An index value of 120 suggests that the U.S. dollar has appreciated 20% versus the basket of currencies over the time period in question.

Simply put, if the USDX goes up, that means the U.S. dollar is gaining strength or value when compared to the other currencies.

Simply put, if the USDX goes up, that means the U.S. dollar is gaining strength or value when compared to the other currencies.

Similarly, if the index is currently 80, falling 20 from its initial value, that implies that it has depreciated 20%

In simple layman terms it can be said that it this index tracks the money flow from riskier bets to safer ones.

In simple layman terms it can be said that it this index tracks the money flow from riskier bets to safer ones.

The dollar index is now at a resistance zone that has come after 19 years. Refer chart at thread start

I exited my swing positions in stock between August and September 2021 when the dollar index was at its support level. From there lets see what has happened to #nifty50

I exited my swing positions in stock between August and September 2021 when the dollar index was at its support level. From there lets see what has happened to #nifty50

Profit booking starts from March 2021 - but the index has to sustain the higher levels so that prices remain stable - so sector management game starts

While the profit booking behind the screens, IT leads the Index, #Nifty50 hits the magic 18k mark

While the profit booking behind the screens, IT leads the Index, #Nifty50 hits the magic 18k mark

When people think the market is so bullish during this period what actually happens is that money is getting out from the stock market

Then starts the decline phase with the #nifty50’s daily swing low break in October 2021 - when the index falls 1% , the stocks fall 5%

Then starts the decline phase with the #nifty50’s daily swing low break in October 2021 - when the index falls 1% , the stocks fall 5%

The same thing I have noticed in the year 2018 when I made entry to the Indian stock market.

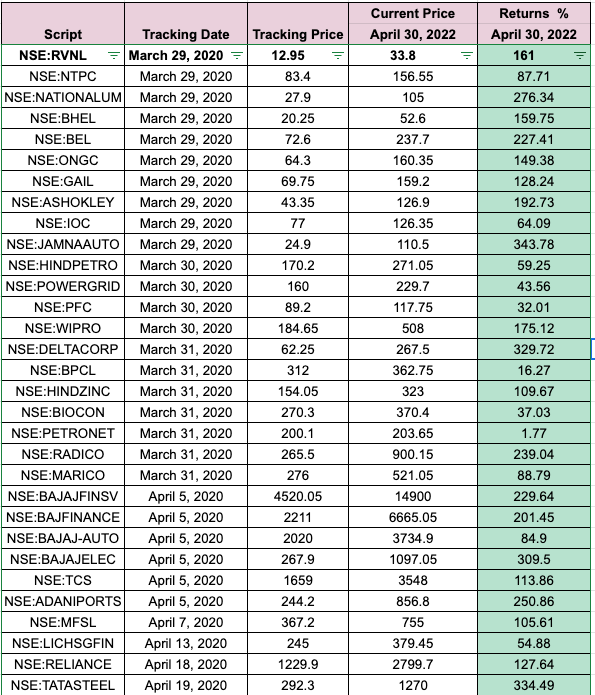

I spent 6 months to read the past data and the behavior of the various stocks and sectors and picked blue chips like Tata Power, Tata steel, Tata motors.

I spent 6 months to read the past data and the behavior of the various stocks and sectors and picked blue chips like Tata Power, Tata steel, Tata motors.

I had no swing positions till 2020 - I had to wait more than 2 years for my levels to come; the covid pandemic drove the markets down heavily giving the opportunity of a life time to invest !!

Then rest is history - Made the money for my life time in this huge rally of 2021 !!

Then rest is history - Made the money for my life time in this huge rally of 2021 !!

#Nifty50 over the past 6 months has fallen in love with 17000-17100 zone; There is no movement in the markets and the next two years are going to be like the days of 2018 to 2020 !!

The aim is to survive this period - Stay put - The next rally when it comes will be much more rewarding, until then

NO TRADE IS THE BEST TRADE

WAIT FOR THE OPPORTUNITY PATIENTLY - THEN GO FOR THE KILL

Thanks - End of thread !!

NO TRADE IS THE BEST TRADE

WAIT FOR THE OPPORTUNITY PATIENTLY - THEN GO FOR THE KILL

Thanks - End of thread !!

Loading suggestions...