How is no one talking about $ICHI @ichifoundation?

How are they solving liquidity issues in DeFi?

Why has the price of $ICHI absolutely mooned?

Let’s get into it🧵👇

1/21

How are they solving liquidity issues in DeFi?

Why has the price of $ICHI absolutely mooned?

Let’s get into it🧵👇

1/21

Every crypto project has 3 main goals:

1. Getting new users

2. Growing protocol value via TVL and native token scarcity

3. Building an ecosystem supporting their protocol

2/21

1. Getting new users

2. Growing protocol value via TVL and native token scarcity

3. Building an ecosystem supporting their protocol

2/21

@ichifoundation aims to help these protocols reach their goals.

ICHI deploys a Decentralized Monetary Authority (DMA), a customized DAO to give any project a branded dollar always worth 1 USD (called a oneToken)!

How does this work?

Let’s go through the steps👇

3/21

ICHI deploys a Decentralized Monetary Authority (DMA), a customized DAO to give any project a branded dollar always worth 1 USD (called a oneToken)!

How does this work?

Let’s go through the steps👇

3/21

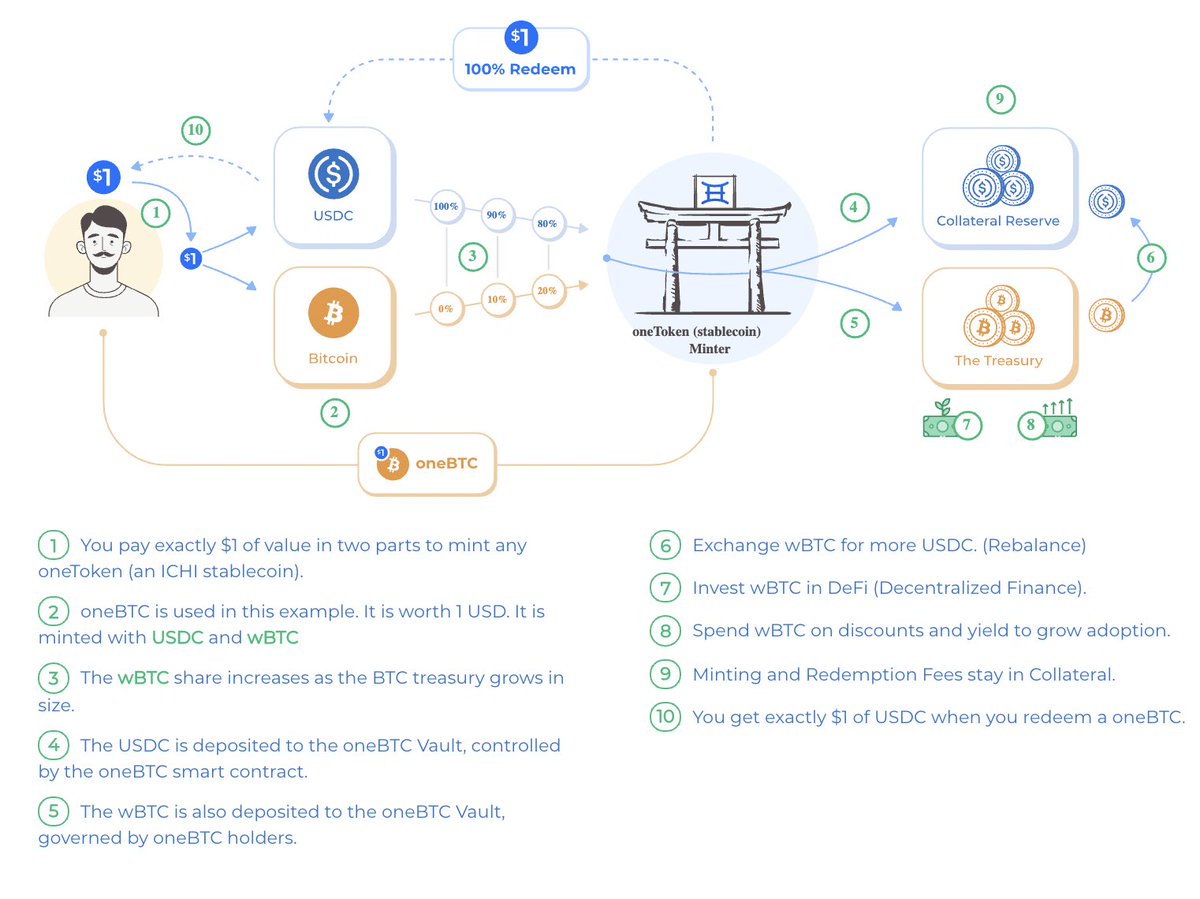

1. User deposits 1$ of value in two parts to mint any oneToken (ICHI stablecoin) For example, oneBTC is always worth 1 USD, and is minted with USDC and wBTC)

2. As the wBTC treasury grows in size, the wBTC share increases

4/21

2. As the wBTC treasury grows in size, the wBTC share increases

4/21

3. The USDC is deposited into the oneBTC vault, acting as collateral for oneBTC.

4. The wBTC is deposited into the treasury, with oneBTC holders governing the funds (can be invested in DeFi, sold for USDC and rebalance, or spent on discounts and yield to grow adoption!)

5/21

4. The wBTC is deposited into the treasury, with oneBTC holders governing the funds (can be invested in DeFi, sold for USDC and rebalance, or spent on discounts and yield to grow adoption!)

5/21

This mechanism can be used for protocol funding, without having to sell native tokens.

Instead, they’re able to use their native branded dollar (oneToken), and generate yield on it (more on that later), mitigating native token sell pressure!

7/21

Instead, they’re able to use their native branded dollar (oneToken), and generate yield on it (more on that later), mitigating native token sell pressure!

7/21

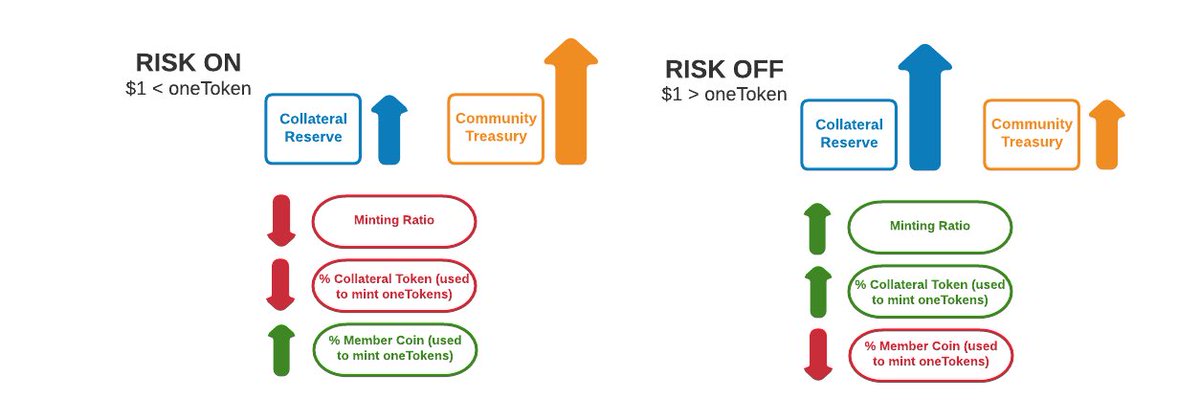

This also creates native token scarcity, as supplied native tokens used to create oneTokens are locked in the treasury as POL!

Native oneToken holders can choose the % of native token need to create the oneToken (98/2%, 80/20% are most common)

8/21

Native oneToken holders can choose the % of native token need to create the oneToken (98/2%, 80/20% are most common)

8/21

What about a regular degen? How does this benefit them?

ICHI provides yield opportunities on the native oneToken that can be used by the protocol or a degen!

Deposit:

Earn $ICHI rewards just for HODLing your OneToken! Simple, with no need for LPing

app.ichi.org

10/21

ICHI provides yield opportunities on the native oneToken that can be used by the protocol or a degen!

Deposit:

Earn $ICHI rewards just for HODLing your OneToken! Simple, with no need for LPing

app.ichi.org

10/21

Here’s where is gets crazy…

Angel Vaults:

This isn’t your standard UniV3 optimizer.

Users will deposit LP tokens, made up of $ICHI-OneToken or a OneToken-native token (for example $FOX and $oneFOX).

ICHI will then supply those LP tokens into UniV3, optimizing rewards!

11/21

Angel Vaults:

This isn’t your standard UniV3 optimizer.

Users will deposit LP tokens, made up of $ICHI-OneToken or a OneToken-native token (for example $FOX and $oneFOX).

ICHI will then supply those LP tokens into UniV3, optimizing rewards!

11/21

For those of you who don’t know, when you provide liquidity on UniV3, you’ll receive trading fees (.3% of swaps) in the specific range you deposited.

ICHI will take the deposited LP tokens, and make sure you’re always earning trading fees!

12/21

ICHI will take the deposited LP tokens, and make sure you’re always earning trading fees!

12/21

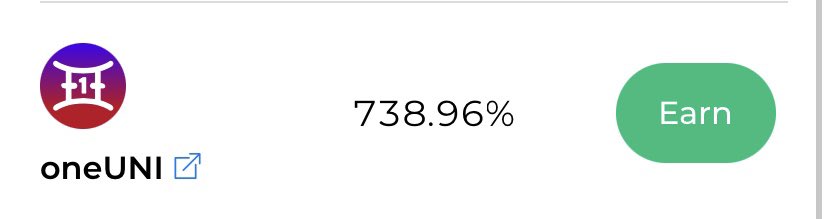

This has allowed for some serious trading fee rewards.

For example, the $ICHI- $oneUNI pool is currently offering 740% ROI!

Check here for all available angel vaults👇

app.ichi.org

13/21

For example, the $ICHI- $oneUNI pool is currently offering 740% ROI!

Check here for all available angel vaults👇

app.ichi.org

13/21

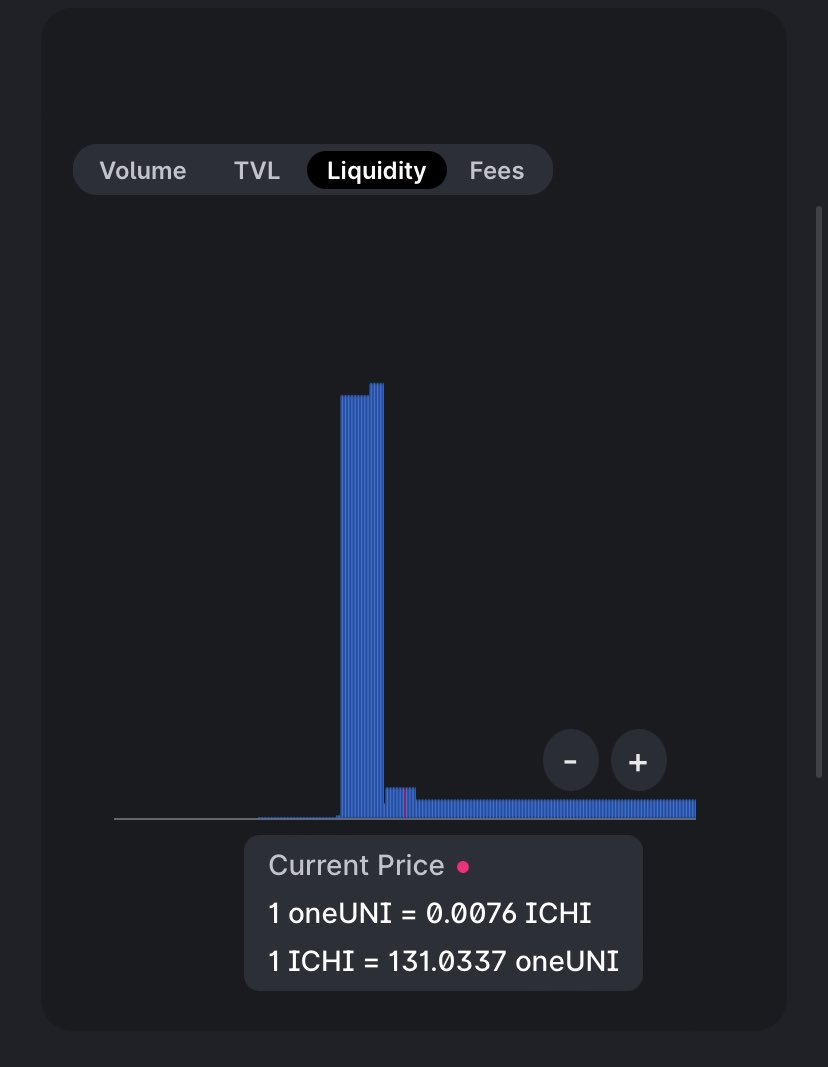

But that’s not all. ICHI has strategically concentrated its liquidity for its $ICHI pairs, placing huge amounts of liquidity in and below the current price range, making it extremely difficult to dump token price!

14/21

14/21

HODL vaults:

Deposit single-sided liquidity, and receive juicy IRR (internal rate of return)

Most notably, deposit $GNO @gnosisdao tokens into ICHI, and earn 2515% IRR! (Note: this will fluctuate based on volume/trading fees)

How?

16/21

Deposit single-sided liquidity, and receive juicy IRR (internal rate of return)

Most notably, deposit $GNO @gnosisdao tokens into ICHI, and earn 2515% IRR! (Note: this will fluctuate based on volume/trading fees)

How?

16/21

When tokens are deposited into HODL vaults, they get supplied in a liquidity pool with $ICHI tokens (token- $ICHI).

Due to optimization of liquidity, the supplied token will receive trading fees at all times, allowing for high IRR!

app.ichi.org

17/21

Due to optimization of liquidity, the supplied token will receive trading fees at all times, allowing for high IRR!

app.ichi.org

17/21

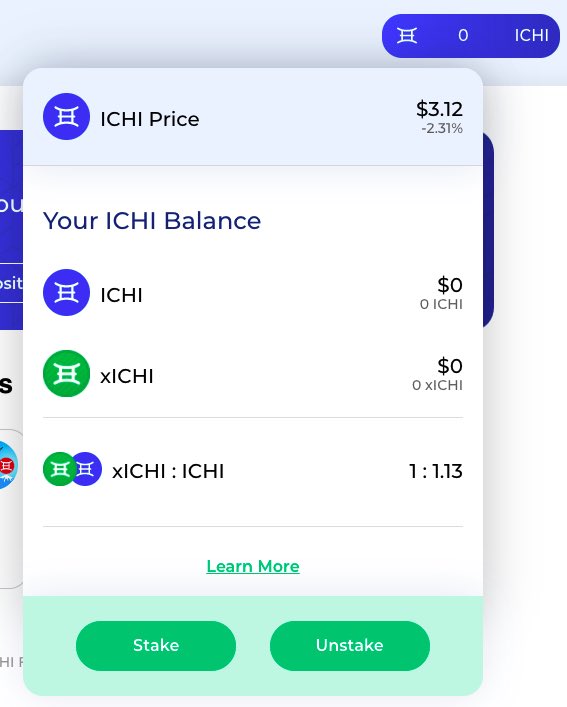

$xICHI is also used as a governance token (or ICHIpowah), and determine future features and parameters of the ICHI platform, as well as protocol improvements.

Those who participate in governance will receive extra $ICHI tokens!

19/21

Those who participate in governance will receive extra $ICHI tokens!

19/21

Oh, @ichifoundation is going cross-chain, launching on Polygon!

Don’t sleep on $ICHI 👀👀

@JumperWave

@CryptoUgluuk

@Route2FI

@milesdeutscher

@crypto_coochie

20/21

Don’t sleep on $ICHI 👀👀

@JumperWave

@CryptoUgluuk

@Route2FI

@milesdeutscher

@crypto_coochie

20/21

Thank you for reading

Like and retweet!

Oh, and your gonna want to follow me for daily crypto threads 😏

@BarryFried1

Comment below what to cover next 👇

21/21

Like and retweet!

Oh, and your gonna want to follow me for daily crypto threads 😏

@BarryFried1

Comment below what to cover next 👇

21/21

Loading suggestions...