1/x

IMF's Global Stability Report has 3 chapters:

1 - The Financial Stability Implications of the War in Ukraine

2 - The Sovereign-Bank Nexus in Emerging Markets: A Risky Embrace

3 - The Rapid Growth of Fintech: Vulnerabilities and Challenges for Financial Stability 👈🔍🚨

IMF's Global Stability Report has 3 chapters:

1 - The Financial Stability Implications of the War in Ukraine

2 - The Sovereign-Bank Nexus in Emerging Markets: A Risky Embrace

3 - The Rapid Growth of Fintech: Vulnerabilities and Challenges for Financial Stability 👈🔍🚨

2/x

Chapter 3 mentions DeFi so we are going to focus on that chapter!

The original reports are available here

imf.org

Chapter 3 mentions DeFi so we are going to focus on that chapter!

The original reports are available here

imf.org

3/x

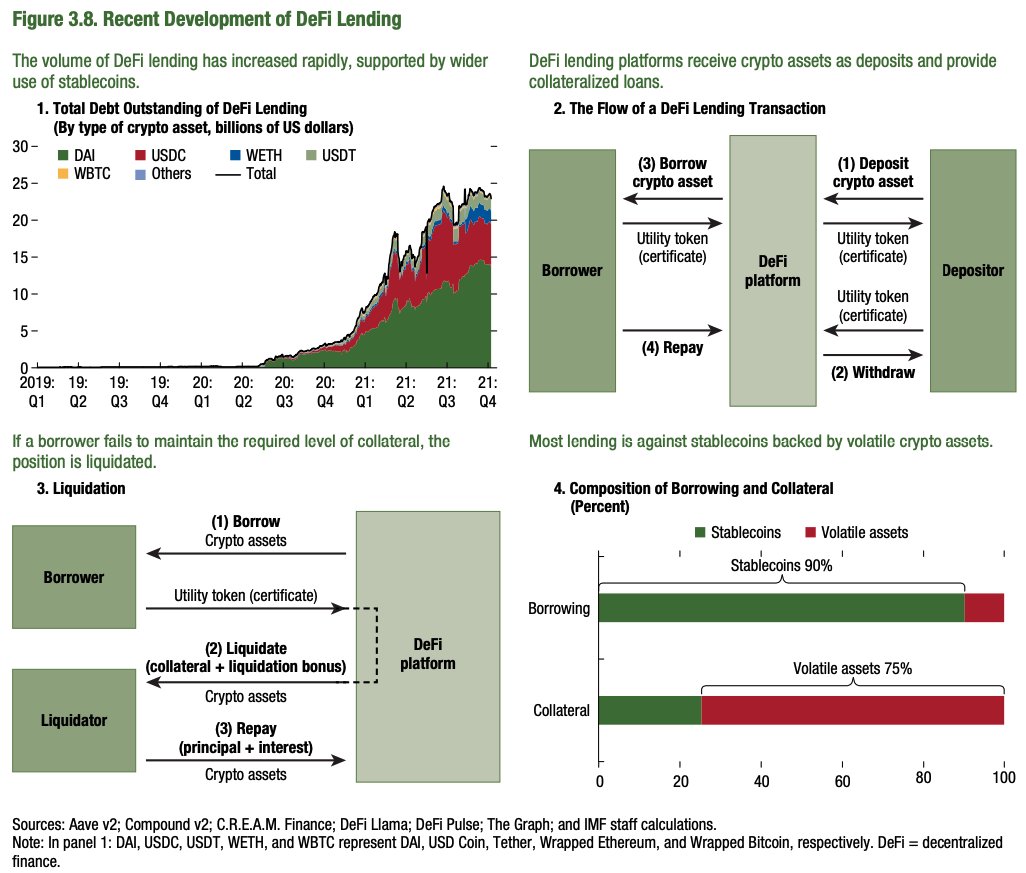

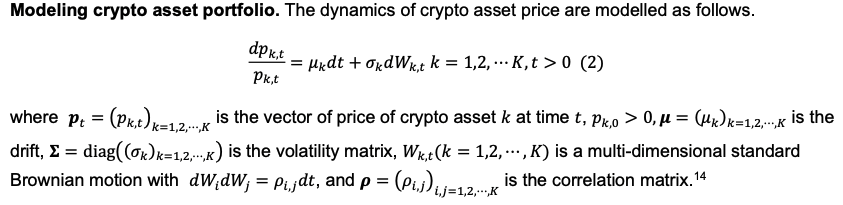

Chapter 3 is about how fintech impacts the banking system. 1st half of the chapter is about neo-banks and shadow banking and their risks. 2nd half is about DeFi: how it works and risks involved.

Let's take a look at what IMF writes about DeFi 👀

Chapter 3 is about how fintech impacts the banking system. 1st half of the chapter is about neo-banks and shadow banking and their risks. 2nd half is about DeFi: how it works and risks involved.

Let's take a look at what IMF writes about DeFi 👀

4/x

I have to say, I am very impressed with IMF's precise explanation of DeFi, referencing @AaveAave, @compoundfinance, @CreamdotFinance, @DefiLlama, @defipulse, @graphprotocol.

No mention of crypto innovations tho (e.g DEX, AMM, PoS staking, flash loan)

I have to say, I am very impressed with IMF's precise explanation of DeFi, referencing @AaveAave, @compoundfinance, @CreamdotFinance, @DefiLlama, @defipulse, @graphprotocol.

No mention of crypto innovations tho (e.g DEX, AMM, PoS staking, flash loan)

5/x

So IMF thinks that 'DeFi has the potential to offer financial services with even greater efficiency, becoming a gravita- tional force that attracts a large number of crypto investors.'

But....

'It may also come at the cost of greater risks and uncertainties.'

So IMF thinks that 'DeFi has the potential to offer financial services with even greater efficiency, becoming a gravita- tional force that attracts a large number of crypto investors.'

But....

'It may also come at the cost of greater risks and uncertainties.'

6/x

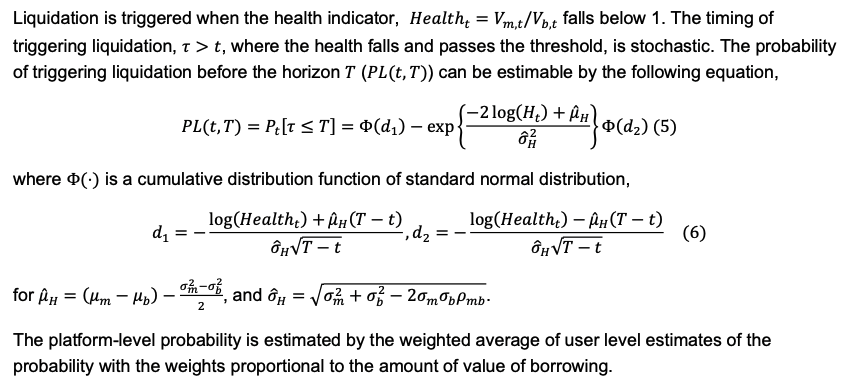

Let's start with risks! IMF on DeFi risks:

DeFi is highly leveraged (but isn't TradFi too?) and volatile.

A robust liquidation mechanism becomes important.

It is triggered when a borrower fails to maintain the collateral requirement (= loan-to-value ratio threshold)

Let's start with risks! IMF on DeFi risks:

DeFi is highly leveraged (but isn't TradFi too?) and volatile.

A robust liquidation mechanism becomes important.

It is triggered when a borrower fails to maintain the collateral requirement (= loan-to-value ratio threshold)

7/x

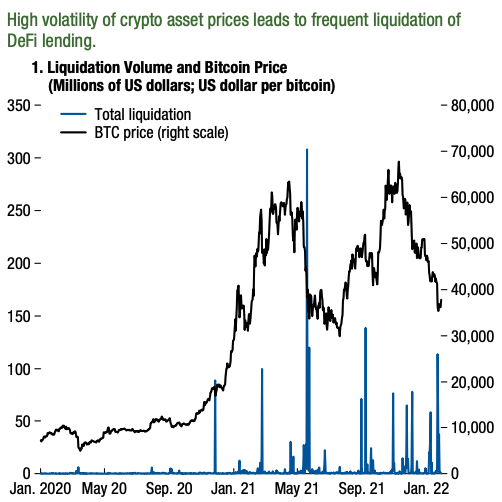

The DeFi lending/borrowing ecosystem is a literal perpetual liquidation machine.

When the collateral shortfall is large, liquidation can be costly. If left unaddressed, it could potentially undermine platform solvency.

@FantomFDN as an example 👇

The DeFi lending/borrowing ecosystem is a literal perpetual liquidation machine.

When the collateral shortfall is large, liquidation can be costly. If left unaddressed, it could potentially undermine platform solvency.

@FantomFDN as an example 👇

9/x

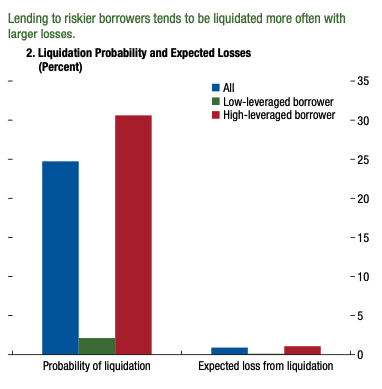

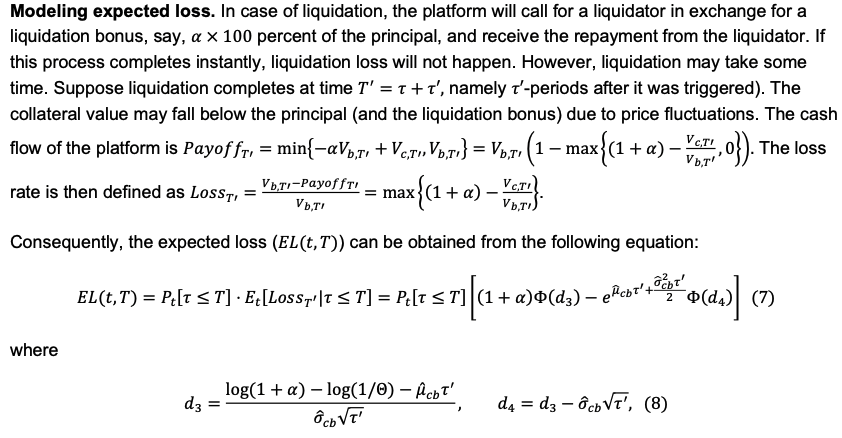

So DeFi liquidation loses $ on average... what else?

IMF found that liquidity is concentrated among the whales... (e.g. @Tetranode @dcfgod)

Higher concentration -> whale exit -> bank run

So DeFi liquidation loses $ on average... what else?

IMF found that liquidity is concentrated among the whales... (e.g. @Tetranode @dcfgod)

Higher concentration -> whale exit -> bank run

11/x

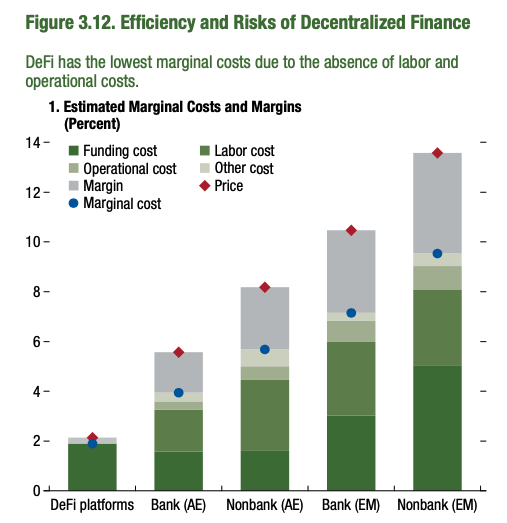

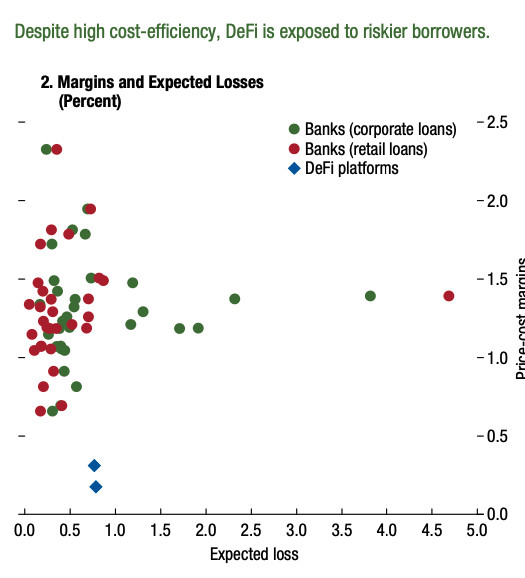

That's it in terms of risks. What about efficiency?

DeFi should always be more efficient than TradFi. DeFi runs on code, TradFi runs on suits.

The margins should reflect this cost basis delta. Does it?

That's it in terms of risks. What about efficiency?

DeFi should always be more efficient than TradFi. DeFi runs on code, TradFi runs on suits.

The margins should reflect this cost basis delta. Does it?

15/x

IMF thought that DeFi's margins are low because they don't need 1) regulatory buffer 2) compliance cost

IMF thought that DeFi's margins are low because they don't need 1) regulatory buffer 2) compliance cost

16/x

My reply to IMF: DeFi costs will stay low because

1) no regulatory buffer means the best protocol that constraint optimizes capital efficiency and risk wins

2) KYC/AML costs stay low thanks to SaaS and API providers

My reply to IMF: DeFi costs will stay low because

1) no regulatory buffer means the best protocol that constraint optimizes capital efficiency and risk wins

2) KYC/AML costs stay low thanks to SaaS and API providers

17/x

So, IMF thinks DeFi is efficient but risky. What policy recommendations do they make?

1) Regulate centralized DeFi entities (stablecoin issuers, CEXes, hosted wallets, and market makers)

2) Encourage industry group - self regulatory organisations

I love the 2) idea!

So, IMF thinks DeFi is efficient but risky. What policy recommendations do they make?

1) Regulate centralized DeFi entities (stablecoin issuers, CEXes, hosted wallets, and market makers)

2) Encourage industry group - self regulatory organisations

I love the 2) idea!

18/x

IMF told us some stone cold facts about DeFi. What's the action point? Here's the alpha drop.

If DeFi wants to truly eat TradFi, founders need to think hard about DeFi's value proposition.

DeFi is efficient, yes. But is it universally 10x more efficient than TradFi?

IMF told us some stone cold facts about DeFi. What's the action point? Here's the alpha drop.

If DeFi wants to truly eat TradFi, founders need to think hard about DeFi's value proposition.

DeFi is efficient, yes. But is it universally 10x more efficient than TradFi?

19/x

To switch TradFi users to DeFi, look in underserved TradFi markets. That's where DeFi is 10x better.

Emerging markets, unbanked, opaque assets, illiquid real world assets are all frontiers that DeFi should conquer

To switch TradFi users to DeFi, look in underserved TradFi markets. That's where DeFi is 10x better.

Emerging markets, unbanked, opaque assets, illiquid real world assets are all frontiers that DeFi should conquer

20/x

On DeFI efficiency, we need to break cost down to 1) origination cost 2) transaction cost (marginal cost)

It seems clear that given how cheap it is to trade TradFi equity, bring them on-chain is going to be a tough sell.

On DeFI efficiency, we need to break cost down to 1) origination cost 2) transaction cost (marginal cost)

It seems clear that given how cheap it is to trade TradFi equity, bring them on-chain is going to be a tough sell.

21/x

Flashy tokens ain't gonna bring sticky users to your protocol.

IMF has shown us the power of DeFi, a priori. Now, founders, go manifest your destiny to harness the power of DeFi, a posteriori!

Flashy tokens ain't gonna bring sticky users to your protocol.

IMF has shown us the power of DeFi, a priori. Now, founders, go manifest your destiny to harness the power of DeFi, a posteriori!

22/x

IMF is a crown jewel of the Bretton Woods system. They hold the keys to institutional DeFi (and thus, help our bags).

Zoltan Pozsar wrote about Bretton Woods III. DeFi will gradually phase out inefficient TradFi.

Which side are you on, anon?

plus2.credit-suisse.com

IMF is a crown jewel of the Bretton Woods system. They hold the keys to institutional DeFi (and thus, help our bags).

Zoltan Pozsar wrote about Bretton Woods III. DeFi will gradually phase out inefficient TradFi.

Which side are you on, anon?

plus2.credit-suisse.com

23/x

DM me if you are researching on 1) DeFi comparative studies 2) asset digitalization/tokenization 3) just find this thread interesting!

Follow me for more 🧵☀️💪

DM me if you are researching on 1) DeFi comparative studies 2) asset digitalization/tokenization 3) just find this thread interesting!

Follow me for more 🧵☀️💪

protocols i'm following that show 10x value prop to tradfi users

@goldfinch_fi @sall @MHiesboeck @aaronherawan @PJoseph_CFA @maplefinance @joe_defi @arca @jdorman81 @jonahschulman_ @pgaff_digital @Bodhi_Pinkner @TrustToken @AaveAave @StaniKulechov

@goldfinch_fi @sall @MHiesboeck @aaronherawan @PJoseph_CFA @maplefinance @joe_defi @arca @jdorman81 @jonahschulman_ @pgaff_digital @Bodhi_Pinkner @TrustToken @AaveAave @StaniKulechov

Secondary note: how govs look at DeFi! (cc @paddi_hansen, and thanks for inspiring this thread on gov x defi !)

other thoughtful econ/long-term thinking crypto accounts I follow

@jmonegro @_charlienoyes @matthuang @n2ckchong @_PorterSmith @milesdeutscher @teddywoodward (his bearish rwa tweet is thoughtful!, tho respectfully disagree) @AnthonyLeeZhang @0xHamz @crypto_condom

@jmonegro @_charlienoyes @matthuang @n2ckchong @_PorterSmith @milesdeutscher @teddywoodward (his bearish rwa tweet is thoughtful!, tho respectfully disagree) @AnthonyLeeZhang @0xHamz @crypto_condom

Loading suggestions...