TL;DR:

- New $ETH issuance will drop by 90%.

- More ETH will be staked due to higher staking APR.

- All the staked ETH and staking rewards will still be locked at least 6 months after The Merge.

- Institutional Demand will surge after The Merge.

- You don't own enough ETH.

- New $ETH issuance will drop by 90%.

- More ETH will be staked due to higher staking APR.

- All the staked ETH and staking rewards will still be locked at least 6 months after The Merge.

- Institutional Demand will surge after The Merge.

- You don't own enough ETH.

The Merge will remove Proof of Work (PoW) from Ethereum and replace it with the Proof of Stake (PoS) consensus mechanism.

There are many good threads and articles covering it in more details, e.g.:

But let's ignore technicalities and focus on $ETH only.

There are many good threads and articles covering it in more details, e.g.:

But let's ignore technicalities and focus on $ETH only.

The price of each asset is shaped by the supply and demand forces.

What factors will change $ETH supply and demand dynamics after the Merge?

1. Triple Halvening

2. ETH Staking APR

3. ETH (Un)Lock

4. Institutional Demand

Let's cover them one by one.

What factors will change $ETH supply and demand dynamics after the Merge?

1. Triple Halvening

2. ETH Staking APR

3. ETH (Un)Lock

4. Institutional Demand

Let's cover them one by one.

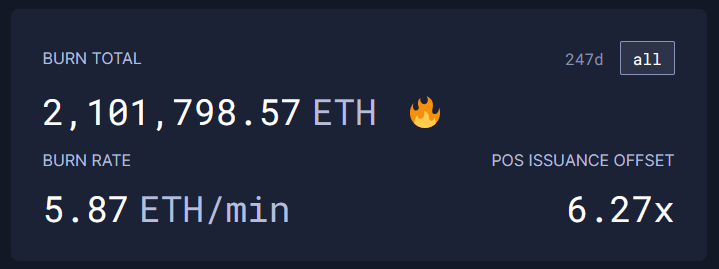

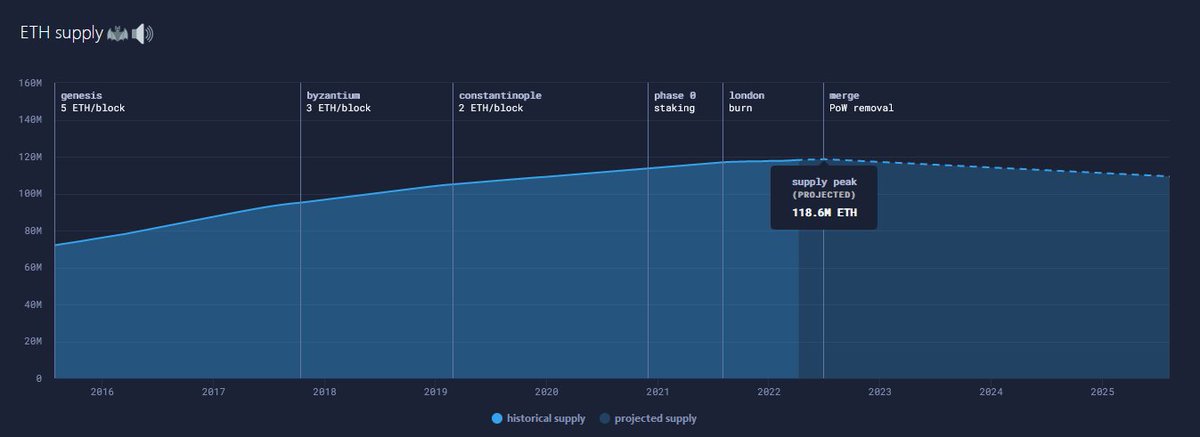

1. Triple Halvening

In PoS $ETH issuance is reduced by 90%!

It will take three $BTC halvings to produce an equivalent supply reduction.

What Bitcoin will achieve in 12 years, Ethereum is doing in one go this year.

But it's not only 90% reduction in sell pressure. It's more...

In PoS $ETH issuance is reduced by 90%!

It will take three $BTC halvings to produce an equivalent supply reduction.

What Bitcoin will achieve in 12 years, Ethereum is doing in one go this year.

But it's not only 90% reduction in sell pressure. It's more...

In PoW $ETH issuance goes to miners who operate extremely costly business. They are forced to sell lots of their ETH to cover high bills.

In PoS new ETH goes to validators and they only have to worry about minimal electricity and hardware cost. They are NOT forced sellers.

In PoS new ETH goes to validators and they only have to worry about minimal electricity and hardware cost. They are NOT forced sellers.

Moreover, Bitcoin miners don't have to be $BTC bulls. They invest in hardware and electricity, not in BTC.

On the contrary, Ethereum validators must stake $ETH so they are usually long-term holders.

Why would they sell their staking rewards if they see ETH go higher in price?

On the contrary, Ethereum validators must stake $ETH so they are usually long-term holders.

Why would they sell their staking rewards if they see ETH go higher in price?

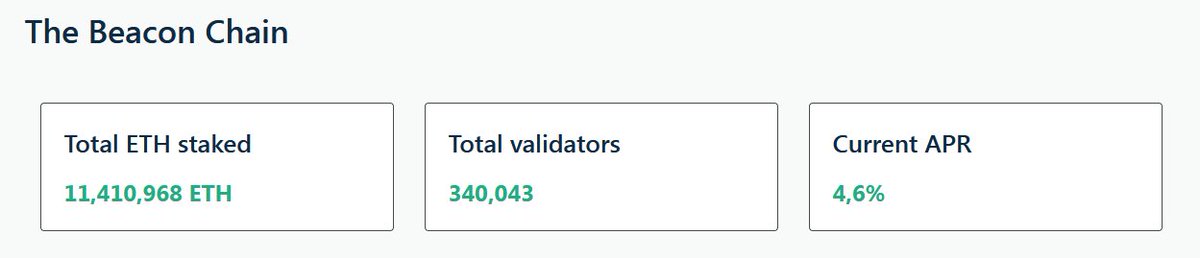

Staking APR can be considered as near risk-free yield on $ETH. When it goes up, it will result in more ETH being staked as it becomes an attractive alternative to other earning opportunities in DeFi.

More ETH staked = less supply on the market or even increased buying pressure.

More ETH staked = less supply on the market or even increased buying pressure.

3. ETH (Un)Lock

Currently staking $ETH is a one-way ticket. Stakers can't withdraw their ETH and rewards.

Many people seem to believe The Merge will enable withdrawals and suddenly >11M ETH will get unlocked to flood the market.

This is completely false.

Currently staking $ETH is a one-way ticket. Stakers can't withdraw their ETH and rewards.

Many people seem to believe The Merge will enable withdrawals and suddenly >11M ETH will get unlocked to flood the market.

This is completely false.

Withdrawals will be enabled at least 6 months after The Merge.

In other words, both staked $ETH and staking rewards will not enter the circulation for at least half a year.

When withdrawals are finally enabled only 30k ETH can be withdrawn per day. There won't be a huge unlock.

In other words, both staked $ETH and staking rewards will not enter the circulation for at least half a year.

When withdrawals are finally enabled only 30k ETH can be withdrawn per day. There won't be a huge unlock.

4. Institutional Demand

Why will PoS transition spike the interest of institutions?

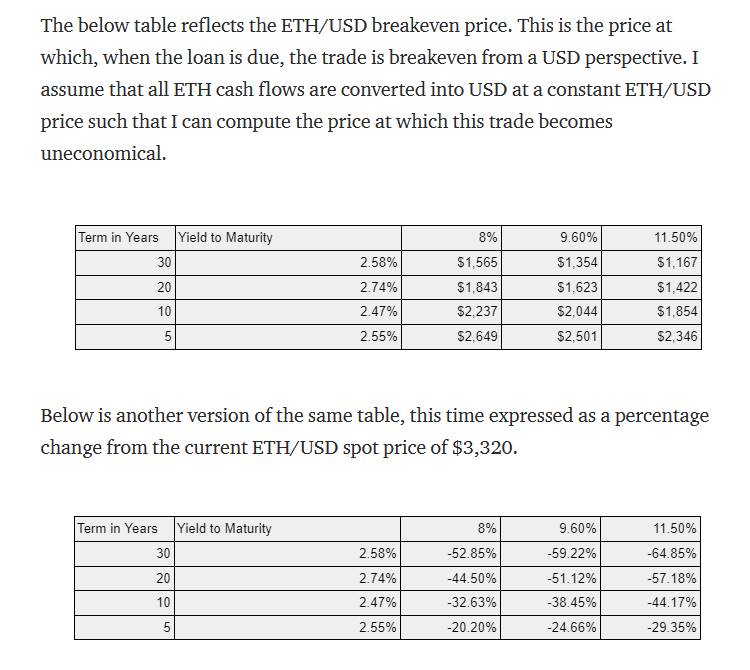

- DCF model will apply to $ETH and it shows ETH is undervalued.

- ETH as the "Internet Bond" will be an alternative to U.S. treasuries.

- ETH will be environmentally friendly - a good narrative.

Why will PoS transition spike the interest of institutions?

- DCF model will apply to $ETH and it shows ETH is undervalued.

- ETH as the "Internet Bond" will be an alternative to U.S. treasuries.

- ETH will be environmentally friendly - a good narrative.

DCF model is a popular valuation method in TradFi. Institutions who control trillions of dollars of global wealth have been using it for decades.

In PoS DCF model will finaly apply to $ETH.

Why is it so important?

In PoS DCF model will finaly apply to $ETH.

Why is it so important?

By predicting future cashflows, it will become possible to evaluate a fair value of $ETH. This is what institutional investors need to approve multi-million dollar investments.

And, you might have guessed by now, ETH is severely undervalued.

And, you might have guessed by now, ETH is severely undervalued.

Moreover, staking yield transforms $ETH into the Internet Bond - a viable alternative to U.S. treasuries.

Even though ETH is more volatile than bonds, it guarantees higher yield, which can still be better in real terms if ETH price doesn't plummet.

cryptohayes.medium.com

Even though ETH is more volatile than bonds, it guarantees higher yield, which can still be better in real terms if ETH price doesn't plummet.

cryptohayes.medium.com

Last but not least, transition to PoS will decline the energy use of the Ethereum network by 99.98%.

When climate change concerns are widespread, energy-intensive PoW gets a lot of hate. Whether this criticism is justified or not is irrelevant. The narrative is all what matters.

When climate change concerns are widespread, energy-intensive PoW gets a lot of hate. Whether this criticism is justified or not is irrelevant. The narrative is all what matters.

While $BTC supporters will have to fight back the attacks on PoW and wearily justify the energy consumption of the Bitcoin network, $ETH holders will bask in the narrative of the environmentally friendly blockchain.

It's easier to change the narrative rather than win a war.

It's easier to change the narrative rather than win a war.

Let's sum it up:

- Triple Halvening to reduce new $ETH issuance by 90%.

- ETH Staking APR to lock more ETH into staking contracts.

- ETH (Un)Lock to keep all the staked ETH and rewards out of the circulation for at least 6 months after The Merge.

- Institutional Demand to surge.

- Triple Halvening to reduce new $ETH issuance by 90%.

- ETH Staking APR to lock more ETH into staking contracts.

- ETH (Un)Lock to keep all the staked ETH and rewards out of the circulation for at least 6 months after The Merge.

- Institutional Demand to surge.

You don't need a degree in economics to understand what happens with the price of an asset if its supply is decreasing and demand increasing.

Yes, it's number go up.

This is exactly what, I think, will happen with $ETH price after The Merge (long-term trajectory).

Yes, it's number go up.

This is exactly what, I think, will happen with $ETH price after The Merge (long-term trajectory).

Moreover, institutional demand is not here yet at full scale.

Many corporate risk committees would not approve an investment into an asset with a "huge execution risk" ahead, as PoS transition is often described.

Only after the merge, $ETH will become an investable asset.

Many corporate risk committees would not approve an investment into an asset with a "huge execution risk" ahead, as PoS transition is often described.

Only after the merge, $ETH will become an investable asset.

Finally, with bears controlling the market now, price action completely ignores the fundamentals.

Therefore:

- The Merge is NOT priced in.

- You can front-run institutions by buying $ETH before them.

- You don't own enough ETH and neither do I.

Therefore:

- The Merge is NOT priced in.

- You can front-run institutions by buying $ETH before them.

- You don't own enough ETH and neither do I.

More in-depth information:

@BanklessHQ:

- What The Merge means for ETH: newsletter.banklesshq.com

- The ETH Bond Market: newsletter.banklesshq.com

@TheDailyGwei:

- You Don't Own Enough ETH: thedailygwei.substack.com

@korpi87:

- Detailed EIP-1559 Summary: xdefi.io

@BanklessHQ:

- What The Merge means for ETH: newsletter.banklesshq.com

- The ETH Bond Market: newsletter.banklesshq.com

@TheDailyGwei:

- You Don't Own Enough ETH: thedailygwei.substack.com

@korpi87:

- Detailed EIP-1559 Summary: xdefi.io

Thank you for your time. Now please go to the first tweet linked below and like / retweet it to send the bears away :)

You can read the unrolled version of this thread here: typefully.com

Loading suggestions...