Every 50-75 years, the world goes through a massive correction cycle.

Stocks crash, bonds crash, real estate crash.

The world presses the "reset button".

Here is an entire explanation:

[A thread…]

Stocks crash, bonds crash, real estate crash.

The world presses the "reset button".

Here is an entire explanation:

[A thread…]

[2] Classic case:

- The economic growth after the 2008 crisis (2009 to 2020) was an expansion phase.

- The market crash post Covid 2020 and its impact till today is a shrinkage phase going on.

- All this is connected by long-term debt.

- The economic growth after the 2008 crisis (2009 to 2020) was an expansion phase.

- The market crash post Covid 2020 and its impact till today is a shrinkage phase going on.

- All this is connected by long-term debt.

Because every time there is a crisis, Govts print insane amount of money to increase liquidity and bring about an economic growth.

This increases the debt on the world. And, hence long-term debt cycles are critical.

This increases the debt on the world. And, hence long-term debt cycles are critical.

[4] Think of it like this-

If your income is not increasing, but you want to buy more things, you will go and take a debt.

Governments do the same.

When it prints money, all the crisis is conveniently converted to a long-term problem, that is the long-term debt cycle.

If your income is not increasing, but you want to buy more things, you will go and take a debt.

Governments do the same.

When it prints money, all the crisis is conveniently converted to a long-term problem, that is the long-term debt cycle.

[7] Which stage are we currently in?

Debt bubble bursting stage.

Lot of countries are facing internal and external conflicts:

USA, because of its money printing shenanigans post Covid. China, due to its housing crisis. Russia due to its economic crisis etc.

Debt bubble bursting stage.

Lot of countries are facing internal and external conflicts:

USA, because of its money printing shenanigans post Covid. China, due to its housing crisis. Russia due to its economic crisis etc.

[8] While there are many problems, let's analyse one.

Interest rates (the rate at which Central Banks lend to the other banks) are increasing.

So, all other rate of interests (home loan, car loan, education etc) increase.

Interest rates (the rate at which Central Banks lend to the other banks) are increasing.

So, all other rate of interests (home loan, car loan, education etc) increase.

If you get home loans at 9%, you might be able to repay it with some basic efforts.

If it becomes 12-13%, more people will default on their loans. People holding this debt (who have invested in these bonds), will suffer.

If it becomes 12-13%, more people will default on their loans. People holding this debt (who have invested in these bonds), will suffer.

This will have a spillover effect on everything.

(For context, the stock market caps at $21 Trillion, while the size of the Debt market is $46 Trillion)

Are we in the end of the long-term debt cycle? Looks like yes.

(For context, the stock market caps at $21 Trillion, while the size of the Debt market is $46 Trillion)

Are we in the end of the long-term debt cycle? Looks like yes.

[10] Two other things that factor into the Debt bubble burst:

- Internal conflicts: Political chaos and conflicts, hate, etc inflicts a pain point.

- External factors: Like Russia-Ukraine war, covid crash, etc.

Is there anything we can do to stop this?

Sadly, no.

- Internal conflicts: Political chaos and conflicts, hate, etc inflicts a pain point.

- External factors: Like Russia-Ukraine war, covid crash, etc.

Is there anything we can do to stop this?

Sadly, no.

[11] You might think, “Let me move to stock market.”

But hey, a crash in debt market, will make the stock market crash too.

Then, which asset classes survive in this scenario?

1. Real Estate

2. Commodities: Gold, Silver

But hey, a crash in debt market, will make the stock market crash too.

Then, which asset classes survive in this scenario?

1. Real Estate

2. Commodities: Gold, Silver

[12] Scenarios in which this crisis is prevented:

-Internal conflicts reduce, and political stability is established.

-Productivity levels of the world raise (in-turn resulting in GDP growth)

-De-militarization of world: avoiding external conflicts

-Internal conflicts reduce, and political stability is established.

-Productivity levels of the world raise (in-turn resulting in GDP growth)

-De-militarization of world: avoiding external conflicts

Finally, do I agree on this whole narrative? The commentary, yes.

- But in general, I have always been positive about growth in the world.

- So I pump in my money in all markets, and diversify into stock, debt, crypto, real estate etc.

- But in general, I have always been positive about growth in the world.

- So I pump in my money in all markets, and diversify into stock, debt, crypto, real estate etc.

If the debt bubble explodes then anyways, everything goes down with it.

So investing/not investing won't make a difference.

If you liked this somber but useful commentary, do consider retweeting the first tweet.

So investing/not investing won't make a difference.

If you liked this somber but useful commentary, do consider retweeting the first tweet.

Loading suggestions...

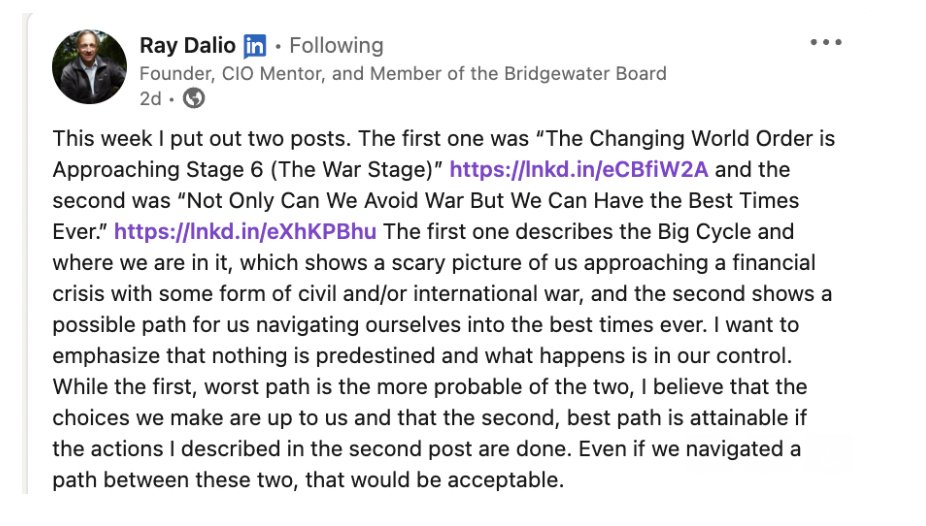

![[1] Ray Dalio, in his book "The Changing World Order" speaks about the long-term debt cycle.

The w...](https://pbs.twimg.com/media/FhlzWWbUAAAiTHu.jpg)

![[3] The chart depicts a series of negative events every 50-60 years.

- Despite all this crisis (70s...](https://pbs.twimg.com/media/Fhl0xGNUAAEkW3K.jpg)

![[5] Right now, there is a sharp rise in the world debt (due to the money printing post covid crisis)...](https://pbs.twimg.com/media/Fhl1jF8UYAE0LI5.jpg)

![[6]

-A new world order is established (Ex: US Empire, right now)

-They take increasing debts (to...](https://pbs.twimg.com/media/Fhl1z4CVUAM5hN9.jpg)

![[9] Because of this, the US Fed also want to sell some debt (actually, a huge 10%) of their debts (b...](https://pbs.twimg.com/media/Fhl2__NVEAEr9gS.png)