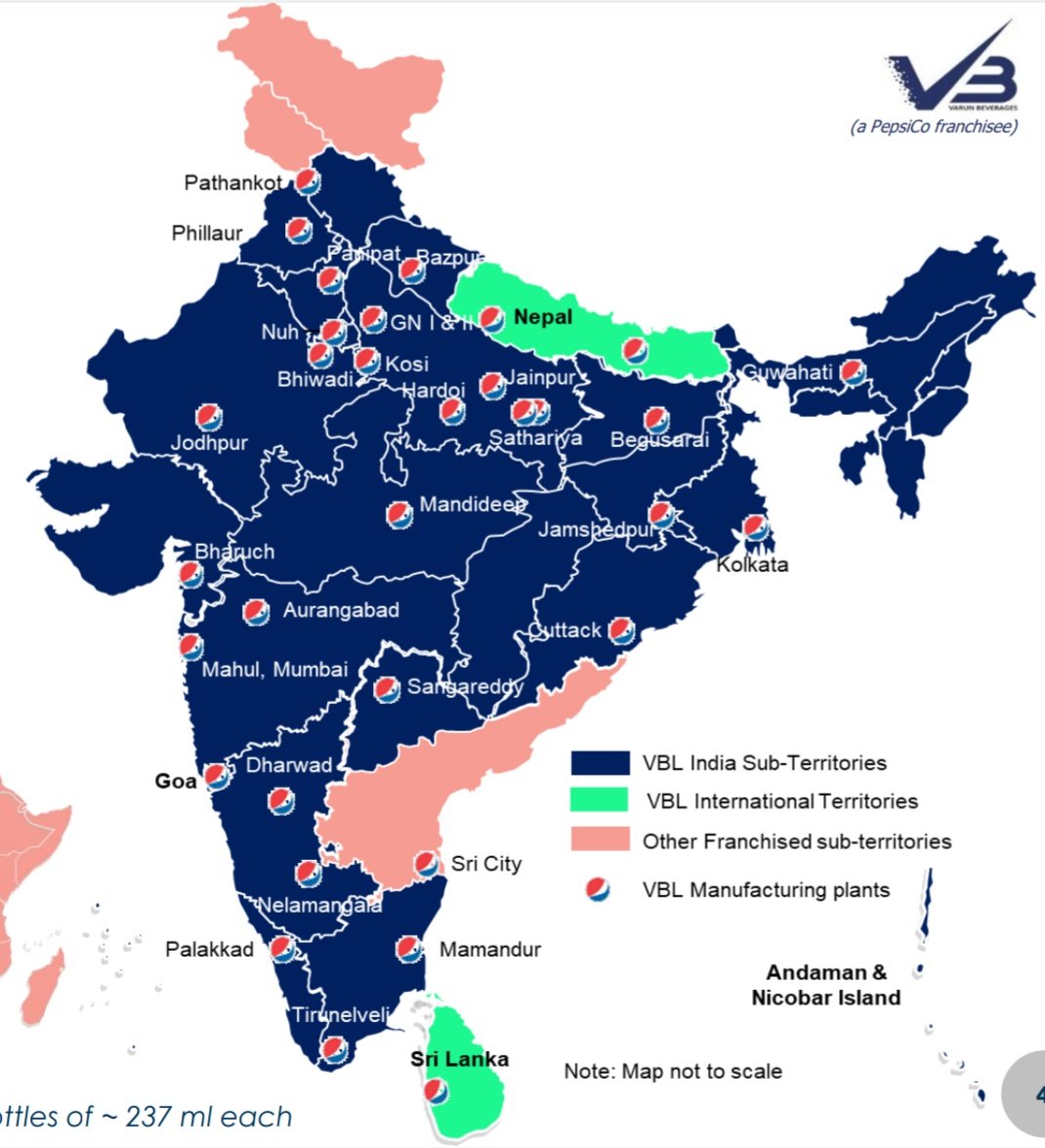

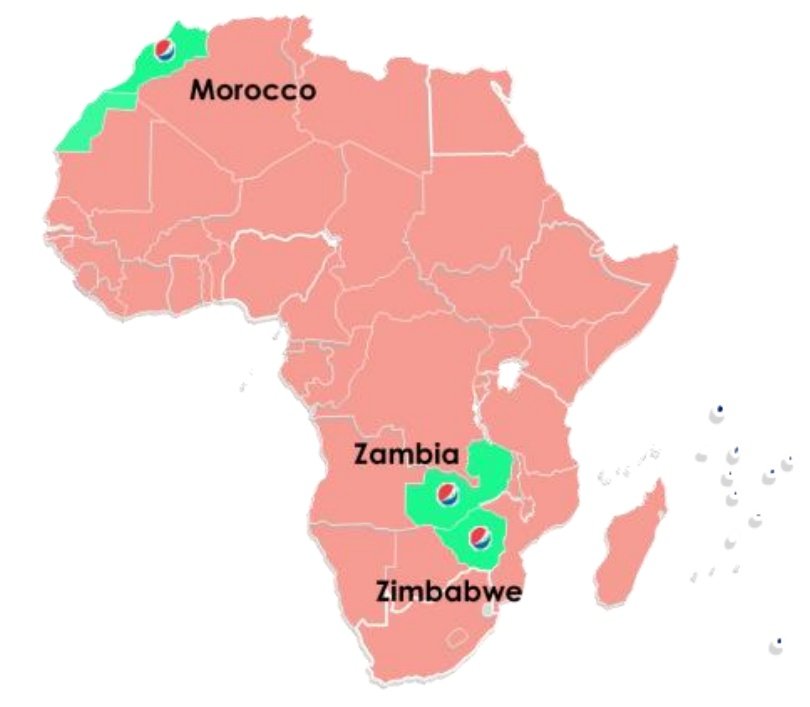

Indian Subcontinent (India, Sri Lanka,

Nepal) contribute 81% to revenues; 3 in Africa contribute 19%.

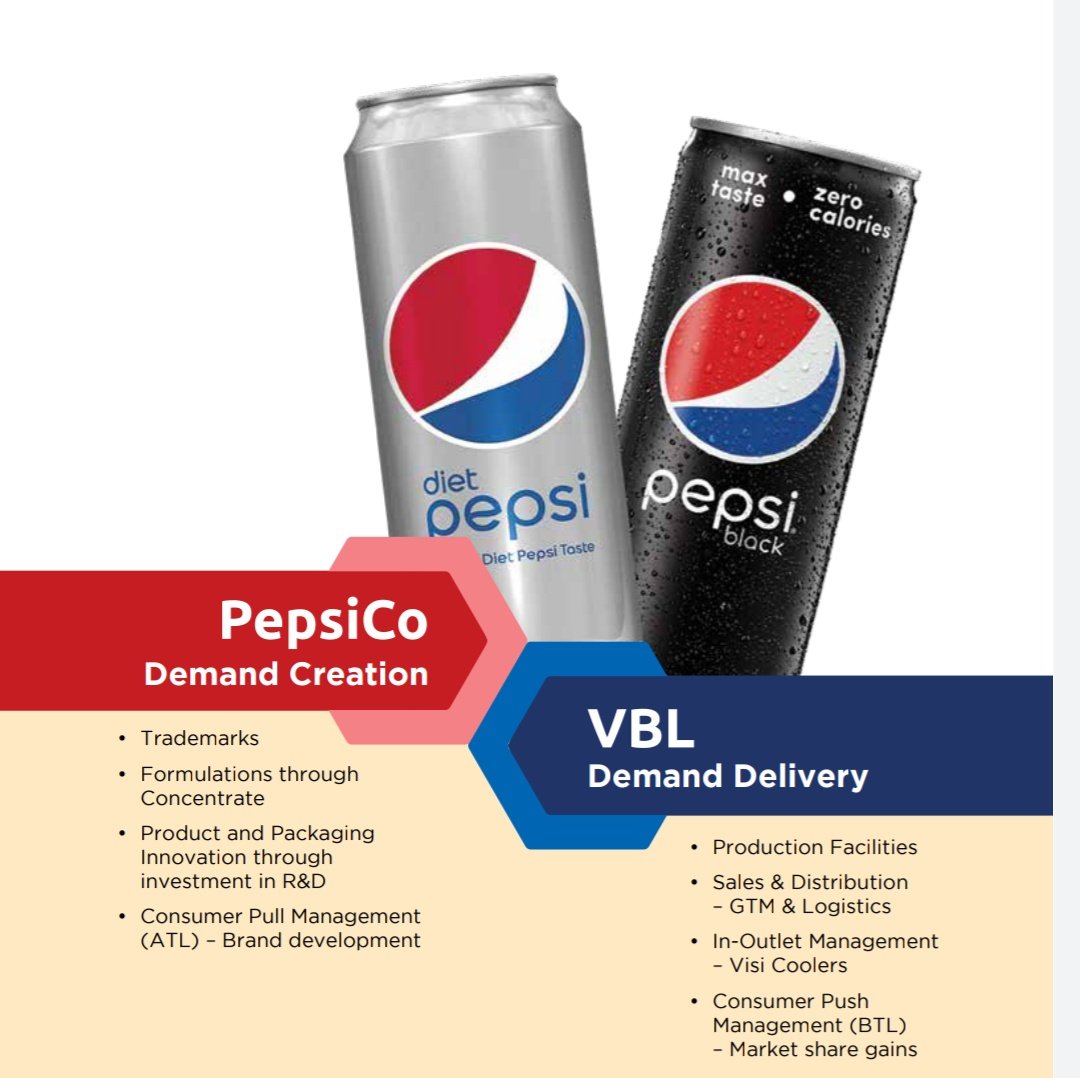

Over 30 years strategic association with

PepsiCo accounting for 85%+ of PepsiCo’s beverage sales volume in India & present in 27 States & 7 Union Territories.

Nepal) contribute 81% to revenues; 3 in Africa contribute 19%.

Over 30 years strategic association with

PepsiCo accounting for 85%+ of PepsiCo’s beverage sales volume in India & present in 27 States & 7 Union Territories.

Distribution Network -

VBL has solid and well-entrenched distribution network covers urban, semi-urban, and rural markets, addressing demands of a wide range of consumers. It has 37 state-of-the-art mfg. facilities, supply chain with 100+ owned depots, 2,500+ owned vehicles,

VBL has solid and well-entrenched distribution network covers urban, semi-urban, and rural markets, addressing demands of a wide range of consumers. It has 37 state-of-the-art mfg. facilities, supply chain with 100+ owned depots, 2,500+ owned vehicles,

2,500+ primary distributors & currently installed 840,000+ visi coolers.

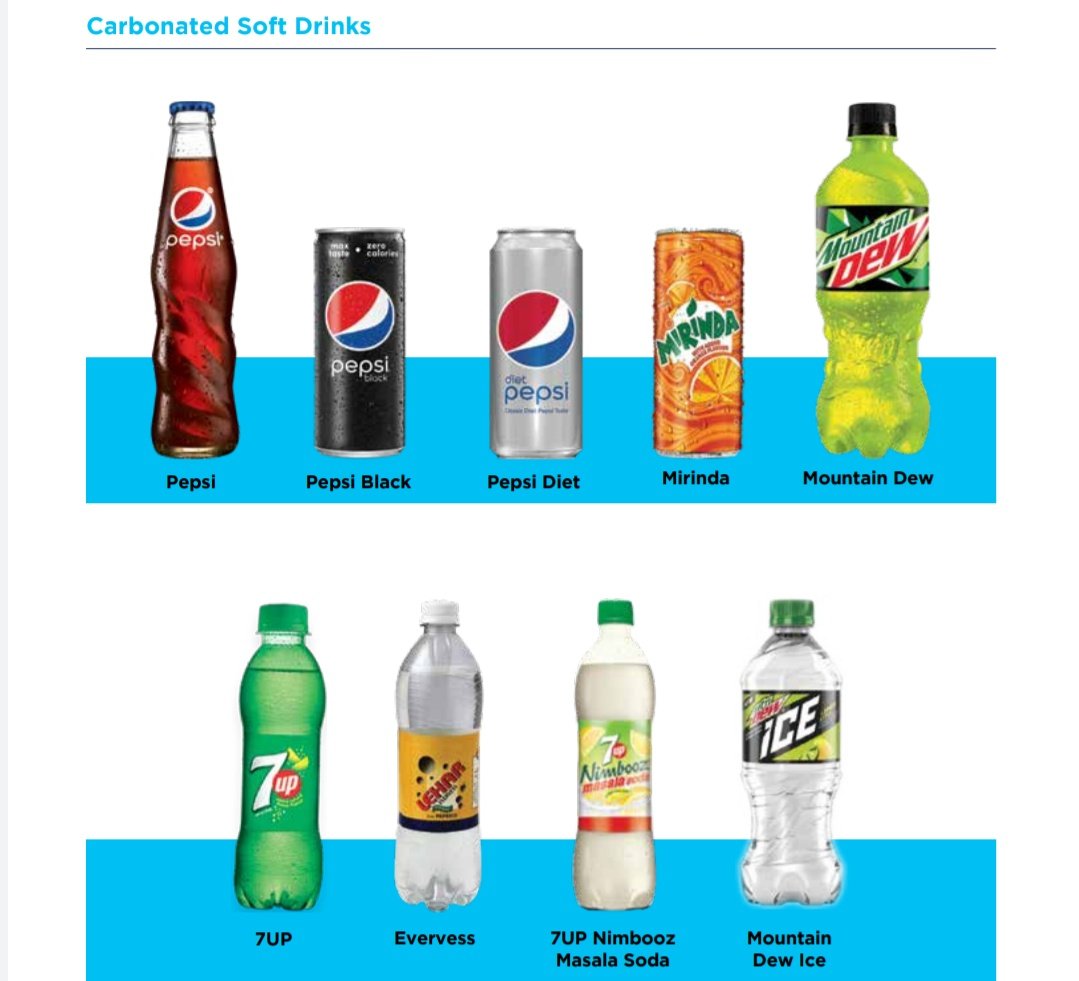

Products -

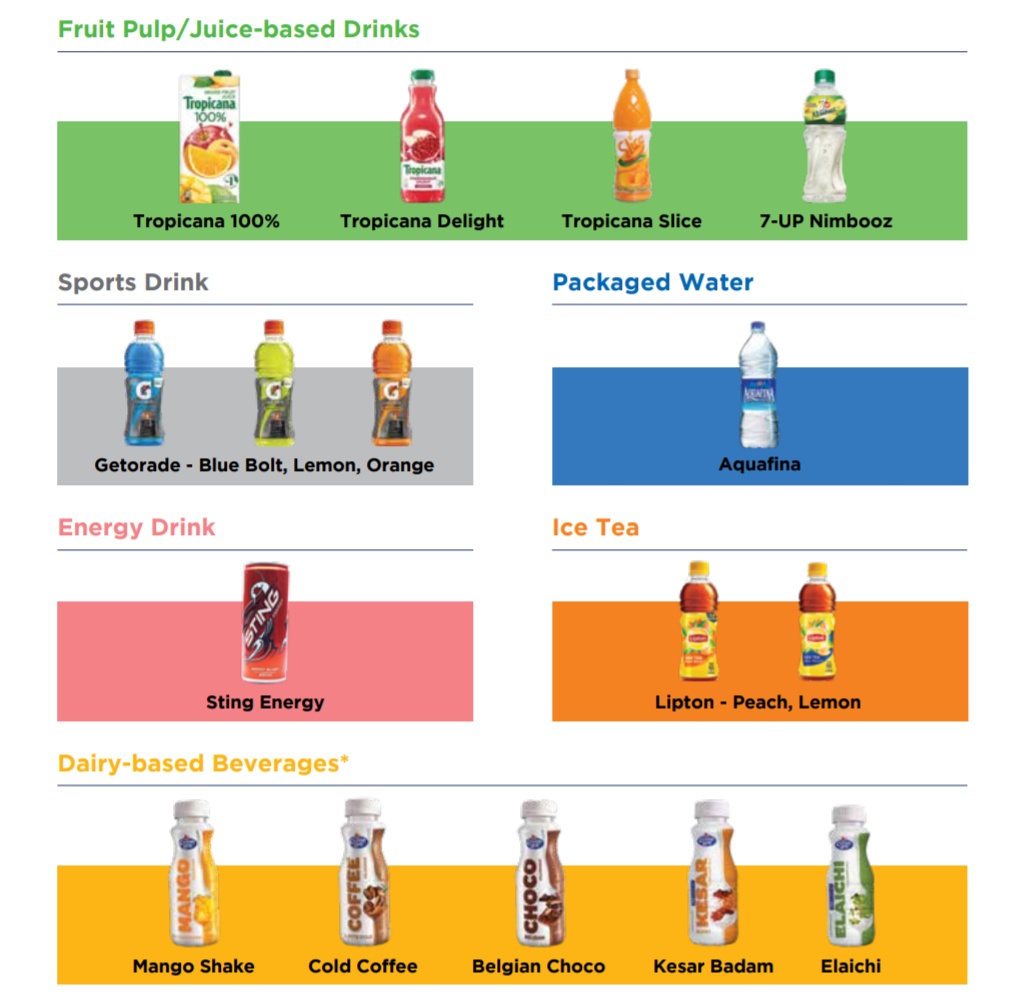

Varun Beverages can be classified into two divisions.

Carbonated Soft Drinks (CSDs) & Non- Carbonated Beverages (NCBs).

Products -

Varun Beverages can be classified into two divisions.

Carbonated Soft Drinks (CSDs) & Non- Carbonated Beverages (NCBs).

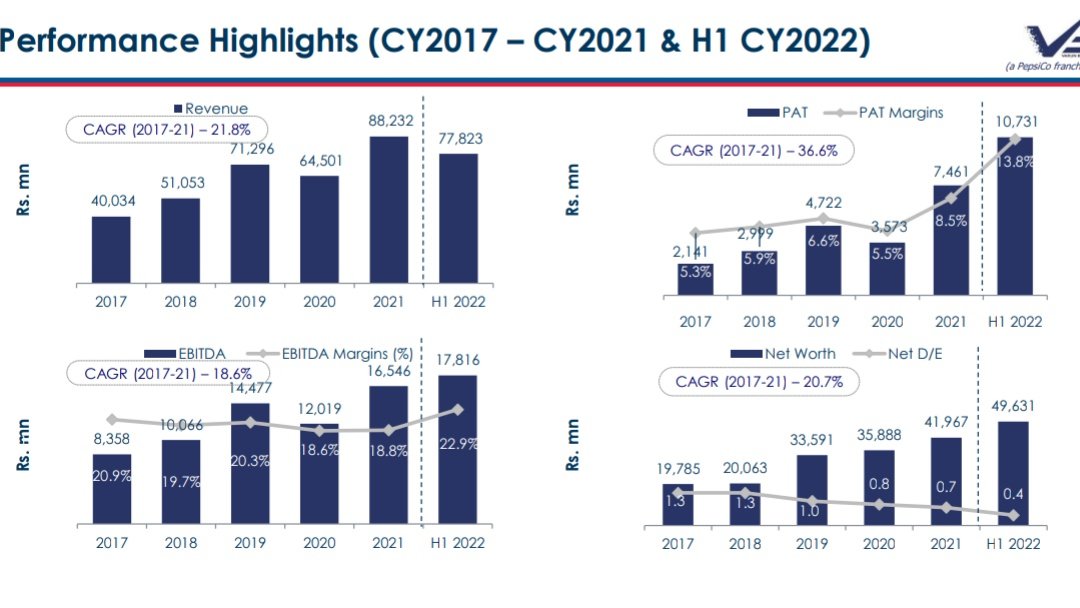

- Net debt stood at ₹20,555 mn as on Jun 30, 2022 as against ₹30,053 mn as on Jun 30, 2021

- D/E ratio stood at 0.4x as on Jun 30, 2022

- CFO is up by 98% in last 5yrs from Dec 2017 to Dec 2021.

- D/E ratio stood at 0.4x as on Jun 30, 2022

- CFO is up by 98% in last 5yrs from Dec 2017 to Dec 2021.

CAPEX -

Total CAPEX incurred by H2CY22 is ₹670 Cr, primarily for setting up of new Greenfield

production facilities in Bihar & Jammu & Brownfield expansion at Sandila facility.

Total CAPEX incurred by H2CY22 is ₹670 Cr, primarily for setting up of new Greenfield

production facilities in Bihar & Jammu & Brownfield expansion at Sandila facility.

CAPEX for

CY23E is ₹1,200 Cr which will increase the total capacity by 30%. Out of this ₹1,200 Cr, 60%

would be Greenfield.

VBL is also looking to double its dairy capacity, for which they are working from the Pathankot,

Punjab facility, catering to the North region.

CY23E is ₹1,200 Cr which will increase the total capacity by 30%. Out of this ₹1,200 Cr, 60%

would be Greenfield.

VBL is also looking to double its dairy capacity, for which they are working from the Pathankot,

Punjab facility, catering to the North region.

Industry Outlook -

Indian non-alcoholic beverages market is expected to compound at 8.7% to reach ₹1.47 trillion by 2030.

Indian non-alcoholic beverages market is expected to compound at 8.7% to reach ₹1.47 trillion by 2030.

Over the past few years, Indian non alcoholic beverages market

has witnessed significant growth as consumption has

been gradually improving in India, driven by a number of

factors like higher spending

capacity of young consumers, rapid urbanization, growing rural consumption.

has witnessed significant growth as consumption has

been gradually improving in India, driven by a number of

factors like higher spending

capacity of young consumers, rapid urbanization, growing rural consumption.

Risks -

▪️Most of the beverages have sugar content in it. Any increase in sugar prices will directly hit margins.

▪️VBL relies on strategic relationships & agreements with PepsiCo. Termination of agreements/less favorable renewal

terms will affect profitability.

▪️Most of the beverages have sugar content in it. Any increase in sugar prices will directly hit margins.

▪️VBL relies on strategic relationships & agreements with PepsiCo. Termination of agreements/less favorable renewal

terms will affect profitability.

▪️Globally, most of the developed countries are shunning beverages with high calories & consumers are moving towards healthy drinks rather than carbonated drinks.

▪️Most of the packaging materials are derivatives of crude. Rise in crude prices will adverse effects on VBL

▪️Most of the packaging materials are derivatives of crude. Rise in crude prices will adverse effects on VBL

Conclusion -

VBL is well placed to capitalize the growth opportunity in the upcoming season due to increasing demand, acceptance of new products by customers, growing out of home consumption with opening of offices, schools, colleges, relaxation in traveling activities.

VBL is well placed to capitalize the growth opportunity in the upcoming season due to increasing demand, acceptance of new products by customers, growing out of home consumption with opening of offices, schools, colleges, relaxation in traveling activities.

Please 🙏 like 👍, comment & retweet ♻️ if you find this useful.

Loading suggestions...