2) Investments should always be backed by thorough research and understanding.

Before spending your hard-earned money toward any asset you should look at all the possible metrics.

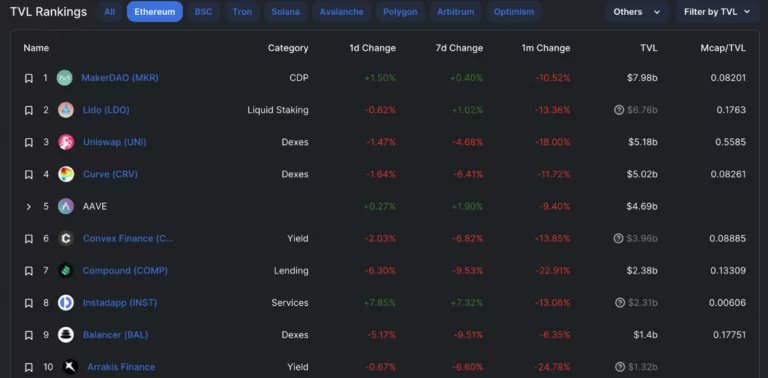

"Total Value Locked" is one of the more important indicators in the DeFi industry.

Before spending your hard-earned money toward any asset you should look at all the possible metrics.

"Total Value Locked" is one of the more important indicators in the DeFi industry.

4) It helps investors determine if a protocol is healthy and worth investing in.

If you see the TVL rapidly rising it might be a project that's worth investing into since it's becoming more popular as we speak.

If you see the TVL rapidly rising it might be a project that's worth investing into since it's becoming more popular as we speak.

6) For this, we need to divide the market cap by the TVL of the token.

An asset is undervalued if the TVL ratio is less than one and vice versa.

What is all of this if you don't know how to do this yourself?

Don't worry I got you. Let's start the guide shall we 📘👇

An asset is undervalued if the TVL ratio is less than one and vice versa.

What is all of this if you don't know how to do this yourself?

Don't worry I got you. Let's start the guide shall we 📘👇

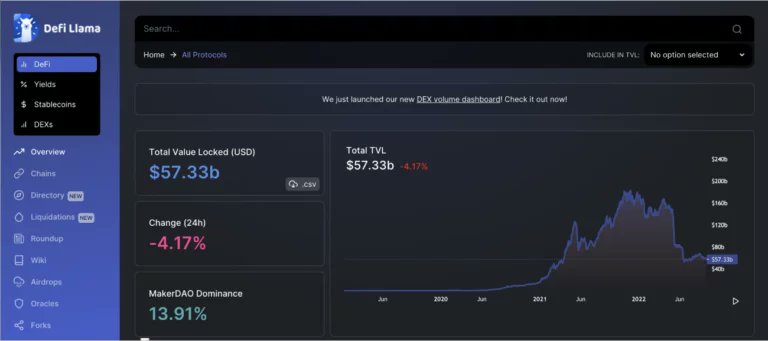

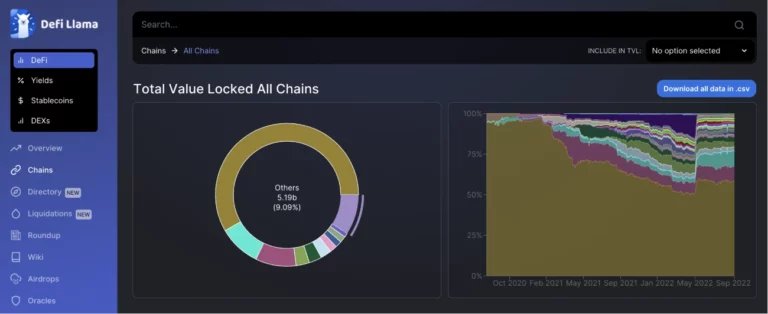

7) ENTER DEFILLAMA

DefiLlama is the absolute best analytics FREE dashboard you will ever need.

It tracks DeFi platforms and their Dapps and uses TVL to show which DeFi protocols are the largest and how they develop over time.

👉 defillama.com

DefiLlama is the absolute best analytics FREE dashboard you will ever need.

It tracks DeFi platforms and their Dapps and uses TVL to show which DeFi protocols are the largest and how they develop over time.

👉 defillama.com

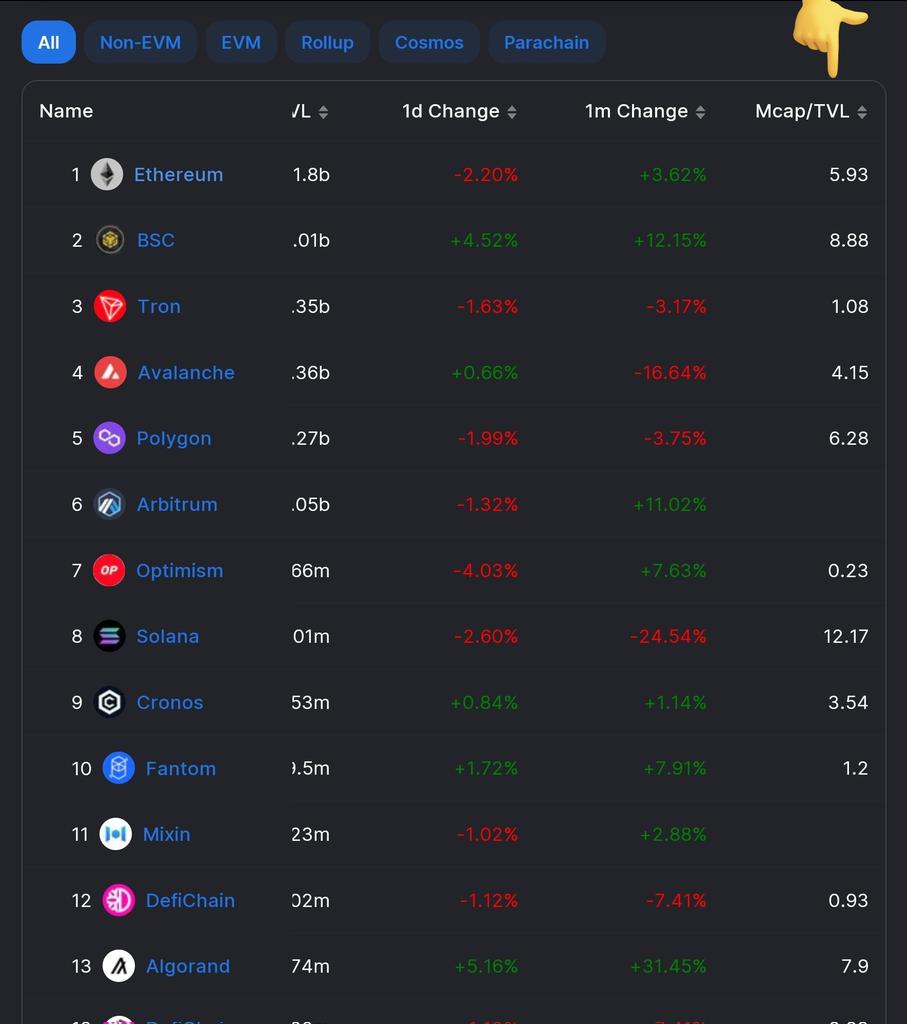

11) A high ratio isn't always bad.

Ethereum has a TVL ratio of 5.93

There are competitors that have a lower number (better) and yet Ethereum has the highest TVL $ value of all.

It just means Ethereum is valuated correctly and has the value to show for it.

Ethereum has a TVL ratio of 5.93

There are competitors that have a lower number (better) and yet Ethereum has the highest TVL $ value of all.

It just means Ethereum is valuated correctly and has the value to show for it.

12) A protocol showing a ratio of 0.5 has a higher TVL than its own market cap.

It might still not even come close to the total TVL in $ than Ethereum.

So it's not likely to compete with Ethereum directly BUT as an investment for us it might be extremely attractive.

It might still not even come close to the total TVL in $ than Ethereum.

So it's not likely to compete with Ethereum directly BUT as an investment for us it might be extremely attractive.

13) It means Protocol X with a high ratio might not give you the same multiplier than protocol Y with a low ratio regardless if protocol X is the better project over all.

The ratio purely tracks the money that flows through the protocol (interest) compared it it's market cap.

The ratio purely tracks the money that flows through the protocol (interest) compared it it's market cap.

14) Also keep in mind you won't find every project you invest in on Defillama.

Not all projects have smart contracts or any form of staking, lending or liquidity pools available.

As such not every project has any TVL.

NOVA OUT ❤️

Not all projects have smart contracts or any form of staking, lending or liquidity pools available.

As such not every project has any TVL.

NOVA OUT ❤️

15) If you want to keep up to date to most of my content and interesting projects give me a follow @CryptoGirlNova.

I also research the communities top voted cryptocurrency every week so you can keep track of all the most exciting projects.

Your favorite writer Nova ✍️

I also research the communities top voted cryptocurrency every week so you can keep track of all the most exciting projects.

Your favorite writer Nova ✍️

16) If you had value from this and liked this thread, it would really bring a smile to my face if you could retweet the first post so this can help as many people as possible.

Everyone deserves free knowledge 📘

Love you all ❤️

First post 👇

Everyone deserves free knowledge 📘

Love you all ❤️

First post 👇

Loading suggestions...