There's a lot of talk about @UmamiFinance and their delta-neutral 25% APY $USDC vault.

But how does it give 25% APY?

The secret is in @Arbitrum projects @GMX_IO and @TracerDAO

Let’s find out the SOURCE of our yield (not u), and how Umami will manage capital risk

🧵 👇

1/21

But how does it give 25% APY?

The secret is in @Arbitrum projects @GMX_IO and @TracerDAO

Let’s find out the SOURCE of our yield (not u), and how Umami will manage capital risk

🧵 👇

1/21

@UmamiFinance @arbitrum @GMX_IO @TracerDAO 2/

tl;dr Umami’s vault holds positions in $GLP on GMX, which pays out 24.7% APR

$GLP is a volatile index token with underlying assets like $BTC, $ETH

To hedge $GLP position, Umami uses Tracer to run 3S-BTC and 3S-ETH short positions to maintain delta neutrality

tl;dr Umami’s vault holds positions in $GLP on GMX, which pays out 24.7% APR

$GLP is a volatile index token with underlying assets like $BTC, $ETH

To hedge $GLP position, Umami uses Tracer to run 3S-BTC and 3S-ETH short positions to maintain delta neutrality

@UmamiFinance @arbitrum @GMX_IO @TracerDAO 3/

End result: Umami is able to pay out high yield without losing initial capital value

This vault idea started out as @0xCarnation was managing Umami’s treasury. They held a large position in $GLP and he wanted to hedge risks around it

End result: Umami is able to pay out high yield without losing initial capital value

This vault idea started out as @0xCarnation was managing Umami’s treasury. They held a large position in $GLP and he wanted to hedge risks around it

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation 4/

Since then, the Umami treasury has outperformed the overall market massively, while STILL generating yield for $UMAMI stakers!

See @crypto_condom’s thread for more details:

Since then, the Umami treasury has outperformed the overall market massively, while STILL generating yield for $UMAMI stakers!

See @crypto_condom’s thread for more details:

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom 5/

To understand how their vault strategy works, we need to learn about the underlying projects that Umami are utilising for the yield generation and hedging strategy.

Enter @GMX_IO and @TracerDAO

To understand how their vault strategy works, we need to learn about the underlying projects that Umami are utilising for the yield generation and hedging strategy.

Enter @GMX_IO and @TracerDAO

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom 6/

On the surface, @GMX_IO is a DeFi Perp Exchange

But their crown jewel is the deep liquidity provided by their index token $GLP.

@0xtanler explains more here:

But I’ll give a short summary:

On the surface, @GMX_IO is a DeFi Perp Exchange

But their crown jewel is the deep liquidity provided by their index token $GLP.

@0xtanler explains more here:

But I’ll give a short summary:

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler 7/

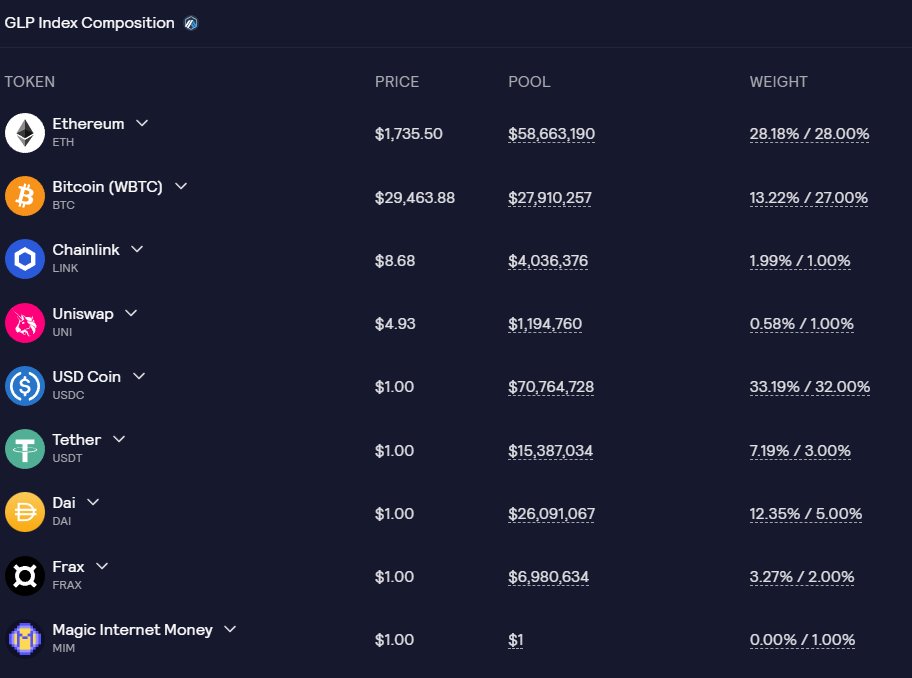

$GLP is an index with stables + $BTC, $ETH, $LINK, $UNI

Users mint $GLP with these listed tokens, providing liquidity for traders on the platform.

The deep liquidity in $GLP is also used for zero-slippage swaps, with DEX aggs like @Paraswap & @1inch routing thruhrough GMX.

$GLP is an index with stables + $BTC, $ETH, $LINK, $UNI

Users mint $GLP with these listed tokens, providing liquidity for traders on the platform.

The deep liquidity in $GLP is also used for zero-slippage swaps, with DEX aggs like @Paraswap & @1inch routing thruhrough GMX.

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch 8/

With trader and swap volume growing for $GMX, this means booming fees and sustainable protocol revenue from trading, liquidations and swaps

$GLP holders get 70% of these fees as incentive (24% APR)

THIS is the source of the yield for Umami’s USDC vault strategy

With trader and swap volume growing for $GMX, this means booming fees and sustainable protocol revenue from trading, liquidations and swaps

$GLP holders get 70% of these fees as incentive (24% APR)

THIS is the source of the yield for Umami’s USDC vault strategy

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch 9/

Ofc there is no free lunch, and there are risks involved with this yield

👉$GLP only wins if traders lose - it is the counterparty. If traders win, $GLP is not profitable

👉$GLP holds ~50% of its index in volatile assets, and high yield means nothing if $GLP value plunges

Ofc there is no free lunch, and there are risks involved with this yield

👉$GLP only wins if traders lose - it is the counterparty. If traders win, $GLP is not profitable

👉$GLP holds ~50% of its index in volatile assets, and high yield means nothing if $GLP value plunges

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch 10/

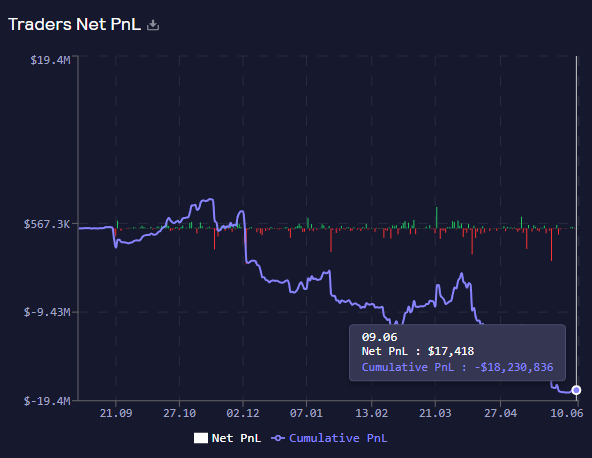

For the first risk, it does look like traders lose over time on GMX, as seen in the stats below. $GLP wins over time and yield stays intact

If traders really do win for a period of time - it will ONLY affect yield. The underlying capital will remain intact

For the first risk, it does look like traders lose over time on GMX, as seen in the stats below. $GLP wins over time and yield stays intact

If traders really do win for a period of time - it will ONLY affect yield. The underlying capital will remain intact

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch 11/

For risk 2: Umami counters $GLP volatility using @TracerDAO’s perpetual pools, running 3S-BTC and 3S-ETH shorts to hedge $GLP

This maintain delta neutrality and protects vault capital deposited in $GLP

@Riley_gmi explains more:

For risk 2: Umami counters $GLP volatility using @TracerDAO’s perpetual pools, running 3S-BTC and 3S-ETH shorts to hedge $GLP

This maintain delta neutrality and protects vault capital deposited in $GLP

@Riley_gmi explains more:

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi 12/

Now we know where our yield comes from, and how Umami plans to hedge against volatility

But what about extreme market conditions? Will my capital be safu?

1st thing to note: both $GLP and $Tracer short positions CANNOT be liquidated, so that’s one risk off the table

Now we know where our yield comes from, and how Umami plans to hedge against volatility

But what about extreme market conditions? Will my capital be safu?

1st thing to note: both $GLP and $Tracer short positions CANNOT be liquidated, so that’s one risk off the table

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi 13/

Umami also plans to build up a buffer for extreme conditions:

1️⃣ $GLP produces esGMX as yield alongside $ETH. esGMX builds multipliers over time and can also be staked, helping earn more $ETH.

This bonus $ETH is not part of current yield calcs and serves as a buffer

Umami also plans to build up a buffer for extreme conditions:

1️⃣ $GLP produces esGMX as yield alongside $ETH. esGMX builds multipliers over time and can also be staked, helping earn more $ETH.

This bonus $ETH is not part of current yield calcs and serves as a buffer

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi 14/

2️⃣ A portion of esGMX can also be vested to become liquid $GMX

While the Umami team would rather keep it staked to earn more $ETH, the vested $GMX can act as a potential buffer if absolutely needed

2️⃣ A portion of esGMX can also be vested to become liquid $GMX

While the Umami team would rather keep it staked to earn more $ETH, the vested $GMX can act as a potential buffer if absolutely needed

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi 15/

Even in the most extreme drawdowns, Umami’s models are built such that the underlying deposited $USDC does not go down more than 5%

Beyond this, Umami will be putting in their OWN SEED CAPITAL into the vaults

Even in the most extreme drawdowns, Umami’s models are built such that the underlying deposited $USDC does not go down more than 5%

Beyond this, Umami will be putting in their OWN SEED CAPITAL into the vaults

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi 16/

If the worst case scenario does happen and there was a liquidity crunch, these buffers will give users ample time to exit

The Umami team are also currently in talks with @NexusMutual, @cozyfinance, @InsurAace_io, @riskharbor about vault insurance

If the worst case scenario does happen and there was a liquidity crunch, these buffers will give users ample time to exit

The Umami team are also currently in talks with @NexusMutual, @cozyfinance, @InsurAace_io, @riskharbor about vault insurance

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor 17/

With all the risk talk aside, let’s chat specifics of the vault.

You can deposit and withdraw $USDC, and the vault will run on a rolling epoch model.

Each epoch is 8 hours to 1 day to match Tracer’s epochs (so you can only withdraw funds at the end of epochs)

With all the risk talk aside, let’s chat specifics of the vault.

You can deposit and withdraw $USDC, and the vault will run on a rolling epoch model.

Each epoch is 8 hours to 1 day to match Tracer’s epochs (so you can only withdraw funds at the end of epochs)

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor 18/

Initial vault funding limit of $100m, so $GLP yield will not be diluted.

Over time, Umami will scout out yield opportunities sustained by real protocol revenue to grow this limit

🚨 $UMAMI stakers get WLed for the vault! I hear the magic number might be 10 $UMAMI...

Initial vault funding limit of $100m, so $GLP yield will not be diluted.

Over time, Umami will scout out yield opportunities sustained by real protocol revenue to grow this limit

🚨 $UMAMI stakers get WLed for the vault! I hear the magic number might be 10 $UMAMI...

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor 19/

On the token side:

Hard cap on 1 million $UMAMI with no emissions

$UMAMI stakers will earn dividends on protocol revenue, the majority of which will come from vaults

On the token side:

Hard cap on 1 million $UMAMI with no emissions

$UMAMI stakers will earn dividends on protocol revenue, the majority of which will come from vaults

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor 20/

More vaults will eventually be launched, each tapping into a different revenue stream.

Each vault will also come with an ERC-4626 standard token with their own liquidity pool (your vault assets are tokenised and can actually be traded!)

More vaults will eventually be launched, each tapping into a different revenue stream.

Each vault will also come with an ERC-4626 standard token with their own liquidity pool (your vault assets are tokenised and can actually be traded!)

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor 21/

This opens up further possibilities of aggregating these tokens into a “metavault”, which allows for scaling and finally, be able to handle institutional capital whose size is size.

@SalomonCrypto gives an example on a meta strategy:

This opens up further possibilities of aggregating these tokens into a “metavault”, which allows for scaling and finally, be able to handle institutional capital whose size is size.

@SalomonCrypto gives an example on a meta strategy:

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor @SalomonCrypto From a degen $OHM fork with anime gurls to talking about aiming for institutional size, @UmamiFinance has come a long way

This is a really exciting project that's well positioned to make the best of all the amazing @Arbitrum projects, and I can’t wait to see what they'll build.

This is a really exciting project that's well positioned to make the best of all the amazing @Arbitrum projects, and I can’t wait to see what they'll build.

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor @SalomonCrypto So… what should you do if you want to take advantage of this?

Follow @UmamiFinance and join their discord for the latest news on vault updates and wen launch!

discord.gg

Follow @UmamiFinance and join their discord for the latest news on vault updates and wen launch!

discord.gg

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor @SalomonCrypto Follow the following people if you want news on @UmamiFinance and the @Arbitrum ecosystem

@crypto_condom

@barryfried

@SalomonCrypto

@IntrinsicDeFi

@MrGrumpyNFT

@0xcarnation

@PrePopAi

@phtevenstrong

@rektdiomedes

@Riley_gmi

@medicinetoad

@808_Investor

@xcurveth

@DefiMoon

@crypto_condom

@barryfried

@SalomonCrypto

@IntrinsicDeFi

@MrGrumpyNFT

@0xcarnation

@PrePopAi

@phtevenstrong

@rektdiomedes

@Riley_gmi

@medicinetoad

@808_Investor

@xcurveth

@DefiMoon

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor @SalomonCrypto @BarryFried @IntrinsicDeFi @MrGrumpyNFT @PrePopAi @phtevenstrong @rektdiomedes @MedicineToad @808_Investor @xcurveth @DefiMoon Tagging for visibility:

@defillama

@route2fi

@prismaticcap

@darrenlautf

@interndao

@thedefiprincess

@mhonkasalo

@thedefiedge

@alpha_pls

@defillama

@route2fi

@prismaticcap

@darrenlautf

@interndao

@thedefiprincess

@mhonkasalo

@thedefiedge

@alpha_pls

@UmamiFinance @arbitrum @GMX_IO @TracerDAO @0xcarnation @crypto_condom @0xtanler @paraswap @1inch @Riley_gmi @NexusMutual @cozyfinance @riskharbor @SalomonCrypto @BarryFried @IntrinsicDeFi @MrGrumpyNFT @PrePopAi @phtevenstrong @rektdiomedes @MedicineToad @808_Investor @xcurveth @DefiMoon @DefiLlama @Route2FI @PrismaticCap @Darrenlautf @InternDAO @thedefiprincess @mhonkasalo @thedefiedge @alpha_pls P.S. loads of alpha in this AMA between the Umami Team (@0xcarnation @IntrinsicDeFi @PrePopAi) and @phtevenstrong! Watch it if you want all the first hand info.

youtube.com

youtube.com

If you have enjoyed the thread, please consider following and RT the first tweet so it can give me a nice dopamine boost in the midst of a bera market!

Loading suggestions...