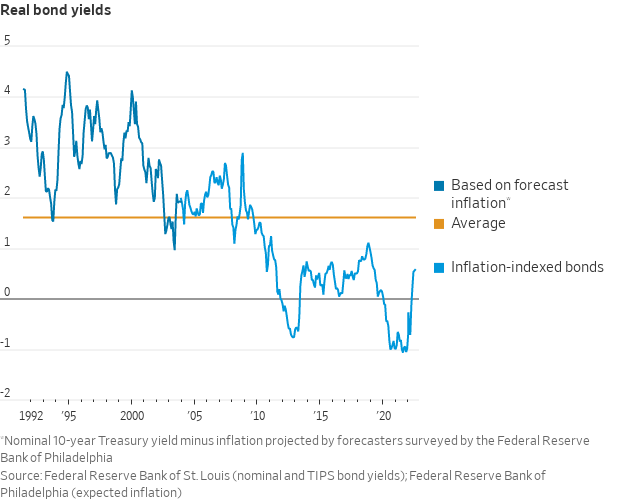

Real rates are still very low, and that can't last if inflation stays stubborn. Today's column explores what that means. First, I note that while real bond yields are no longer negative, they are low by historic standards. wsj.com

2/ Second, I note that to actually reduce inflation, the fed has to do more than raise nominal rates - it must raise real rates materially, which has yet to do - and markets don't really expect. They are still betting on immaculate disinflation.

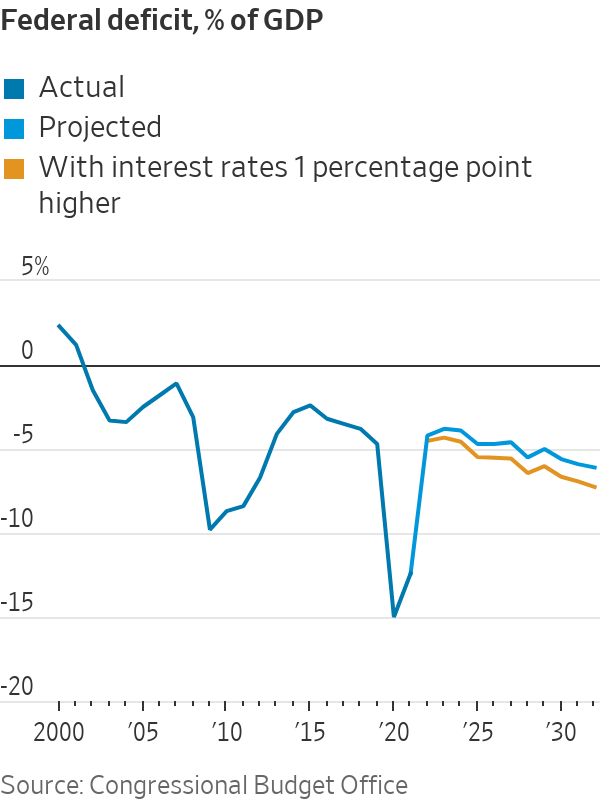

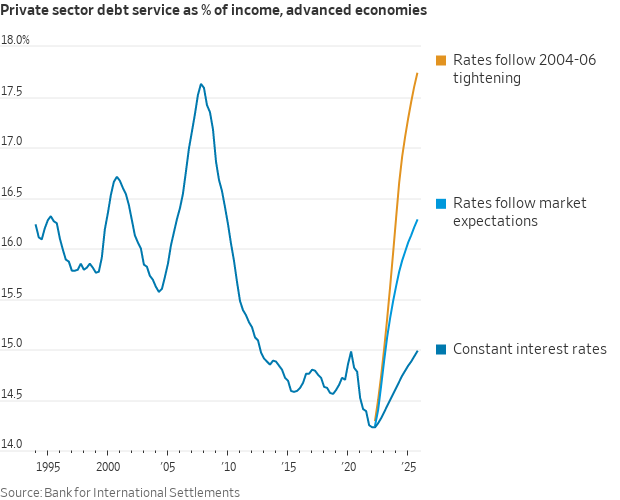

5/ And of the Fed raises real rates enough to induce a severe recession, then nominal GDP/incomes are hit and the ratios look even worse. /end

Loading suggestions...