first of all, this whole new wave of ICT traders that are recently coming on crypto Twitter and trade BTC don't understand how markets work in the first place, justifying every move as the evil intention of market makers is not how markets work and what market makers do.

The principle of why markets move and what role market makers actually do in the market is explained here - tradingriot.com

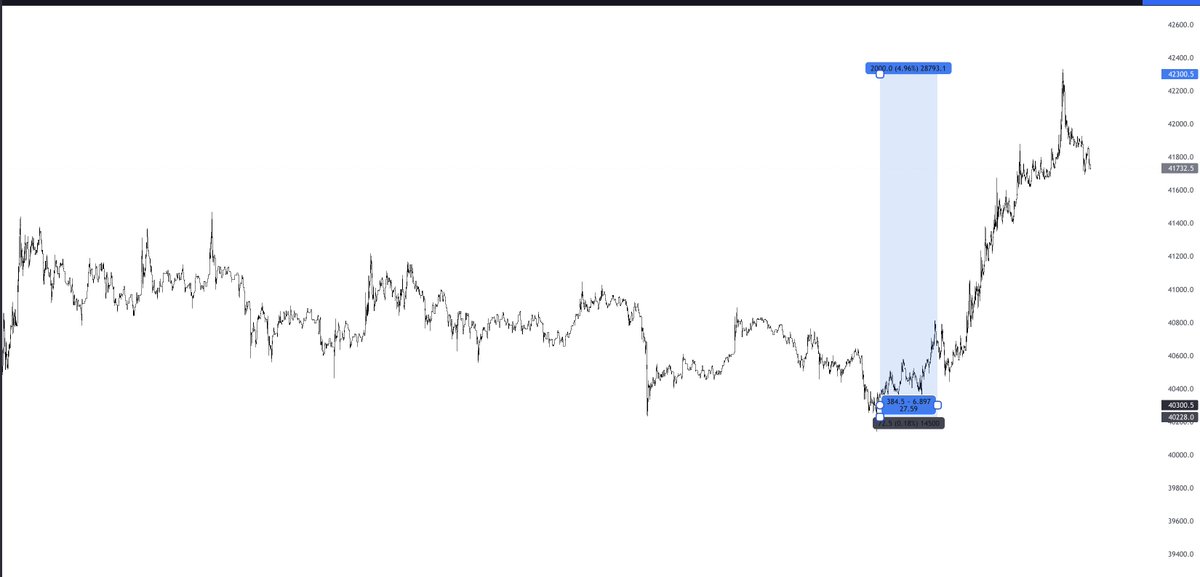

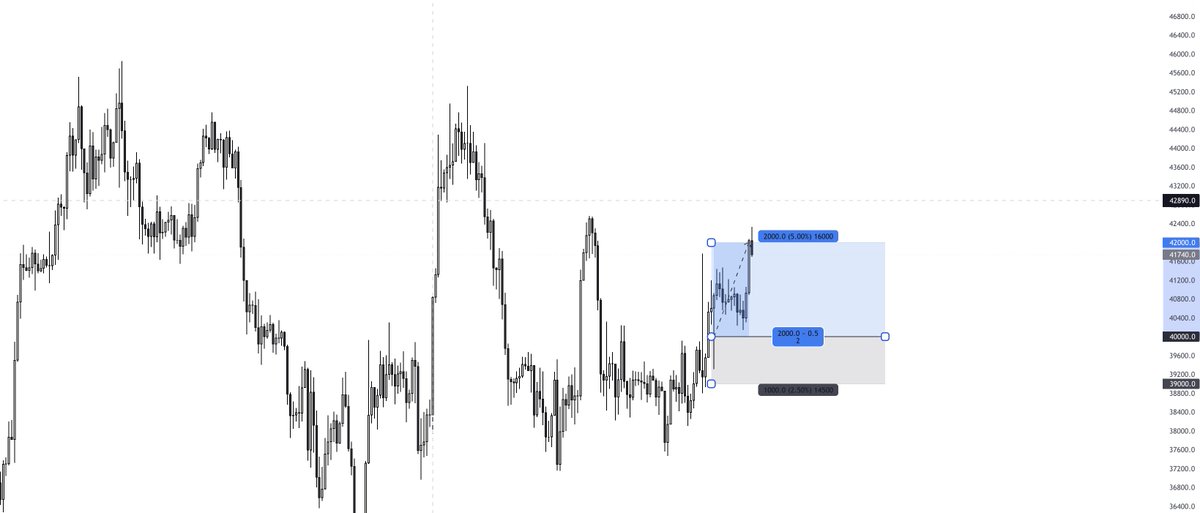

the real issue with these massive R trades comes in the execution if you are looking at daily or hourly timeframes. The opportunities to let your trades run for 10times or more of your risk are very rare and they take weeks to play out.

so most of these people you see on Twitter post 1 minute or sometimes even second charts that are of course always hindsight but let's give this the benefit of doubt for now.

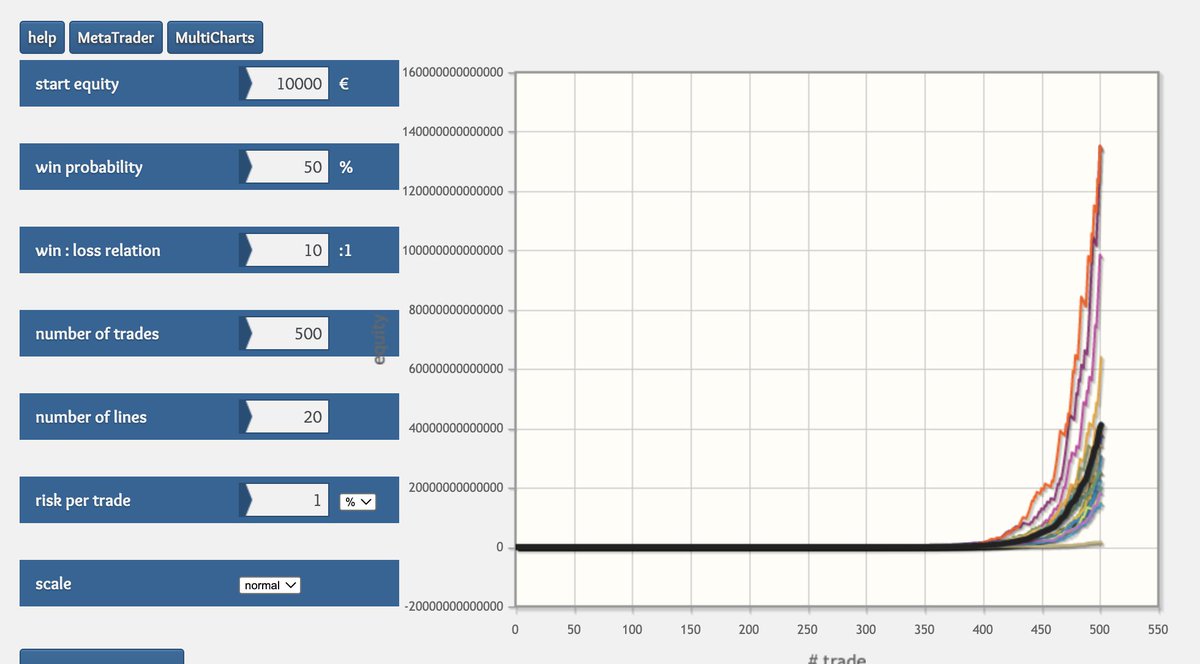

As you can notice after 500 trades, you are the richest man in the world. If you still are delusional and think this is something that is possible, let's talk about sizing and actual trading.

First of all, on lower timeframes, there is much more "noise" it's not actually noise, but the room for random wicks and spikes in price is much higher therefore your actual win rate will drop drastically I would say to around 10-20%

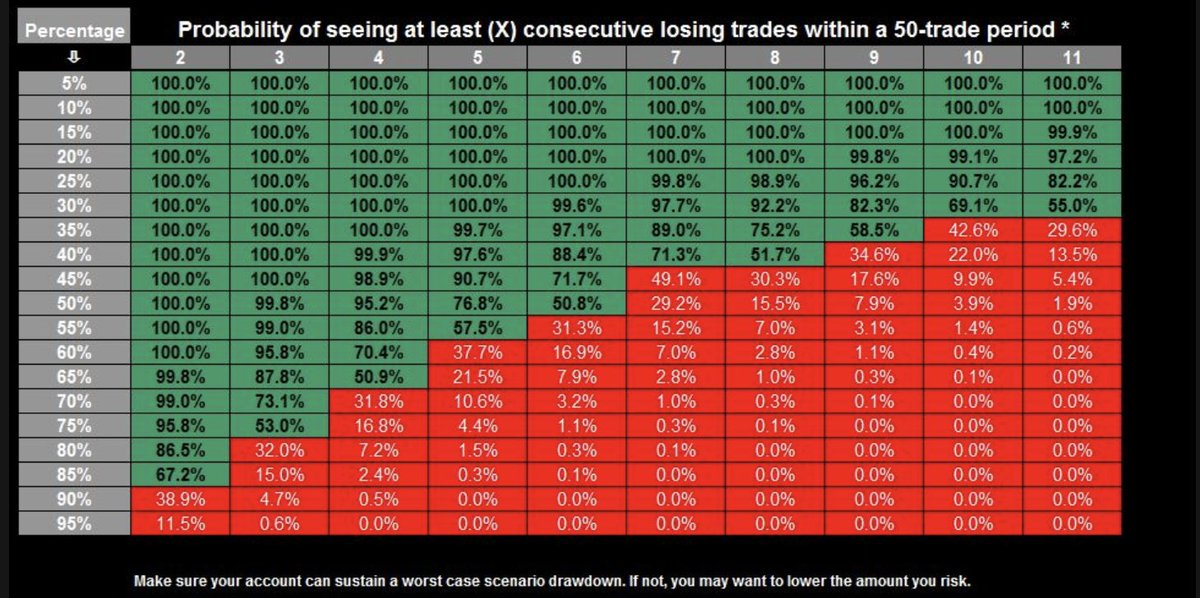

On this sheet shared by @Trader_Dante you can see that there is pretty much a 100% chance to have 11 and more losses in a row with this type of strategy, good luck not losing your mind during these prolonged drawdowns.

Another thing Tom shared is this example of a black swan in EURCHF. Since you are trading with such a tight invalidation and huge size any unexpected event will cause massive slippage which will pretty much clean your whole account.

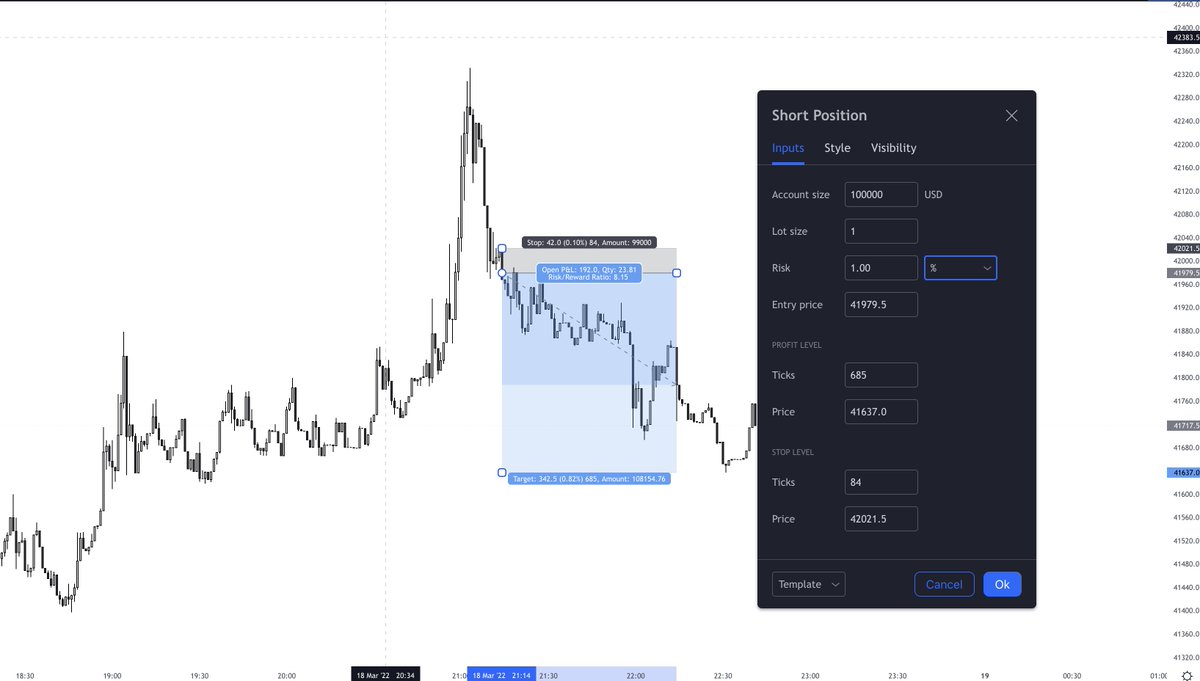

100k can still be considered modest account size but you can already see how these trades are just not possible to take in the real world.

To conclude this, don't trust people who larp online claiming they take these huge R trades on a daily basis because they are a) lying and b) most likely trade with very little money.

I have some blog posts about more of a realistic side of trading like this one about risk management tradingriot.com

last thing to add is focus on consistency and staying in trading for a long run. My average R is between 2-3 which is more than enough if you focus on high probability trades.

Loading suggestions...