What is QT?

Quantitative tightening (QT) is a process whereby the central bank reduces its balance sheet by eliminating bank reserves.

It is exactly the opposite of quantitative easing (QE).

Quantitative tightening (QT) is a process whereby the central bank reduces its balance sheet by eliminating bank reserves.

It is exactly the opposite of quantitative easing (QE).

One common misconception among market participants and even among mainstream financial press is that QT reduces money and QE increases money.

However, this is not correct as neither QE increases money nor QT reduces money.

However, this is not correct as neither QE increases money nor QT reduces money.

Only bank reserves are increased in the former and bank reserves are decreased in the latter.

Fresh money is created when commercial banks lend to the real economy. QT basically reduces the level of cash held by Banks (reserves).

Fresh money is created when commercial banks lend to the real economy. QT basically reduces the level of cash held by Banks (reserves).

What happened with the last QT?

The prior QT experiment began in late 2017 and ended in September 2019, when a sudden spike in interest rates on overnight repurchase agreements (“repos”) panicked the Fed into restarting quantitative easing.

The prior QT experiment began in late 2017 and ended in September 2019, when a sudden spike in interest rates on overnight repurchase agreements (“repos”) panicked the Fed into restarting quantitative easing.

Repos are short-term loans between financial institutions.

On 17th Sep 2019, Repos spiked to 5.25% from 2.43% since the last trading day. During the trading day, it spiked to as high as 10% which immediately brought back FED intervention.

On 17th Sep 2019, Repos spiked to 5.25% from 2.43% since the last trading day. During the trading day, it spiked to as high as 10% which immediately brought back FED intervention.

Federal reserve bank of NY injected $75 billion in liquidity on the same day and continued to do so every morning for the rest of the week.

On 19th Sep, FOMC also lowered interest rates on bank reserves and the QT cycle ended.

On 19th Sep, FOMC also lowered interest rates on bank reserves and the QT cycle ended.

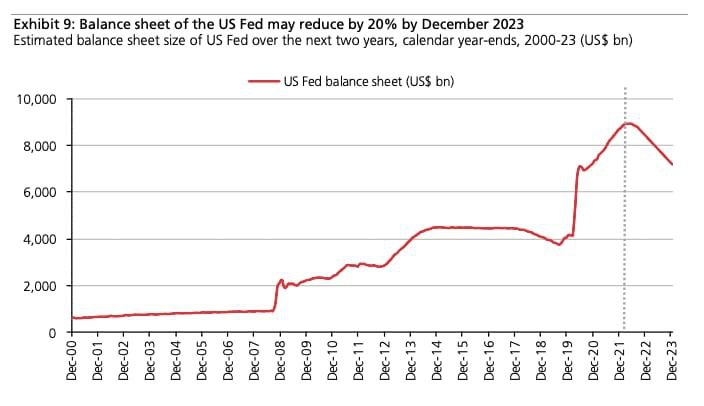

During this QT cycle, FED reduced its balance sheet size from ~ $4.5 trillion to ~$3.8 trillion (reduced assets to the tune of $650 billion).

Many economists see officials targeting about $3 trillion in total balance sheet shrinkage over a three-year span.

FED current balance sheet stands at ~ $9 trillion. The pace of this QT cycle is almost double of the previous 2017-2019 QT cycle.

FED current balance sheet stands at ~ $9 trillion. The pace of this QT cycle is almost double of the previous 2017-2019 QT cycle.

Why is QT required?

QT basically reduces liquidity in the commercial banking system which tightens financial conditions.

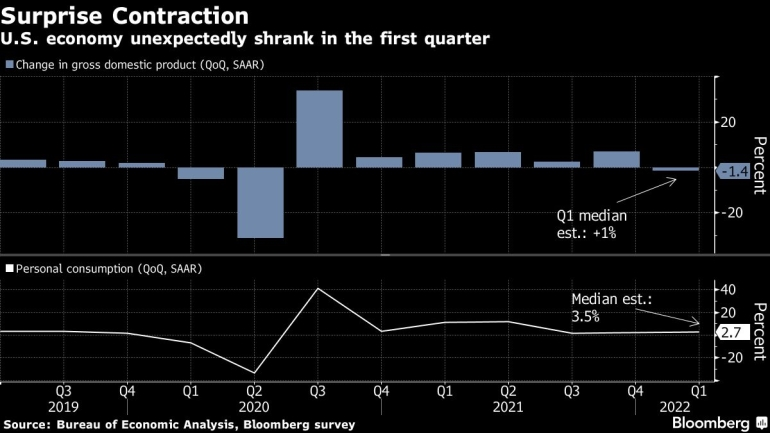

Tighter financial conditions would slow down the economy as it needs to combat inflation which is the primary objective of FED.

QT basically reduces liquidity in the commercial banking system which tightens financial conditions.

Tighter financial conditions would slow down the economy as it needs to combat inflation which is the primary objective of FED.

As the burden of higher inflation is disproportionately borne by the economically weaker sections of the society, (as they don’t own many assets and live from paycheck to paycheck) keeping inflation under control is one of the most important objectives of the government.

This has put massive pressure on the stock market globally and also on the US markets which is down close to 20% (SPX).

The primary reason is as funding cost increases it will become more and more difficult for such loss-making companies to get funding or even roll over their existing debt.

One can expect asset prices to remain under pressure until FED slows its QT program which again will be closely linked to the inflation readings

Loading suggestions...