Okay let me try to explain, multiple tweets

You have 1 BTC long (delta is 1)

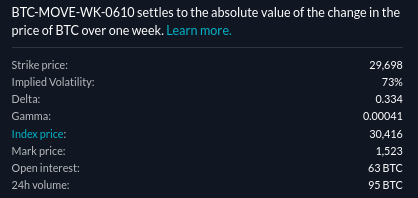

Weekly MOVE contract

Strike: $29k

Price: 2.5k

btc price: $31k

Delta: 0.5

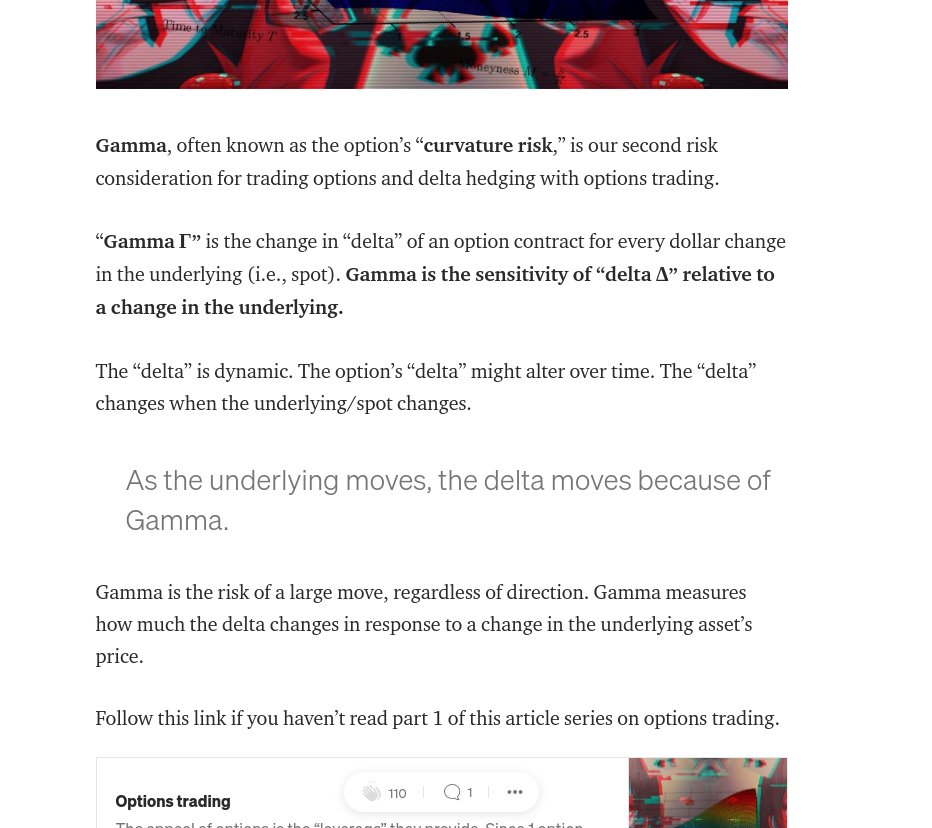

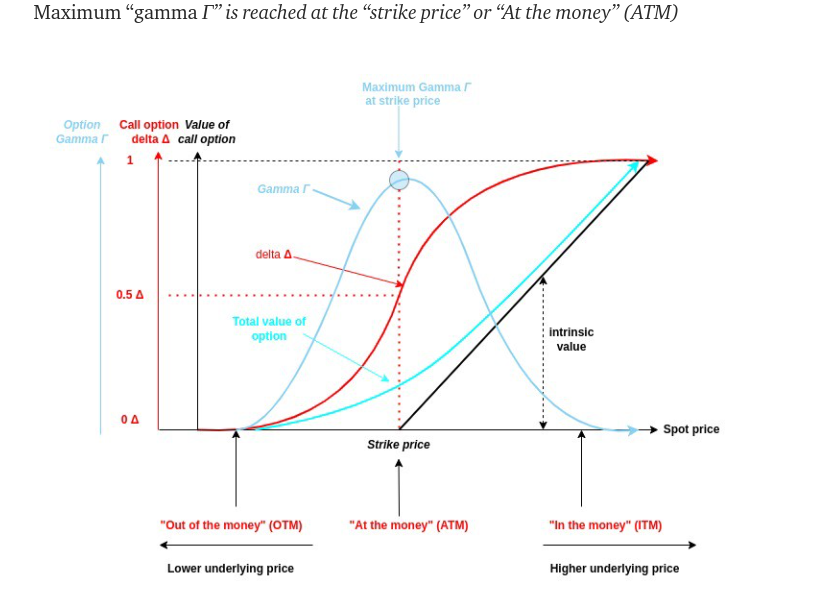

Gamma: some positive value

Theta: negative value

Short 2 MOVE contracts

2 * -0.5 = -1

Negative delta bc short MOVE

You have 1 BTC long (delta is 1)

Weekly MOVE contract

Strike: $29k

Price: 2.5k

btc price: $31k

Delta: 0.5

Gamma: some positive value

Theta: negative value

Short 2 MOVE contracts

2 * -0.5 = -1

Negative delta bc short MOVE

Our 1 BTC long is a delta 1 position

Our 2 MOVE contracts have delta of -1

1 - 1 = 0 We are delta neutral

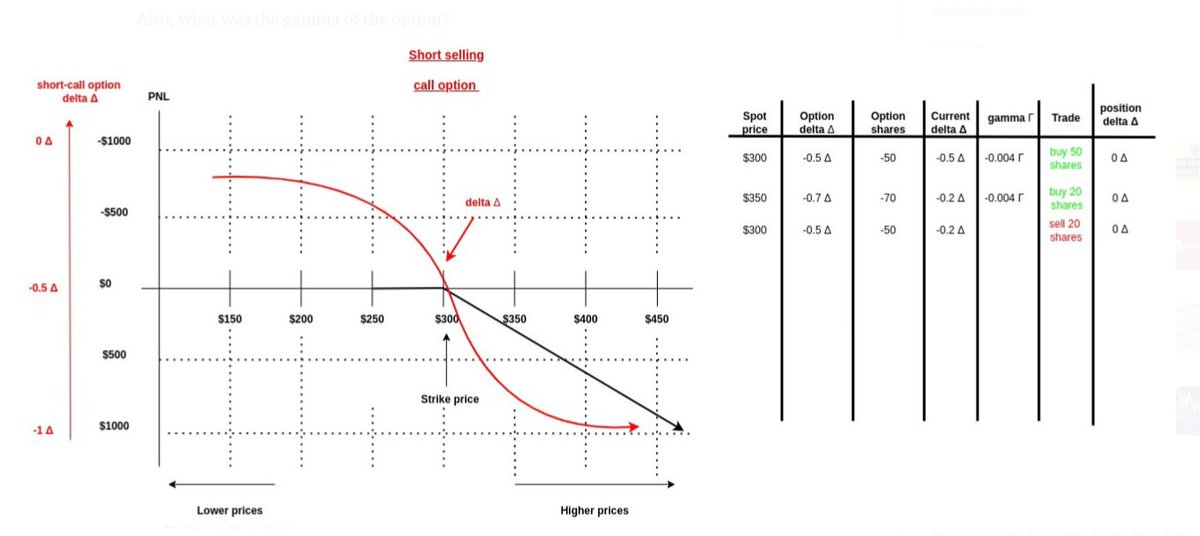

We short weekly, positive & negative values are swapped

Our gamma is negative: Sharp movements will hurt our MOVE pnl

Our theta is positive: we gain money as time passes

Our 2 MOVE contracts have delta of -1

1 - 1 = 0 We are delta neutral

We short weekly, positive & negative values are swapped

Our gamma is negative: Sharp movements will hurt our MOVE pnl

Our theta is positive: we gain money as time passes

Imagine BTC drops 30k to 29.5k

Our BTC perp loses PNL becomes less

Our MOVE contract PNL gains value

Suddenly the delta of a MOVE contract is 0.4

We shorted 2 MOVE so our MOVE delta is -0.8

Our 1 BTC long has a still a delta of 1

1 - 0.8 = 0.2

We aren't delta neural so...

Our BTC perp loses PNL becomes less

Our MOVE contract PNL gains value

Suddenly the delta of a MOVE contract is 0.4

We shorted 2 MOVE so our MOVE delta is -0.8

Our 1 BTC long has a still a delta of 1

1 - 0.8 = 0.2

We aren't delta neural so...

We have a delta exposure of +0.2

Our short MOVE contract gamma is negative

We need to sell, reduce our BTC long by 0.2 BTC

We sell 0.2 BTC at 29.5k to stay delta hedged

Our current position:

Long 0.8 BTC

Short 2 MOVE

Our short MOVE contract gamma is negative

We need to sell, reduce our BTC long by 0.2 BTC

We sell 0.2 BTC at 29.5k to stay delta hedged

Our current position:

Long 0.8 BTC

Short 2 MOVE

Now imagine BTC drops to 29.5k to 29k

MOVE contract delta changes from 0.4 to 0.3

We are short 2 MOVE contracts

2 * -0.3 = -0.6

Our BTC long of 0.8 has a delta of 0.8

0.8 - 0.6 = 0.2

We have a delta exposure of 0.2, we need to neutralize by selling 0.2 BTC at 29k

MOVE contract delta changes from 0.4 to 0.3

We are short 2 MOVE contracts

2 * -0.3 = -0.6

Our BTC long of 0.8 has a delta of 0.8

0.8 - 0.6 = 0.2

We have a delta exposure of 0.2, we need to neutralize by selling 0.2 BTC at 29k

Our MOVE contract short makes us money as it moves back to the strike price and the time decay lowers the value of our MOVE contract

But you can see. Market makers/dealers have to do the same when being short volatility or short gamma

Sell underlying low to offset the risk

But you can see. Market makers/dealers have to do the same when being short volatility or short gamma

Sell underlying low to offset the risk

Now if BTC jumps back to $29.5K

MOVE contract delta goes from 0.3 to 0.4

We are short so 2*-0.4 = -0.8

Our current BTC long is 0.6 BTC (delta 0.6)

0.6 - 0.8 = -0.2 delta

Fuck now need to buy back 0.2 BTC at $29.5k (we sold at $29k)

Short gamma/vol makes us chase our delta

MOVE contract delta goes from 0.3 to 0.4

We are short so 2*-0.4 = -0.8

Our current BTC long is 0.6 BTC (delta 0.6)

0.6 - 0.8 = -0.2 delta

Fuck now need to buy back 0.2 BTC at $29.5k (we sold at $29k)

Short gamma/vol makes us chase our delta

This is how market makers/dealers/delta neural traders have to hedge

See you can see how this drives a lot of price action we are seeing

Bart up, bart down, Bart up

Remember everytime you open a long/short, you fill a market maker. He is stuck with the opposite of your trade

See you can see how this drives a lot of price action we are seeing

Bart up, bart down, Bart up

Remember everytime you open a long/short, you fill a market maker. He is stuck with the opposite of your trade

And needs to delta hedge it

Either with an option strategy, a move contract (basically a straddle)

Dealers aren't watching PNL but rather their Greeks which are risk params for them

And stay within the risk param (could be different for any firm/fund/market maker) assigned

Either with an option strategy, a move contract (basically a straddle)

Dealers aren't watching PNL but rather their Greeks which are risk params for them

And stay within the risk param (could be different for any firm/fund/market maker) assigned

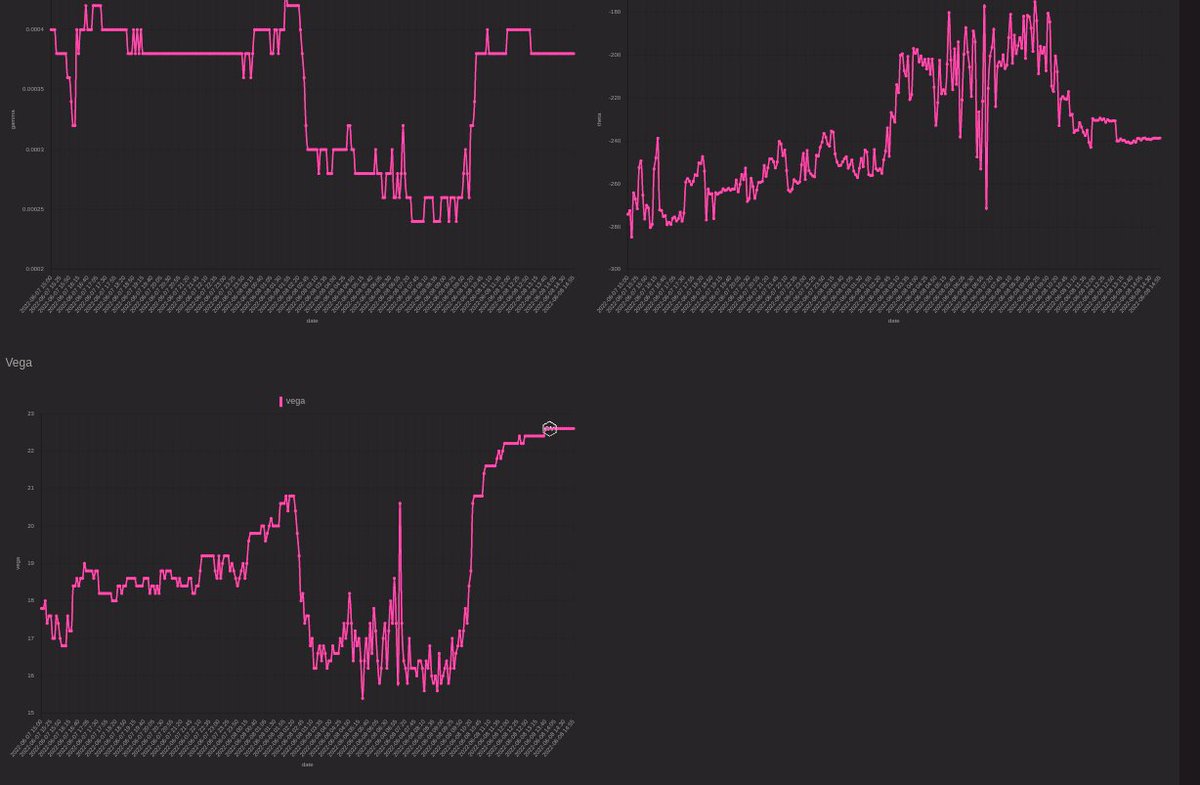

Dealers/market makers/institutions/prop firms

They don't use stop-losses

They hedge and watch their Greeks as risk considerations

Could be working for a prop firm and an alarm goes off

"Hey you have too much Vega risk. That's not within your risk parameter. Reduce Vega risk"

They don't use stop-losses

They hedge and watch their Greeks as risk considerations

Could be working for a prop firm and an alarm goes off

"Hey you have too much Vega risk. That's not within your risk parameter. Reduce Vega risk"

Now they don't have one degen position open

They market make & thousands positions open. all different assets. execute thousands of orders within risk params

They don't use stops to bail out of a MOVE contract for example

They will trade ie underlying/derive to offset risk

They market make & thousands positions open. all different assets. execute thousands of orders within risk params

They don't use stops to bail out of a MOVE contract for example

They will trade ie underlying/derive to offset risk

So if you thought the way of MOVE contracts work like statistics

Hmmm Saturday on average there's on average a $500 move

MOVE contract is trading at $800, good to short!

Hate to break it to you, you aren't as savvy as you think you are. It doesn't work like that "actually"

Hmmm Saturday on average there's on average a $500 move

MOVE contract is trading at $800, good to short!

Hate to break it to you, you aren't as savvy as you think you are. It doesn't work like that "actually"

"naked" move contracts trade

Like shorting MOVE and not delta hedging by trading the underlying or perpetual

You bring unlimited risk, you might be right 8/10 times

2/10 times it takes away all your profit

Long, lose 8/10 times

Also forget prices, implied vol vs realized vol

Like shorting MOVE and not delta hedging by trading the underlying or perpetual

You bring unlimited risk, you might be right 8/10 times

2/10 times it takes away all your profit

Long, lose 8/10 times

Also forget prices, implied vol vs realized vol

This is kind of hard to cover in my FTX MOVE contract article since you need to know all about options trading first

Written a lot about options trading lately: @romanornr/" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

You need to read every post and do advanced reading later on but that's up to you

Written a lot about options trading lately: @romanornr/" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

You need to read every post and do advanced reading later on but that's up to you

When I wrote that first FTX MOVE Contracts article in 2020

I just bet Sam & his quants had a good laugh

"lmfao he thinks it just works like a that. Absolute value of a MOVE"

"lmfao he uses statistics to get a the average of each day. He doesn't know"

Still much I don't know

I just bet Sam & his quants had a good laugh

"lmfao he thinks it just works like a that. Absolute value of a MOVE"

"lmfao he uses statistics to get a the average of each day. He doesn't know"

Still much I don't know

And Sam & his quants probably have a great laugh right now if they read this thread

"Lmfao he doesn't know about x y z yet. Retail noob is getting closer lmao but still low IQ lmao. Not gonna make it"

Can just imagine kek

"Lmfao he doesn't know about x y z yet. Retail noob is getting closer lmao but still low IQ lmao. Not gonna make it"

Can just imagine kek

Disclaimer:

I don't have any formal education or training in finance. I'm just like you guys. A retail traders who tries to a ascend

At middle school, I only remember Pythagorean theorem, so I'm neither an algebra god or calculus

However calculus would be useful

I don't have any formal education or training in finance. I'm just like you guys. A retail traders who tries to a ascend

At middle school, I only remember Pythagorean theorem, so I'm neither an algebra god or calculus

However calculus would be useful

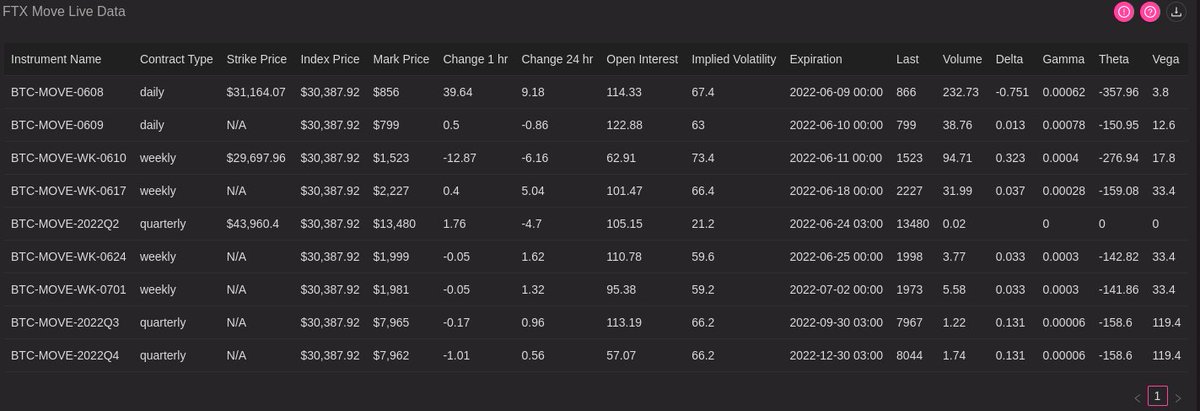

You can use @GenesisVol to get all the information you need. ie @FTX_Official doesn't show the vega, theta, etc

Also kinda "annoying" that they don't show the delta value of MOVE when using their mobile app.

An alternative incoming....

Also kinda "annoying" that they don't show the delta value of MOVE when using their mobile app.

An alternative incoming....

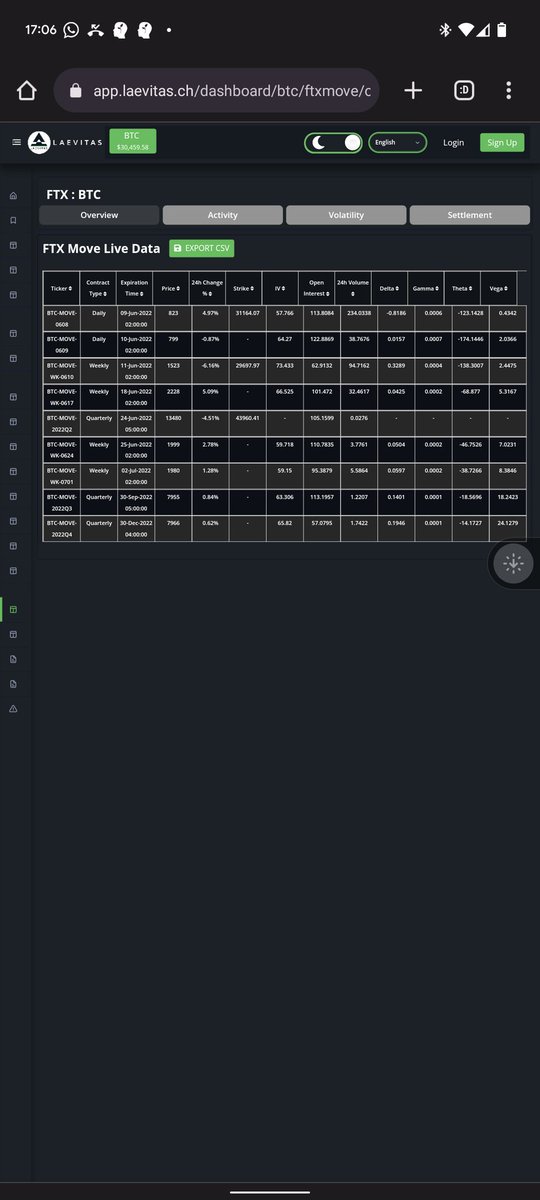

@GenesisVol @FTX_Official When I am on mobile, I use the FTX MOVE dashboard from @laevitas1 which he build

app.laevitas.ch

Also shows other data. Easy to use mobile. On genesisvol I often have to login again & again & again

Also @laevitas1 is for free

app.laevitas.ch

Also shows other data. Easy to use mobile. On genesisvol I often have to login again & again & again

Also @laevitas1 is for free

But when you are on mobile and visit @laevitas1 his dashboard

Make sure on mobile chrome to view in desktop mode

But good dashboard and quick to check & view on mobile when you're afk

Arguably a professional trader ofc doesn't trade from his phone or uses FTX UI but API instead

Make sure on mobile chrome to view in desktop mode

But good dashboard and quick to check & view on mobile when you're afk

Arguably a professional trader ofc doesn't trade from his phone or uses FTX UI but API instead

You don't have to be completely delta-neutral

Some firms/dealers accept "some" directional risk within certain constraints

Also Less frequently rehedging (by trading underlying derivs ie perp)

You *can* accept some directional risk by being delta-neutral'ish

Ie 0.05 delta

Some firms/dealers accept "some" directional risk within certain constraints

Also Less frequently rehedging (by trading underlying derivs ie perp)

You *can* accept some directional risk by being delta-neutral'ish

Ie 0.05 delta

However, you could also be long 2 MOVE contracts

Delta: 0.5 * 2 = 1

Now you're long 1 delta. To neutralize your delta, short 1 BTC (spot 1 btc = 1 delta)

Delta neutral

Now if BTC drops from $30k to 29k

MOVE contract delta drops to 0.4

2 *0.4 = 0.8

0.8 - 1 = -0.2 delta

Delta: 0.5 * 2 = 1

Now you're long 1 delta. To neutralize your delta, short 1 BTC (spot 1 btc = 1 delta)

Delta neutral

Now if BTC drops from $30k to 29k

MOVE contract delta drops to 0.4

2 *0.4 = 0.8

0.8 - 1 = -0.2 delta

Since we are long gamma (by being long MOVE)

In total we now have a negative delta of -0.2

We can fix that by BUYING 0.2 BTC

Which reduces our short to 0.8 BTC

Now we are delta neutral by buying lower instead of selling lower

In total we now have a negative delta of -0.2

We can fix that by BUYING 0.2 BTC

Which reduces our short to 0.8 BTC

Now we are delta neutral by buying lower instead of selling lower

If BTC would move again from 29k to $30k

MOVE contract delta: 0.5

2 * 0.5 = 1 delta

-0.8 BTC short = -0.8 delta

1-0.8 = 0.2 delta

We can fix this by selling 0.2 BTC at $30k to be delta neutral

MOVE contract delta: 0.5

2 * 0.5 = 1 delta

-0.8 BTC short = -0.8 delta

1-0.8 = 0.2 delta

We can fix this by selling 0.2 BTC at $30k to be delta neutral

You wonder what the point of all that was

Well you bought 0.2 BTC at 29k

Sold 0.2 BTC at 30k

These delta hedging trades are profitable. Because you buy low & sell high whenever being long MOVE (long gamma)

By being short MOVE (short gamma) you sell low & chase market higher

Well you bought 0.2 BTC at 29k

Sold 0.2 BTC at 30k

These delta hedging trades are profitable. Because you buy low & sell high whenever being long MOVE (long gamma)

By being short MOVE (short gamma) you sell low & chase market higher

Now you wonder why the fuck someone would be rather short gamma (short move) instead of long gamma (long move)

Being long MOVE and keep making delta hedging profitable trades sounds good unfortunately there's no free lunch

Being long gamma comes with negative theta (time decay)

Being long MOVE and keep making delta hedging profitable trades sounds good unfortunately there's no free lunch

Being long gamma comes with negative theta (time decay)

As time passes, MOVE contracts keep losing their value as time passes if the underlying doesn't move with magnitude

So it's a trade off. You rather short MOVE contracts & chase delta but yield from the time decay of move contracts

Or long MOVE but you need timing & enough move

So it's a trade off. You rather short MOVE contracts & chase delta but yield from the time decay of move contracts

Or long MOVE but you need timing & enough move

Thing to look at is implied volatiltiy vs realized volatility

high implied volatiltiy but low realized volatiltiy

You're usually better off shorting MOVE A

However if realized vol is higher than implied vol. You rather long a MOVE contract & hedge

This is an oversimplification!

high implied volatiltiy but low realized volatiltiy

You're usually better off shorting MOVE A

However if realized vol is higher than implied vol. You rather long a MOVE contract & hedge

This is an oversimplification!

However shorting MOVE contracts might work out way more often than being long MOVE contract

People tend to overestimate how much the market will move (just look at CT)

However being short MOVE comes with unlimited risk since it's shorting & max gain is your size shorted

People tend to overestimate how much the market will move (just look at CT)

However being short MOVE comes with unlimited risk since it's shorting & max gain is your size shorted

Being short MOVE is being short gamma

You know why it's dangerous? Remember that GamrStock "gamma squueze"

Yeah you might get the idea of "chasing delta"

As hedgefunds had to chase delta by buying the underlying which kept the market squeezing higher

You know why it's dangerous? Remember that GamrStock "gamma squueze"

Yeah you might get the idea of "chasing delta"

As hedgefunds had to chase delta by buying the underlying which kept the market squeezing higher

This constantly hedging to mitigate/transfer risk and delta hedge by trading the underlying is what drives a lot of price action.

Maybe the option market has grown so big that the option market drives price action instead of the other way around

Maybe the option market has grown so big that the option market drives price action instead of the other way around

It's a "tail that wags the dog" situation

Massive ignorance when someone doesn't want to study options trading because "I don't want to trade options"

Even if you don't want to, understanding the mechanics and the hedging flows can give you a massive edge

Massive ignorance when someone doesn't want to study options trading because "I don't want to trade options"

Even if you don't want to, understanding the mechanics and the hedging flows can give you a massive edge

Working on part 5 of my options trading article but felt like I needed to tweet this all

because too many seem to be oblivious about how hedging flows impact the market

How prop firms/dealers/market makers work

Been writing a lot of articles about this

romanornr.medium.com

because too many seem to be oblivious about how hedging flows impact the market

How prop firms/dealers/market makers work

Been writing a lot of articles about this

romanornr.medium.com

Decided to write my thoughts out in a stupid tweet thread

Have gotten tired of people saying "not interested in options because I won't trade them"

But this is how hedge funds/prop firms/market makers/dealers etc work

Have gotten tired of people saying "not interested in options because I won't trade them"

But this is how hedge funds/prop firms/market makers/dealers etc work

Anyways remember this tweet from CMS

He basically says he doesn't do TA at all

Because he most likely does hedging and understands how hedging flows impacts price action

He basically says he doesn't do TA at all

Because he most likely does hedging and understands how hedging flows impacts price action

Anyways everyone calling others retail traders

You and I are retail traders. When you say "retail traders" you just mean normies&newbies

But we are still retail

Everyone thinks they are "not retail" but understanding hedging flows, market dynamics is really something else

You and I are retail traders. When you say "retail traders" you just mean normies&newbies

But we are still retail

Everyone thinks they are "not retail" but understanding hedging flows, market dynamics is really something else

So if you're planning to apply at Alameda Research and show your tradingview with your "technical analysis" charts

Or you're a "wanna be quant" who relies on statistics or market profiles

You will most likely be laughed in your face, it's not good enough to be prop desk trader

Or you're a "wanna be quant" who relies on statistics or market profiles

You will most likely be laughed in your face, it's not good enough to be prop desk trader

I hope reading this thread was a game changer

A tweet thread written in a rush on mobile with no spell checker but whatever

Options trading & FTX MOVE Contracts, I've written multiple articles

@romanornr/" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

Anyways

A tweet thread written in a rush on mobile with no spell checker but whatever

Options trading & FTX MOVE Contracts, I've written multiple articles

@romanornr/" target="_blank" rel="noopener" onclick="event.stopPropagation()">medium.com

Anyways

Loading suggestions...