2/ What's the first thing people learn when they start trading?

Technical analysis of the chart. Usually through some sort of patterns system, Fibonacci, Elliot Waves, Fair Value Gaps for example.

But what is something is consistently overlooked?

Time.

Technical analysis of the chart. Usually through some sort of patterns system, Fibonacci, Elliot Waves, Fair Value Gaps for example.

But what is something is consistently overlooked?

Time.

3/ Time is important because it's when the Market Makers and the algorithms are most active in the market. You'll see this through sessions whereby most of the activity in the charts happens whenever the key legacy sessions are open. These are Asia, London and New York

4/ Yes crypto is 24/7 but the biggest and most key movements in the charts come whilst these legacy sessions are open and this is during the working week when Market Makers are at their desk

5/ You'll notice that outside of these sessions the markets are usually dead - this is why weekends are usually boring on #Bitcoin and full of sideways movement - because legacy markets are closed.

Here's a link to find out session times in your timezone: market24hclock.com

Here's a link to find out session times in your timezone: market24hclock.com

7/ How do you catch the ride up when a coin makes a move like this?

I very rarely catch moves up like this. I always prefer to let the MM show their hand first. In these cases we are aware big moves up on weekends are usually scams pumps...

I very rarely catch moves up like this. I always prefer to let the MM show their hand first. In these cases we are aware big moves up on weekends are usually scams pumps...

8/ ...so why not just let the MM make the move and take advantage of them reversing price when the right time of the week comes when you have a high probability of a reversal?

I will explain more about the time of the week for reversals later in the thread.

I will explain more about the time of the week for reversals later in the thread.

9/ So when does the week begin?

Depends on your timezone, but for me it's Sunday night when the Sydney markets open.

Sydney is not an overly important session as they move the market much less than the other 3 - Asia (specifically Tokyo), London and NYC.

Depends on your timezone, but for me it's Sunday night when the Sydney markets open.

Sydney is not an overly important session as they move the market much less than the other 3 - Asia (specifically Tokyo), London and NYC.

10/ Sydney is at the beginning of the week and are the last session before the weekly candle closes. This is why you'll often see high activity at this time as it transitions into the Tokyo pre-market. It's a bad time to trade as there are fast, false moves.

11/ Sunday/Monday false moves.

Now all sessions are back at their desk ready to begin the week. What's their intention? To get their orders filled at the highest/lowest points in the chart to begin the week. Why? Because they'll collect their profits towards to end of the week

Now all sessions are back at their desk ready to begin the week. What's their intention? To get their orders filled at the highest/lowest points in the chart to begin the week. Why? Because they'll collect their profits towards to end of the week

12/ At the beginning of the week they'll move the market into where they want to get their orders filled. If they're going Short they'll move the market up. If their intention is to go Long they'll move the market down. They want to get their orders filled at the best prices.

14/ So how to take advantage of the move up or down at the start of the week?

It's simple - if you're inexperienced then don't. Wait for them to show their hand first and you'll have a higher probability chance of getting it right later in the week.

It's simple - if you're inexperienced then don't. Wait for them to show their hand first and you'll have a higher probability chance of getting it right later in the week.

15/ After they've made their moves on Sun/Mon more often than not Tuesday is a holding day. (This isn't always the case - the drop from 48k to 28k was started on a Tuesday after Saylor announced a purchase - which is usually a trigger to go short

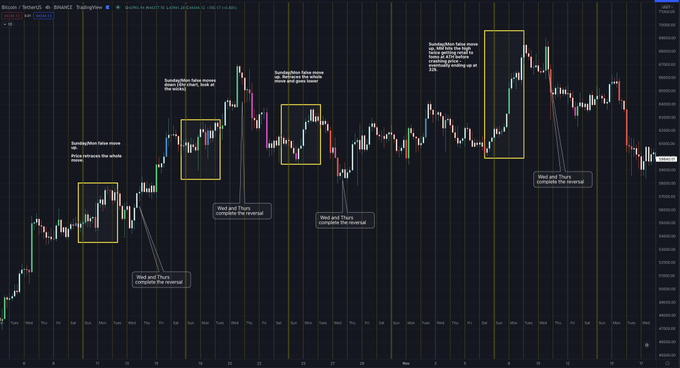

18/ This is a repeating pattern. Here are just some more recent examples (there are many more in the chart)

Here's a link to a chart where I fill them in from time to time when doing threads like this tradingview.com

Here's a link to a chart where I fill them in from time to time when doing threads like this tradingview.com

19/ Back to the importance of sessions.

Here are some key tendencies i've noticed:

a) Tokyo is usually where orders are accumulated. The Asian session can be a little quiet sometimes, but sometimes they make big moves.

Here are some key tendencies i've noticed:

a) Tokyo is usually where orders are accumulated. The Asian session can be a little quiet sometimes, but sometimes they make big moves.

21/ To add higher probability to your timings - the Wed/Thurs reversals more often than not come during the NYC session

Tokyo and NYC are the biggest players and the sessions to be most aware of and they move the markets the most. Sydney are London are usually the 'set up guys'

Tokyo and NYC are the biggest players and the sessions to be most aware of and they move the markets the most. Sydney are London are usually the 'set up guys'

Loading suggestions...