Magic phase!

When most new investors look at the microcap space.

S&P BSE Smallcap Index

A Mindblowing Meteoric rise!

~2003-2008: 880 to 13.8k: A 15X in 5 yrs

~2009-2010: 3K to 11K: A 3x in 1 yr

~2013-2017: 5.5k to 20K: A 3x in 4 yrs

~2020-2022: 9.5k to 30k: A 3x in 2 yrs

When most new investors look at the microcap space.

S&P BSE Smallcap Index

A Mindblowing Meteoric rise!

~2003-2008: 880 to 13.8k: A 15X in 5 yrs

~2009-2010: 3K to 11K: A 3x in 1 yr

~2013-2017: 5.5k to 20K: A 3x in 4 yrs

~2020-2022: 9.5k to 30k: A 3x in 2 yrs

Here's a true story of an Indian investor who has been in this space for 30 long years.

The odds are high that you don't know him as he prefers to maintain a low profile.

Let us try to give you a few hints and see if you can find out.

The odds are high that you don't know him as he prefers to maintain a low profile.

Let us try to give you a few hints and see if you can find out.

1. Graduated in Civil Engineering from L D College of Engineering, Ahmedabad

2. Went through Rollwala computer center - the only institute in 1984 with a Mainframe computer

3. Did MBA from B K School of Business Mgmt, Gujarat University

2. Went through Rollwala computer center - the only institute in 1984 with a Mainframe computer

3. Did MBA from B K School of Business Mgmt, Gujarat University

4. Career started with L D Engg college as lecturer in Applied Mechanics

5. A brief stint at Narmada Dam followed by a position of a Civil engineer at Gujarat State Water supply (GWSSB) till 1993

6. Switched to an IT role for in GWSSB, and retired as Head (IT) in 2020

5. A brief stint at Narmada Dam followed by a position of a Civil engineer at Gujarat State Water supply (GWSSB) till 1993

6. Switched to an IT role for in GWSSB, and retired as Head (IT) in 2020

We know you would not have heard about him.

But he has seen it all in the markets.

~Harshad Mehta phase

~ASEAN market crisis

~Ketan Pareekh Scam

~Dotcom Bubble & Bust

~RE-Construction-Infra Boom

~Global Financial Crisis

~Taper Tantrum

~Demonetization

~IL&FS crisis

~Covid crash

But he has seen it all in the markets.

~Harshad Mehta phase

~ASEAN market crisis

~Ketan Pareekh Scam

~Dotcom Bubble & Bust

~RE-Construction-Infra Boom

~Global Financial Crisis

~Taper Tantrum

~Demonetization

~IL&FS crisis

~Covid crash

His two investing styles worth emulating are:

1. Yard investing

2. Ancillary ka ancillary

1. Yard investing

2. Ancillary ka ancillary

Now let's come to the 2nd one

Ancillary ka Ancillary

We have explained it here:👇

Ancillary ka Ancillary

We have explained it here:👇

And here🙂👇

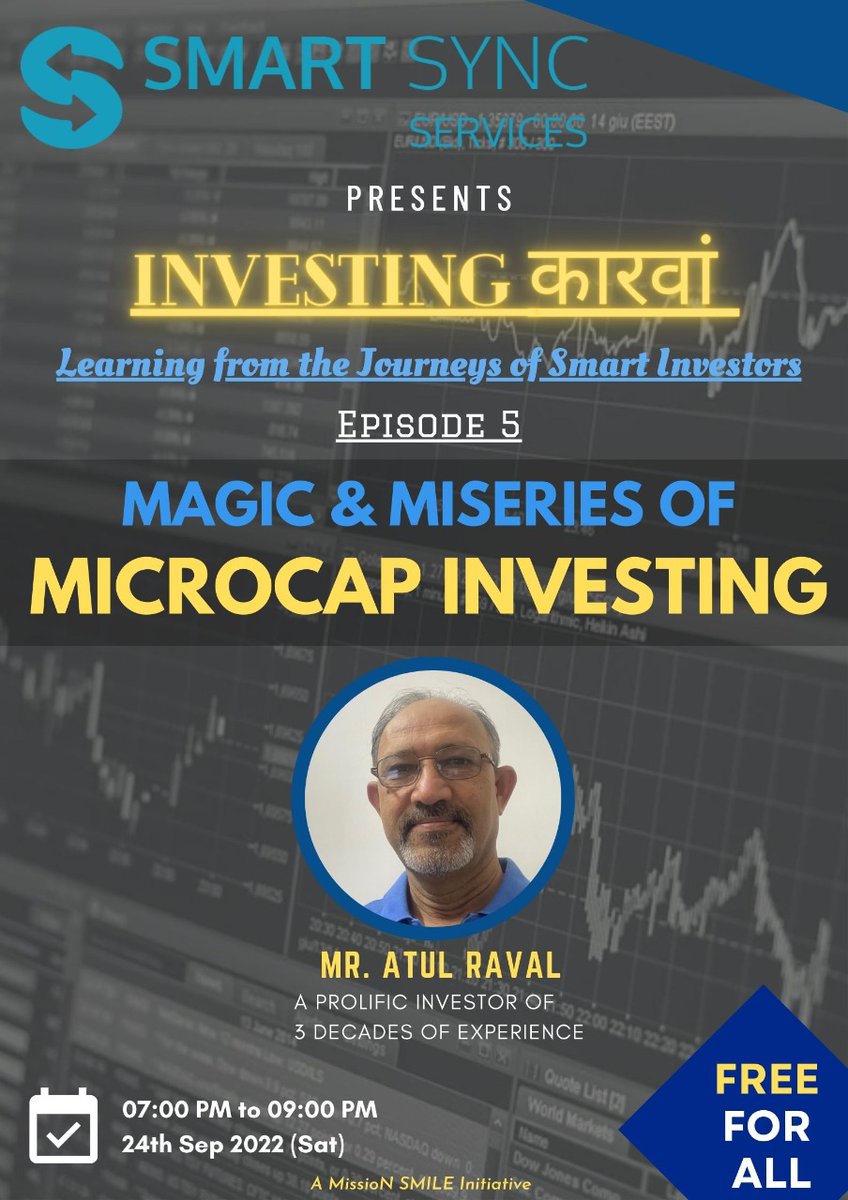

To learn more about

"Magic & Miseries of Microcap Investing"

Register for our 5th Episode of

Investing कारवां

To educate most investors, we have kept this episode free.

missionsmile.smartsyncservices.com

"Magic & Miseries of Microcap Investing"

Register for our 5th Episode of

Investing कारवां

To educate most investors, we have kept this episode free.

missionsmile.smartsyncservices.com

Please note that to watch this event live, you must register before 6 pm today.

All MissioN SMILE members and registered participants will get a Webex invite link to join the event.

And a surprise gift awaits you today at 6 pm.🎁😃

Thank you!🙏

All MissioN SMILE members and registered participants will get a Webex invite link to join the event.

And a surprise gift awaits you today at 6 pm.🎁😃

Thank you!🙏

To help us reach out to and educate maximum investors with this free session on "Magic & Miseries of Microcap Investing"

"Retweet" the tweet below👇

"Retweet" the tweet below👇

Congratulations to all who utilized the 20% discount on MissioN SMILE membership.👏👏

As it was only supposed to be active till the session was on, the discount is no more available.

DM us for any query.🙂

As it was only supposed to be active till the session was on, the discount is no more available.

DM us for any query.🙂

The recording of the 4 hour-long session full of experience and wisdom of 3 long decades of investing in microcaps is here:

missionsmile.smartsyncservices.com

missionsmile.smartsyncservices.com

Loading suggestions...