Is $OHM going to surprise everyone soon?

- @OlympusDAO starts buying OHM with treasury assets.

- OHM liquidity gets reduced by $122M which makes the price impact of buying pressure stronger.

- $61M worth of OHM gets burned.

Number go up?

Read on for more details.

- @OlympusDAO starts buying OHM with treasury assets.

- OHM liquidity gets reduced by $122M which makes the price impact of buying pressure stronger.

- $61M worth of OHM gets burned.

Number go up?

Read on for more details.

OIP-94 (Olympus Improvement Proposal) is now in voting with nearly 100% of voters being for the proposed changes: snapshot.org

This OIP grants the protocol authority to actively use its treasury and protocol-owned liquidity (POL) in order to move $OHM price up.

How?

This OIP grants the protocol authority to actively use its treasury and protocol-owned liquidity (POL) in order to move $OHM price up.

How?

The key to push $OHM price up is in the combination of two mechanisms:

- Inverse Bonds above backing

- POL management

Both are supposed to help Olympus conduct efficient market operations.

Let's cover them shortly.

- Inverse Bonds above backing

- POL management

Both are supposed to help Olympus conduct efficient market operations.

Let's cover them shortly.

Traditional Olympus bonds consist in selling discounted $OHM by the protocol in exchange for other assets (e.g. stables or LP tokens).

Inverse Bonds are the opposite - the protocol buys OHM from holders at a premium to the market price in exchange for assets from the treasury.

Inverse Bonds are the opposite - the protocol buys OHM from holders at a premium to the market price in exchange for assets from the treasury.

120-day MA is the target price around which the future concept of Range-Bound Stability (RBS) will operate.

RBS is an interesting mechanism proposed by @ohmzeus but it's not the topic of this thread.

You can read more about it here:

RBS is an interesting mechanism proposed by @ohmzeus but it's not the topic of this thread.

You can read more about it here:

Inverse Bonds can push $OHM price up:

- They absorb selling pressure without affecting the market price.

- They incentivize buying from the market as it's possible to sell OHM at a higher price to the protocol.

- They attract new buyers due to the expectation of increasing price.

- They absorb selling pressure without affecting the market price.

- They incentivize buying from the market as it's possible to sell OHM at a higher price to the protocol.

- They attract new buyers due to the expectation of increasing price.

The impact of Inverse Bonds on the market price is dependent on the AMM liquidity. The higher the liquidity, the lower the impact.

$OHM is very liquid. Large buys don't move the price up by a lot, therefore, Inverse Bonds efficiency is suppressed.

Unless...

$OHM is very liquid. Large buys don't move the price up by a lot, therefore, Inverse Bonds efficiency is suppressed.

Unless...

Unless the liquidity is substantially reduced!

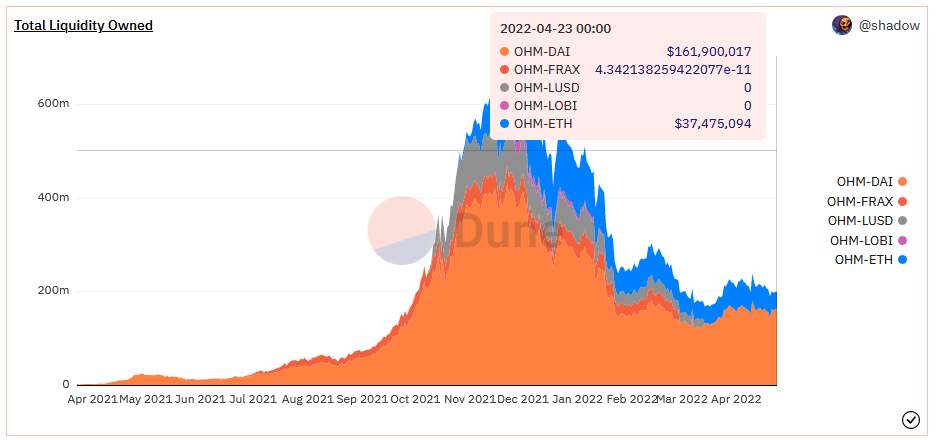

Piece of cake for @OlympusDAO. The protocol owns more than 99% of the $OHM liquidity on Ethereum!

This is almost $200M which constitutes 45% of the current market cap ($450M). Liquidity to MC ratio (L/MC) is now 0.45.

Piece of cake for @OlympusDAO. The protocol owns more than 99% of the $OHM liquidity on Ethereum!

This is almost $200M which constitutes 45% of the current market cap ($450M). Liquidity to MC ratio (L/MC) is now 0.45.

OIP-94 sets the target for L/MC at 0.2.

It means liquidity should be reduced to 0.2 * $450M = $90M. This would be a reduction by $110M!

But it's not the final outcome. According to OIP-94, $OHM removed from the liquidity will be burned...

It means liquidity should be reduced to 0.2 * $450M = $90M. This would be a reduction by $110M!

But it's not the final outcome. According to OIP-94, $OHM removed from the liquidity will be burned...

With $110M reduction in liquidity, $55M worth of $OHM will be removed from the supply. It lowers the MC by $55M which increases L/MC above the target 0.2! 🤯

To keep L/MC at 0.2, liquidity should be reduced by $122M which will burn $61M worth of OHM (L=$78M, MC=$389M).

To keep L/MC at 0.2, liquidity should be reduced by $122M which will burn $61M worth of OHM (L=$78M, MC=$389M).

Not only does this operation improve the efficiency of Inverse Bonds but also it increases the treasury value per $OHM since the same amount of treasury assets backs the lower amount of OHM in circulation.

It should be comforting for those concerned about the backing price.

It should be comforting for those concerned about the backing price.

Reads:

- @Coots1212 on Range-Bound Stability:

- @knowerofmarkets on Range-Bound Stability:

- @OlympusDAO on Inverse Bonds:

- @Asfi3333 on OIP-94:

- OIP-94: forum.olympusdao.finance

- @Coots1212 on Range-Bound Stability:

- @knowerofmarkets on Range-Bound Stability:

- @OlympusDAO on Inverse Bonds:

- @Asfi3333 on OIP-94:

- OIP-94: forum.olympusdao.finance

Thank you for your time. Now please go to the first tweet linked below and like / retweet it to help me support Inverse Bonds in pumping the $OHM price :)

I cover many DeFi-related topics in the form of comprehensive and informative threads. Check my Notion workspace to easily browse threads that can still be valuable today and consider following me for more.

bit.ly

bit.ly

You can read the unrolled version of this thread here: typefully.com

Loading suggestions...