Technology

Business

Entrepreneurship

Startups

Startup

Fundraising

Startup Funding

Cold Email Outreach

Investor Research

I’ve raised ~$30M for my startup, most of it through cold email.

Fundraising is about WHO to email and HOW to email.

My 5 step process you can copy to raise $$ (🧵).

Reading Time: 5 minutes

Value: Millions of $$$

Fundraising is about WHO to email and HOW to email.

My 5 step process you can copy to raise $$ (🧵).

Reading Time: 5 minutes

Value: Millions of $$$

With investors, your process should look something like this:

Phase 1: Find Investors

Phase 2: Get a meeting

Phase 3: Raise $$$

Let's first understand how to find investors...

Phase 1: Find Investors

Phase 2: Get a meeting

Phase 3: Raise $$$

Let's first understand how to find investors...

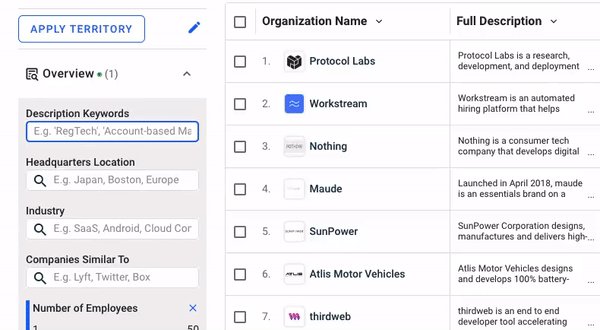

Let's say you're building a Chrome Extension.

Go to Crunchbase.com and find all the startups that are building browser extensions.

Compile a list.

Go to Crunchbase.com and find all the startups that are building browser extensions.

Compile a list.

Now that you've made your list of prospective investors, it's time for phase two.

Secure the initial meeting.

Secure the initial meeting.

You need to compile a spreadsheet of 300-400 Investors and answer the following questions:

1) Which round do they typically invest in?

2) How much do they typically invest?

3) Do they lead rounds or follow?

4) Which similar companies have they invested in?

1) Which round do they typically invest in?

2) How much do they typically invest?

3) Do they lead rounds or follow?

4) Which similar companies have they invested in?

Investor thesis are usually around a certain market.

SaaS, Crypto, Financial Services, etc.

If an investor has funded a chrome extension before, they are generally believers in the whole 'space' and will want to fund multiple non-competitive companies within it.

SaaS, Crypto, Financial Services, etc.

If an investor has funded a chrome extension before, they are generally believers in the whole 'space' and will want to fund multiple non-competitive companies within it.

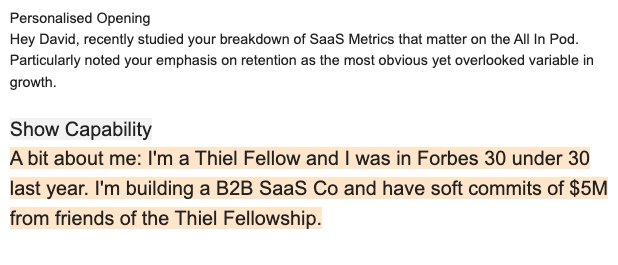

Once you have their emails, you need to write a killer first email.

A good email will have:

1) Personalized opening

2) Proof that you're capable

3) Brief and clear description of the company

4) Show traction

5) A clear ask

A good email will have:

1) Personalized opening

2) Proof that you're capable

3) Brief and clear description of the company

4) Show traction

5) A clear ask

I send out my cold emails in batches.

Group 1: C List Investors

Group 2: B List Investors

Group 3: A List Investors

Go from least compatible to most compatible.

Why? Because your pitch will improve over time, don't go for tier A funds until you're ready.

Group 1: C List Investors

Group 2: B List Investors

Group 3: A List Investors

Go from least compatible to most compatible.

Why? Because your pitch will improve over time, don't go for tier A funds until you're ready.

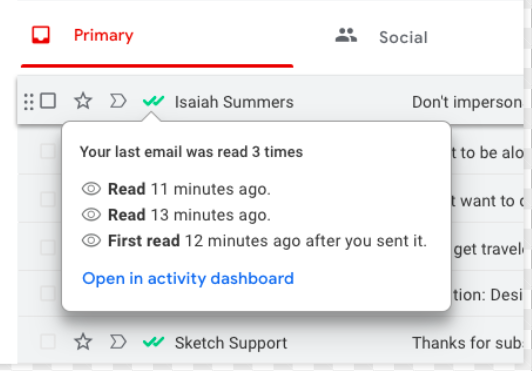

Then, I use mailtrack.io to know who's opening my email and who hasn't.

I also track other interesting email analytics that can help me determine if my cold email is working or if it needs iteration.

I also track other interesting email analytics that can help me determine if my cold email is working or if it needs iteration.

Before you take any investor calls, you need to ensure you have a killer pitch deck.

Study examples of successful pitch decks.

Here's AirBnB's Seed Round deck:

slidebean.com

Study examples of successful pitch decks.

Here's AirBnB's Seed Round deck:

slidebean.com

I'll write a thread on building a successful pitch deck but for now it's all about the above steps to get that initial meeting.

Remember...

Fundraising is not like sales.

IT IS sales.

Leverage the above approach and I guarantee you your connect rate will increase.

Remember...

Fundraising is not like sales.

IT IS sales.

Leverage the above approach and I guarantee you your connect rate will increase.

Since you made it this far, here are 4 free resources of 1,000+ active investors:

1. 750 Seed Funds by Matt Estes

docs.google.com

docs.google.com

2. 219 Early Stage VC Funds by Shai Goldman

airtable.com

airtable.com

3. 500 Active Investors in the US by Trace Cohen

docs.google.com

docs.google.com

4. Investors Open to Cold Outreach by Yuliya Bel

airtable.com

airtable.com

Thanks for reading.

If you've learned something, retweet the first tweet so others can too.

For more content like this, follow @lukesophinos

I share my learnings founding, operating, investing, and advising vertical software companies.

Onwards!

If you've learned something, retweet the first tweet so others can too.

For more content like this, follow @lukesophinos

I share my learnings founding, operating, investing, and advising vertical software companies.

Onwards!

Loading suggestions...