Yep, you read that right

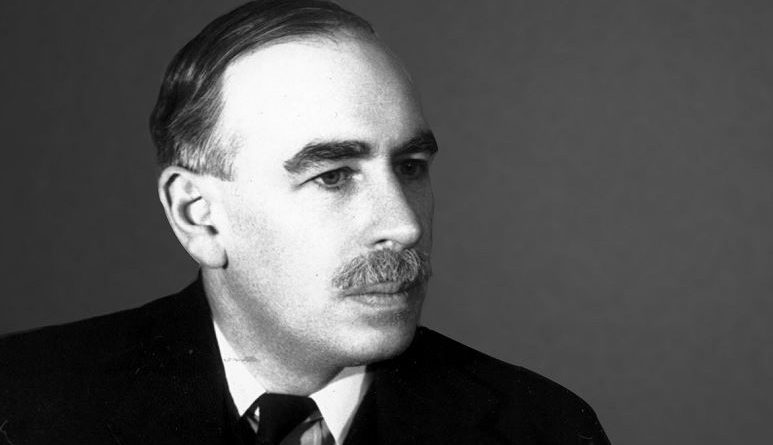

John Maynard Keynes achieved a 1000% return from 1931 - 1945

Following the great depression, when no one wanted to touch stocks and the overall market stood still

These returns are truly extraordinary

Here are some of his best quotes...

John Maynard Keynes achieved a 1000% return from 1931 - 1945

Following the great depression, when no one wanted to touch stocks and the overall market stood still

These returns are truly extraordinary

Here are some of his best quotes...

1. 'My purpose is to buy securities where I am satisfied as to assets and ultimate earnings power and where the market price seems cheap in relation to these'

Lesson: Buy high-quality businesses with assets and strong fundamentals which are underappreciated by investors

Lesson: Buy high-quality businesses with assets and strong fundamentals which are underappreciated by investors

2. 'Hold onto stocks through thick and thin. "Be quiet" is our motto'

Lesson: Ignore the short-term noise and let the longer-term forces assert themselves.

Also, limit trading activities and only buy when intrinsic values are far above stock prices

Lesson: Ignore the short-term noise and let the longer-term forces assert themselves.

Also, limit trading activities and only buy when intrinsic values are far above stock prices

3. In a reply to criticisms of his large exposure to a particular company in his portfolio: 'Sorry to have gone too large on Elder Dempster. I was suffering from my chronic delusion that one good share is safer than 10 bad ones'

Lesson: Buy high-quality & don't diworsify

Lesson: Buy high-quality & don't diworsify

4. 'When the facts change, I change my mind'

Lesson: Hold onto your investments only until the facts change, i.e. the fundamentals of the business break down. Until then, short-term price volatility is the price you pay for superior returns in the long-term

Lesson: Hold onto your investments only until the facts change, i.e. the fundamentals of the business break down. Until then, short-term price volatility is the price you pay for superior returns in the long-term

5. 'Markets can remain irrational longer than you can remain solvent'

Lesson: Ensure you have consistent cashflow to invest, or keep a % of your portfolio as cash during turbulent markets so you can make the most of downturns and buy great businesses at low prices

Lesson: Ensure you have consistent cashflow to invest, or keep a % of your portfolio as cash during turbulent markets so you can make the most of downturns and buy great businesses at low prices

6. 'It is better to be roughly right than precisely wrong'

Lesson: No one will get it right event 75% of the time. Do you research to mitigate the risks of getting it completely wrong.

Lesson: No one will get it right event 75% of the time. Do you research to mitigate the risks of getting it completely wrong.

7. 'By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens'

Lesson: Preserve your wealth by investing. It's the only proven, reliable, long-term hedge against inflation

Lesson: Preserve your wealth by investing. It's the only proven, reliable, long-term hedge against inflation

8. 'The markets are moved by animal spirits, and not by reason'

Lesson: Short-term fluctuations in the stock market are rarely justified, and are usually the response to a fear of circumstances that are yet to occur. Pay no attention and continue buying quality

Lesson: Short-term fluctuations in the stock market are rarely justified, and are usually the response to a fear of circumstances that are yet to occur. Pay no attention and continue buying quality

9. 'The expected never happens; it is the unexpected always'

Lesson: You cannot predict what the markets will do, or how they will react to an unexpected circumstance. No one can truly time the market with any consistent accuracy. So, DCA and never stop

Lesson: You cannot predict what the markets will do, or how they will react to an unexpected circumstance. No one can truly time the market with any consistent accuracy. So, DCA and never stop

10. 'Investing is an activity of forecasting the yield over the life of the asset; speculation is the activity of forecasting the psychology of the market'

Lesson: The former is far easier than the latter, and statistically much more profitable over the long-term

Lesson: The former is far easier than the latter, and statistically much more profitable over the long-term

11. 'If farming were to be organised like the stock market, a farmer would sell his farm in the morning when it was raining, only to buy it back in the afternoon when the sun came out'

Lesson: Stop selling your stocks because they didn't go up in the short term. Buy & hold

Lesson: Stop selling your stocks because they didn't go up in the short term. Buy & hold

12. 'The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future'

Lesson: Stay informed and let compounding over time do its thing

Lesson: Stay informed and let compounding over time do its thing

13. 'When my information changes, I alter my conclusions'

Lesson: You don't need to change your position with a stock until the information that forms your thesis changes. If the fundamentals are intact, hold. If they deteriorate, sell

Lesson: You don't need to change your position with a stock until the information that forms your thesis changes. If the fundamentals are intact, hold. If they deteriorate, sell

14. 'Once doubt begins it spreads rapidly'

Lesson: You see this in the stock market all the time

Learn to leverage the doubt of others buy buying up the high-quality stocks they're selling on the cheap

Lesson: You see this in the stock market all the time

Learn to leverage the doubt of others buy buying up the high-quality stocks they're selling on the cheap

I've studied the traits of the most successful investors of the last century, implementing the learnings into the successful investment strategy I teach in my community

If you enjoyed this thread, please:

- Retweet the original tweet

- Follow @FiSavvy

If you enjoyed this thread, please:

- Retweet the original tweet

- Follow @FiSavvy

Loading suggestions...