🧵 on FED's policy,

- US Fed increased rates by 0.75% on expected lines

- Will also keep reducing the balance sheet on expected lines BUT

- Equity, Yields & DXY all showed risk off signs?

Reason is the ‘Dot Plot’, let me explain

Please re-tweet & help us educated more investor

- US Fed increased rates by 0.75% on expected lines

- Will also keep reducing the balance sheet on expected lines BUT

- Equity, Yields & DXY all showed risk off signs?

Reason is the ‘Dot Plot’, let me explain

Please re-tweet & help us educated more investor

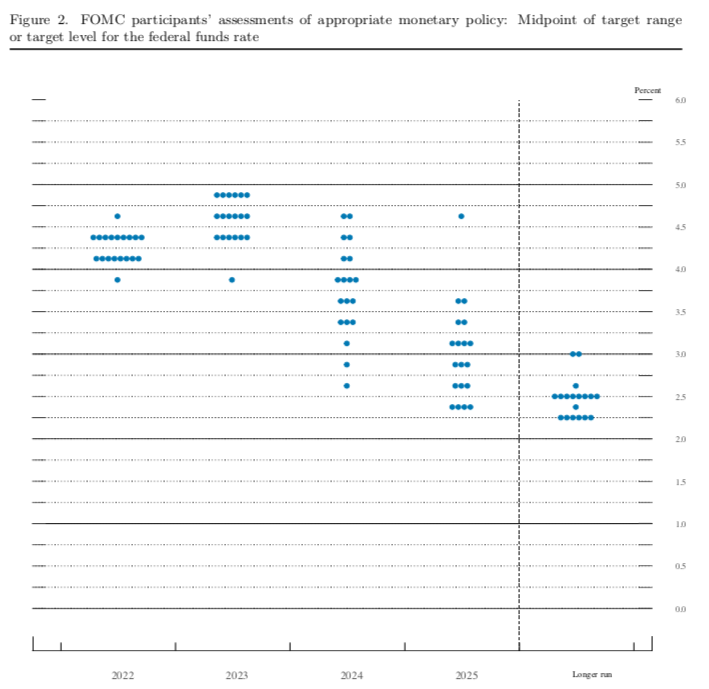

(Q1) What is a Dot Plot?

(a) It is an expectation (as on today) of the future interest rate movement over the next 3 years as predicted by the 19 members of the FED

(b) Every dot represents each fed members judgment of the future rates (1/n)

(a) It is an expectation (as on today) of the future interest rate movement over the next 3 years as predicted by the 19 members of the FED

(b) Every dot represents each fed members judgment of the future rates (1/n)

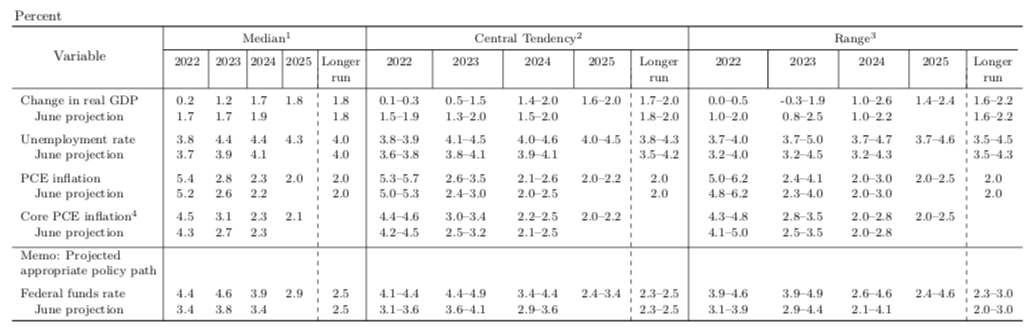

(Q2) Whats the importance of the Dot Plot?

(a) Financial markets like more stability & fewer surprises

(b) The dot plot tells the market in advance where interest rates could be heading in future as per the FED members judgement today (3/n)

(a) Financial markets like more stability & fewer surprises

(b) The dot plot tells the market in advance where interest rates could be heading in future as per the FED members judgement today (3/n)

(c) Though the dot plot may change with each Fed meeting, markets seem to prefer having something to work with rather than shooting in the dark (4/n)

(Q3) Why should you care?

(a) Over the last 2 years, the markets went up because of low interest rates & a flood of liquidity

(b) In a low rate regime, fixed income investing dint look interesting & hence liquidity chased Equities & markets were up (5/n)

(a) Over the last 2 years, the markets went up because of low interest rates & a flood of liquidity

(b) In a low rate regime, fixed income investing dint look interesting & hence liquidity chased Equities & markets were up (5/n)

(c) But now the US 2Y yield at 4% is better than the dividend yields on most stocks in the US & hence fixed income is looking better vs stocks in the short term

(d) Also if rates keep going up, it hurts consumption, real estate is starting to show some trouble in US already (6/n)

(d) Also if rates keep going up, it hurts consumption, real estate is starting to show some trouble in US already (6/n)

(e) Stock valuations also get negatively impacted with rising yields

All of this warrants for us to track where rates are heading (7/n)

All of this warrants for us to track where rates are heading (7/n)

Closing comments,

While India will surely out perform global markets, its difficult to de couple completely. Look at domestic facing stocks likes Financials, Consumption, Auto, Utilities, Industrials etc. because the global picture seems will take some time (11/12)

While India will surely out perform global markets, its difficult to de couple completely. Look at domestic facing stocks likes Financials, Consumption, Auto, Utilities, Industrials etc. because the global picture seems will take some time (11/12)

This is my 57th thread, you can follow me at

@KirtanShahCFP for some interesting content around investing

Have earlier written on,

-Sector Analysis

-Macro

-Debt Markets

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below (END)

@KirtanShahCFP for some interesting content around investing

Have earlier written on,

-Sector Analysis

-Macro

-Debt Markets

-Equity

-Gold

-Personal Finance etc.

You can find them all in the link below (END)

@FI_InvestIndia hopefully you will like it 🙏

Loading suggestions...