Inflation is structural, a thread. Ready?

First, to understand whether inflation is transitory or structural, we must address both demand & supply side of the equation.

The easy part - global demand is resilient & even with a slowdown expected in H2 or even 2023, no contraction of global demand.

What about supply?

The easy part - global demand is resilient & even with a slowdown expected in H2 or even 2023, no contraction of global demand.

What about supply?

Supply is a word everyone throws about without understanding what that means. When we talk about supply shocks, we talk about the following:

a) Inputs to production, whether labor or fuels or commodities like metals & agriculture or electricity etc

b) Operations

c) Transport

a) Inputs to production, whether labor or fuels or commodities like metals & agriculture or electricity etc

b) Operations

c) Transport

Let's talk about b & c, which is what people focus on when they say inflation is transitory (famous people have said that in 2021 & not I & I'm not famous so not as key but I understand A, B & C).

Operations can be shocked & resumed (China 2020 Covid) so can be transitory...

Operations can be shocked & resumed (China 2020 Covid) so can be transitory...

ASEAN locking down people in Q3 is also a transitory supply shock (operationally hard to manufacturer if people are suppressed) & China Q2 2022 is also transitory b/c one would assume China'll open up its export engine...

Transport can also be shocked if there is say a strike, imbalance in trade routes, blockages, etc.

So such logistical issue usually resolve with time, especially if the shock is not permanent like the Suez Canal disappearing so to speak.

So let's talk about about A.

So such logistical issue usually resolve with time, especially if the shock is not permanent like the Suez Canal disappearing so to speak.

So let's talk about about A.

Btw, before we talk about A, I think C warrants a very close examination but to keep the thread restricted to A, I will skip it this time around. C is actually very tight too & not as elastic as people think but let's assume that this shock can be normalized...

A)What do u know?

A)What do u know?

Inputs to production are things such as labor, commodities, etc.

Let's talk about commodities & this is a supply shock that everyone knows well, although we know less of the very thing we use than we think.

Let's start w/ the most basic.

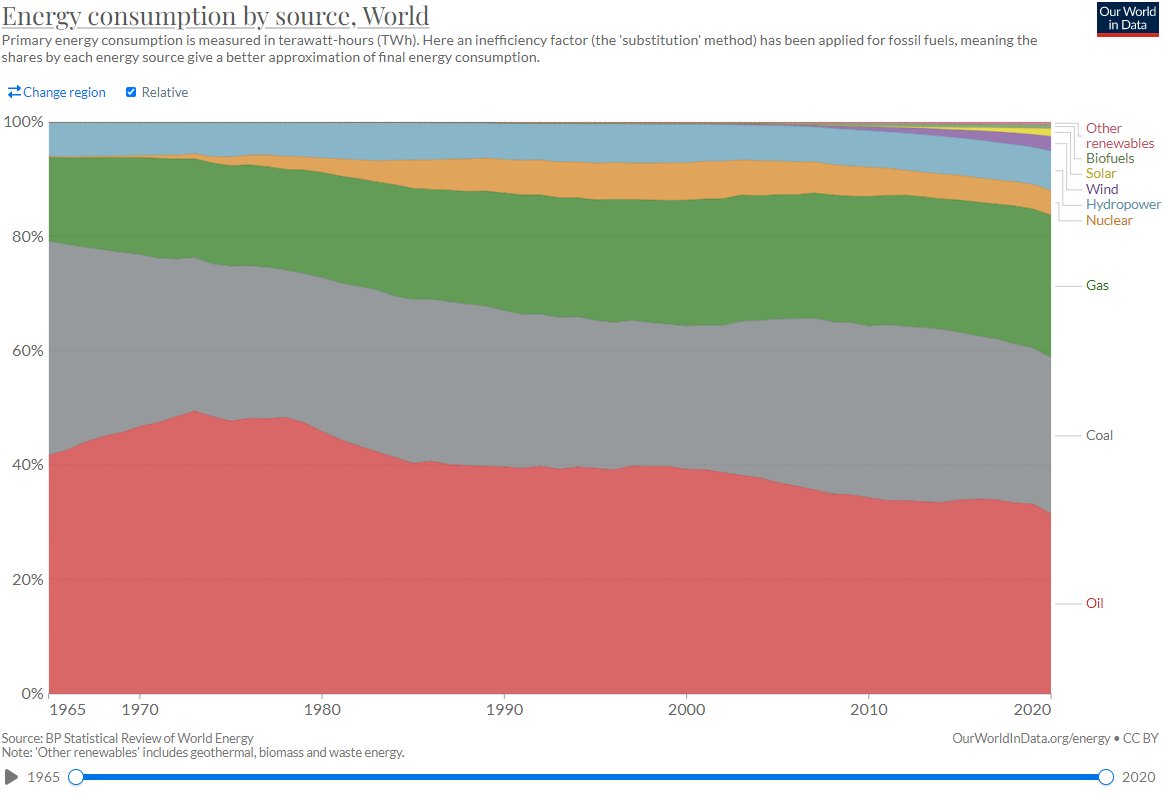

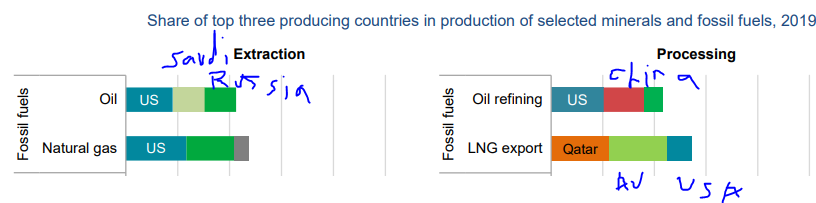

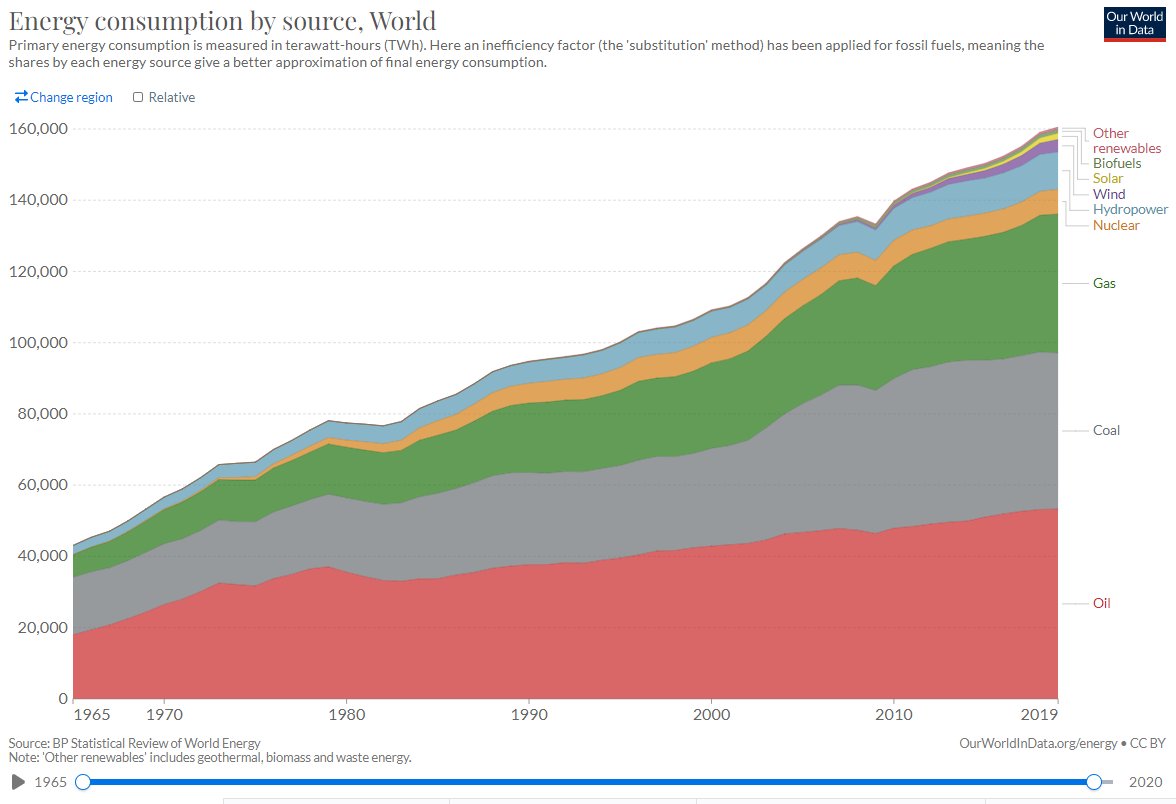

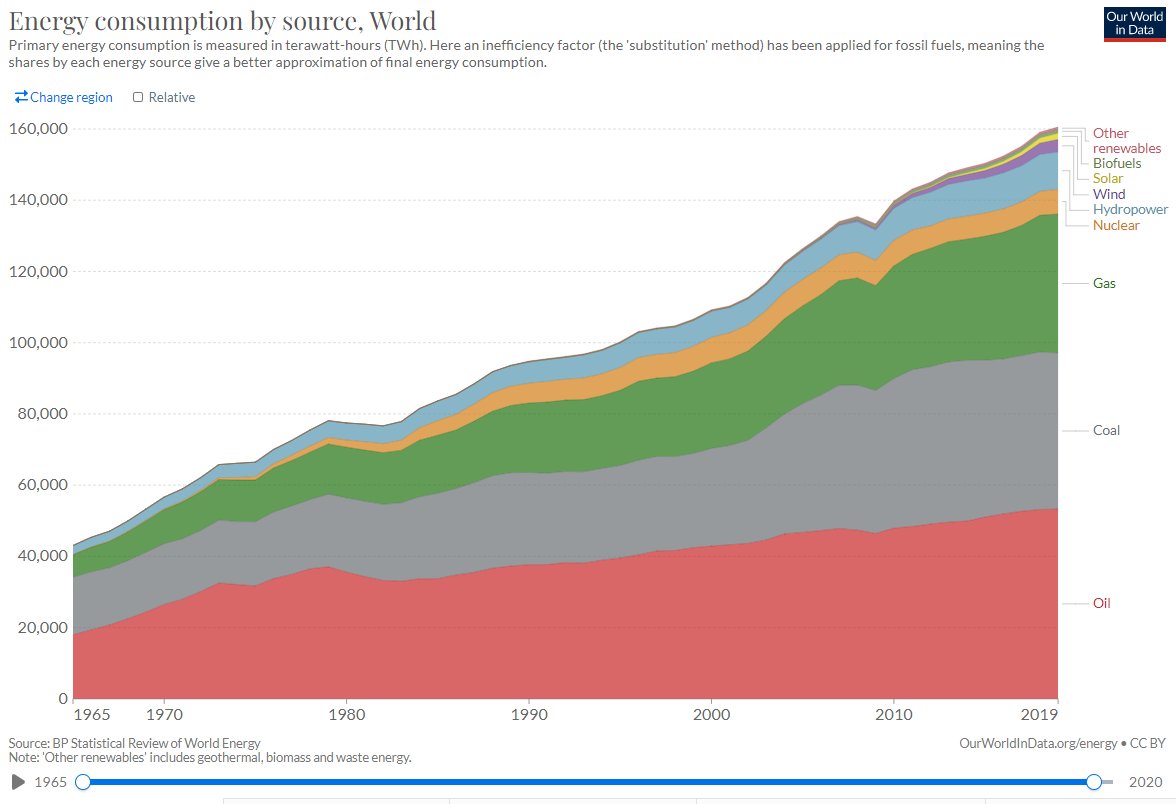

What do we use to energize our world?

Let's talk about commodities & this is a supply shock that everyone knows well, although we know less of the very thing we use than we think.

Let's start w/ the most basic.

What do we use to energize our world?

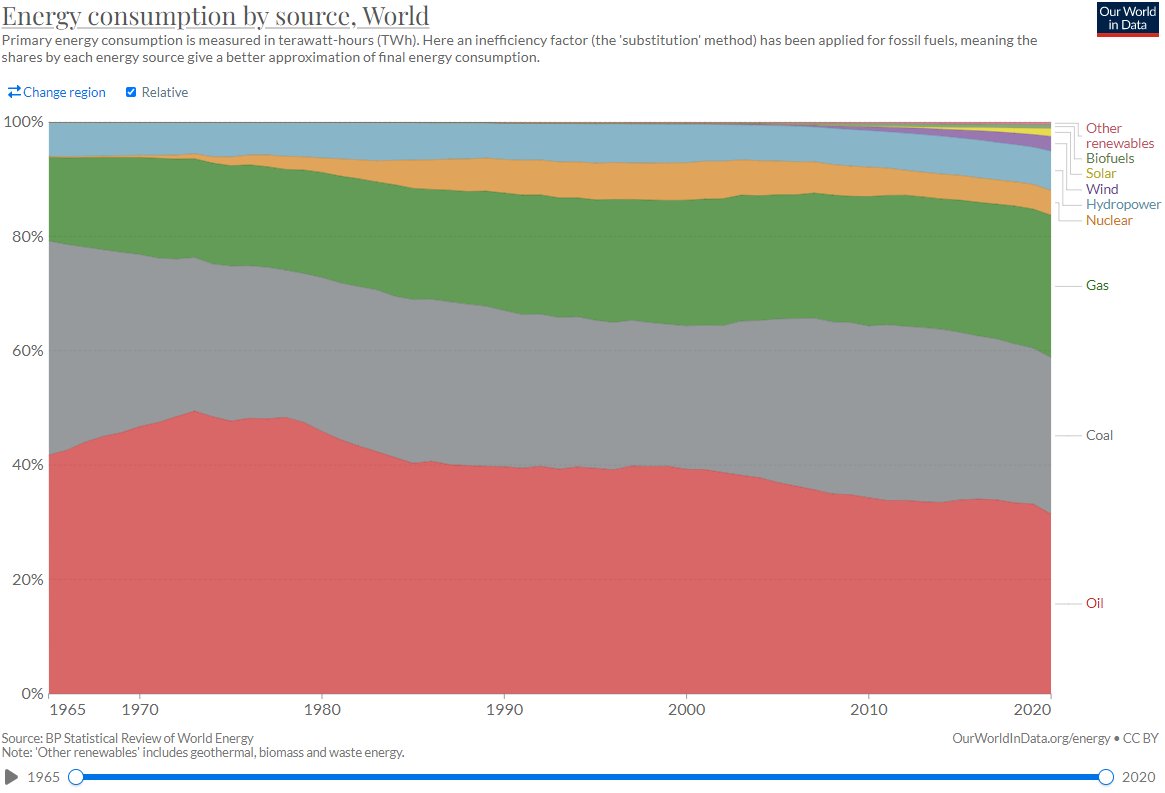

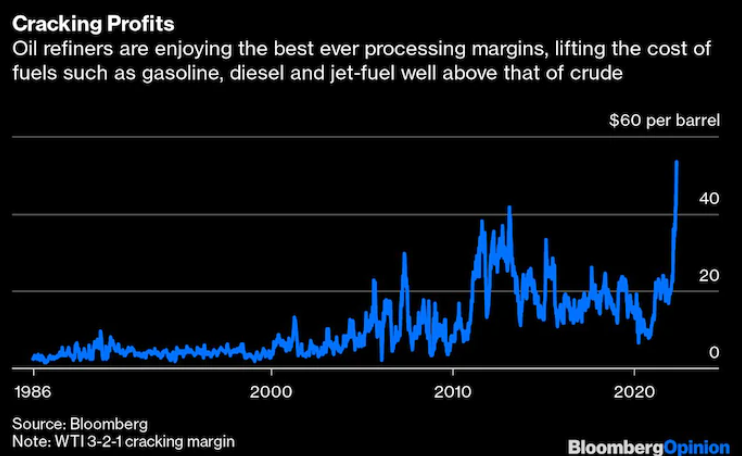

Meaning, there is an entire infrastructure built to refine Russian oil in Europe and if it were to replace it, it would need to build an entire infrastructure for it & so on & so forth.

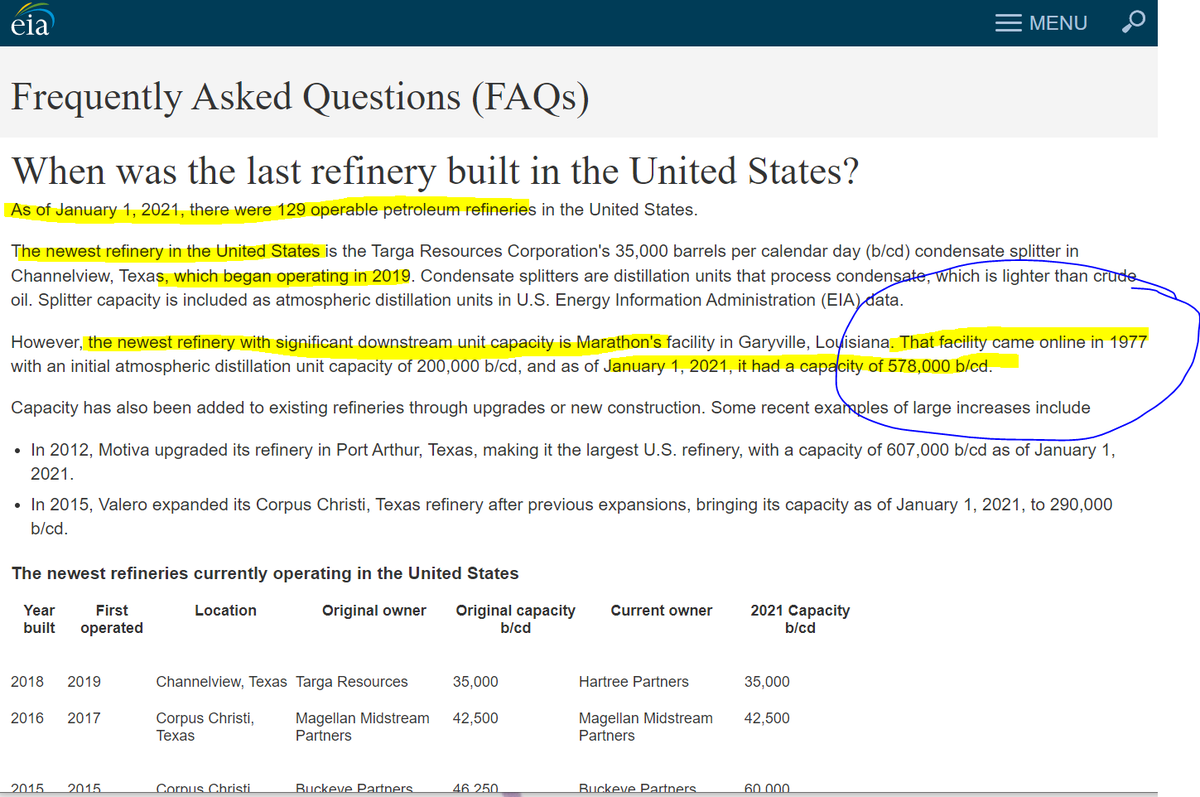

The bottlenecks aren't in just in crude but refining industry...

washingtonpost.com

The bottlenecks aren't in just in crude but refining industry...

washingtonpost.com

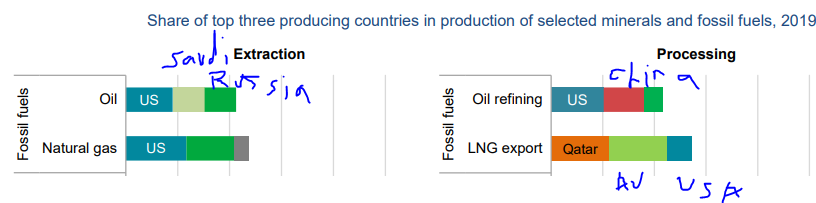

While you stare at Brent thinking 120/barrel is tres expensive, well, reality is much much worse because, well, refinery infrastructure in the US hasn't really been invested & frankly refining capacity reduced.

Ex China & Middle East, oil distillation capacity fell by 1.9 m/b/d

Ex China & Middle East, oil distillation capacity fell by 1.9 m/b/d

But China controls tightly its refined oil export so we're short of oil in many ways.

And did you know that only 1% of global autos are electric even if it is the fastest growing segment.

Or total is 16 million cars. Most are in China and EU & lesser extent USA.

So oil key.

And did you know that only 1% of global autos are electric even if it is the fastest growing segment.

Or total is 16 million cars. Most are in China and EU & lesser extent USA.

So oil key.

Europe, by not buying Russian oil, needs to find extra crude to produce diesel etc but also needs to get REFINING capacity.

So u get why refiners are sitting on fat margins & inflation feels worse than 120/barrel vibe.

Okay, what about coal?

So u get why refiners are sitting on fat margins & inflation feels worse than 120/barrel vibe.

Okay, what about coal?

If demand isn't destroyed but supply is relatively inelastic & supply is shocked in the short-term by geopolitics (Russian invasion of Ukraine = Western sanctions, leading to shortages), then ask the following:

*How long will the geopolitical shock last?

*Will investment rise?

*How long will the geopolitical shock last?

*Will investment rise?

For the former, I am not a war strategist so I can't answer but it doesn't seem like it will end imminently, but that all depends on Western (and rest of world) resolve to pay for defending international norms/etc.

Irrespective, not looking like a short one. Second, investment.

Irrespective, not looking like a short one. Second, investment.

When prices are high (refine premiums are le high) and crude is le high, and so are the substitutes like coal and gas (have you seen LNG???), one would imagine that investors response to incentives and INVEST!!!

But, but, but not so fast.

But, but, but not so fast.

So we know that our existence on earth & the way we organize our consumer oriented lifestyle/value/worth is not sustainable. Must do something about it. Things that have made life cheaper like globalization and consumption have NEGATIVE EXTERNALITY.

But how if our system depends

But how if our system depends

The solution of course is to transition away from this way of life. But the world transition is misleading & masks the TURBULENCE of steering an economic engine so dependent on consumption of fossil fuel to something else.

Geopolitics sparked the need to transition but...

Geopolitics sparked the need to transition but...

Globally there is no consensus. The EU is spearheading it but this is a challenge that requires global cooperation but we're living in a world marked by 24 February invasion of Ukraine that marks the beginning of a bifurcated world rather than one that collaborates more.

So?

So?

While the EU (and to a lesser extent the US) uses regulations to "transition" from fossil fuel (although it needs first to transition away from Russian cheap gas etc) by squeezing supply and demand to shape this new world, China & very much a lot of EM take a different approach..

First, you may say, how do u "transition" (btw, the usage of this is rather misleading because it is definitely not a transition but more like disruption and some places addition (China)???

On the demand side, u can reduce the demand of fossil fuel through taxes or subsidies.

On the demand side, u can reduce the demand of fossil fuel through taxes or subsidies.

An area where people generally use is say subsidies for purchases of EV cars, tax like carbon tax etc.

On the supply side, you can choke the financing channels via banks or subsidize the very thing you want to promote (ESG ratings etc).

So?

On the supply side, you can choke the financing channels via banks or subsidize the very thing you want to promote (ESG ratings etc).

So?

Meaning, the regulations can work and you can see that in the reduced capacity to refine in the EU and US and why we have the margins rising for refined products.

Also you can see why oil producers are hesitant to invest. Why coal producers aren't investing more etc.

Reluctance

Also you can see why oil producers are hesitant to invest. Why coal producers aren't investing more etc.

Reluctance

Either forced by financing choke hole or via conservatism to not flood the market of the goods that won't be desired in the future.

So here we are with this supply shock.

Note that China is not employing this strategy. It is using what @DanielYergin calls the ENERGY ADDITION...

So here we are with this supply shock.

Note that China is not employing this strategy. It is using what @DanielYergin calls the ENERGY ADDITION...

Meaning, China is adding more coal, more refinery capacity, more gas, more renewables, more nuclear.

Why? Because it doesn't want to have higher costs of inputs and want to grow the supply of energy to meet the demand.

China is going to be the Saudi Arabia of renewables.

Why? Because it doesn't want to have higher costs of inputs and want to grow the supply of energy to meet the demand.

China is going to be the Saudi Arabia of renewables.

Anyway, gotta go, will continue another day. This thread is getting very long but trust me, this much is true:

Inflation is structural, not transitory & this is a beginning of a thread, not the end.

Inflation is structural, not transitory & this is a beginning of a thread, not the end.

Loading suggestions...