Now, a nuance.

Whether an HDFC subscribes to their service, or I myself sign up, PropEquity charges both of us the same amount.

So the size of the client doesn't translate into revenues. Instead, this is a vertical with annual recurring revenue.

6/

Whether an HDFC subscribes to their service, or I myself sign up, PropEquity charges both of us the same amount.

So the size of the client doesn't translate into revenues. Instead, this is a vertical with annual recurring revenue.

6/

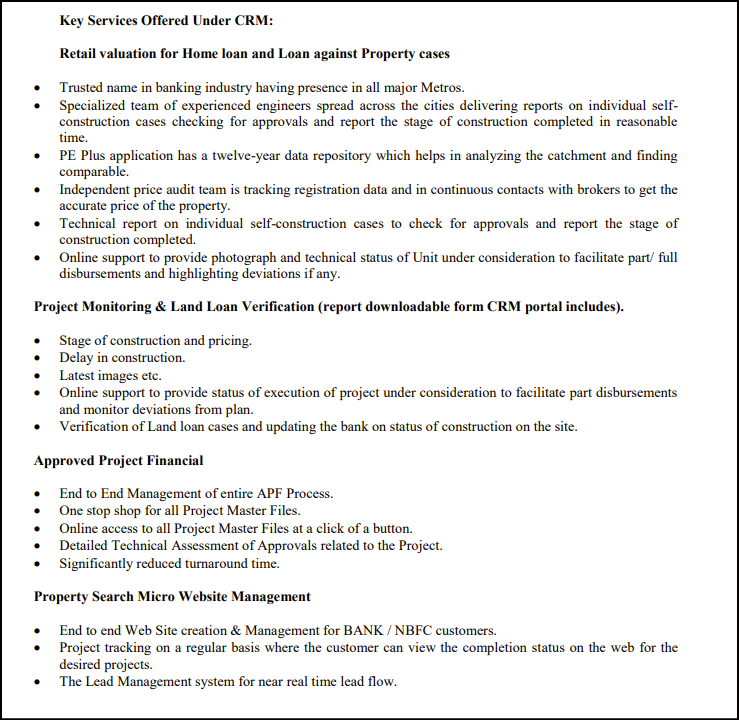

PropEquity created a new product two years ago.

Using their very specific database and engineers on the ground, they have partnered with banks that offer home loans, and loans against properties.

9/

Using their very specific database and engineers on the ground, they have partnered with banks that offer home loans, and loans against properties.

9/

Every time a partner issues a LAP, they consult PropEquity to understand the underlying valuations of the property serving as collateral.

The competitive landscape here is purely the in-house teams of these banks, and thus forms an outsourcing opportunity.

10/

The competitive landscape here is purely the in-house teams of these banks, and thus forms an outsourcing opportunity.

10/

They have partnered with 15 banks over this new product.

Note how unlike the subscription business, this isn't a fixed source of revenue.

The more transactions they do with partners, the larger this vertical grows.

11/

Note how unlike the subscription business, this isn't a fixed source of revenue.

The more transactions they do with partners, the larger this vertical grows.

11/

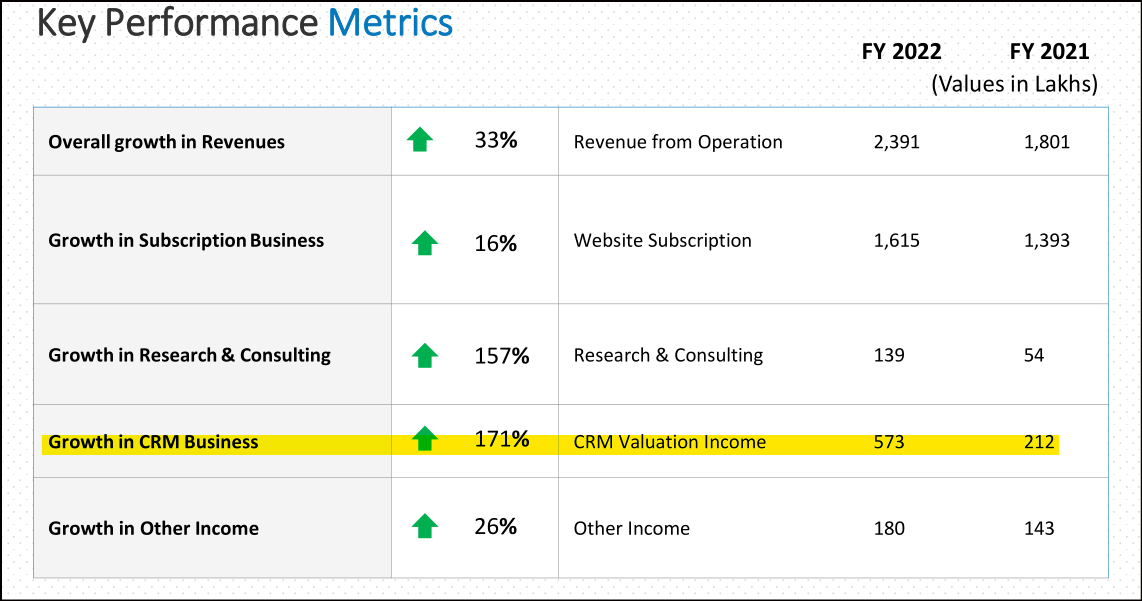

This product has been rolled out in 8 cities so far, and grew from revenues of 24 lakhs a year to 6 Cr. of revenues in FY22.

In just two years, this new product now forms 25% of the overall topline.

13/

In just two years, this new product now forms 25% of the overall topline.

13/

The next product they're working on is a B2C vertical, that leverages the same database to offer a valuation tool to retail users.

This is in the pipeline, and management has yet to finalise the specifics of the model.

14/

This is in the pipeline, and management has yet to finalise the specifics of the model.

14/

So let's talk about the management.

In my conversation with him, he came across as a very prudent capital allocator.

They turned profitable 5 years after inception. Management is unwilling to roll out any B2C business unless they're sure of getting unit economics right.

15/

In my conversation with him, he came across as a very prudent capital allocator.

They turned profitable 5 years after inception. Management is unwilling to roll out any B2C business unless they're sure of getting unit economics right.

15/

The decision for each product and vertical was made after being sure there is no cash burn. CRM product was profitable from the start.

For this reason, one doesn't expect the company to pay out dividends, and there are no immediate plans for the 65 Cr. of cash on the book.

16/

For this reason, one doesn't expect the company to pay out dividends, and there are no immediate plans for the 65 Cr. of cash on the book.

16/

So what forms the risk?

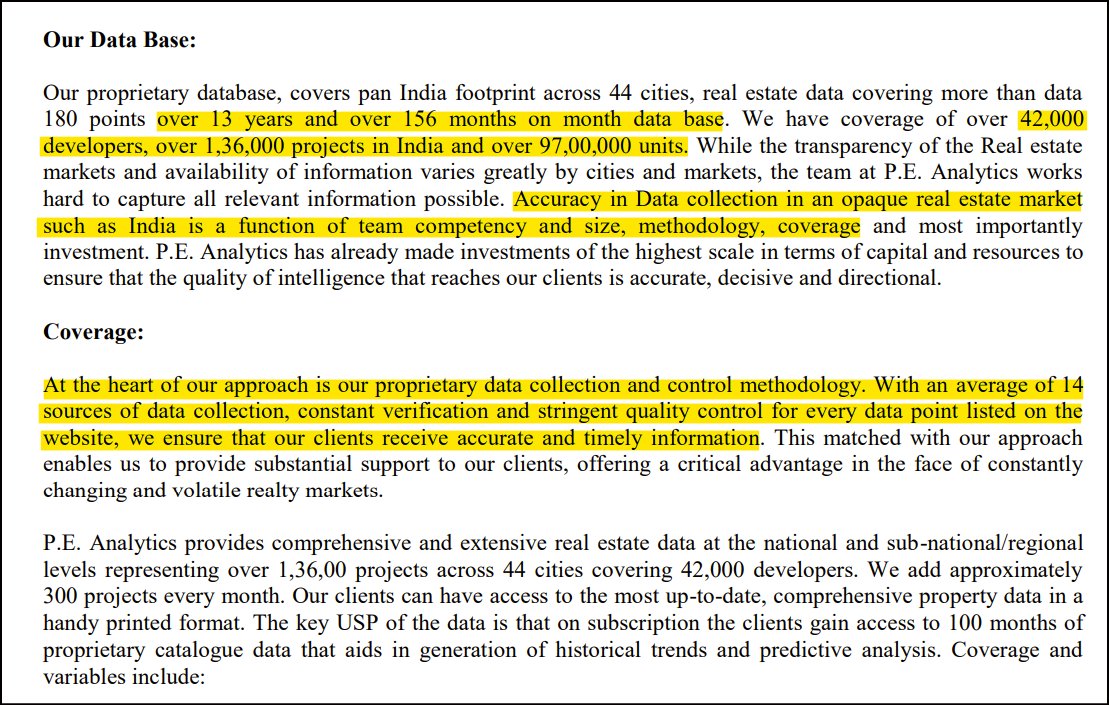

The catch is that the market is nascent, and entirely depends on products being adopted successfully.

PropEquity is much larger than competitors like PropEdge and LiasesForas.

Yet, the topline is around 25 Cr.

17/

The catch is that the market is nascent, and entirely depends on products being adopted successfully.

PropEquity is much larger than competitors like PropEdge and LiasesForas.

Yet, the topline is around 25 Cr.

17/

There is no addressable market to say they have a headroom to grow into. This is the risk, and why it is entirely a bet on the management.

Will the B2C vertical be successful, and what can the CRM vertical turn into after a few years?

These are my million dollar questions.

18/

Will the B2C vertical be successful, and what can the CRM vertical turn into after a few years?

These are my million dollar questions.

18/

Globally the industry is more developed, and one can find many startups in this area.

From some scuttlebutt, successful companies have made anywhere between 400-600 Cr. in revenues in fragmented markets.

19/

From some scuttlebutt, successful companies have made anywhere between 400-600 Cr. in revenues in fragmented markets.

19/

This is not investment advice, please consult your Telegram guru before making an investment.

Companies listed on the SME index are very volatile.

Disclosure: I have a tracking position in the business.

Please consider re-tweeting if you've found the thread useful!

Companies listed on the SME index are very volatile.

Disclosure: I have a tracking position in the business.

Please consider re-tweeting if you've found the thread useful!

Loading suggestions...