Working in a cubicle for 50+ years is a crime.

💰10 tips to free yourself from a 9-5 job:

💰10 tips to free yourself from a 9-5 job:

Your job doesn't care about your retirement or your wealth. Your job's only concern is how much money the company can make.

Job security is an illusion.

Having only 1 source of income, is 1 away from 0.

Job security is an illusion.

Having only 1 source of income, is 1 away from 0.

Your job lied and your boss lied, your 9-5 is really a 5-7.

(Don't forget to include getting ready, meals, commuting, work events, etc.)

You deserve more from life than having to ask permission for time off from a job, only to be allowed 2-4 weeks off each year.

(Don't forget to include getting ready, meals, commuting, work events, etc.)

You deserve more from life than having to ask permission for time off from a job, only to be allowed 2-4 weeks off each year.

You should work a 9-5 job but also:

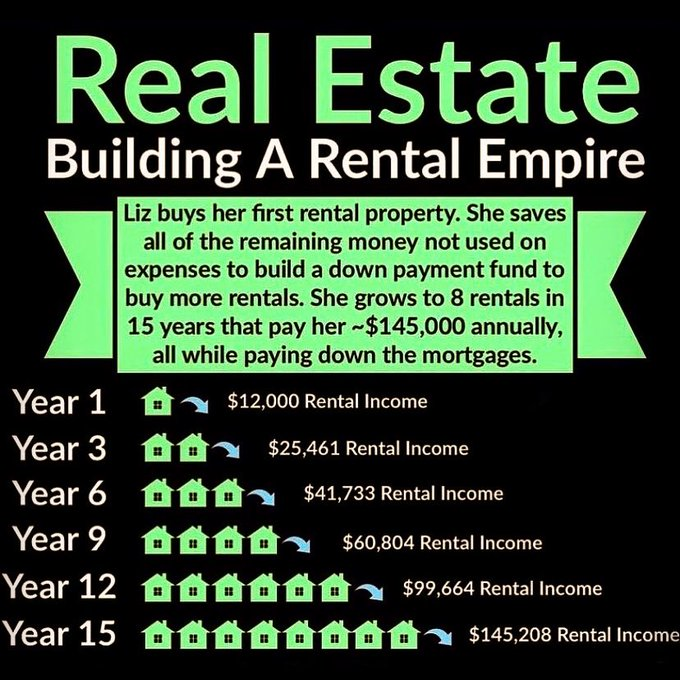

• invest in real estate

• invest in the stock market

• start a small business or side-hustle

The secret to building wealth is to find ways to increase income, spend less than you earn and invest the difference.

• invest in real estate

• invest in the stock market

• start a small business or side-hustle

The secret to building wealth is to find ways to increase income, spend less than you earn and invest the difference.

Use your salary to buy assets. Use your 9-5 to escape your 9-5.

Invest in your 20s & 30s, so that you don't have to work in your 50s & 60s.

Invest so that a job becomes a choice, and not an obligation.

Invest in your 20s & 30s, so that you don't have to work in your 50s & 60s.

Invest so that a job becomes a choice, and not an obligation.

One of the biggest risks in life is depending on only 1 source of income.

If you can work over 8 hours a day for someone else, you can use your evenings to work on a side-hustle, side business or learning new skills which you can be paid for.

If you can work over 8 hours a day for someone else, you can use your evenings to work on a side-hustle, side business or learning new skills which you can be paid for.

There are 168 hours in a week. If you spend 40 working & 50 sleeping, you are still left with 78 hours to:

• learn new skills

• find a higher paying job

• invest in stocks or real estate

• increase your income with a side hustle or business

• learn new skills

• find a higher paying job

• invest in stocks or real estate

• increase your income with a side hustle or business

Time is your greatest asset, you can never get back lost time.

Many income generating hobbies or skills that people can learn can be replaced by scrolling though social media for hours.

Many income generating hobbies or skills that people can learn can be replaced by scrolling though social media for hours.

The wealthy invest in these 4 assets, and you should too:

• stocks

• real estate

• businesses

• self education/ self improvement

• stocks

• real estate

• businesses

• self education/ self improvement

The leverage you have putting down 3.5% as a first-time homeowner gives you control of a $300,000 asset with $10,500

It can:

• increase income with cash flow

• increase net worth by appreciating in value

It can:

• increase income with cash flow

• increase net worth by appreciating in value

You can create passive income through:

• REITs

• Business Income

• Real Estate Rentals

• Dividend Stocks Income

• Covered Call Options Income

• REITs

• Business Income

• Real Estate Rentals

• Dividend Stocks Income

• Covered Call Options Income

As a business owner, you can deduct everyday expenses if they are used for business purposes.

Examples include:

• rent

• Wifi

• electricity

• cell phone bill

• business meals

• vehicle expenses

• home office deduction

Examples include:

• rent

• Wifi

• electricity

• cell phone bill

• business meals

• vehicle expenses

• home office deduction

The richest 10% of Americans own 90% of all stocks!

The bottom 90% own 10% of all stocks!

Money is a tool, so use your salary to build wealth, so that your job becomes a choice, not an obligation.

The bottom 90% own 10% of all stocks!

Money is a tool, so use your salary to build wealth, so that your job becomes a choice, not an obligation.

Patience is rewarded in investing.

$5,000 in these stocks, 5 years ago would be worth:

• AMD $AMD: ~$40,000

• Tesla $TSLA: ~$80,000

• Apple $AAPL: ~$25,000

• Google $GOOG: ~$15,000

• NVIDIA $NVDA: ~$45,000

• Amazon $AMZN: ~$20,000

• Microsoft $MSFT: ~$25,000

$5,000 in these stocks, 5 years ago would be worth:

• AMD $AMD: ~$40,000

• Tesla $TSLA: ~$80,000

• Apple $AAPL: ~$25,000

• Google $GOOG: ~$15,000

• NVIDIA $NVDA: ~$45,000

• Amazon $AMZN: ~$20,000

• Microsoft $MSFT: ~$25,000

The Stock Market crashed:

• 34% in 2020

• 57% in 2008

• 49% in 2000

• 29% in 1987

But since 1926, the stock market increased 11% each year on average, or 1,325,558% over 96 years!

• 34% in 2020

• 57% in 2008

• 49% in 2000

• 29% in 1987

But since 1926, the stock market increased 11% each year on average, or 1,325,558% over 96 years!

Index funds have been a great way to build wealth for many and even Warren Buffett recommends that the everyday person invests in an S&P 500 Index Fund.

The S&P 500 is a group of America's largest companies and has returned ~11% each year, over the last 96 years, since 1926.

The S&P 500 is a group of America's largest companies and has returned ~11% each year, over the last 96 years, since 1926.

If you don't know where to start investing, buy an Index Fund that tracks the S&P 500 (such as $VOO).

The S&P 500 has recovered from every bear market, and rose to new all-time highs, every time!

The S&P 500 has recovered from every bear market, and rose to new all-time highs, every time!

If you invest $100 a week into an S&P 500 index fund, you'll have:

• 30 years: Over $1 million

• 35 years: Over $2 million

• 40 years: Over $3 million

• 50 years: Over $10 million

After 20 years, over 90% of that balance is from doing nothing, it's from compound interest!

• 30 years: Over $1 million

• 35 years: Over $2 million

• 40 years: Over $3 million

• 50 years: Over $10 million

After 20 years, over 90% of that balance is from doing nothing, it's from compound interest!

If want to build wealth and retire early, learn as much as you can about:

• Taxes

• Investing

• Real Estate

• Personal Finance

• The Stock Market

• Financial Planning

• Taxes

• Investing

• Real Estate

• Personal Finance

• The Stock Market

• Financial Planning

If you don't figure out how to make money in your sleep, a day may come where you lose sleep due to money.

If you found this thread🧵helpful:

• Follow me: @FluentInFinance

•🔁RT the FIRST tweet

•❤️LIKE the tweets

This account was created to help you build wealth!

If you found this thread🧵helpful:

• Follow me: @FluentInFinance

•🔁RT the FIRST tweet

•❤️LIKE the tweets

This account was created to help you build wealth!

Loading suggestions...