A very dovish Powell, but he is making a communication mistake here.

A thread on the Fed!

1/13

A thread on the Fed!

1/13

The key (and conflicting) headlines were:

*Inflation is much too high, but we we have the resolve it takes to bring it down and the American economy is well positioned to handle tighter monetary policy

BUT

*The committee is not actively considering 75 bps hikes

Ehm...

2/13

*Inflation is much too high, but we we have the resolve it takes to bring it down and the American economy is well positioned to handle tighter monetary policy

BUT

*The committee is not actively considering 75 bps hikes

Ehm...

2/13

And he made clear that while he can't solve supply issues, he'll make sure to tame demand...

...but NOT with a 75 bps hike. That's off the table.

The signal you send here is wrong: you want to get ahead of the curve, not being chased by markets to do so.

4/13

...but NOT with a 75 bps hike. That's off the table.

The signal you send here is wrong: you want to get ahead of the curve, not being chased by markets to do so.

4/13

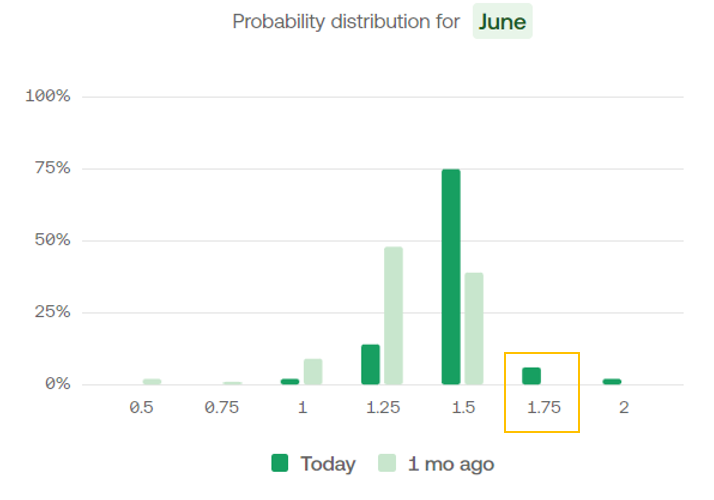

Obviously, markets adjust quickly and the probability of a 75 bps hike in June becomes negligible - the chart below from @Kalshi shows the probability distribution for the upper side of the Fed Funds range in June (today: 1%).

5/13

5/13

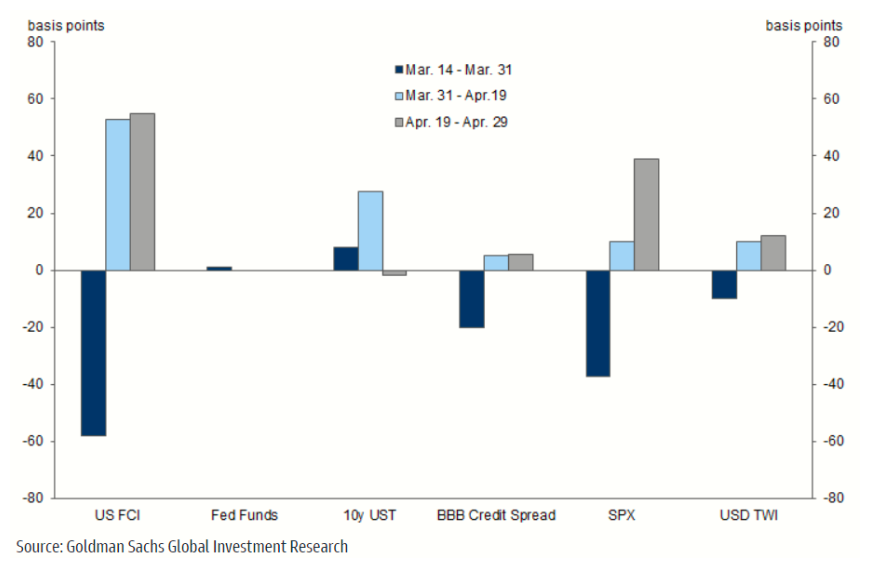

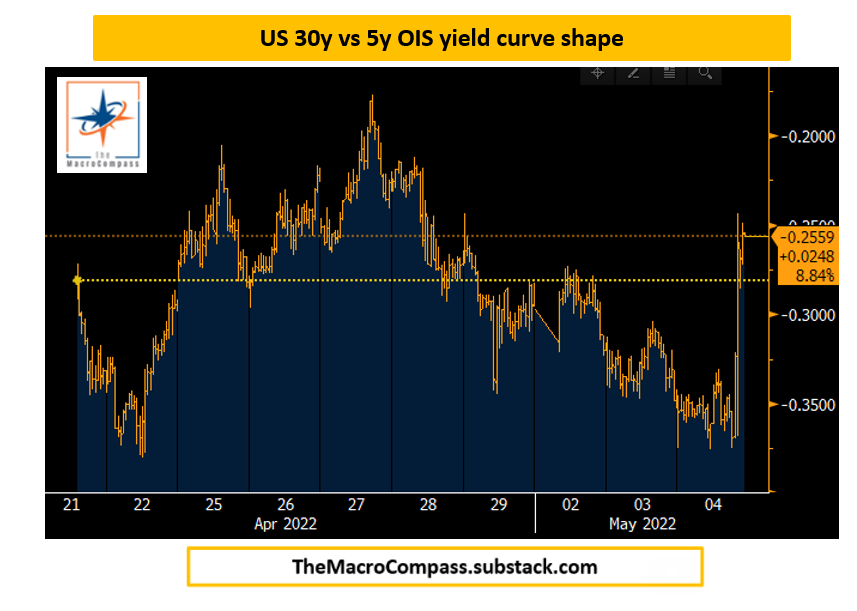

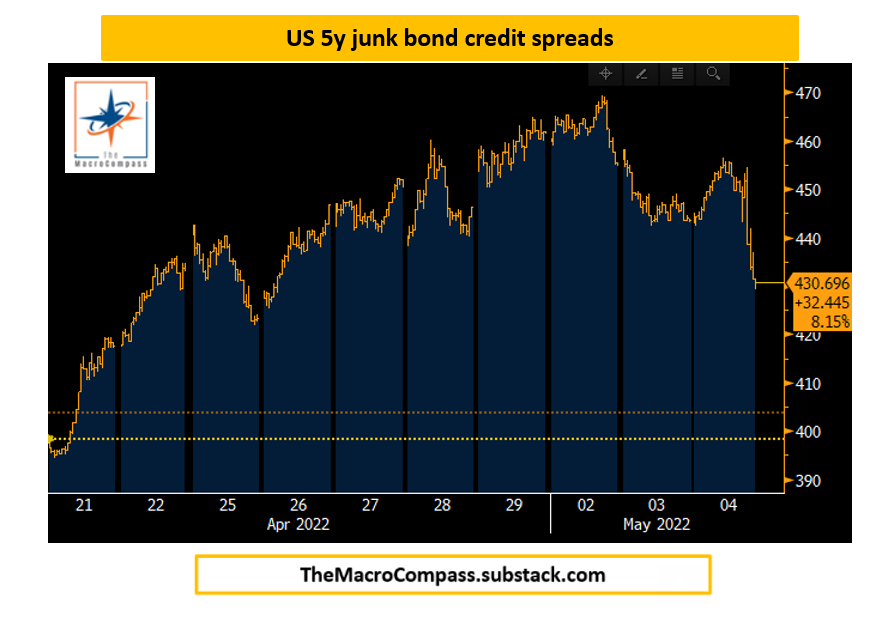

What's even more relevant is that Powell gets all the moves he is NOT looking for.

Remember, the Fed wants tighter financial conditions to slow demand down - so what's in the financial conditions index actually?

Rates, credit spreads, equities, trade-weighted USD.

6/13

Remember, the Fed wants tighter financial conditions to slow demand down - so what's in the financial conditions index actually?

Rates, credit spreads, equities, trade-weighted USD.

6/13

...few weeks later Fed speakers had to boost their hawkish rhetoric (Bullard, you there?) to stop the risk asset rally in April (light blue and grey bars).

This press conference is shaping to be a communication mistake similar to March, which will need to be corrected.

8/13

This press conference is shaping to be a communication mistake similar to March, which will need to be corrected.

8/13

As in March, FOMC speakers in the end will need to stop this but before we get there risk assets can rally further

As announced already, I went out of my shorts in the S&P 500 and in US credit spreads (LQDH)

Will be looking to reposition short after a solid rally

11/13

As announced already, I went out of my shorts in the S&P 500 and in US credit spreads (LQDH)

Will be looking to reposition short after a solid rally

11/13

Medium term, risk assets can seriously rally only if inflation materially slows down

Betting on inflation is tough without complex derivatives, but the guys at Kalshi.com allow you to trade probabilistic economic outcomes without all the hassle - pretty cool!

12/13

Betting on inflation is tough without complex derivatives, but the guys at Kalshi.com allow you to trade probabilistic economic outcomes without all the hassle - pretty cool!

12/13

Overall, this was a big communication mistake that unleashed an unwanted market reaction

Tomorrow, I'll cover what this means in more details and do a Fed meeting deep dive on TheMacroCompass.Substack.com - make sure you subscribe so you get the article directly in your inbox!

13/13

Tomorrow, I'll cover what this means in more details and do a Fed meeting deep dive on TheMacroCompass.Substack.com - make sure you subscribe so you get the article directly in your inbox!

13/13

Loading suggestions...