Following WWII, the US enjoyed 25 years of strong economic growth and price stability.

This changed in 1965 as the next 17 years were marked by uncontrollable price increases & high unemployment.

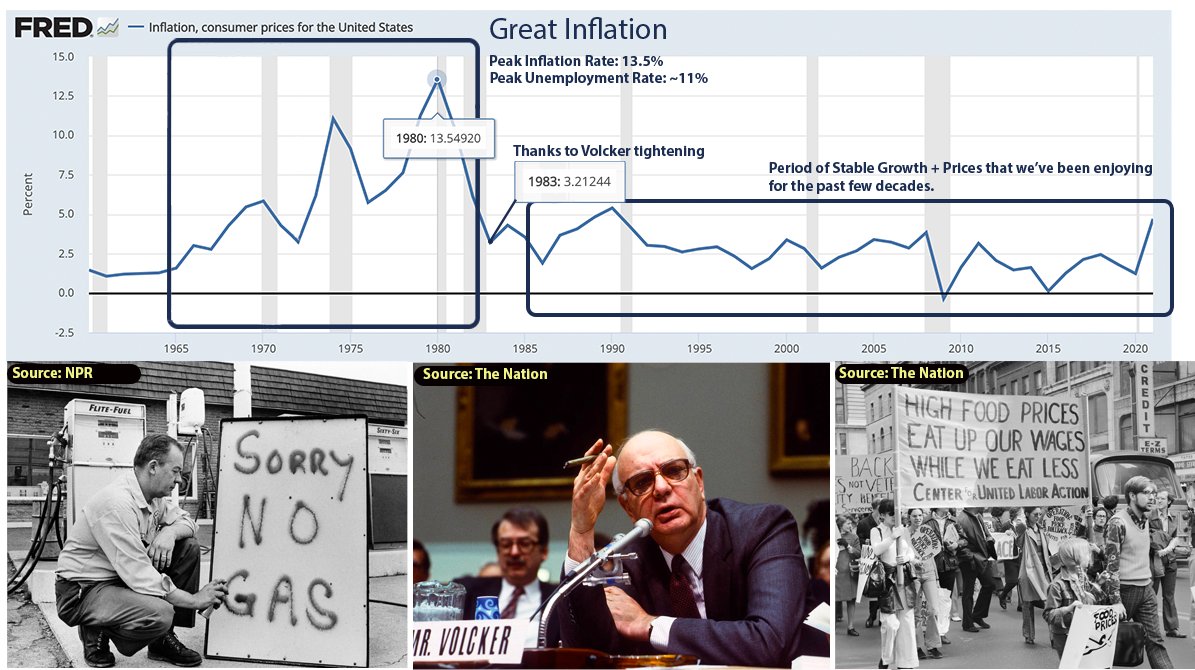

This moment in history, ending in 1982, is known as The Great Inflation.

This changed in 1965 as the next 17 years were marked by uncontrollable price increases & high unemployment.

This moment in history, ending in 1982, is known as The Great Inflation.

This model was attractive to economists back then, since prevailing sentiment was that combating unemployment was paramount due to memories of The Great Depression.

Unemployment peaked at 25.6% in 1933, a scary statistic that was fresh in the minds of policymakers back then.

Unemployment peaked at 25.6% in 1933, a scary statistic that was fresh in the minds of policymakers back then.

Inflation was an afterthought at the time.

It was considered a small price to pay for attaining economic growth and prosperity.

This is because the US had never experienced high and sustained inflation during peacetime.

Price levels generally only spiked briefly during wars.

It was considered a small price to pay for attaining economic growth and prosperity.

This is because the US had never experienced high and sustained inflation during peacetime.

Price levels generally only spiked briefly during wars.

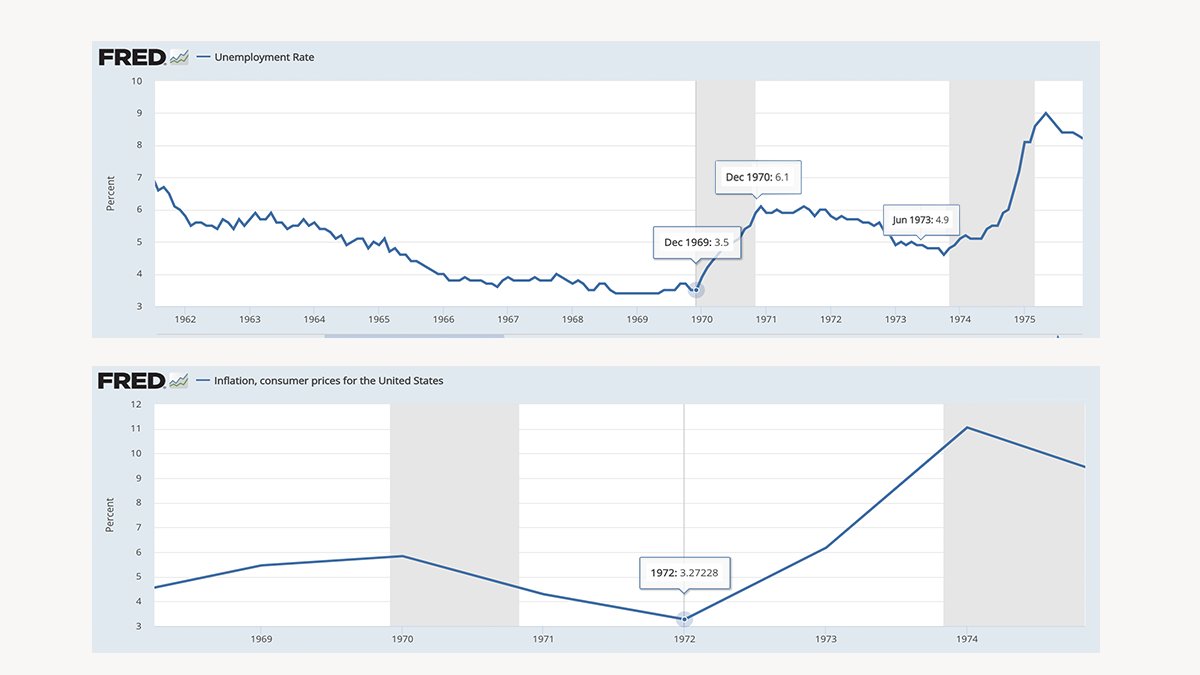

The assumptions of the Phillips Curve did not hold up during the Great Inflation.

Economists were left perplexed as they found themselves in a situation where both inflation and unemployment rose together.

This phenomenon came to be known as stagflation.

Economists were left perplexed as they found themselves in a situation where both inflation and unemployment rose together.

This phenomenon came to be known as stagflation.

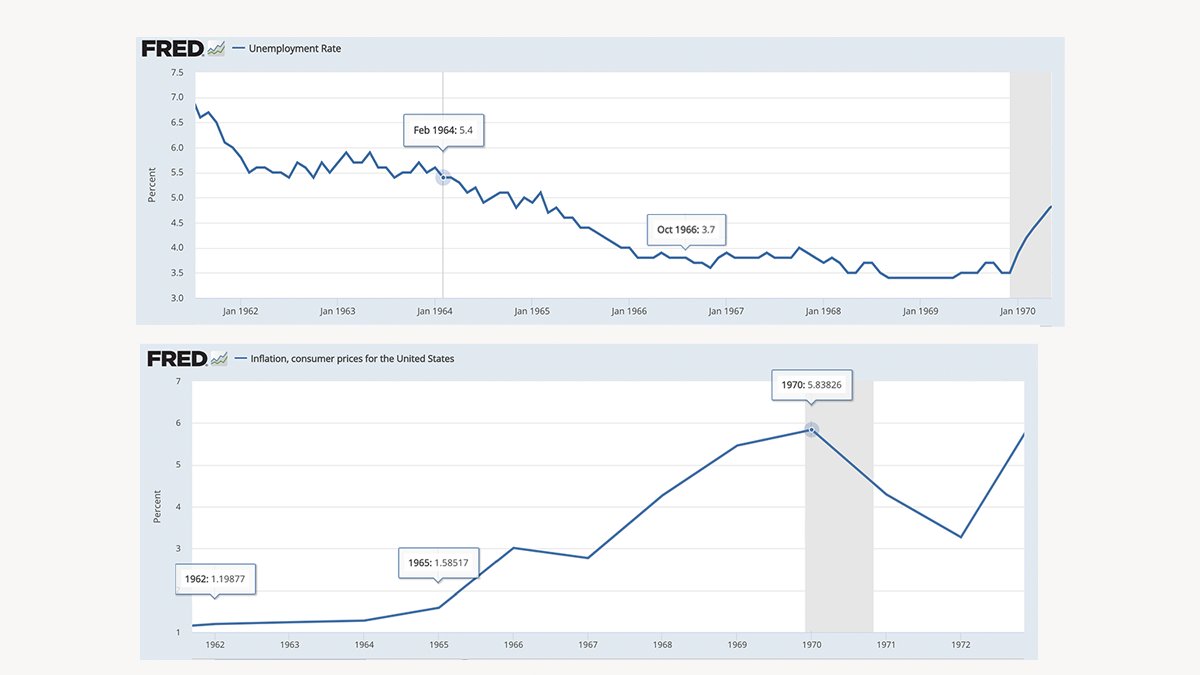

President Nixon, taking office in 1969, undid a lot of the initiatives from The Great Society as he reduced government spending to combat inflation.

This triggered a short recession in 1970.

Prices dropped temporarily, but unemployment pushed up from 3.5% to 6.1% that year.

This triggered a short recession in 1970.

Prices dropped temporarily, but unemployment pushed up from 3.5% to 6.1% that year.

With elections coming up in 1972, Nixon needed to gain favor for re-election.

He engaged in short-sighted quick-fix measures that had long-term ramifications for inflation and economic activity, as seen in the following years.

He engaged in short-sighted quick-fix measures that had long-term ramifications for inflation and economic activity, as seen in the following years.

Furthermore, to address the balance of trade deficit (imports > exports) that the US experienced for the 1st time in 1971, Nixon took the dollar off the gold standard.

This brought an end to Bretton Woods, a system that had previously made US exports expensive due to $ strength.

This brought an end to Bretton Woods, a system that had previously made US exports expensive due to $ strength.

Under Bretton Woods, foreign currencies had a fixed exchange rate with USD.

USD was anchored and convertible to gold.

As imports exceeded exports, the supply of US Dollars held abroad exceeded gold reserves.

This weakened the anchor and convertibility of USD to gold.

USD was anchored and convertible to gold.

As imports exceeded exports, the supply of US Dollars held abroad exceeded gold reserves.

This weakened the anchor and convertibility of USD to gold.

This action paved the way for faster money supply growth in the 70s, enabled by Fed Chairman Burns, and contributed to higher inflation.

Though Nixon's policies provided quick-fixes, they set the environment for larger systemic issues that perpetuated the Great Inflation.

Though Nixon's policies provided quick-fixes, they set the environment for larger systemic issues that perpetuated the Great Inflation.

Inflation was widely considered to be caused by exogenous factors such as rising food (due to weather) and energy (due to war).

Chairman Burns established the Core CPI measure, which excludes energy and food, as he argued these were out of the control of monetary policy.

Chairman Burns established the Core CPI measure, which excludes energy and food, as he argued these were out of the control of monetary policy.

While the oil embargo ended in 1974, annual inflation levels remained elevated at above 5% for the entire decade.

The Fed is largely to blame for this, as real interest rates remained low and money supply continued to grow at a fast rate.

The Fed is largely to blame for this, as real interest rates remained low and money supply continued to grow at a fast rate.

Chairman Burns continued to shy away from raising rates to the level needed to contain inflation as he feared sending the economy into a deep recession.

Hence, the Fed lost its credibility and the public's inflation expectations for the decade became very high.

Hence, the Fed lost its credibility and the public's inflation expectations for the decade became very high.

As the public came to expect persistent and uncontrollable inflation, their behavior changed.

In anticipation of more inflation, workers demanded higher wages, and firms charged higher prices.

This wage-price spiral sent inflation rates up even higher.

In anticipation of more inflation, workers demanded higher wages, and firms charged higher prices.

This wage-price spiral sent inflation rates up even higher.

By 1979, a second oil crisis caused by the Iranian Revolution created more stagflation pressures as inflation skyrocketed to its peak of 13.5% and drove unemployment up with it.

Drastic measures needed to be taken.

Drastic measures needed to be taken.

At this point, then President Jimmy Carter appointed Paul Volcker as Fed Chairman, the man who eventually put an end to the Great Inflation.

Chairman Volcker acted independently, forgoing not only Jimmy Carter’s political interests, but his own as well.

Chairman Volcker acted independently, forgoing not only Jimmy Carter’s political interests, but his own as well.

He was fully committed to fighting inflation through tighter monetary policy.

Since there was a lot of resistance against raising interest rates directly from other Fed members, Volcker focused on restraining the growth of the money supply instead.

Since there was a lot of resistance against raising interest rates directly from other Fed members, Volcker focused on restraining the growth of the money supply instead.

With Volcker, the Fed shifted its policy to control the supply of money instead of interest rates.

The Fed would determine how much money was available, and markets would set the price (interest rates).

This made rates shoot up to a peak of 20% by 1981.

The Fed would determine how much money was available, and markets would set the price (interest rates).

This made rates shoot up to a peak of 20% by 1981.

His bold policies were highly unpopular at the time as they triggered two deep but temporary economic recessions.

What he did, however, was necessary to bring inflation down to 3.2% in 1983.

This is the first time it was below 5% since the first Oil Crisis in 1973.

What he did, however, was necessary to bring inflation down to 3.2% in 1983.

This is the first time it was below 5% since the first Oil Crisis in 1973.

Two major lessons learned from this period:

1. Price stability is necessary for a strong and sustainable economy. A country's economy cannot grow properly if there is persistent and elevated inflation.

1. Price stability is necessary for a strong and sustainable economy. A country's economy cannot grow properly if there is persistent and elevated inflation.

2. The economy consists of individuals and their perception of what inflation is going to be in the near and distant future.

The Fed must maintain its credibility to keep price stability by managing these expectations.

The Fed must maintain its credibility to keep price stability by managing these expectations.

The Great Inflation and Volcker's actions forced Keynesian economists to rethink their philosophies.

The government can’t excessively spend its way into economic prosperity, and disregard the effect that its spending has on price stability and overall economic sustainability.

The government can’t excessively spend its way into economic prosperity, and disregard the effect that its spending has on price stability and overall economic sustainability.

Thank you for reading!

Given the lessons learned from 1965-1982, do you think the Fed is well equipped to contain inflation and avoid stagflation?

List of sources used for this write-up: docs.google.com

Given the lessons learned from 1965-1982, do you think the Fed is well equipped to contain inflation and avoid stagflation?

List of sources used for this write-up: docs.google.com

We'll be regularly sharing our notes and research across various topics in finance.

The financial world is complex, and we aim to produce content that is valuable to readers of all levels.

A follow, like and retweet👇is greatly appreciated!

The financial world is complex, and we aim to produce content that is valuable to readers of all levels.

A follow, like and retweet👇is greatly appreciated!

Loading suggestions...