Technology

Business

Space

Engineering

Finance

Energy

manufacturing

Defense

nuclear energy

Clean energy

#MTAR Technologies - Leader in Niche Precision Engineering 🛩️🛩️

Like & Retweet For Max Reach !

CMP - ₹ 1803

Like & Retweet For Max Reach !

CMP - ₹ 1803

1. Company Overview

MTAR Technologies is a leader in the precision engineering industry. They serve clients in the Defence, Space, Nuclear and Clean Energy industries. The company is engaged in the manufacture of

MTAR Technologies is a leader in the precision engineering industry. They serve clients in the Defence, Space, Nuclear and Clean Energy industries. The company is engaged in the manufacture of

Power Corporation of India Limited (NPCIL) which controls all operational, under construction and planned reactors in the country given India does not allow private participation. They manufacture products which are highly critical to the functioning of nuclear reactors.

They have 14 kinds of products with a wide range of applications.

Defence: In this segment, the company has undertaken complex assemblies for the DRDO, such as the base shroud assembly for Agni missiles and the assembly of Secondary Injection Thrust Vector Control (SITVC)

Defence: In this segment, the company has undertaken complex assemblies for the DRDO, such as the base shroud assembly for Agni missiles and the assembly of Secondary Injection Thrust Vector Control (SITVC)

valves and Hydraulic Fin Tip Control (HFTC) valves. They also supplied critical defence products such as aluminum weldments and other machined components to international customers including, an Israeli defense technology company.

Space: In the Space segment, the company mainly serves ISRO. They offer a wide variety of mission critical components and critical assemblies such as liquid propulsion engines, components and assemblies for cryogenic engines, specifically turbo pumps,

booster pumps, gas generators and injector heads for such engines and electro-pneumatic modules to serve space launch vehicles.

Clean Energy: This is their biggest segment and most of their revenues in this segment comes from Bloom Energy.

Clean Energy: This is their biggest segment and most of their revenues in this segment comes from Bloom Energy.

They manufacture power units - specifically hot boxes (which use methane to produce energy) and are also involved in the development and manufacture of hydrogen boxes and electrolyzers. Bloom is one of the largest and the fastest growing players globally in the

stationary hydrogen fuel cell segment and has 70% of its revenues coming from these product segments, the balance comes from services.

The company derives 55% of its revenues from exports and 45% is from domestic customers.

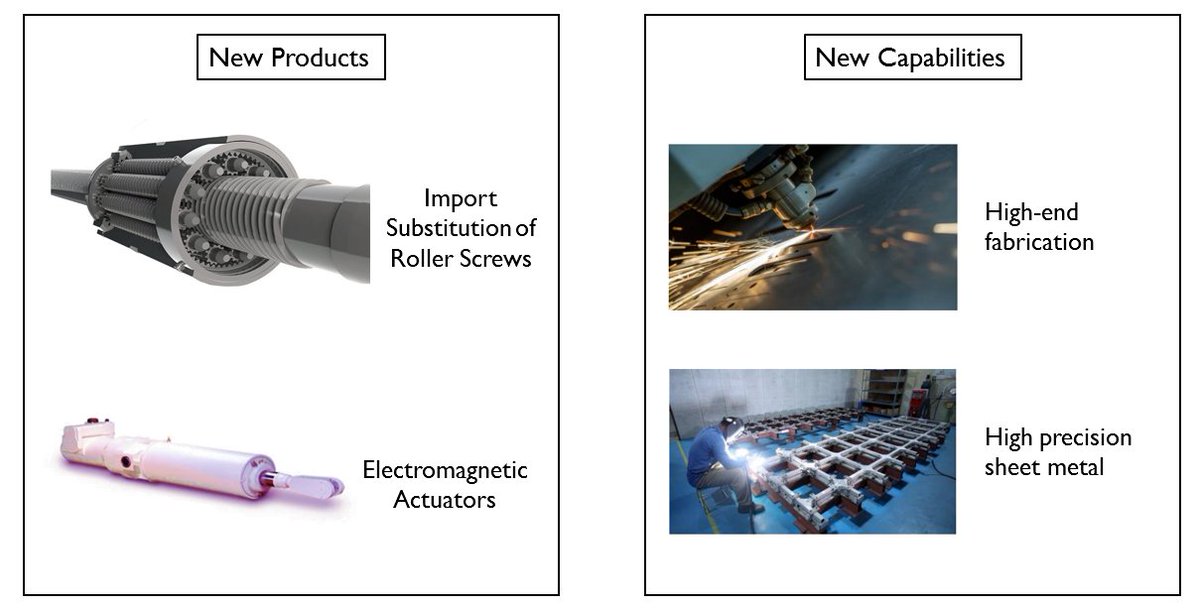

5. New Products/Capabilities

They company is launching new products and new capabilities which can provide significant growth in the future. They are developing roller screws which are very complex to manufacture and are used in space and defence applications.

They company is launching new products and new capabilities which can provide significant growth in the future. They are developing roller screws which are very complex to manufacture and are used in space and defence applications.

Currently, there are no manufacturers for this product in India and roller screws are imported for all of India’s requirements. MTAR is hoping to be the sole manufacturer of this product in India. The market for this product in India is ₹80 Cr.

They are also expanding their capabilities to offer high end fabrication and high precision sheet metal to their customers. They are already in talks with ISRO and Bloom energy to fabricate products for them.

Also, since these products are so complex to manufacture, the new suppliers have to go through a long qualification process. Also, the customer is very dependent on MTAR for the manufacturing as they are usually involved in the development process of the products as well.

7. Financials

The company has the ability to pass on price increases in their contracts. So the management has indicated the EBITDA margins are sustainable over 30% in the long term.

The company has the ability to pass on price increases in their contracts. So the management has indicated the EBITDA margins are sustainable over 30% in the long term.

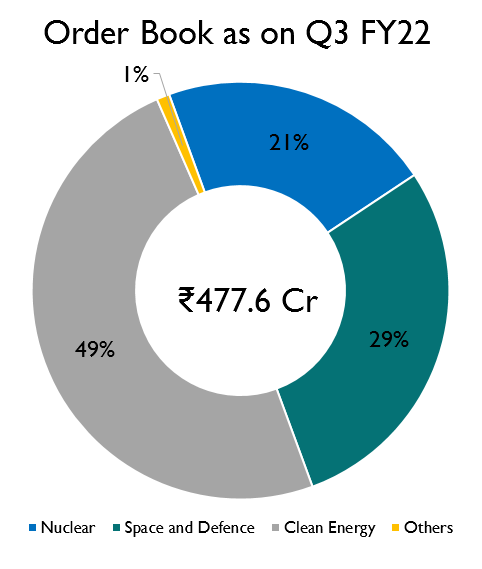

Future Outlook

In September of 2021, they received their largest single order of about ₹220 Cr to manufacture hotboxes for Bloom Energy. This order is going to be executed over the 4 quarters of calendar year 2022. They also expect orders for hydrogen boxes and electrolysers in

In September of 2021, they received their largest single order of about ₹220 Cr to manufacture hotboxes for Bloom Energy. This order is going to be executed over the 4 quarters of calendar year 2022. They also expect orders for hydrogen boxes and electrolysers in

FY23. In addition to this, the capacities for the import substitute products will also be live.

The management had initially given a guidance of 20-25% revenue growth in FY22 which they have revised to 30-35%.

The management had initially given a guidance of 20-25% revenue growth in FY22 which they have revised to 30-35%.

The management has also given a guidance of 50% revenue growth for FY23.

Loading suggestions...