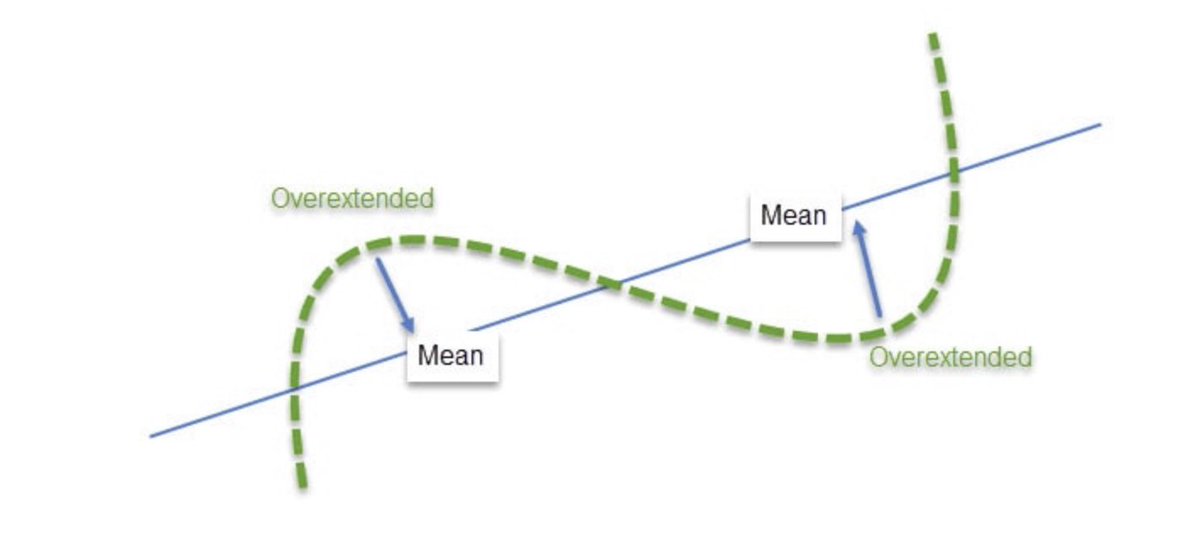

1. Remember Reversion to the Mean

“Don’t think the past is prologue, it rarely is. Sometimes it’s anti prologue.”

Investors tend to storm funds and stocks that are currently outperforming.

This recency-biased action is very costly.

“Don’t think the past is prologue, it rarely is. Sometimes it’s anti prologue.”

Investors tend to storm funds and stocks that are currently outperforming.

This recency-biased action is very costly.

3. Invest You Must

Investing is without alternative.

Not investing is the biggest risk people can take.

Without earning a sufficient return on ones capital it’ll certainly lose value over time

There’s no equal alternative to participating in the markets.

Investing is without alternative.

Not investing is the biggest risk people can take.

Without earning a sufficient return on ones capital it’ll certainly lose value over time

There’s no equal alternative to participating in the markets.

4. Buy Right and Hold Tight

Most people aren’t traders by choice.

Their research before establishing a position is simply insufficient.

Therefore, small changes in price and rather unimportant news are intimidating enough to panic-sell.

Most people aren’t traders by choice.

Their research before establishing a position is simply insufficient.

Therefore, small changes in price and rather unimportant news are intimidating enough to panic-sell.

Instead, investors should invest more time in researching and thus gain confidence in their decision.

If that’s too hard or time-consuming, there’s always Jack Bogle’s favorite option, an index fund.

If that’s too hard or time-consuming, there’s always Jack Bogle’s favorite option, an index fund.

5. Forget the Needle, Buy the Haystack

Speaking about index funds.

Very few investors and even fewer retail investors succeed with their stock-picking skills.

According to Jack Bogle, choosing a broad, diversified index fund will serve investors a lot better.

Speaking about index funds.

Very few investors and even fewer retail investors succeed with their stock-picking skills.

According to Jack Bogle, choosing a broad, diversified index fund will serve investors a lot better.

6. Have Realistic Expectations

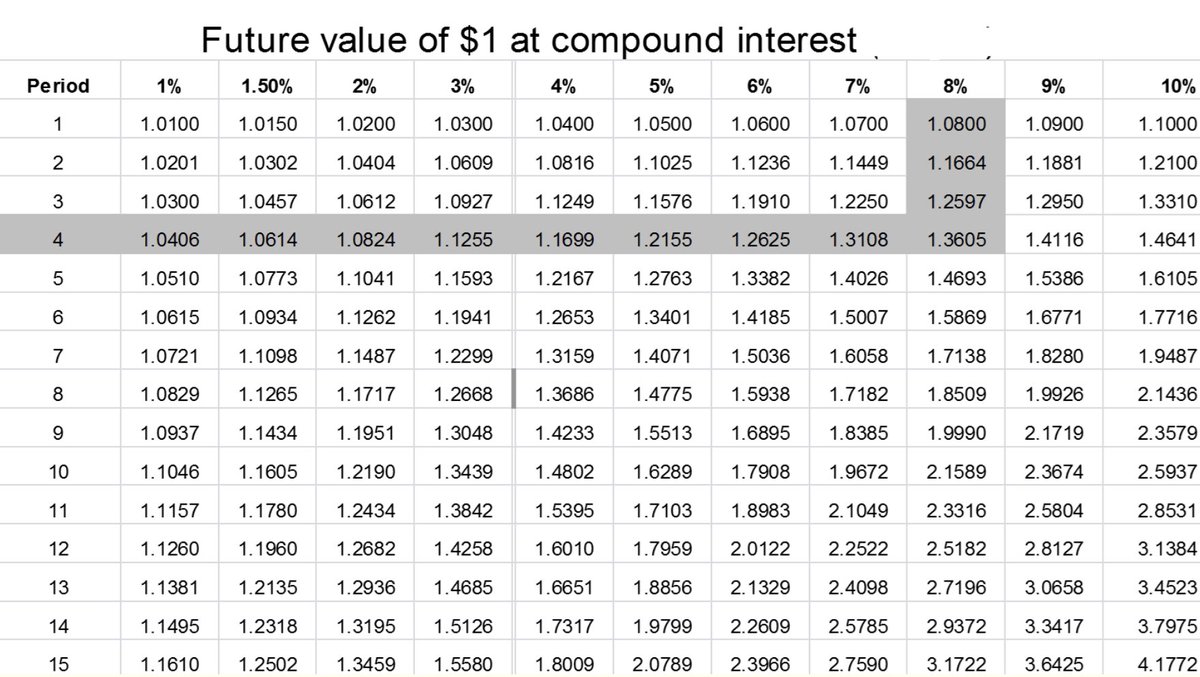

The historical return for stocks as an asset class is about 7%.

This is the return you can expect from owning a worldwide, diversified index fund in the long run.

As you can see in the table above, at 7%, your money doubles every ten years.

The historical return for stocks as an asset class is about 7%.

This is the return you can expect from owning a worldwide, diversified index fund in the long run.

As you can see in the table above, at 7%, your money doubles every ten years.

Most investors dramatically overestimate their abilities and aim for absurd returns.

Such expectations will cause you to make mistakes and take huge risks.

Realistic expectations are the foundation for your investing journey.

Such expectations will cause you to make mistakes and take huge risks.

Realistic expectations are the foundation for your investing journey.

7. Inactivity is Hard but Necessary

You’re bombarded with news every day.

You’ll hear that everything will go south thousands of times, the same goes for bullish news.

Remaining unaffected by this has been the most profitable thing to do historically.

Stay the course.

You’re bombarded with news every day.

You’ll hear that everything will go south thousands of times, the same goes for bullish news.

Remaining unaffected by this has been the most profitable thing to do historically.

Stay the course.

Summary:

1. Everything Reverses to its Mean

2. Time is your Friend

3. Investing is without Alternative

4. Buy Right and Hold

5. Buy the Haystack, not the Needle

6. Have Realistic Expectations

7. Inactivity is King

1. Everything Reverses to its Mean

2. Time is your Friend

3. Investing is without Alternative

4. Buy Right and Hold

5. Buy the Haystack, not the Needle

6. Have Realistic Expectations

7. Inactivity is King

That’s it for today!

In case this Thread helped you in any way, please consider Retweeting and Liking it.

Learn more about Investment Philosophy by following me @MnkeDaniel

Have a Great Weekend!

In case this Thread helped you in any way, please consider Retweeting and Liking it.

Learn more about Investment Philosophy by following me @MnkeDaniel

Have a Great Weekend!

Loading suggestions...