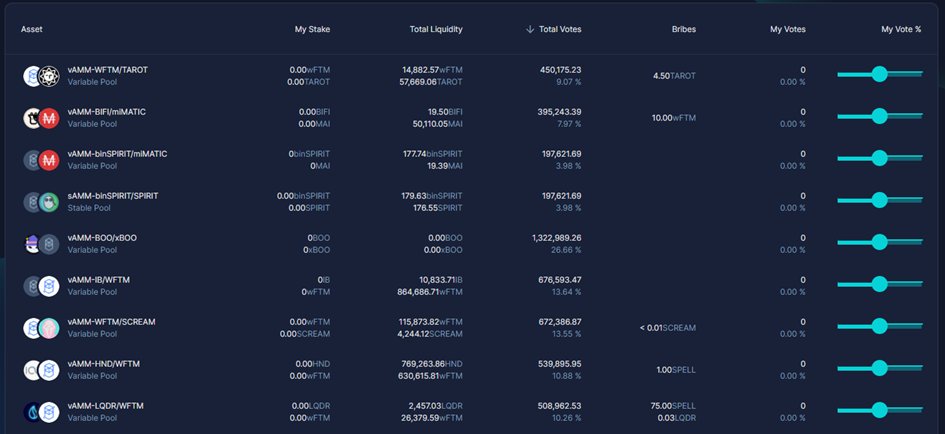

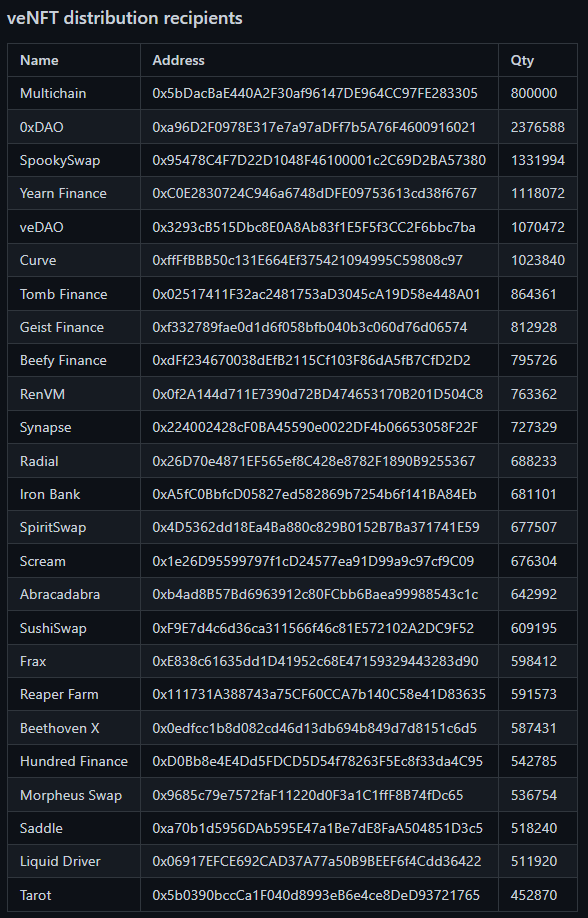

veNFTs have been airdropped to the top 25 protocols by TVL on Fantom, which have the power to vote on where SOLID emissions go. veNFT holders only receive fees from pools they vote for.

Solidly is @andrecronje’s new DEX on Fantom, with experimental ve(3,3) mechanics.

veNFTs have been airdropped to the top 25 protocols by TVL on Fantom, which have the power to vote on where SOLID emissions go. veNFT holders only receive fees from pools they vote for.

TLDR cont.

- $SOLID can be ve-locked a la Curve, giving power over where emissions go.

- (3,3) game theory prevents dilution for ve-lockers

Emissions will start February 17th.

- $SOLID can be ve-locked a la Curve, giving power over where emissions go.

- (3,3) game theory prevents dilution for ve-lockers

Emissions will start February 17th.

TLDR: How to capitalize

-Buy tokens that receive most veNFT relative to their mcap (table added later on)

-LP boosted pools

-Buy $WEVE or $OXD

-Buy tokens that receive most veNFT relative to their mcap (table added later on)

-LP boosted pools

-Buy $WEVE or $OXD

1/ Where did it start?

It all started over a month ago when @andrecronje (the notorious DeFi dev best known from $YFI, $KP3R and more) posted his ve(3,3) article: andrecronje.medium.com

This post got a lot of attention and the TVL on the Fantom network skyrocketed. Before...

It all started over a month ago when @andrecronje (the notorious DeFi dev best known from $YFI, $KP3R and more) posted his ve(3,3) article: andrecronje.medium.com

This post got a lot of attention and the TVL on the Fantom network skyrocketed. Before...

2/ ...going into ve(3,3), let’s take a quick look at ve and (3,3) separately.

👇

👇

3/ What is ve?

‘ve’ stands for ‘vote escrow’, a term popularized by @curvefinance. ‘ve’ allows you to lock up your $CRV for $veCRV, which gives you a boost on rewards. In addition, the longer you luck up the token, the more voting power you get over the platform.

‘ve’ stands for ‘vote escrow’, a term popularized by @curvefinance. ‘ve’ allows you to lock up your $CRV for $veCRV, which gives you a boost on rewards. In addition, the longer you luck up the token, the more voting power you get over the platform.

4/ What is ve? Cont.

At its core, it is a mechanic to reduce selling pressure by incentivizing those who lock their tokens for longer periods of time.

Longer lock -> more ve tokens -> more voting power on where emissions go

Further read: resources.curve.fi

At its core, it is a mechanic to reduce selling pressure by incentivizing those who lock their tokens for longer periods of time.

Longer lock -> more ve tokens -> more voting power on where emissions go

Further read: resources.curve.fi

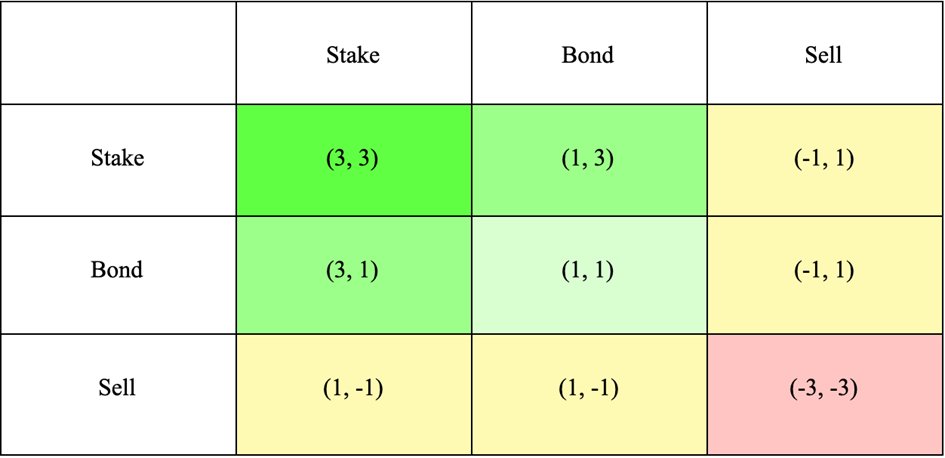

5/ What is (3,3)?

(3,3) was popularized by @olympusdao. It’s a concept from game theory: how can we optimize this system so that both parties do the best thing for themselves it’s also the best thing for all of the protocol?

(3,3) was popularized by @olympusdao. It’s a concept from game theory: how can we optimize this system so that both parties do the best thing for themselves it’s also the best thing for all of the protocol?

6/ What is (3,3)? Cont.

As seen in the matrix, the concept where two players decide to both stake their $OHM is the most optimal outcome for the whole system (3,3). Everyone stakes, everyone wins.

Further read: olympusdao.medium.com

As seen in the matrix, the concept where two players decide to both stake their $OHM is the most optimal outcome for the whole system (3,3). Everyone stakes, everyone wins.

Further read: olympusdao.medium.com

8/

…integrate the AMM into their own design, still accruing all fees to their own system without losing any fees, volume or liquidity.

AC published 5 articles explaining the protocol, which I’ve linked at the end of this thread. Let’s look at the tokenomics and $SOLID 👇

…integrate the AMM into their own design, still accruing all fees to their own system without losing any fees, volume or liquidity.

AC published 5 articles explaining the protocol, which I’ve linked at the end of this thread. Let’s look at the tokenomics and $SOLID 👇

9/ ve(3,3) x Solidly

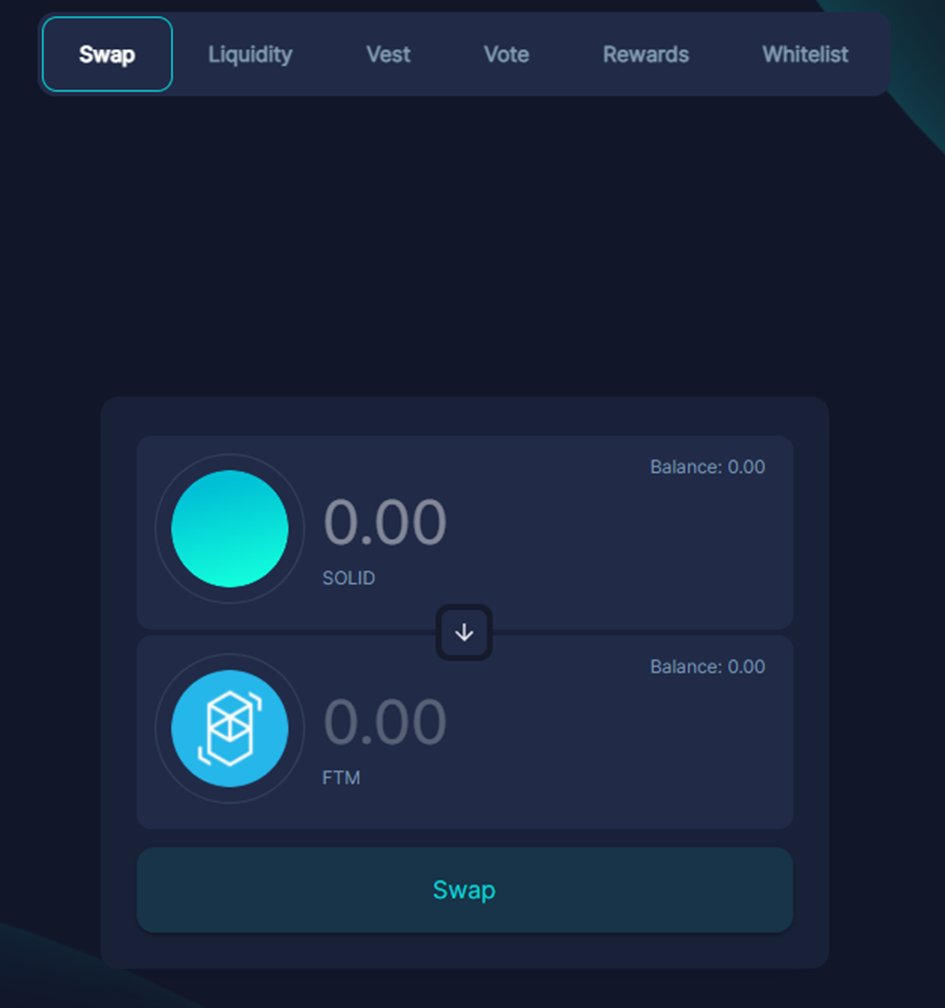

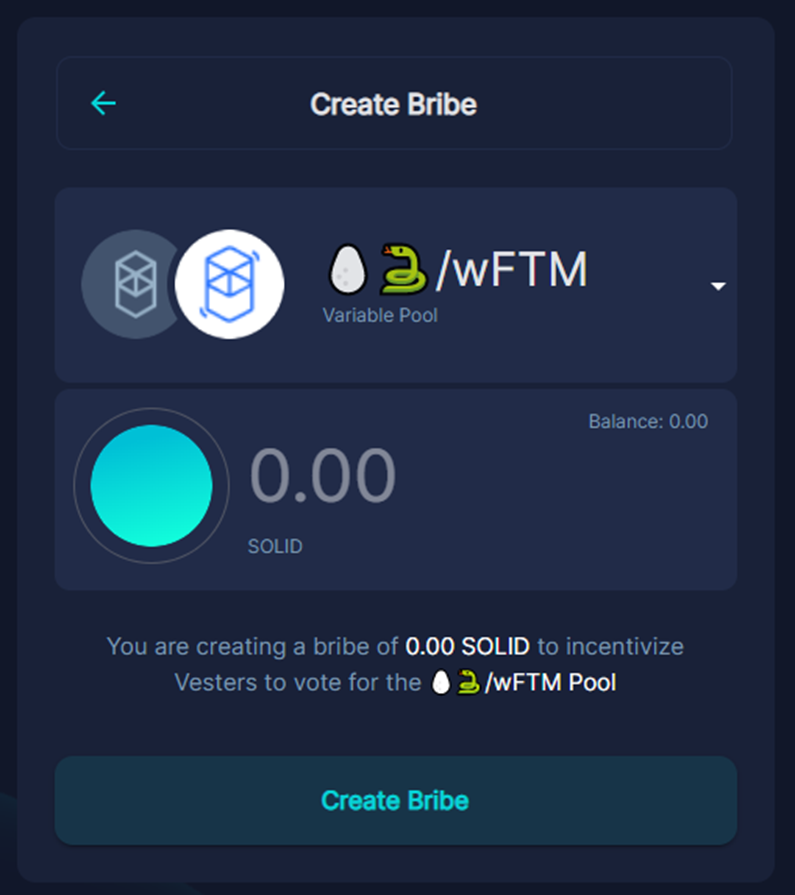

The first big change with Solidly is that swap fees don’t go to LP’s, but to ve lockers that are voting on emissions for the pools. This way lockers are incentivized to vote on and give emissions to the most active pools.

The first big change with Solidly is that swap fees don’t go to LP’s, but to ve lockers that are voting on emissions for the pools. This way lockers are incentivized to vote on and give emissions to the most active pools.

10/ Benefits of this mechanic

- It incentivizes fees for the protocol

- Emissions will promote the highest fee earning pools, which will increase liquidity on those pools to allow for better rates

- It aligns emissions with protocol incentives (liquidity – volume justified)

- It incentivizes fees for the protocol

- Emissions will promote the highest fee earning pools, which will increase liquidity on those pools to allow for better rates

- It aligns emissions with protocol incentives (liquidity – volume justified)

11/

Emissions are adjusted based on how much will be locked up:

- The less $SOLID is locked, the higher emissions are .

- The more $SOLID is locked, the lower emissions are.

This encourages more lockups, because this will simply lead to less delution.

Emissions are adjusted based on how much will be locked up:

- The less $SOLID is locked, the higher emissions are .

- The more $SOLID is locked, the lower emissions are.

This encourages more lockups, because this will simply lead to less delution.

12/ veNFT

Locked solidly won’t be trading as a $veSOLID token like veCRV, but will be trading as NFTs. The main benefits are that you don't lose out on capital efficiency of SOLID by locking it, because veSOLID NFTs can be traded in secondary markets and be used as collateral.

Locked solidly won’t be trading as a $veSOLID token like veCRV, but will be trading as NFTs. The main benefits are that you don't lose out on capital efficiency of SOLID by locking it, because veSOLID NFTs can be traded in secondary markets and be used as collateral.

15/

With everything we’ve discussed, I’m excited to see where things go. I think the majority of the supply will be locked up, since it accrues fees and controls emissions. This not only makes solidly valuable, but also increases demand for all of the Fantom ecosystem tokens.

With everything we’ve discussed, I’m excited to see where things go. I think the majority of the supply will be locked up, since it accrues fees and controls emissions. This not only makes solidly valuable, but also increases demand for all of the Fantom ecosystem tokens.

16/ Distribution

The initial supply has been given to the top 25 Fantom projects by TVL, in the form of veNFTs. These protocols can decide how they will distribute their SOLID. They are likely to use their voting power to boost emissions to a pool paired with their own token.

The initial supply has been given to the top 25 Fantom projects by TVL, in the form of veNFTs. These protocols can decide how they will distribute their SOLID. They are likely to use their voting power to boost emissions to a pool paired with their own token.

18/

@Jackniewold made a thread comparing the amount of veNFT projects receive to their mcap. This gives us an idea on the amount of $ paid/SOLID. When this thread was made, it showed 2 protocols receive more SOLID relative tot heir mcap: $IB and $PILLS

@Jackniewold made a thread comparing the amount of veNFT projects receive to their mcap. This gives us an idea on the amount of $ paid/SOLID. When this thread was made, it showed 2 protocols receive more SOLID relative tot heir mcap: $IB and $PILLS

19/ How to capitalize

We have 3 options:

1. Buy tokens that receive the most $SOLID relative to their marketcap (like @jackniewold)

2. Provide liquidity in the pool with the highest rewards or tokens you are bullish on (least risky option)

We have 3 options:

1. Buy tokens that receive the most $SOLID relative to their marketcap (like @jackniewold)

2. Provide liquidity in the pool with the highest rewards or tokens you are bullish on (least risky option)

20/ How to capitalize cont.

3. Buy $WEVE or $OXD, protocols who launched with the sole purpose of acquiring veNFTs, and with plans to distribute SOLID to holders.

3. Buy $WEVE or $OXD, protocols who launched with the sole purpose of acquiring veNFTs, and with plans to distribute SOLID to holders.

21/ Closing thoughts

All in all, I’m very excited to see how things progress with Solidly. It has gained a lot of attention and I’m looking forward to the start of emissions February 17th.

Below I will add some quality threads and resources on Solidly.

All in all, I’m very excited to see how things progress with Solidly. It has gained a lot of attention and I’m looking forward to the start of emissions February 17th.

Below I will add some quality threads and resources on Solidly.

22/ Check out these threads 1/3

23/ Check out these threads 2/3

24/ Check out these threads 3/3

27/ fin

If you liked the thread, I would very much appreciate it if you give it a retweet and a like. For more threads like this, give me a follow.

If you liked the thread, I would very much appreciate it if you give it a retweet and a like. For more threads like this, give me a follow.

Loading suggestions...