Stablecoins are NOT created equal.

Here's a breakdown of how different stablecoins work:

(+my rankings and recommendations)

Here's a breakdown of how different stablecoins work:

(+my rankings and recommendations)

Here's What We'll Cover:

• What are Stablecoins

• Why use Stablecoins?

• The types of Stablecoins

• The risks involved

• My recommendations

Here's your edge 🗡️

• What are Stablecoins

• Why use Stablecoins?

• The types of Stablecoins

• The risks involved

• My recommendations

Here's your edge 🗡️

Why Would You Want Stablecoins?

• They lower the volatility in a portfolio. Crypto prices can swing wildly.

Stablecoins help you preserve your portfolio from losing too much money.

• They act as dry powder so you can easily buy the dips.

• They lower the volatility in a portfolio. Crypto prices can swing wildly.

Stablecoins help you preserve your portfolio from losing too much money.

• They act as dry powder so you can easily buy the dips.

• Speed. You don't have to wait 5 days to transfer from your bank to your CEX to buy the dip.

• Fiat loses 8.3% each year because of inflation. You can earn yield with stable coins to offset inflation.

• You can take profits into stable coins.

• Fiat loses 8.3% each year because of inflation. You can earn yield with stable coins to offset inflation.

• You can take profits into stable coins.

The Types of Stablecoins

Not all stable coins are created equal.

There's no perfect stable coin right now - there are tradeoffs.

Let's look at the different types of Stablecoins out there.

Not all stable coins are created equal.

There's no perfect stable coin right now - there are tradeoffs.

Let's look at the different types of Stablecoins out there.

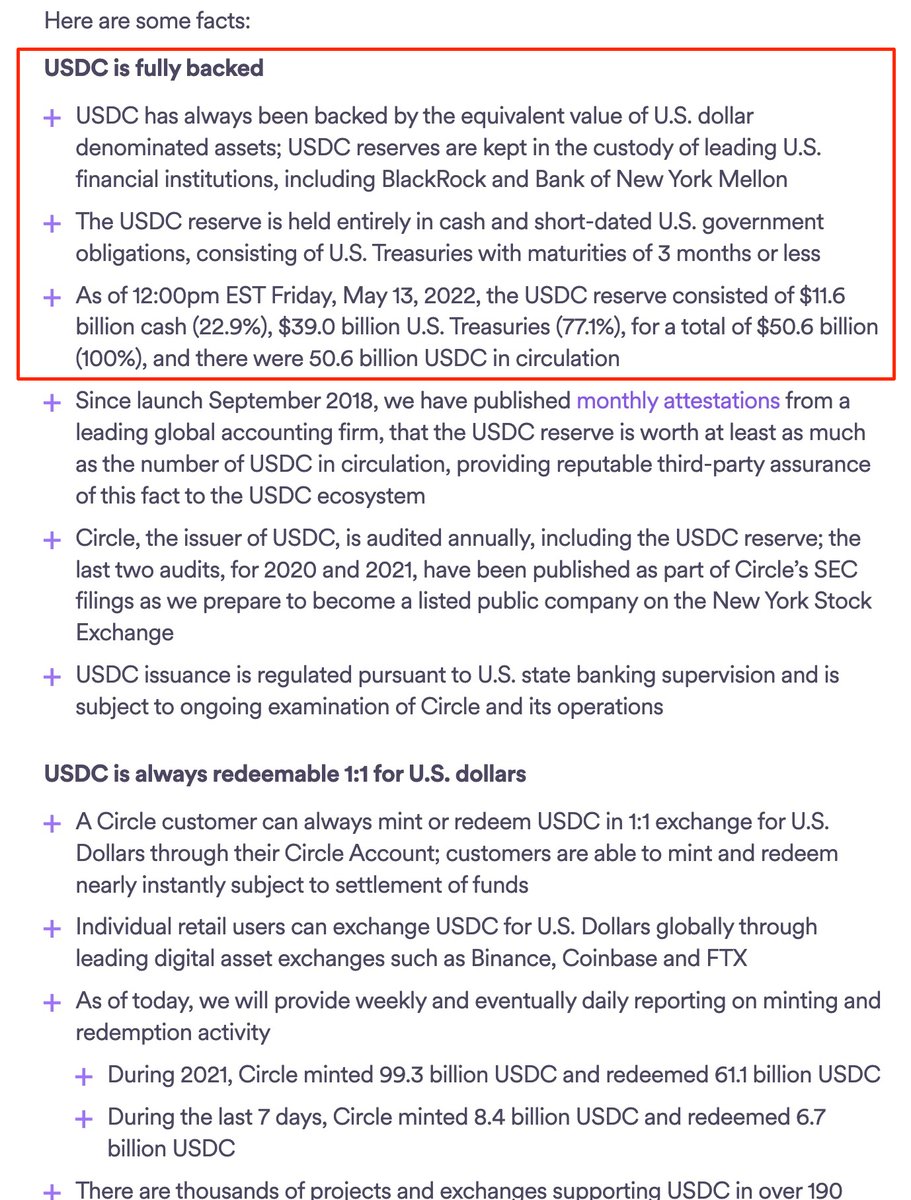

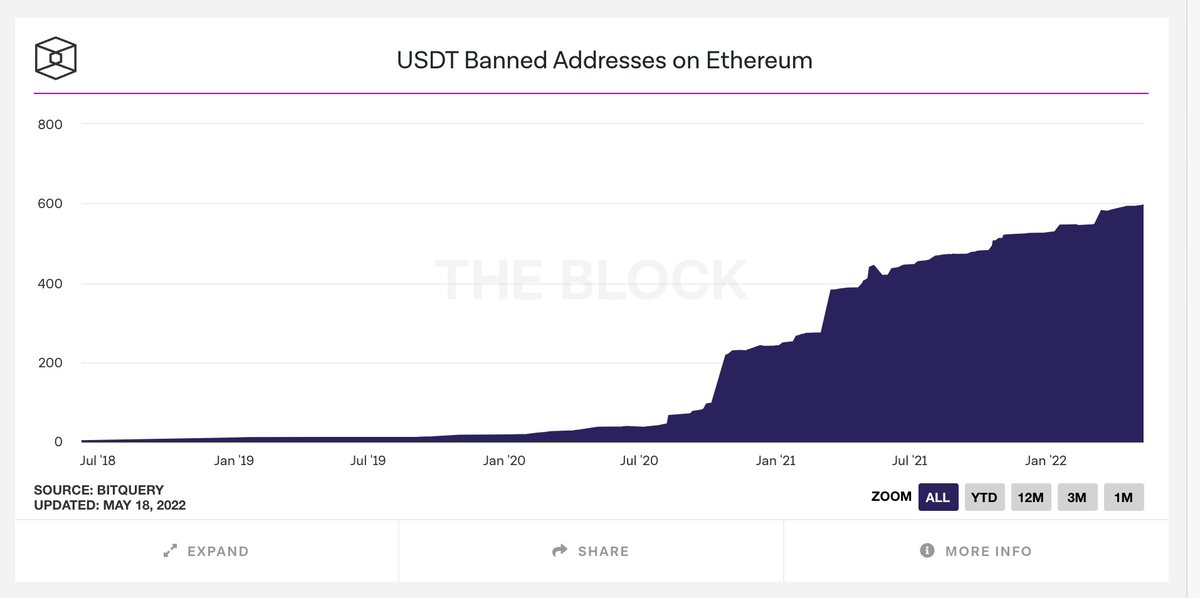

U.S. regulators fined Tether $41m last year.

Tether has been lying for years that their stable coin was fully backed by fiat currencies.

Where there's smoke, there's fire.

Tether has been lying for years that their stable coin was fully backed by fiat currencies.

Where there's smoke, there's fire.

a. @MakerDao DAI

The most famous one is MakerDao's Dai on Ethereum.

• Primarily collateralized by ETH and USDC.

• The main criticism is that it isn't truly decentralized due to the amount of USDC it holds.

The most famous one is MakerDao's Dai on Ethereum.

• Primarily collateralized by ETH and USDC.

• The main criticism is that it isn't truly decentralized due to the amount of USDC it holds.

@MakerDAO b. @mim_spell Abracadabra ($MIM)

The centerpiece of Daniele Sesta's Frog Nation.

• It has held up its peg well

• One of the most decentralized stablecoins

• Deposit a variety of tokens.

• Has lost popularity due to the downfall of Frog Nation.

The centerpiece of Daniele Sesta's Frog Nation.

• It has held up its peg well

• One of the most decentralized stablecoins

• Deposit a variety of tokens.

• Has lost popularity due to the downfall of Frog Nation.

@MakerDAO @MIM_Spell Crypto-Backed Stablecoin Risks

• It's not the most capital efficient because it requires over-collateralization.

• Smart Contract risks

• Asset collateral depreciation

• It's not the most capital efficient because it requires over-collateralization.

• Smart Contract risks

• Asset collateral depreciation

@MakerDAO @MIM_Spell Algorithmic (Seigniorage) Stablecoins

They're either undercollateralized or not backed by anything.

Their primary way to maintain a $1 peg is through arbitrage opportunities.

It's an experiment in human behavior and game theory.

Let's look at Luna / UST.

They're either undercollateralized or not backed by anything.

Their primary way to maintain a $1 peg is through arbitrage opportunities.

It's an experiment in human behavior and game theory.

Let's look at Luna / UST.

@MakerDAO @MIM_Spell How it Worked (Simplified):

If 1 UST goes below $1, you can swap it for $1 worth of Luna and immediately make a profit.

(UST drops to $0.95. People buy and swap for $1 of Luna, and immediately make a $.05 profit)

If 1 UST goes below $1, you can swap it for $1 worth of Luna and immediately make a profit.

(UST drops to $0.95. People buy and swap for $1 of Luna, and immediately make a $.05 profit)

@MakerDAO @MIM_Spell "As long as Luna has a non-zero market value"

Luna / UST collapsed last week.

It doesn't matter if it was an attack or a bank run.

The problem is people lost faith in Luna, and the value plummeted.

It failed the stress tress.

Luna / UST collapsed last week.

It doesn't matter if it was an attack or a bank run.

The problem is people lost faith in Luna, and the value plummeted.

It failed the stress tress.

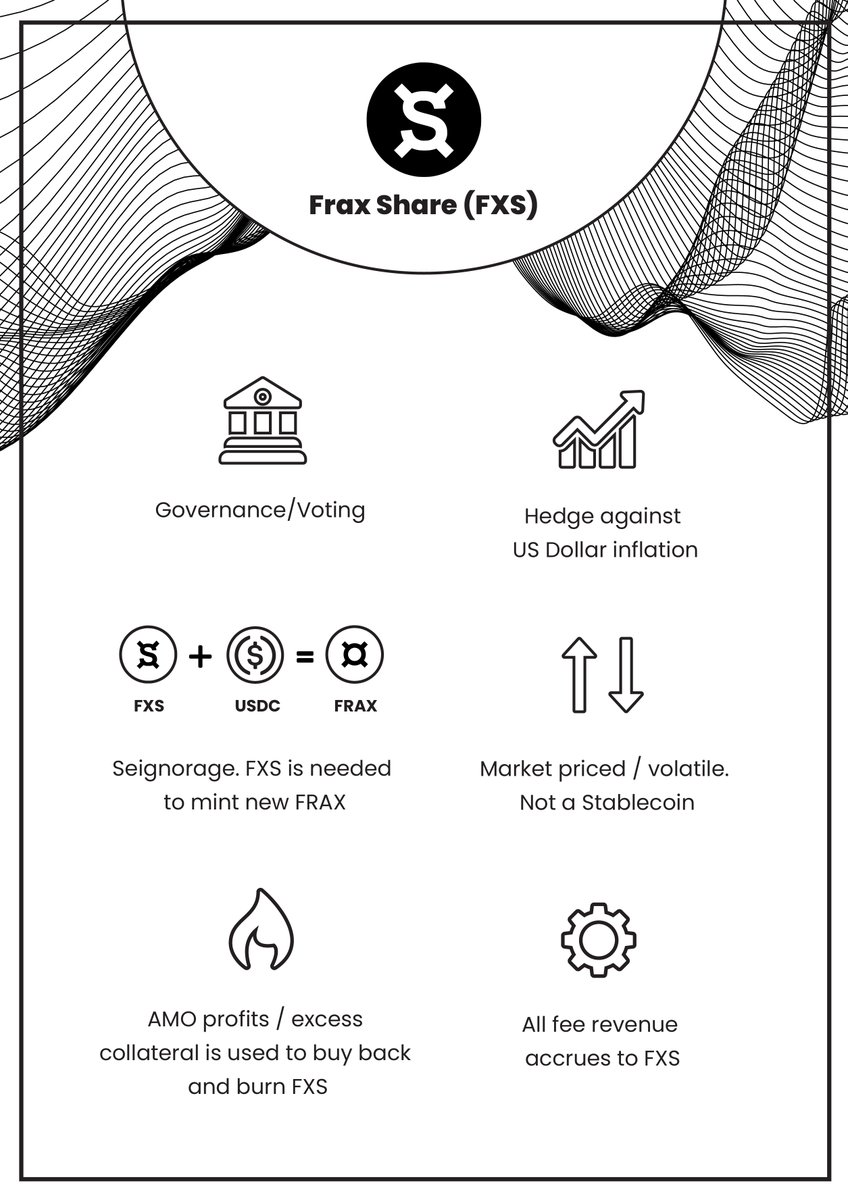

@MakerDAO @MIM_Spell Semi Algorithmic Stablecoin

These coins are an attempt at the best of both worlds - they're backed by collateral AND there's an algorithm portion.

The most popular is @FraxFinance.

• 1 Frax = $1 USD

• FXS (Frax shares). Governance / Utility.

These coins are an attempt at the best of both worlds - they're backed by collateral AND there's an algorithm portion.

The most popular is @FraxFinance.

• 1 Frax = $1 USD

• FXS (Frax shares). Governance / Utility.

@MakerDAO @MIM_Spell @fraxfinance How it Works (simplified)

• There are arbitrage opportunities similar to Luna. If Frax <$1, you can mint new Frax and make a profit.

• Frax is backed by collateral + FXS. The ratio is 89% now.

• The collaterals are earning yield.

• There are arbitrage opportunities similar to Luna. If Frax <$1, you can mint new Frax and make a profit.

• Frax is backed by collateral + FXS. The ratio is 89% now.

• The collaterals are earning yield.

@MakerDAO @MIM_Spell @fraxfinance The Utility of FXS (Utility Token of Frax)

• Seignorage. FXS is needed to mint new FRAX. Depends on the collateral ratio.

• Excess collateral/profits are used to buy back and burn FXS

• Protocol Fees accrue to FXS

• and Governance

A ton of value accrual to the token.

• Seignorage. FXS is needed to mint new FRAX. Depends on the collateral ratio.

• Excess collateral/profits are used to buy back and burn FXS

• Protocol Fees accrue to FXS

• and Governance

A ton of value accrual to the token.

@MakerDAO @MIM_Spell @fraxfinance The Future of Stablecoins

Newer stable coins are taking the approach of Frax - partially backed by collateral and partially algorithmic.

People will keep attempting a pure algorithmic coin.

It's kinda like the search for the Holy Grail - the rewards are too great to ignore.

Newer stable coins are taking the approach of Frax - partially backed by collateral and partially algorithmic.

People will keep attempting a pure algorithmic coin.

It's kinda like the search for the Holy Grail - the rewards are too great to ignore.

@MakerDAO @MIM_Spell @fraxfinance Emerging Stablecoins:

• USDD - Tron's new stablecoin offering high yields. Don't trust Justin Sun.

• USN - Near's stablecoin. Algorithmic + Double collateralized by Near and USDT.

• CMST - Collateralized stable coin for Cosmos. (Just announced)

• USDD - Tron's new stablecoin offering high yields. Don't trust Justin Sun.

• USN - Near's stablecoin. Algorithmic + Double collateralized by Near and USDT.

• CMST - Collateralized stable coin for Cosmos. (Just announced)

@MakerDAO @MIM_Spell @fraxfinance The Attributes of a Stablecoin:

• Amount of Centralization: Centralization presents risks

• Collateral backing: What collaterals are they using, and what %?

• Transparency: If it is backed by off-chain assets, how transparent is the entity?

• Amount of Centralization: Centralization presents risks

• Collateral backing: What collaterals are they using, and what %?

• Transparency: If it is backed by off-chain assets, how transparent is the entity?

@MakerDAO @MIM_Spell @fraxfinance • Pegging history: How well has the token maintained its peg throughout its history?

• Liquidity: This affects slippage.

• Yield opportunities: Be careful chasing high yields.

Stablecoins are meant to preserve capital - not to get you rich.

• Liquidity: This affects slippage.

• Yield opportunities: Be careful chasing high yields.

Stablecoins are meant to preserve capital - not to get you rich.

@MakerDAO @MIM_Spell @fraxfinance Ranking the Stablecoins

Here's my PERSONAL opinion of the top 5 Stablecoins.

S: None

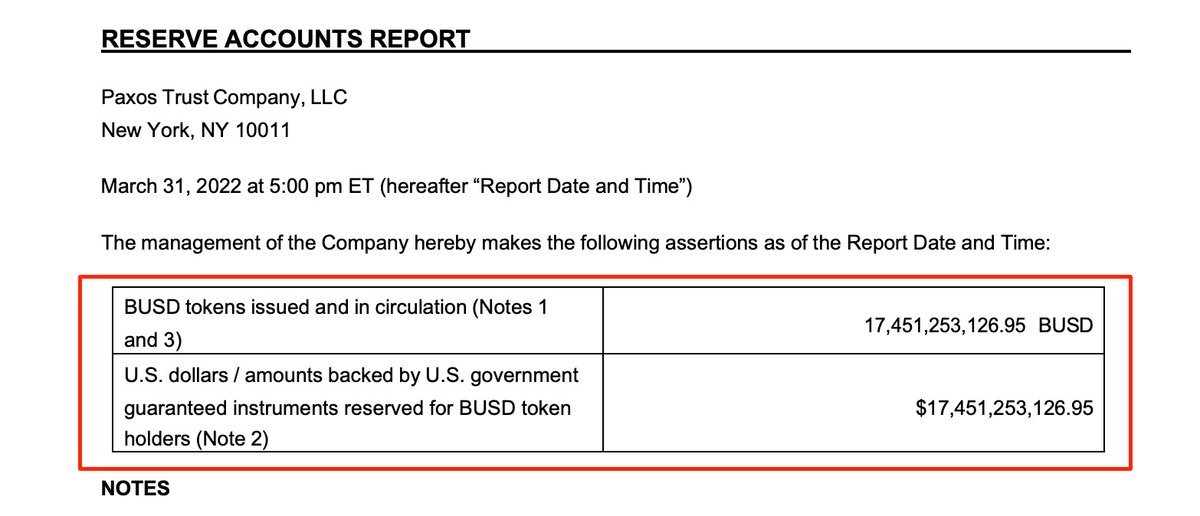

A: USDC, BUSD

B: USDT, DAI, MIM

C: Frax

USDT is shady, but they do have the most liquidity and farming opportunities.

Despite a C ranking, I view Frax positively - it will rise over time.

Here's my PERSONAL opinion of the top 5 Stablecoins.

S: None

A: USDC, BUSD

B: USDT, DAI, MIM

C: Frax

USDT is shady, but they do have the most liquidity and farming opportunities.

Despite a C ranking, I view Frax positively - it will rise over time.

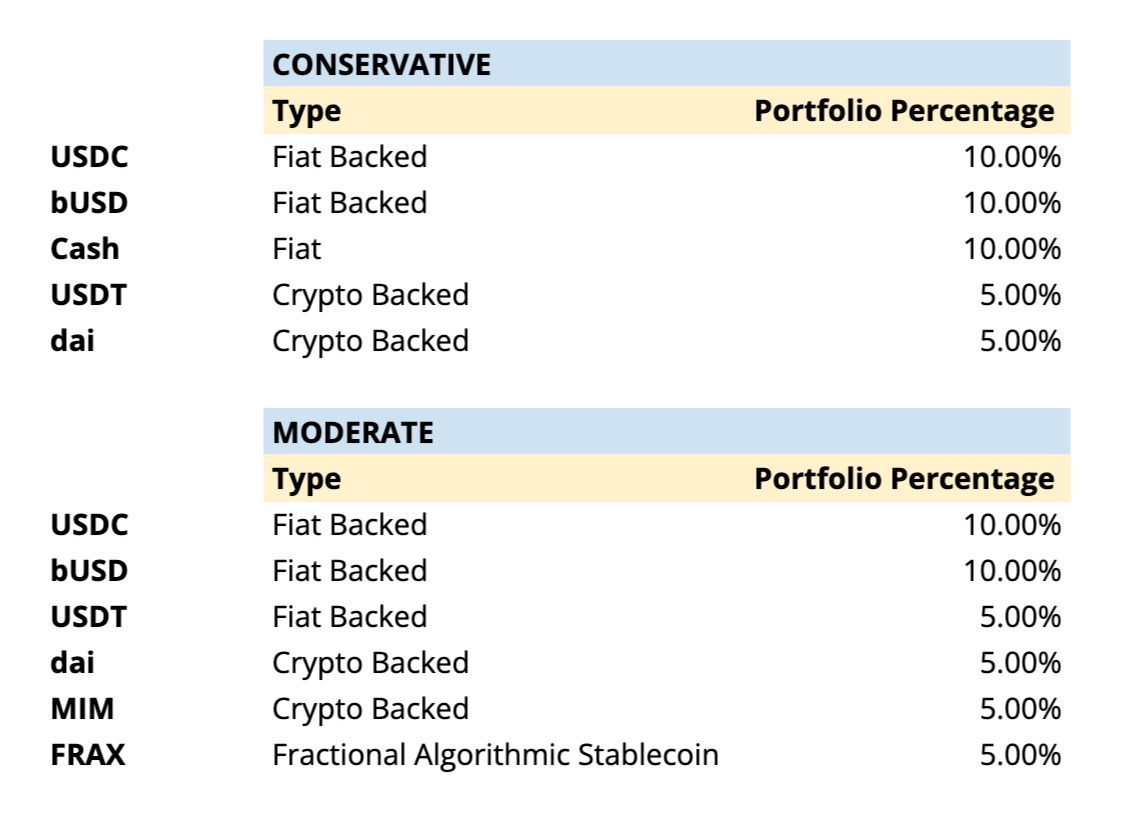

@MakerDAO @MIM_Spell @fraxfinance Stablecoin Allocations

I created two sample portfolios.

It assumes that 40% of your portfolio is in stable coins, and I separated it based on risk tolerance.

I created two sample portfolios.

It assumes that 40% of your portfolio is in stable coins, and I separated it based on risk tolerance.

@MakerDAO @MIM_Spell @fraxfinance One option to consider is to keep a portion in FIAT.

This avoids stable coin risks altogether.

The problem? The U.S. reported inflation is 8.3%.

(most likely it's a LOT higher)

So having your cash sit around in a bank means you're losing 8.3% a year.

This avoids stable coin risks altogether.

The problem? The U.S. reported inflation is 8.3%.

(most likely it's a LOT higher)

So having your cash sit around in a bank means you're losing 8.3% a year.

@MakerDAO @MIM_Spell @fraxfinance Some Best Practices

• Diversify your stable coins among different types

• Stick to Stablecoins > $1 billion in market cap

• Be careful of Algorithmic stable coins for now - UST and DEI lost their peg recently.

We're in uncharted territory.

• Diversify your stable coins among different types

• Stick to Stablecoins > $1 billion in market cap

• Be careful of Algorithmic stable coins for now - UST and DEI lost their peg recently.

We're in uncharted territory.

@MakerDAO @MIM_Spell @fraxfinance Stablecoin Risks

• Regulators have their sights on Stablecoins

• Algorithmic stablecoins keep getting destroyed

• Lack of transparency with USDT

• The top stable coins are all centralized

• Regulators have their sights on Stablecoins

• Algorithmic stablecoins keep getting destroyed

• Lack of transparency with USDT

• The top stable coins are all centralized

@MakerDAO @MIM_Spell @fraxfinance Takeaways:

• Stablecoins protect your downside

• Not all stable coins are created equal. They all have risks.

• Think about the tradeoffs among stablecoins.

• Diversify your stable coins

• Be careful chasing high yield on stables.

• Stablecoins protect your downside

• Not all stable coins are created equal. They all have risks.

• Think about the tradeoffs among stablecoins.

• Diversify your stable coins

• Be careful chasing high yield on stables.

@MakerDAO @MIM_Spell @fraxfinance That's it for today.

I plan to keep writing consistently during the bear market.

Level up with me by following @thedefiedge

Like/Retweet the first tweet below if you learned something new.

I plan to keep writing consistently during the bear market.

Level up with me by following @thedefiedge

Like/Retweet the first tweet below if you learned something new.

@MakerDAO @MIM_Spell @fraxfinance Did you enjoy this?

Make sure you subscribe to my free newsletter below for additional content each week.

↓

TheDeFiEdge.com

Make sure you subscribe to my free newsletter below for additional content each week.

↓

TheDeFiEdge.com

Loading suggestions...