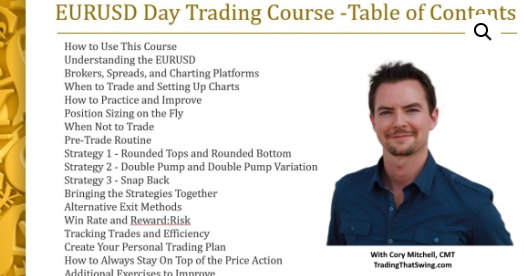

10 Lessons for #Daytrading the $EURUSD

from the

EURUSD Day Trading Course

Including strategies, ways to improve, position-sizing, and making rapid trades on the fly.

from the

EURUSD Day Trading Course

Including strategies, ways to improve, position-sizing, and making rapid trades on the fly.

1. When day trading #forex, I only trade the EURUSD.

It has enough movement, the smallest spread, and the biggest volume (which translates to less slippage on orders).

No need to waste time or effort on anything else. Specialize and get good at the EURUSD.

It has enough movement, the smallest spread, and the biggest volume (which translates to less slippage on orders).

No need to waste time or effort on anything else. Specialize and get good at the EURUSD.

2. Use an ECN broker for day trading. Ideally, the spread should be under 0.5 pips and the commissions should be $5/standard lot or less.

$1 to $3 commissions and a 0.4 pip spread or less is better.

Bigger spreads and commissions create a big disadvantage.

$1 to $3 commissions and a 0.4 pip spread or less is better.

Bigger spreads and commissions create a big disadvantage.

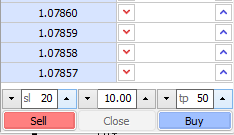

3. Set yourself up for making quick trades. A stop loss & target should go out with each entry...too time-consuming ot put them out manually.

MT4/5 has a handy tool. Right-click the chart. Select Market Depth...

MT4/5 has a handy tool. Right-click the chart. Select Market Depth...

4. Set the y-axis every day before trading. I set mine to the daily average range for the last 10 weeks. I don't change it until there is a significant change in volatility.

I want a 10 pip pattern (or whatever) to look the same visually every day.

More: tradethatswing.com

I want a 10 pip pattern (or whatever) to look the same visually every day.

More: tradethatswing.com

5. Take daily screenshots of your trades. After trading, write notes and highlight mistakes, etc. Take a screenshot, every day. Save them. Review them weekly/monthly or at scheduled times.

Can also track your stats in this trading log:

tradethatswing.com

Can also track your stats in this trading log:

tradethatswing.com

6. Risk 1% or less of the ACCOUNT BALANCE on each trade. As SL changes our position size changes, yet risk to the account stays the same.

Know your position sizes for the day. Calculate them beforehand for various SL distances you often see. Knowing them means quicker trades...

Know your position sizes for the day. Calculate them beforehand for various SL distances you often see. Knowing them means quicker trades...

For example, 1% of $5000 account means we can lose up to $50/trade.

If typical Stop loss is 5 pips trading EURUSD, you can trade 1 standard lot.

4 pip SL = 1.25 standard lots

6 pip SL = 0.83 standard lots

You can read about position sizing here: tradethatswing.com

If typical Stop loss is 5 pips trading EURUSD, you can trade 1 standard lot.

4 pip SL = 1.25 standard lots

6 pip SL = 0.83 standard lots

You can read about position sizing here: tradethatswing.com

Leverage in being used with these position sizes: 5K in the account but trading a 100K position.

Leverage is a double-edged sword. This is why a SL must be used to keep the loss to less than 1% of the account.

Don't hold day trades through impact news announcements.

Leverage is a double-edged sword. This is why a SL must be used to keep the loss to less than 1% of the account.

Don't hold day trades through impact news announcements.

7. Less than 15 pips of movement in the last 2 hours means I'm very cautious. Less than 10 pips in last 2 hours, I'm not trading.

Knowing when not to trade is as important as knowing when to take a trade. Don't trade in shit conditions when the price isn't moving.

Knowing when not to trade is as important as knowing when to take a trade. Don't trade in shit conditions when the price isn't moving.

8. Strategies: Double Pump

Relatively simple trending strategy. The chart shows an example from the article below.

tradethatswing.com

If risking 1% per trade (that's 1R), making 2.5R means making 2.5% on the account.

Relatively simple trending strategy. The chart shows an example from the article below.

tradethatswing.com

If risking 1% per trade (that's 1R), making 2.5R means making 2.5% on the account.

9. Strategies: Rounded Top and Bottom

One of my favorites.

Covered in this thread:

One of my favorites.

Covered in this thread:

10. While trading, "commentate" the price action. Discuss with yourself what has to happen to take a trade, or why there are no trades right now. This helps many newer traders develop their analysis and timing skills.

Discussed more in this article:

tradethatswing.com

Discussed more in this article:

tradethatswing.com

If you like this thread, please retweet it.

Follow @corymitc for more info like this.

To start day trading forex in an effective risk-controlled way, the EURUSD Day Trading Course provides more strategies and trading hacks to get you up and running.

tradethatswing.com

Follow @corymitc for more info like this.

To start day trading forex in an effective risk-controlled way, the EURUSD Day Trading Course provides more strategies and trading hacks to get you up and running.

tradethatswing.com

And if you're wondering what the hell #forex is or how to trade it, this article provides an introduction to the biggest financial market in the world:

tradethatswing.com

tradethatswing.com

For Double Pump, we want to see a strong move up, for example. A small pullback, a move back to the near the recent swing high, and then a drop back to pullback low that just occurred. As the price transitions up, take a long. SL below recent lows. Target 2.5x SL distance.

I continually add new videos to the $EURUSD course to help peole out with problem areas. I just added another video looking at Price Action Context - When not to trade and noticing "chop" as it starts forming so we can avoid getting whipsawed.

tradethatswing.com

tradethatswing.com

Loading suggestions...