Why don't I see a bullish PA?

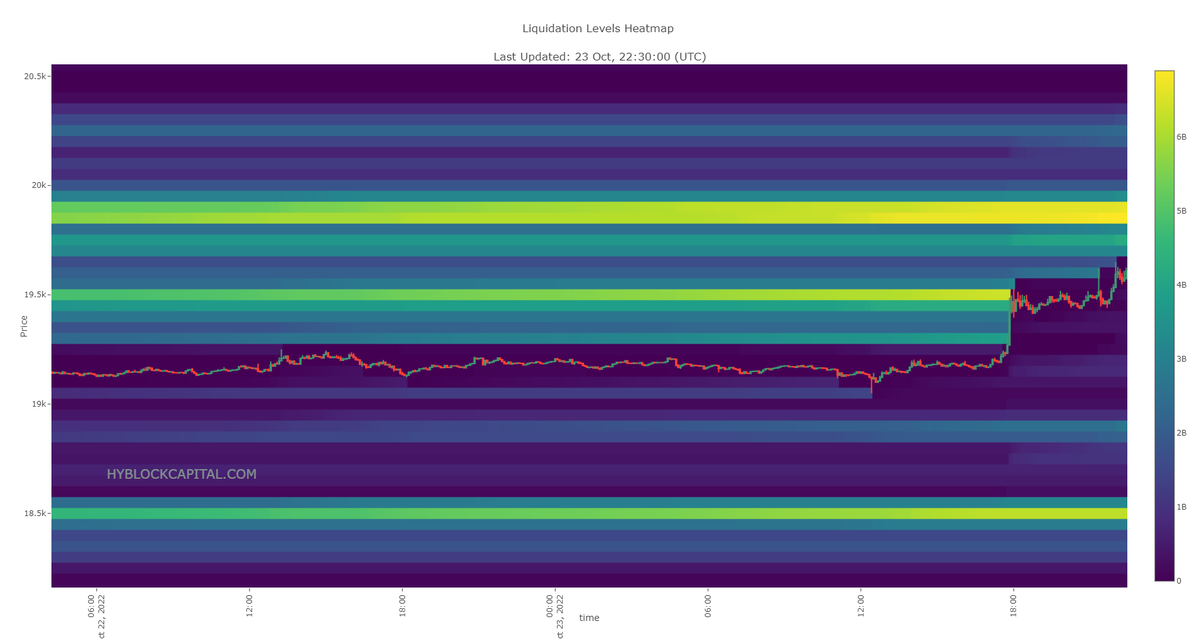

- First 1 year yellow liquidation bar at $17.4k

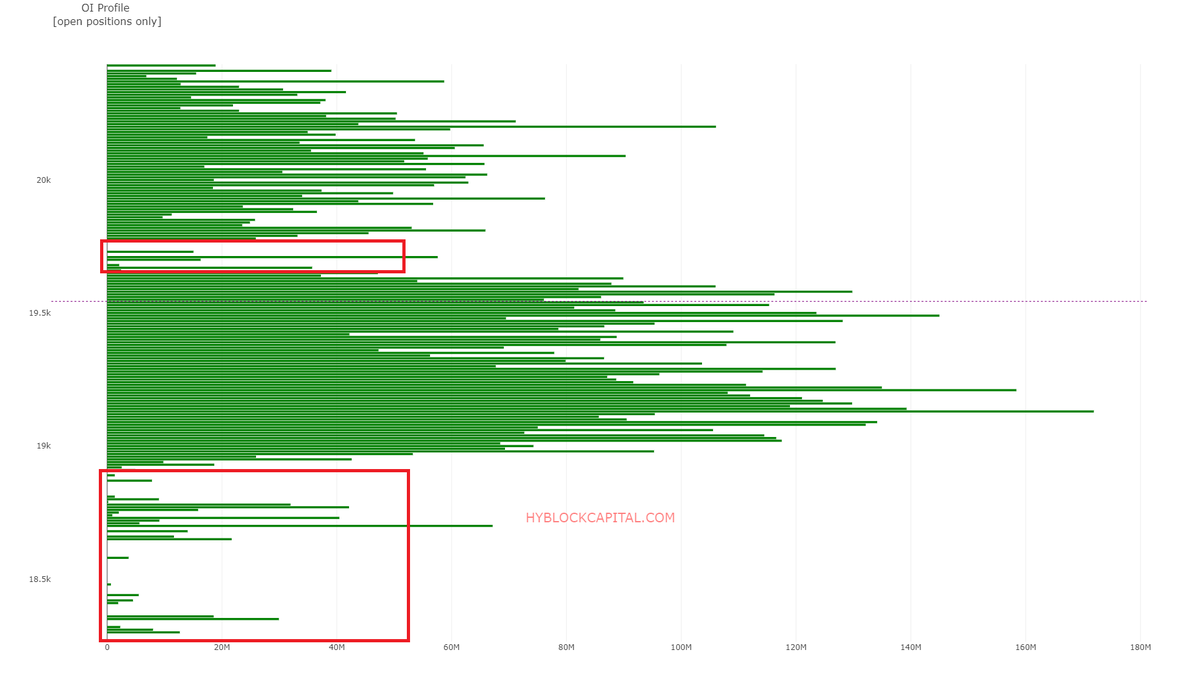

- Unrecovered wicks from $19k to $18k

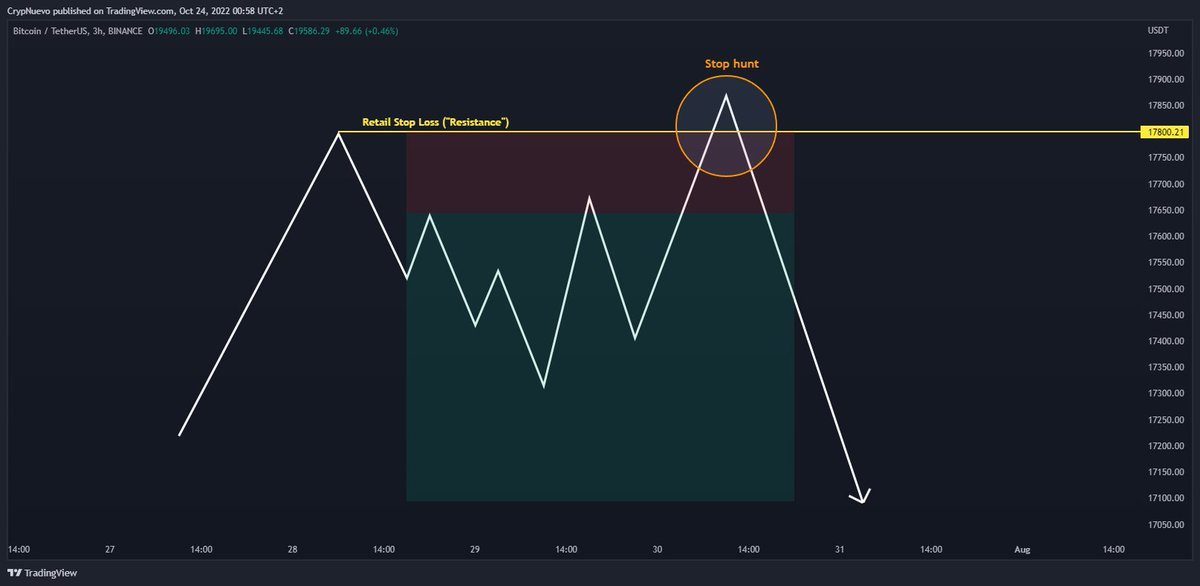

- Fast moves = False moves as they create and leave liquidity pools behind

CT will induce you to swing long here. I only see shorts liquidity hunts for now.

- First 1 year yellow liquidation bar at $17.4k

- Unrecovered wicks from $19k to $18k

- Fast moves = False moves as they create and leave liquidity pools behind

CT will induce you to swing long here. I only see shorts liquidity hunts for now.

Loading suggestions...