Business Overview

- Company was able to generate strong sales growth during the quarter.

- Their Annuity APE grew by 44% in last 6 month.

- As compared to their peers company did perform better then it’s peers improving their market share up by 0.5% percentage.

- Company was able to generate strong sales growth during the quarter.

- Their Annuity APE grew by 44% in last 6 month.

- As compared to their peers company did perform better then it’s peers improving their market share up by 0.5% percentage.

- Company has also elevated Suresh Badami as deputy managing director. His entry has let good growth in business key areas.

- Company has been able to get good value in their new business premium, as well as annuity new business.

- At march,31st 2022 AUM stood around 2000 cr.

- Company has been able to get good value in their new business premium, as well as annuity new business.

- At march,31st 2022 AUM stood around 2000 cr.

- For the given period their CP volumes displayed strong increment in growth compared to last year.

- For product mix, under total APE space non par savings and par savings contributes about 57% and Under NBP space major holdings are with protection and annuity products.

- For product mix, under total APE space non par savings and par savings contributes about 57% and Under NBP space major holdings are with protection and annuity products.

- The company has also smoothen the customer journey and simplified the underwriting part.

- Home based risk assessment service are issued and have aided the home medical initiatives not just in India but other 20 countries as well.

- Home based risk assessment service are issued and have aided the home medical initiatives not just in India but other 20 countries as well.

Financials

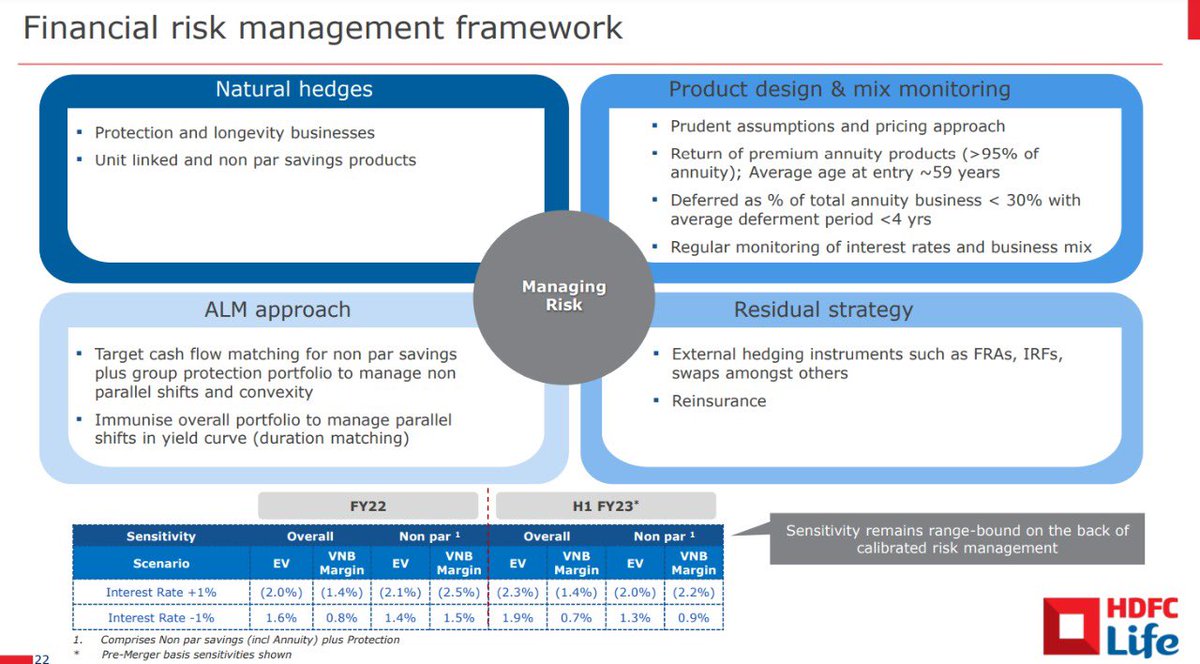

- Though with strong sales growth there has been a decline in the operating profits and margins compared to last quarter.

- Solvency ratio for the company stood around 200% plus based on capital infusion.

- Though with strong sales growth there has been a decline in the operating profits and margins compared to last quarter.

- Solvency ratio for the company stood around 200% plus based on capital infusion.

- New business value stands around 12.9 Bn post merger with margin at 26%.

- Their Shareholders surplus stood around 2.4 Bn during this 1 half of FY 23.

- Their Shareholders surplus stood around 2.4 Bn during this 1 half of FY 23.

- More focus is been build upon ULIPs, Par and Non par saving plans Under earlier years of life and annuity is pitched to the once in later stage.

- There we’re complaints that company receive related to their product pricing.

- There we’re complaints that company receive related to their product pricing.

Expansions

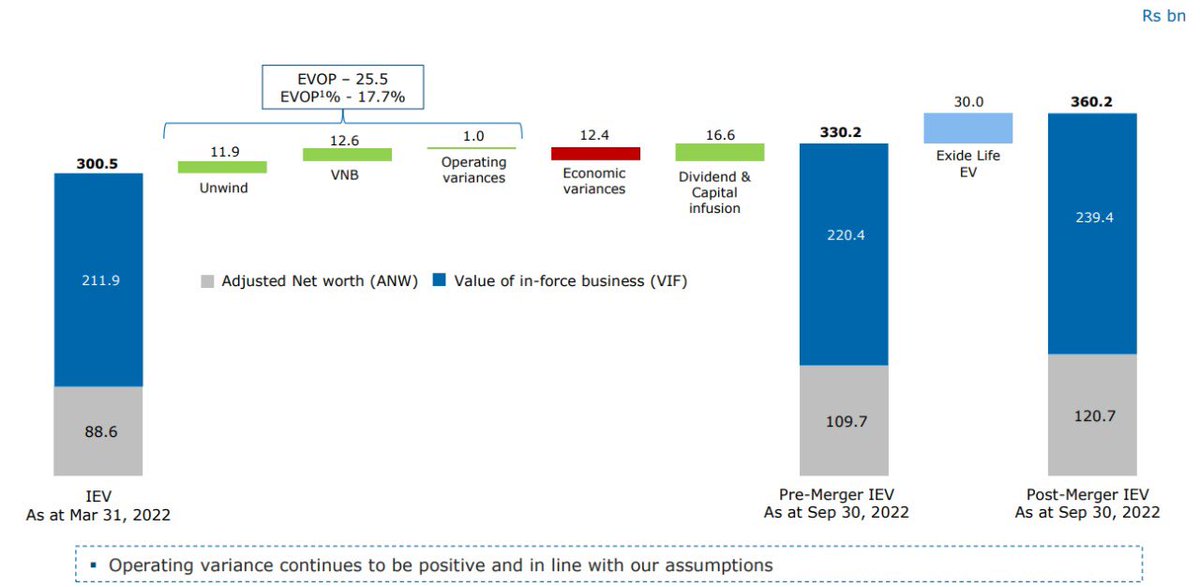

- Exide life merger got completed under 14 months with strong performance in NBM: 27.6%.

- The margin expansion was been witnessed by the firm both pre and post merger.

- New opportunities are been tapped to create a new profit pool.

- Exide life merger got completed under 14 months with strong performance in NBM: 27.6%.

- The margin expansion was been witnessed by the firm both pre and post merger.

- New opportunities are been tapped to create a new profit pool.

- Distribution channels are been updated more towards need based selling.

- More focus towards technology is been made to deliver consistent performance.

- More focus towards technology is been made to deliver consistent performance.

- The company also aspire to reduce the NBM gap in FY24 through optimised geographical pick up.

- Rationalising reductant spending’s and enabling-more digital operating to scale.

- Rationalising reductant spending’s and enabling-more digital operating to scale.

Loading suggestions...