It is impossible to understand the current existential threat the US feels from China without first understanding what happened to Japan 37 years ago.

This is the story of the Plaza Accord 🧵

This is the story of the Plaza Accord 🧵

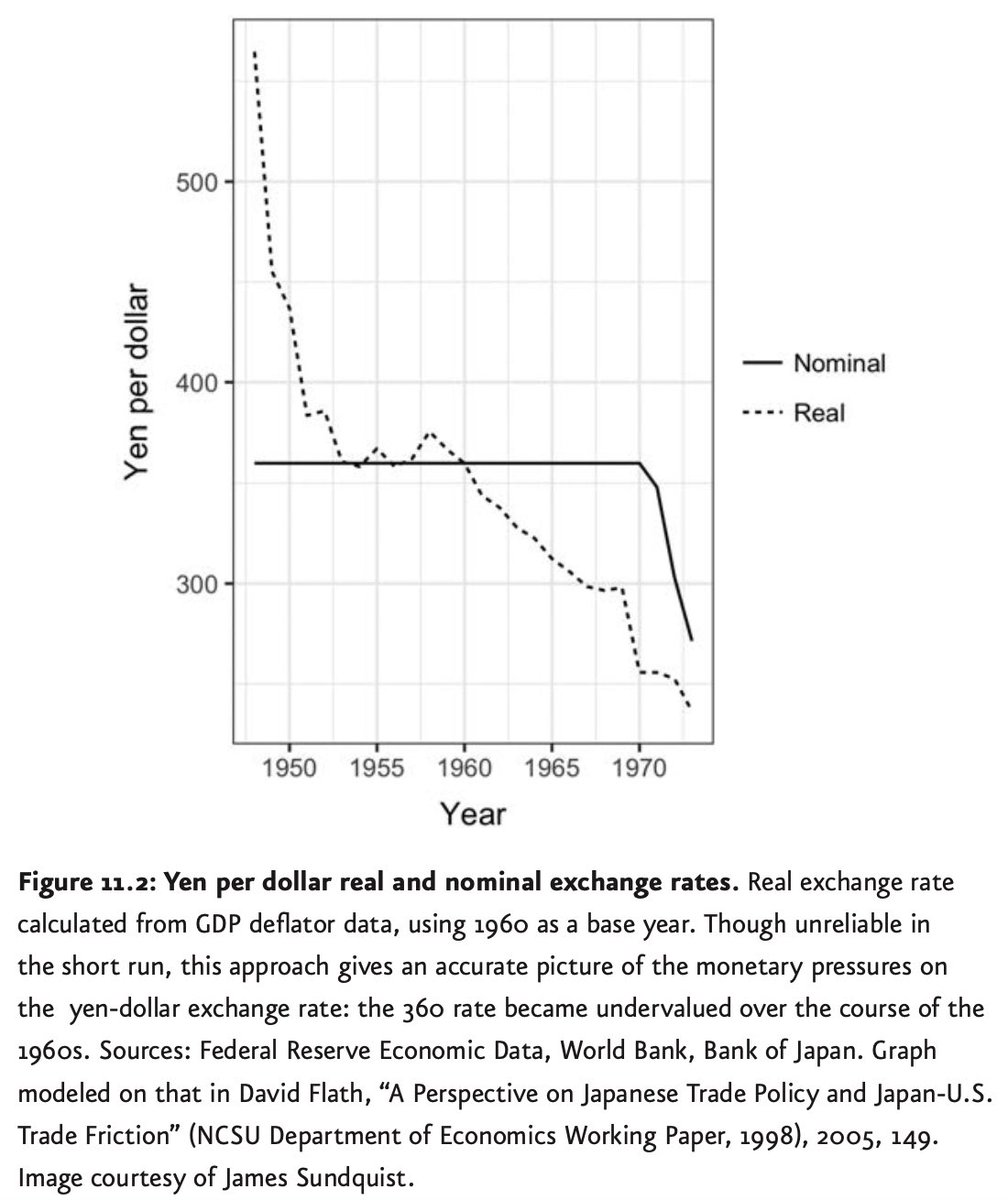

As Japan emerged shattered from WW2, the US was intent on establishing a forward operating base from which to combat communism in Asia. So in the spring of 1949, under allied occupation, Japan joined a US-led system of monetary management known as the Bretton Woods agreement.

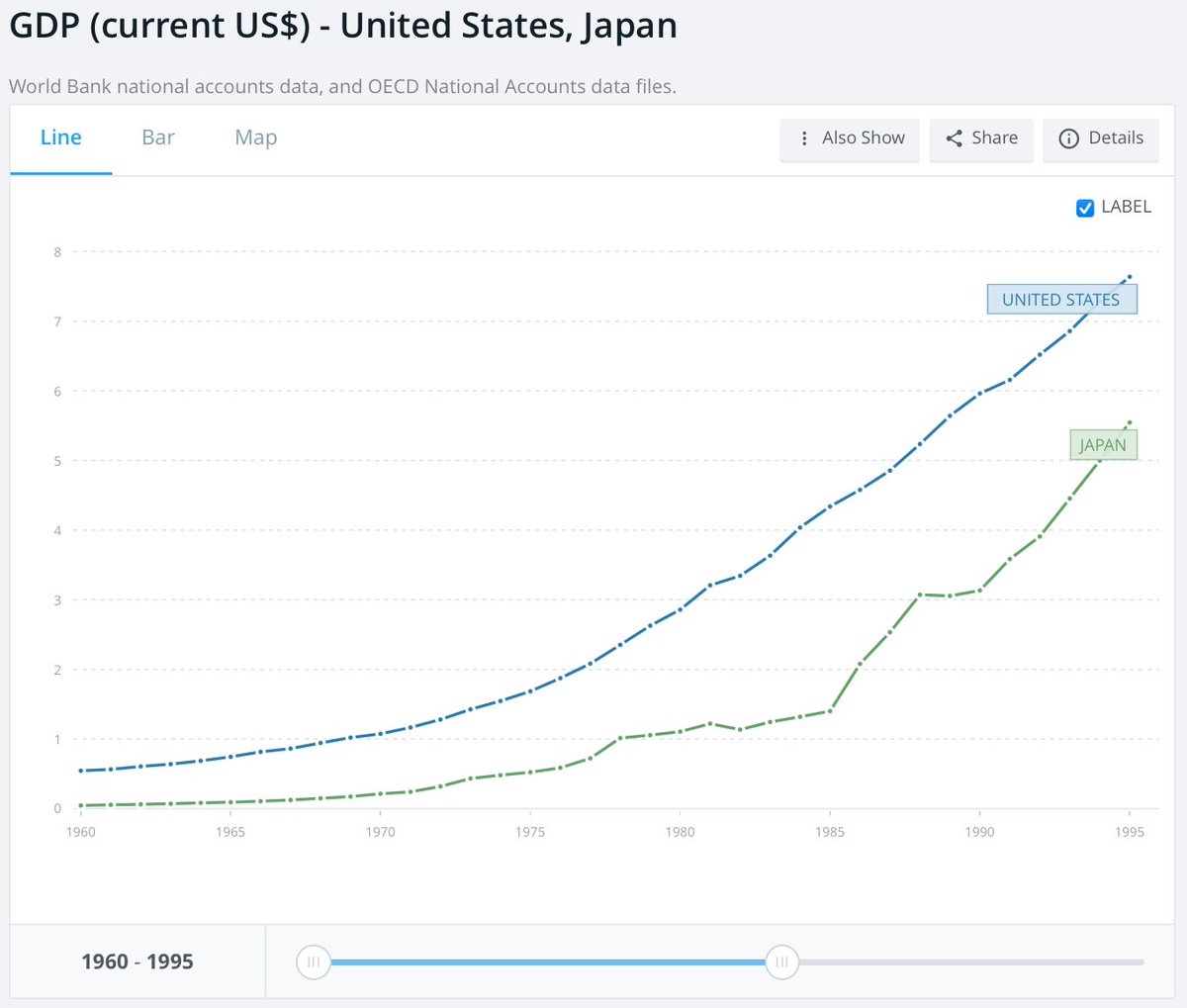

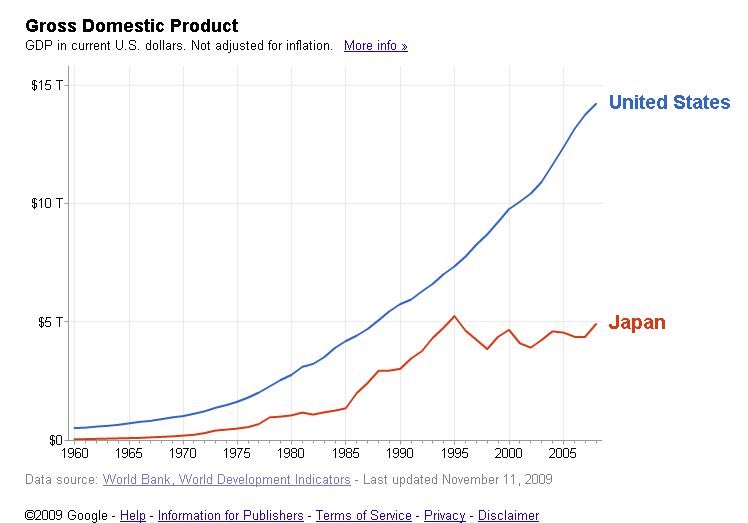

As a result of this growth, experts began predicting in the ’70s that Japan could overtake the US as the world’s largest economy by century’s end. This trend only accelerated when the US was hit by the ’73 oil embargo.

nytimes.com

nytimes.com

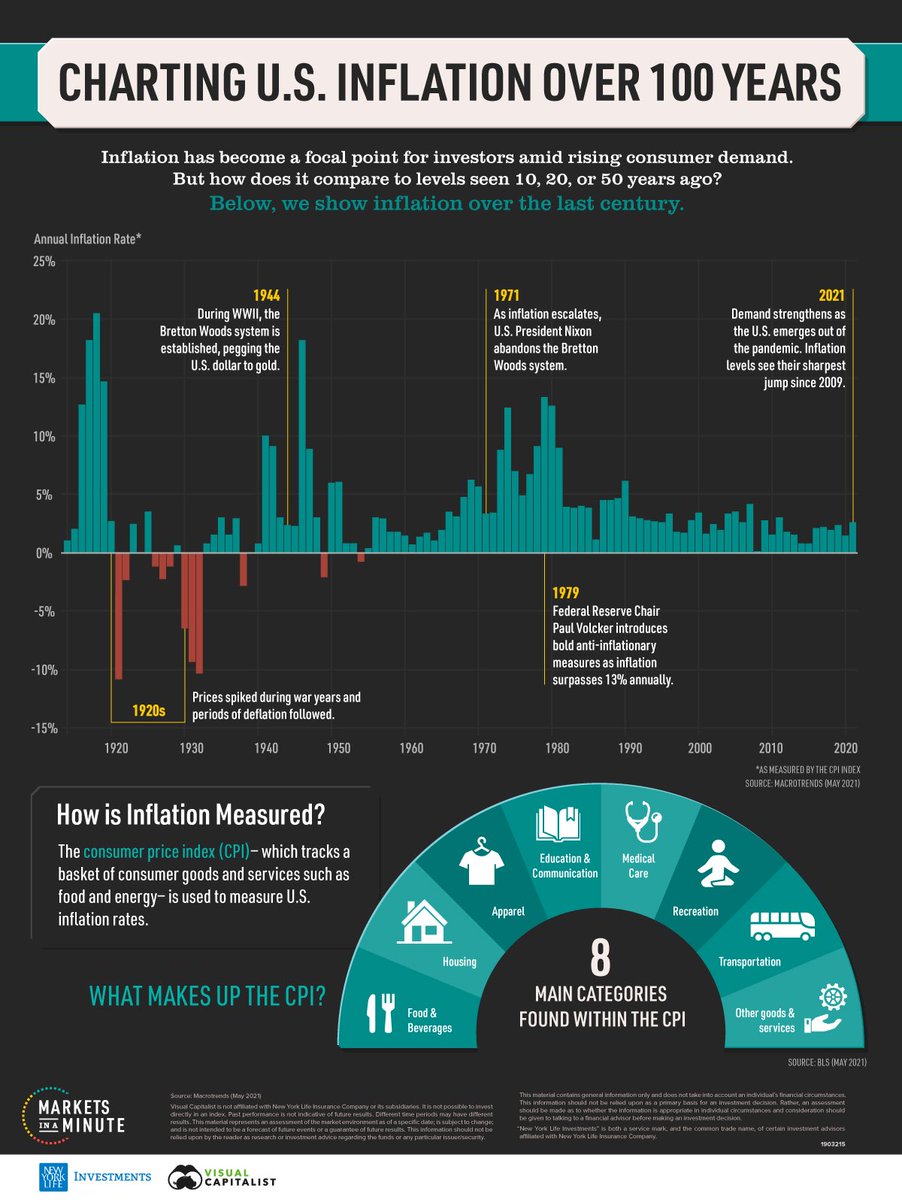

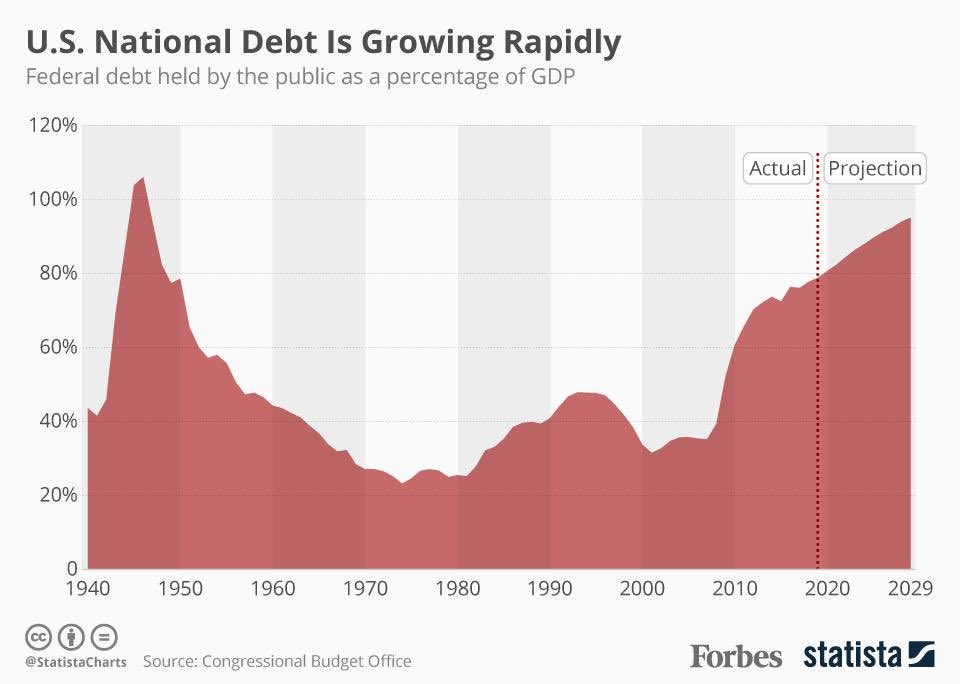

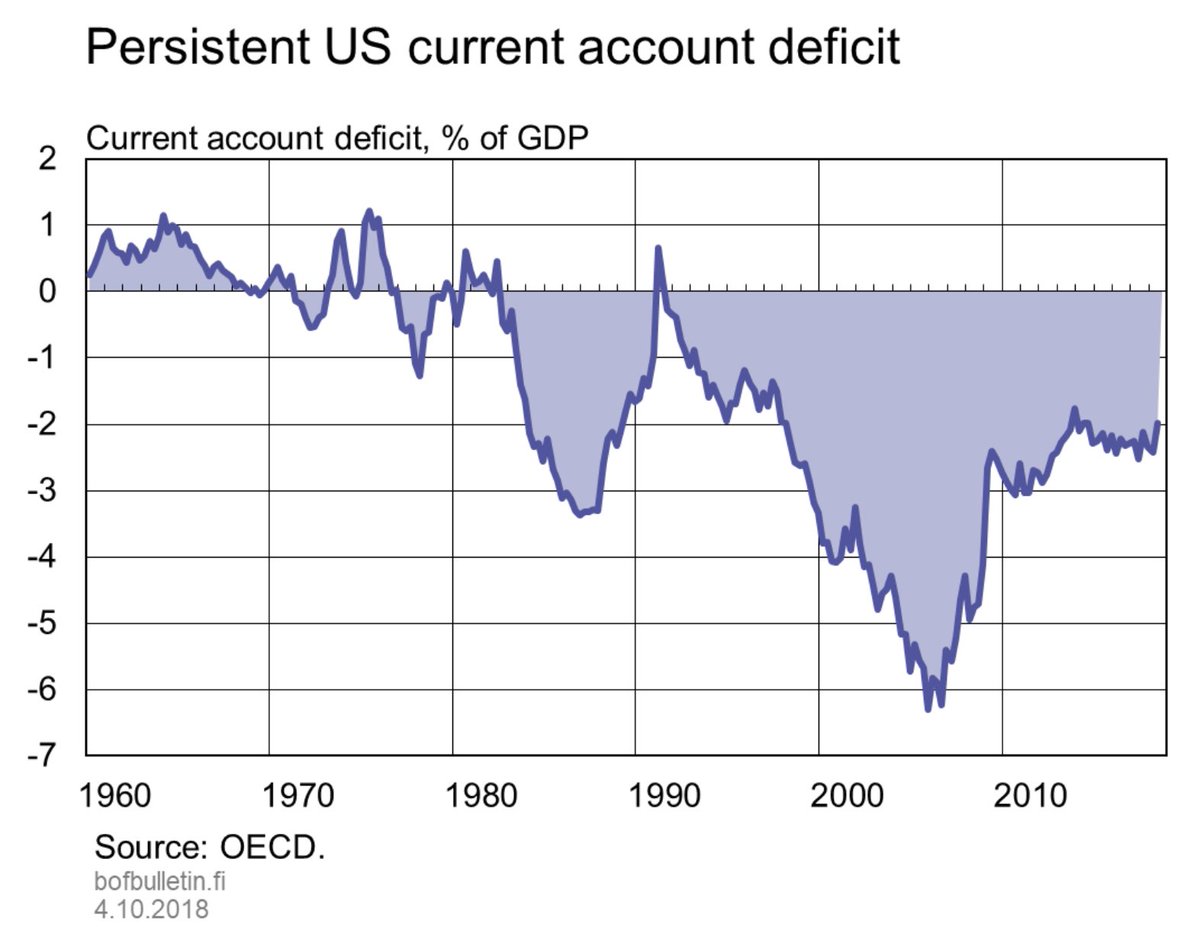

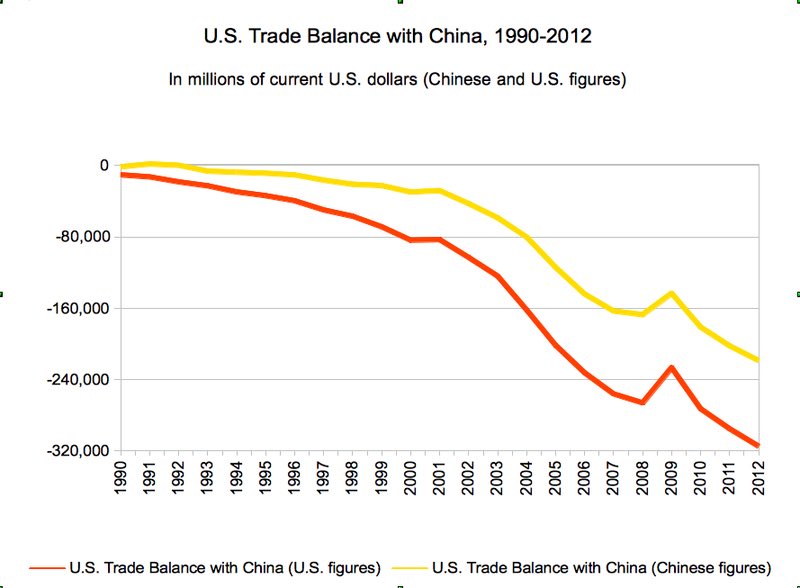

Meanwhile in the US, the costly Vietnam war, high social spending, and growing negative trade balance were all being financed by money printing. But almost as soon as they were printed, these newly minted dollars left the country via the US’s negative balance of trade.

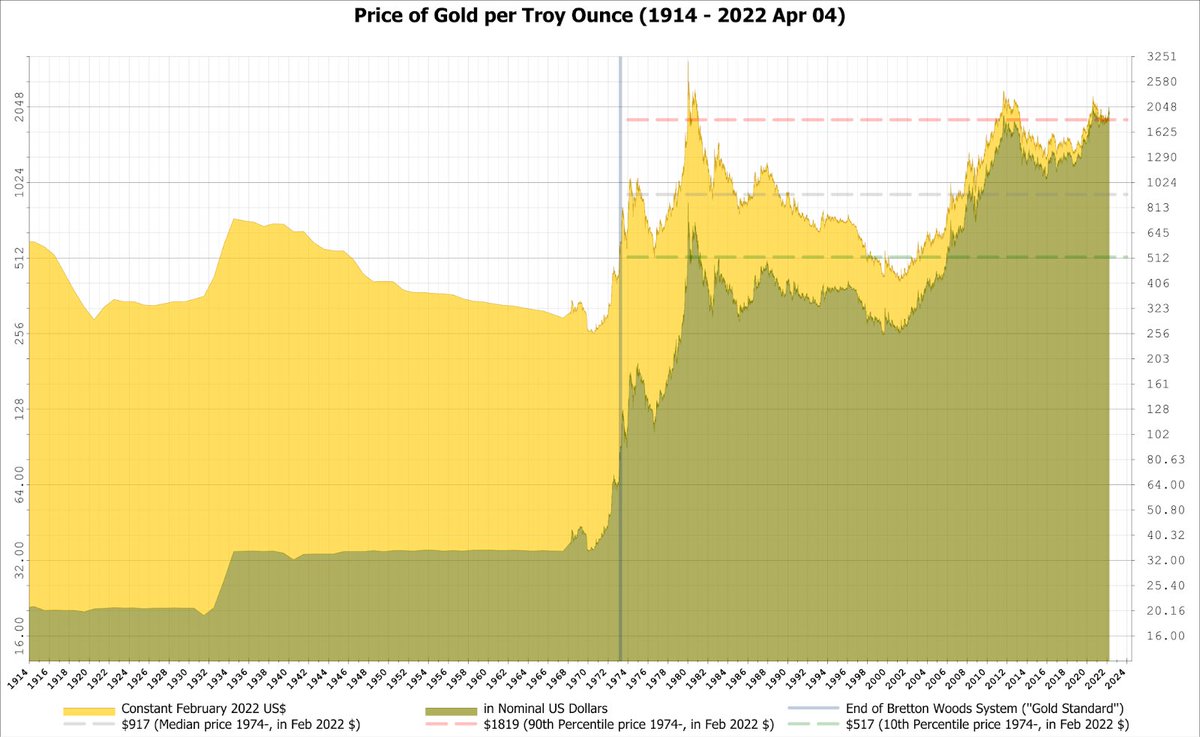

As a result of this monetary inflation, it was becoming increasingly clear the USD was overvalued relative to its fixed gold tether and in 1968, this overvaluation manifested as a collapse of the London gold pool, when growing US debts caused a loss of confidence in the dollar.

While this finally brought inflation under control, it came at the expense of dramatic economic slowdown and mass unemployment. What followed was an era of lower interest rates, slashed social spending, regressive taxation, and massive military spending, aka ‘Reaganomics’.

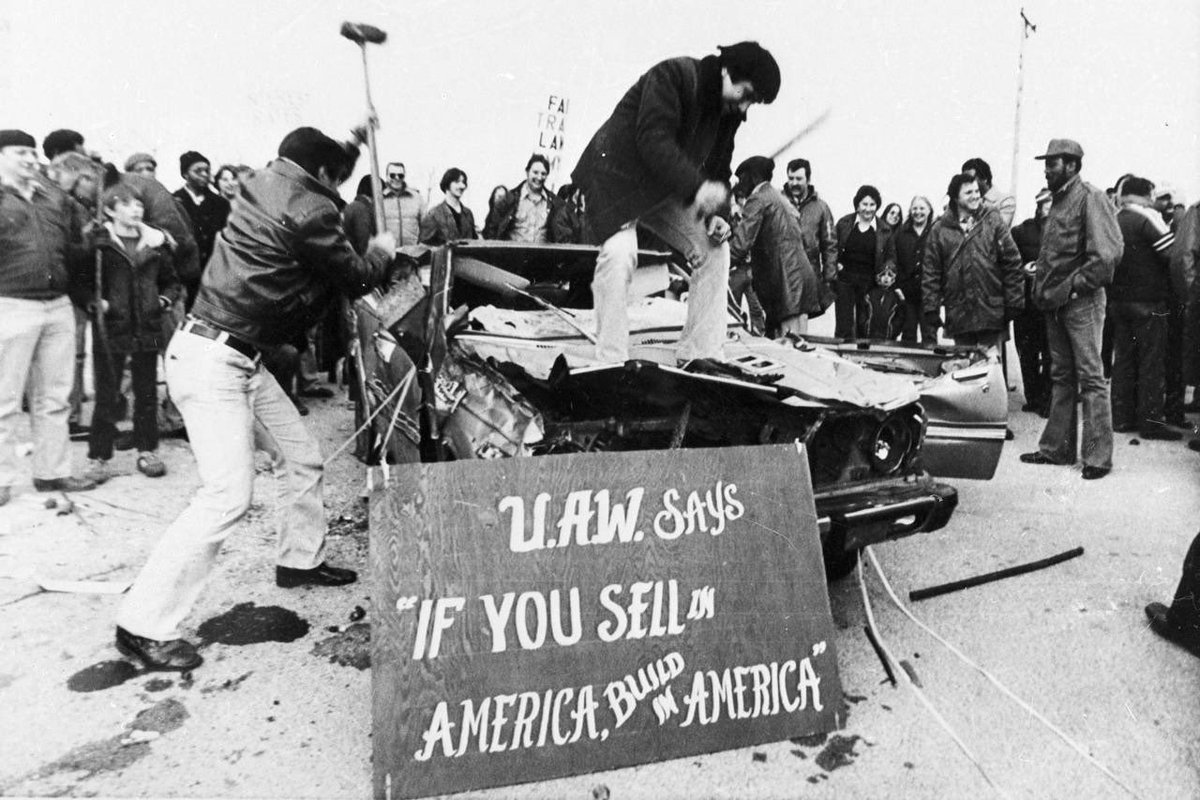

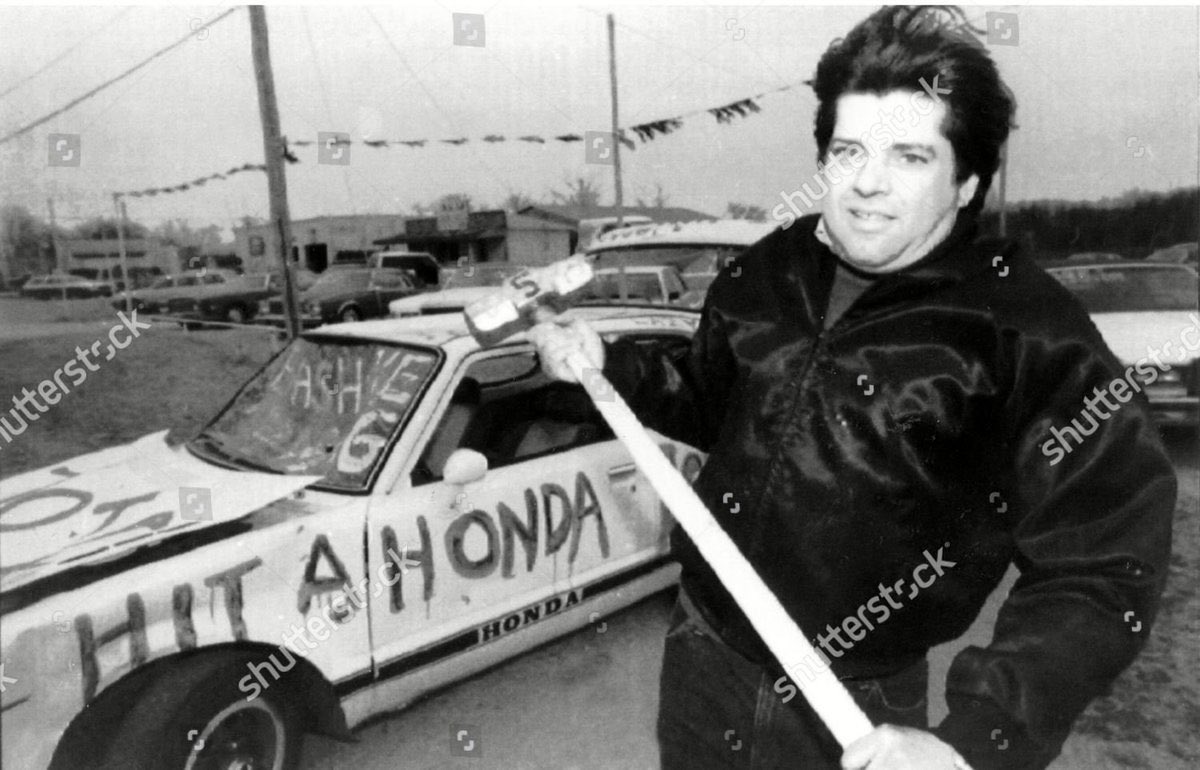

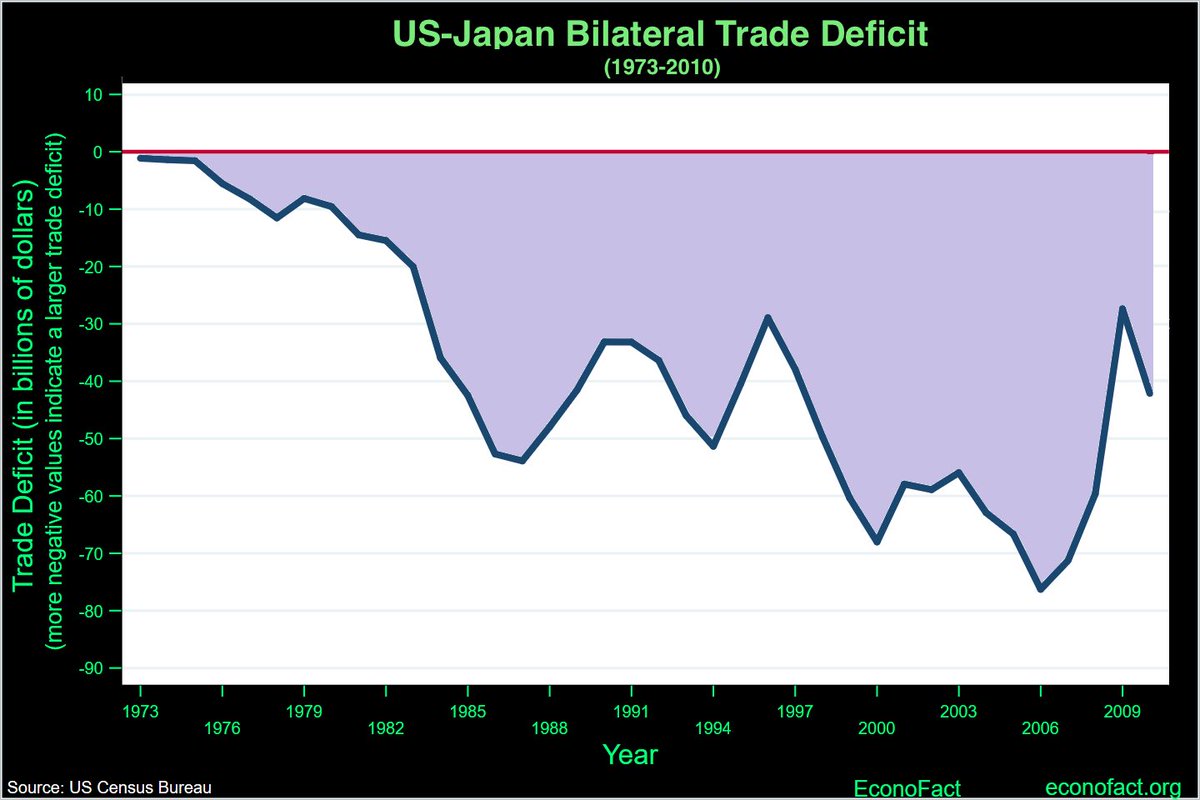

While good news for the cost of imported goods, this strong dollar was disastrous for US exports, and contributed to the further collapse of domestic manufacturing.

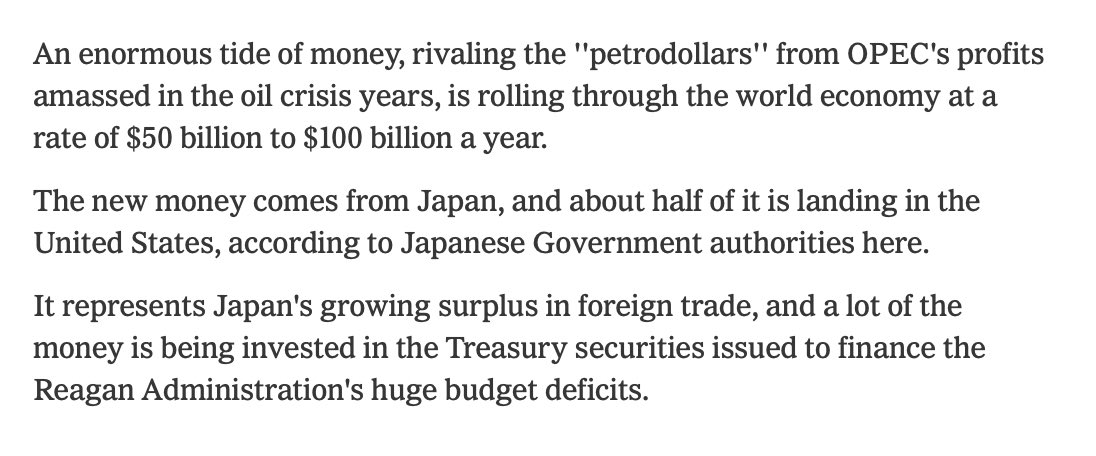

But who was buying all this debt?

But who was buying all this debt?

Because after the collapse of Bretton Woods, the US began stipulating that dollars accrued through trade surplus could not be used to buy major American companies, only allowing them to be recycled back into the American economy to purchase debt securities.

And while export countries gain a small but stable return from these US securities, they inadvertently finance the cost of surrounding themselves with 800 American military bases, which are then used to break any country that tries to form alternatives to this dollar system.

But this system of maintaining the dollar created a new problem: too much indebtedness to one country would pose a strategic threat. And with Japan now the primary debt holder, the US needed to throw a wrench in the engine driving Japan’s growing leverage.

Enter the Plaza Accord

Enter the Plaza Accord

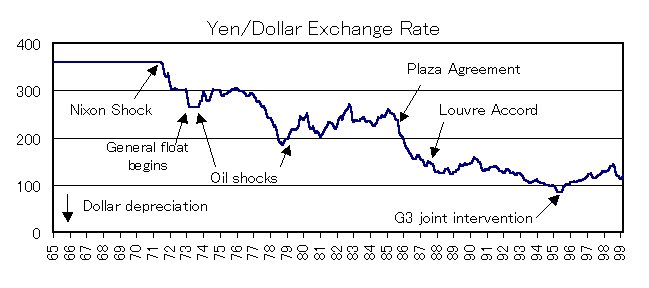

Assembling leaders from the top 5 economies in Sept ’85, the Plaza accord was designed to boost US manufacturing and agricultural exports and lower the value of the US Treasury instruments purchased with the trade surpluses held by other countries. At least on paper.

To accomplish the first, Germany agreed to dump a massive portion of its USD foreign reserves, flooding markets with USD and driving the relative value downward. The actual USD surplus that entered the market was less impactful than the implied threat of further intervention.

The deregulation that followed also led to foreign capital flowing into Japan like a firehose. Tokyo’s stock market index rose 49% in the year after the accords. By 1989, it had risen 300% and Japanese stocks comprised almost half the entire world’s equity market cap.

And while Japanese exports became more expensive overnight, productive capital couldn’t shift as quickly. It took another 5 years after the financial bubble popped before the actual productive output of Japan finally began to sputter.

Given that this exact outcome was largely predictable at the outset of the accords, why did Japan agree to so thoroughly subordinate their own economy to US interests?

Because the post-WW2 US occupation of Japan never ended.

Because the post-WW2 US occupation of Japan never ended.

Part 2

Loading suggestions...