What is Hindu Undivided Family(HUF)?

An HUF, under the Hindu law, is a family consisting of lineal descendants from a common ancestor. It includes their wives and unmarried children.

(2/19)

An HUF, under the Hindu law, is a family consisting of lineal descendants from a common ancestor. It includes their wives and unmarried children.

(2/19)

‘HUF’ is treated as a ‘person’ under section 2(31) of the Income-tax Act, 1961 (herein after referred to as ‘the Act’).

HUF is a separate entity for the purpose of assessment under the Act.

(3/19)

HUF is a separate entity for the purpose of assessment under the Act.

(3/19)

To explain simply:-

If XYZ is a married taxpayer and has a family.

He can create an entity called XYZ (HUF) which is treated as a separate entity for tax purposes.

(4/19)

If XYZ is a married taxpayer and has a family.

He can create an entity called XYZ (HUF) which is treated as a separate entity for tax purposes.

(4/19)

Who can create a HUF?

A Hindu family can come together and form a HUF. Buddhists, Jains, and Sikhs can also form a HUF.

(5/19)

A Hindu family can come together and form a HUF. Buddhists, Jains, and Sikhs can also form a HUF.

(5/19)

How to form a HUF?

An HUF gets formed automatically after the marriage of an individual, which is considered the start of a family.

However, it would be legally accepted only when a deed of HUF is drafted and executed following due procedure.

(7/19)

An HUF gets formed automatically after the marriage of an individual, which is considered the start of a family.

However, it would be legally accepted only when a deed of HUF is drafted and executed following due procedure.

(7/19)

Process to form HUF:-

1. Write an HUF deed

2. Apply for an HUF PAN card

3. Open an HUF bank account

(8/19)

1. Write an HUF deed

2. Apply for an HUF PAN card

3. Open an HUF bank account

(8/19)

Who can create assets for HUF?

A karta can contribute to the assets of HUF

Coprcenars can also contribute to creating assets for the HUF

(9/19)

A karta can contribute to the assets of HUF

Coprcenars can also contribute to creating assets for the HUF

(9/19)

How is HUF taxed?

HUF has its own PAN and files a separate tax return.

The taxation is as per normal income tax slabs

Deductions under section 80 and other exemptions can be claimed by the HUF in its income tax return.

(10/19)

HUF has its own PAN and files a separate tax return.

The taxation is as per normal income tax slabs

Deductions under section 80 and other exemptions can be claimed by the HUF in its income tax return.

(10/19)

HUF can pay a salary to its members if they contribute to the functioning of the HUF. This salary expense can be deducted from the income of HUF.

Investments can be made from HUF’s income. Any returns from these investments are taxable in the hands of the HUF.

(11/19)

Investments can be made from HUF’s income. Any returns from these investments are taxable in the hands of the HUF.

(11/19)

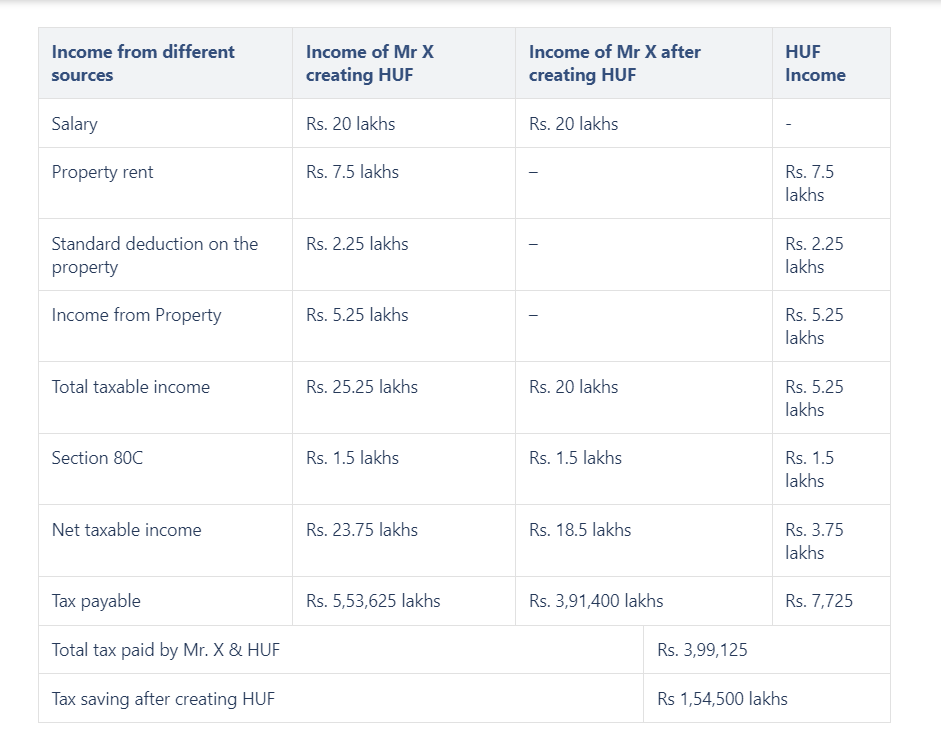

Example of tax saving under HUF:-

Let’s suppose an individual Mr X, decides to start a HUF including his wife, son & daughter after his father passes away. Since Mr X doesn’t have any sibling, his father’s property was transferred under HUF.

(12/19)

Let’s suppose an individual Mr X, decides to start a HUF including his wife, son & daughter after his father passes away. Since Mr X doesn’t have any sibling, his father’s property was transferred under HUF.

(12/19)

Due to the aforementioned tax arrangement, Mr X managed to save tax of 1 lakh 54 thousand, five-hundred rupees. Both Mr X and the HUF (including other members of HUF) can claim tax deduction u/s 80C.

(14/19)

(14/19)

Advantages of HUF:-

1. A separate legal entity is created which helps in bringing down taxes for the family.

2. HUF enjoys tax exemption until 5 lacs just as an individual.

(15/19)

1. A separate legal entity is created which helps in bringing down taxes for the family.

2. HUF enjoys tax exemption until 5 lacs just as an individual.

(15/19)

Disadvantages:-

1. Karta has a lot of power

2. Equal rights to all coparceners

3. A new legal entity is created which may mean extra paperwork

(16/19)

1. Karta has a lot of power

2. Equal rights to all coparceners

3. A new legal entity is created which may mean extra paperwork

(16/19)

Conclusion:-

HUF is an excellent tool to save tax.

All those in the higher tax bracket must look at HUF to save taxes.

It will mean a separate legal entity is created in the name of karta.

However the saving of taxes trumps the extra paper work that needs to be done.

(17/19)

HUF is an excellent tool to save tax.

All those in the higher tax bracket must look at HUF to save taxes.

It will mean a separate legal entity is created in the name of karta.

However the saving of taxes trumps the extra paper work that needs to be done.

(17/19)

Stay tuned for more posts where we sectoral trends in depth

We will analyze more such tax optimization techniques

Follow me @AdityaD_Shah for more such insights into personal finance,equities etc.

(18/19)

We will analyze more such tax optimization techniques

Follow me @AdityaD_Shah for more such insights into personal finance,equities etc.

(18/19)

Disclaimer:-

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

(19/19)

This is my study

Not an Investment Advise

Please consult your own investment advisor before investing.

(19/19)

Loading suggestions...