A Thread on #GNFC and a Deep Dive into it's Business

Gujarat Narmada Valley Fertilizers and Chemicals

⚡️A Chemical Major in love with a Fertilizer Minor

Retweet and Like this Thread to have a wider Reach

( A small Effort from your side could make a big Impact )

Gujarat Narmada Valley Fertilizers and Chemicals

⚡️A Chemical Major in love with a Fertilizer Minor

Retweet and Like this Thread to have a wider Reach

( A small Effort from your side could make a big Impact )

GNFC - A small peek into Valuations and Results before studying the Business

Posted Best ever Results - It was a clear Bumper

An EPS of 35 in a Quarter with a Margin of 28% and Sales at 2400 crores

Trades at a P/E of 6 ... Yes you heard me right .. A P/E of 6 ..

Posted Best ever Results - It was a clear Bumper

An EPS of 35 in a Quarter with a Margin of 28% and Sales at 2400 crores

Trades at a P/E of 6 ... Yes you heard me right .. A P/E of 6 ..

Well before concluding what is cheap is cheap for a reason do hear me

I question valuations a lot and always trust my charts and price more . More often i think market values stocks better than me ..

Reserves of 7200 Crores on Books with almost Zero Debt . ( I'm not Kidding)

I question valuations a lot and always trust my charts and price more . More often i think market values stocks better than me ..

Reserves of 7200 Crores on Books with almost Zero Debt . ( I'm not Kidding)

Now what makes GNFC different from the Ex-GNFC in 2018

It was clearly a cyclical business . Still it is but not so cyclical like the past . The FII know this and is jumping in Quickly

Selling everything around the market but Buying GNFC .. Looks unique and cool

It was clearly a cyclical business . Still it is but not so cyclical like the past . The FII know this and is jumping in Quickly

Selling everything around the market but Buying GNFC .. Looks unique and cool

How to manage Risk ..

According to me the Stock is ready for a Blasting move with regards to technicals if the PEG is held .

If the stock doesnot fall back into the Earnings Gap , it's all set for a Blast .

So my Stop Loss is the Power Earnings Gap ( 490 SL)

Let's move on

According to me the Stock is ready for a Blasting move with regards to technicals if the PEG is held .

If the stock doesnot fall back into the Earnings Gap , it's all set for a Blast .

So my Stop Loss is the Power Earnings Gap ( 490 SL)

Let's move on

Let's talk about business .

Dont fret because i'm too optimistic about valuations

I have mentioned this name at 400 as a great investment and invested too . Do read my Tweet about GNFC

GNFC is a chemical major in love with a Fertilizer Minor

Dont fret because i'm too optimistic about valuations

I have mentioned this name at 400 as a great investment and invested too . Do read my Tweet about GNFC

GNFC is a chemical major in love with a Fertilizer Minor

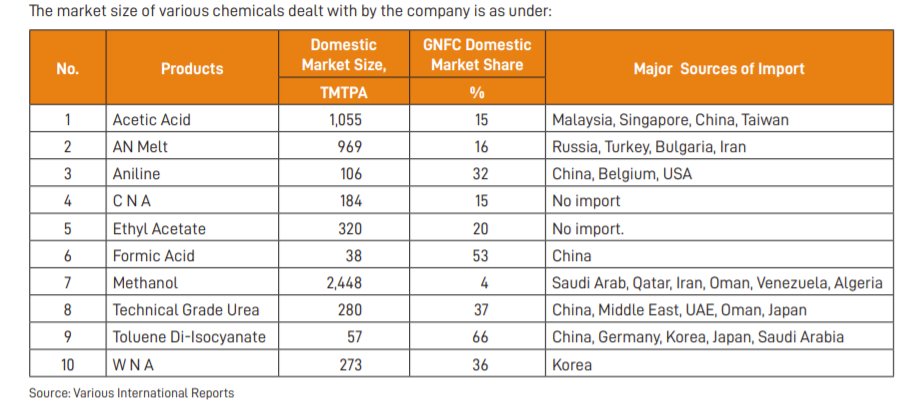

Most of these chemicals are commodity chemicals and hence the profit is based on the Spreads internationally

If you deal in more chemicals if the spread of one chemicals is down 5-10Rs the other could gain the same and compensate the net EBIDTA

Dependence on single chem is Bad

If you deal in more chemicals if the spread of one chemicals is down 5-10Rs the other could gain the same and compensate the net EBIDTA

Dependence on single chem is Bad

"Among the very few Public Sector companies with no Debt "

Give them an applause

Best Result among peers and least valued company

Things will change . The volume Charts and RS say that as of now ..

Give them an applause

Best Result among peers and least valued company

Things will change . The volume Charts and RS say that as of now ..

Ok let's wrap it up now . Hey after analysing for this long you have a Stop Loss . Dont you feel silly

This is a question i frequently get

For me Risk first Reward later . All this research is done to find the reward .

But Risk first . @markminervini

This is a question i frequently get

For me Risk first Reward later . All this research is done to find the reward .

But Risk first . @markminervini

Hope you liked this detailed explanation about Fundamentals and technicals

take a second to scroll up and Like , Retweet and do comment this thread to show your support .

would mean a lot for the effort i put

Didn't tag anyone as i trust the Readers would share and spread

take a second to scroll up and Like , Retweet and do comment this thread to show your support .

would mean a lot for the effort i put

Didn't tag anyone as i trust the Readers would share and spread

Loading suggestions...