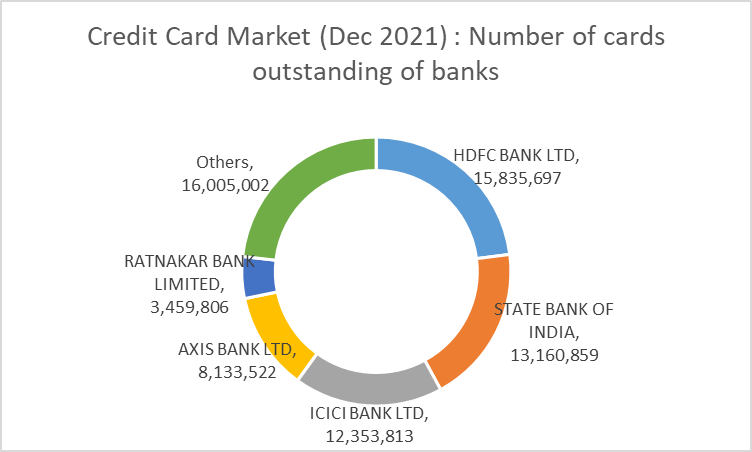

While NBFCs and Fintechs have been able to make in-roads in normal lending products, credit card market has been largely dominated by banks. This is not due to great service that banks are providing rather due to regulatory moat that they enjoy.

Presently, NBFCs and Fintechs on a standalone basis cannot easily issue credit cards to their customers. They need to tie up with a bank which issues the card while these entities do the heavy lifting of sourcing, credit underwriting and take the entire credit risk.

This introduces a dependency on the bank and also makes the entire process inefficient. Partner bank takes a chunk of revenue for just providing the facility to issue the card. This revenue leakage has to be ultimately borne by the card holder.

With Fintechs/ NBFCs being allowed to issue cards, this revenue leakage can be prevented. Secondly,

there will be lot more product innovation as well since there will be no dependency on bank partners( who typically need to approve changes in underlying products)

there will be lot more product innovation as well since there will be no dependency on bank partners( who typically need to approve changes in underlying products)

Lastly, its good from regulatory perspective that the entity which is sourcing and underwriting customers becomes the issuer of cards also and becomes directly accountable to the regulatory framework.

Loading suggestions...