Technology

Crime

Finance

Cryptocurrency

Financial Fraud

Business Analysis

Investigative Journalism

Financial Crime

1/82

I'll be pinning this detailed timeline, as my final piece covering this topic, as now the case is closed in my mind.

This was a crime plain and simple and I'll put no more wind in this criminals sails:

FTX: Meltdown.

The definitive and chronological thread.

I'll be pinning this detailed timeline, as my final piece covering this topic, as now the case is closed in my mind.

This was a crime plain and simple and I'll put no more wind in this criminals sails:

FTX: Meltdown.

The definitive and chronological thread.

2/82

Sept 30th, 2022:

On September 30th, I noticed an odd behavior, that while other exchanges were declining in their Ethereum "open interest" (amount of futures contracts bought on leverage)

FTX was not.

It was at an all time high:

Sept 30th, 2022:

On September 30th, I noticed an odd behavior, that while other exchanges were declining in their Ethereum "open interest" (amount of futures contracts bought on leverage)

FTX was not.

It was at an all time high:

3/82

At the time, we didn't know why.

We'd later learn that the FTX<>Alameda relationship had for years misused customer funds illegally, and set up their systems in a way to maximize every dollar for their own benefit.

At the time, we didn't know why.

We'd later learn that the FTX<>Alameda relationship had for years misused customer funds illegally, and set up their systems in a way to maximize every dollar for their own benefit.

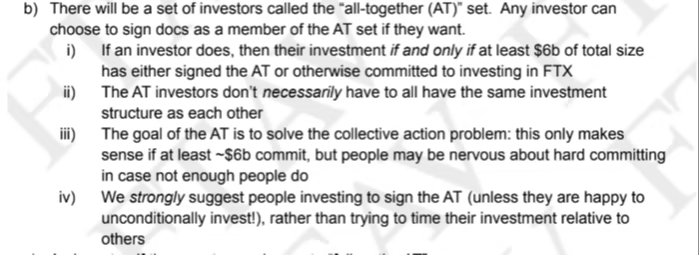

5/82

So what is the problem with these tokens?

They are primarily controlled by Alameda, with a low circulating supply.

It would be as if you sold one single strand of your hair for $100, and now claimed that the rest of all our hair was worth $1T in collateral.

So what is the problem with these tokens?

They are primarily controlled by Alameda, with a low circulating supply.

It would be as if you sold one single strand of your hair for $100, and now claimed that the rest of all our hair was worth $1T in collateral.

6/82

But, the market assumed that these games stopped with simply bad lenders making deals they shouldn't have.

We were wrong.

In early October SBF began to quietly lobby the US congress for the DCCPA bill:

But, the market assumed that these games stopped with simply bad lenders making deals they shouldn't have.

We were wrong.

In early October SBF began to quietly lobby the US congress for the DCCPA bill:

7/82

This bill would effectively ban decentralized finance, and force consumers to use centralized products like FTX.

There was a pattern emerging here that none of us saw at the time.

An obvious thread in hindsight, where everything was about putting more assets in FTX.

This bill would effectively ban decentralized finance, and force consumers to use centralized products like FTX.

There was a pattern emerging here that none of us saw at the time.

An obvious thread in hindsight, where everything was about putting more assets in FTX.

8/82

We later learned than whenever FTX/Alameda invested in an entity, they often told the projects to use the FTX exchange as their bank account/keep their assets on the exchange, as a part of the deal term.

This DCCPA bill was the same mantra, more assets on the exchange

We later learned than whenever FTX/Alameda invested in an entity, they often told the projects to use the FTX exchange as their bank account/keep their assets on the exchange, as a part of the deal term.

This DCCPA bill was the same mantra, more assets on the exchange

9/82

October 19th:

Near the end of October, lawyer @lex_node managed to get and release a copy of the DCCPA bill that had been floated around Washington as a draft.

The community, seeing that it would result in banning DeFi expressed their outrage towards Sam.

October 19th:

Near the end of October, lawyer @lex_node managed to get and release a copy of the DCCPA bill that had been floated around Washington as a draft.

The community, seeing that it would result in banning DeFi expressed their outrage towards Sam.

11/82

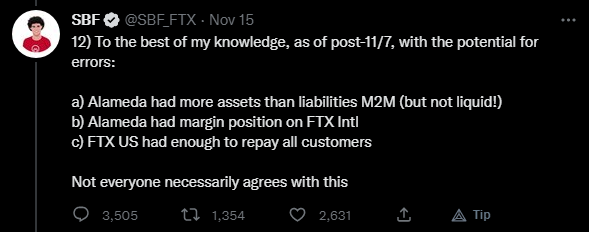

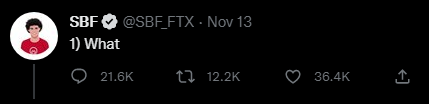

To this day, Sam wrongly claims that this led to CZ attacking the value of their token and collapsing their exchange. (But more on that soon)

The flippant tone of SBF struck the community as odd. It seemed like something was clearly wrong behind the scenes.

To this day, Sam wrongly claims that this led to CZ attacking the value of their token and collapsing their exchange. (But more on that soon)

The flippant tone of SBF struck the community as odd. It seemed like something was clearly wrong behind the scenes.

12/82

November 2nd:

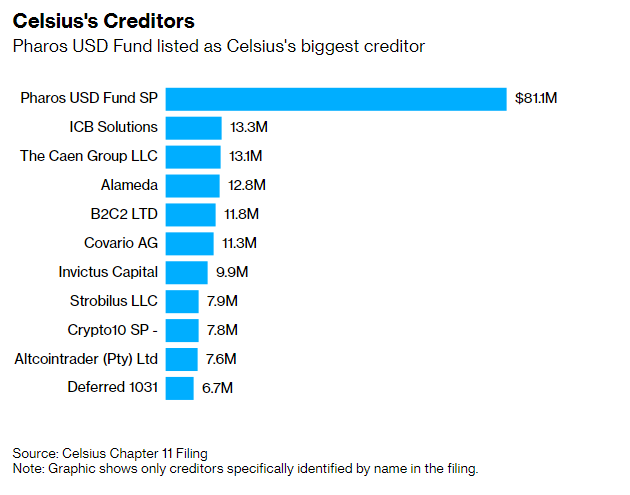

On November 2nd, Coindesk then published an overview of Alameda's assets, which suggested that Alameda could be insolvent:

coindesk.com

November 2nd:

On November 2nd, Coindesk then published an overview of Alameda's assets, which suggested that Alameda could be insolvent:

coindesk.com

14/82

We learned then, that Alameda had over $8b of loans on their books, that was primarily backed by their $FTT token - something that no sophisticated lending desk (the type that would have $8b to spare) would ever allow.

Except perhaps FTX...

We learned then, that Alameda had over $8b of loans on their books, that was primarily backed by their $FTT token - something that no sophisticated lending desk (the type that would have $8b to spare) would ever allow.

Except perhaps FTX...

15/82

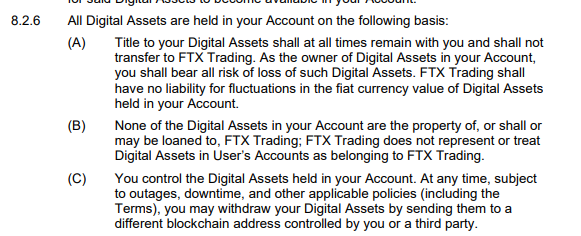

This is when we became alarmed.

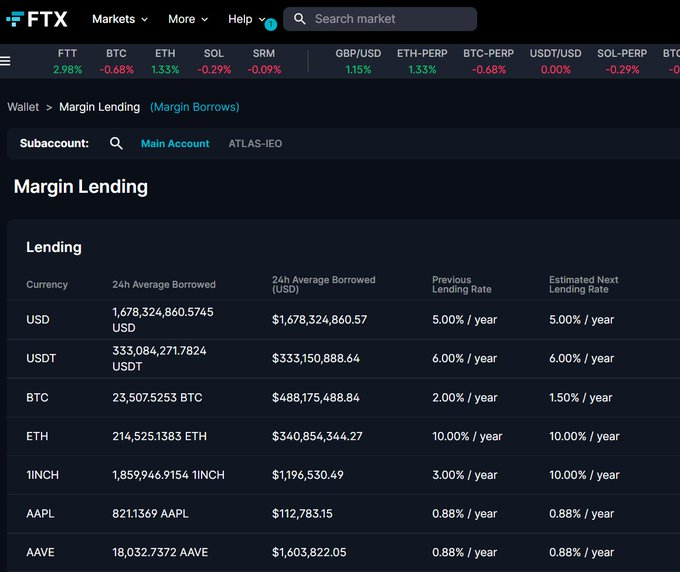

You see unlike a bank, a crypto exchange isn't authorized to simply lend all your assets, unless its outlined in their terms of service, or unless you opt-in to a specific lending product.

This is when we became alarmed.

You see unlike a bank, a crypto exchange isn't authorized to simply lend all your assets, unless its outlined in their terms of service, or unless you opt-in to a specific lending product.

18/82

FTX also had an "Earn" program through the old Blockfolio app but it was later confirmed by head of sales @tackettzane that (at least as far as FTX employees were told) these funds came from marketing dollars and not lending.

FTX also had an "Earn" program through the old Blockfolio app but it was later confirmed by head of sales @tackettzane that (at least as far as FTX employees were told) these funds came from marketing dollars and not lending.

19/82

Since historical snapshots of FTX's balance on November 3rd showed only about $3B in assets, of which $1.4B was their own token, this suggested two possibilities:

-FTX had an undocumented "cold wallet" somewhere

-FTX was illegally lending (stealing) user assets.

Since historical snapshots of FTX's balance on November 3rd showed only about $3B in assets, of which $1.4B was their own token, this suggested two possibilities:

-FTX had an undocumented "cold wallet" somewhere

-FTX was illegally lending (stealing) user assets.

20/82

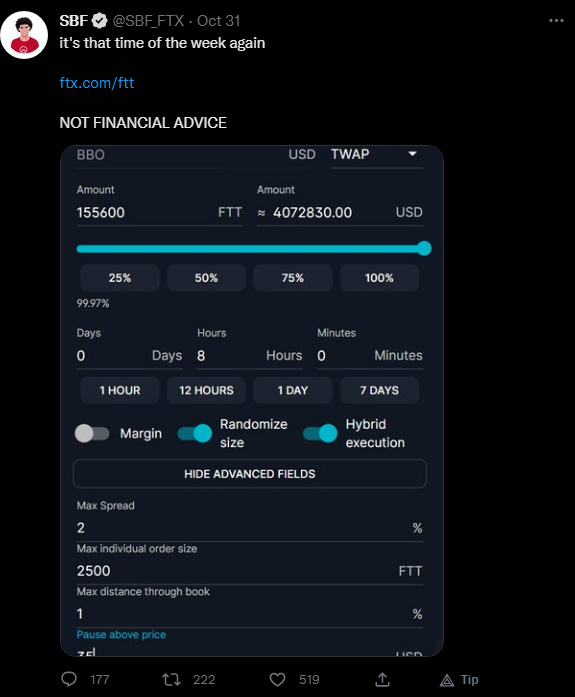

Given I had seen lots of large FTT transaction sold over the counter (peer to peer rather than on exchange) the past few weeks, I figured FTX was trying to cover up a hole:

Given I had seen lots of large FTT transaction sold over the counter (peer to peer rather than on exchange) the past few weeks, I figured FTX was trying to cover up a hole:

21/82

That was when Binance moved their $583M of FTT left over from their investment in FTX.

The next morning CZ made a rare announcement of their intent to sell their FTT:

That was when Binance moved their $583M of FTT left over from their investment in FTX.

The next morning CZ made a rare announcement of their intent to sell their FTT:

22/82

He noted irregularities among FTX.

While I had suspected a small gap in finances, this seemed like something much larger.

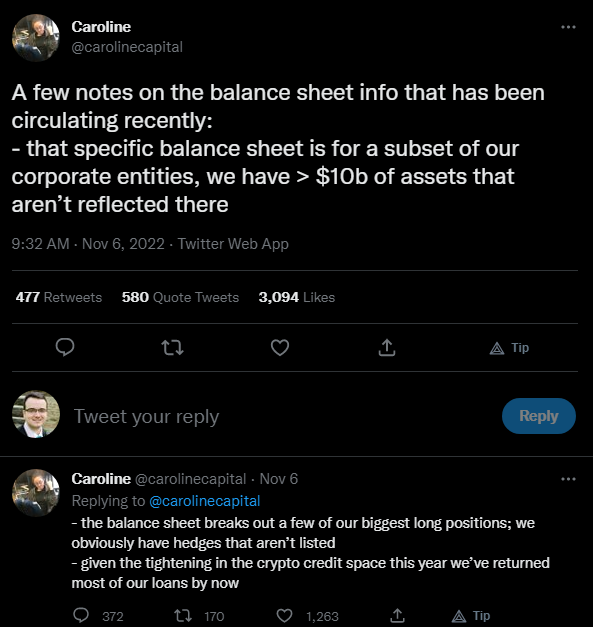

Which was suddenly confirmed when Alameda CEO Caroline broke he silence about finances, and offered to buy out the remaining FTT

He noted irregularities among FTX.

While I had suspected a small gap in finances, this seemed like something much larger.

Which was suddenly confirmed when Alameda CEO Caroline broke he silence about finances, and offered to buy out the remaining FTT

23/82

It was an odd choice for her to publicly name a price and odd for Alameda to care about the specific price.

It was this moment that set off tons of onchain sleuthing.

It was an odd choice for her to publicly name a price and odd for Alameda to care about the specific price.

It was this moment that set off tons of onchain sleuthing.

24/82

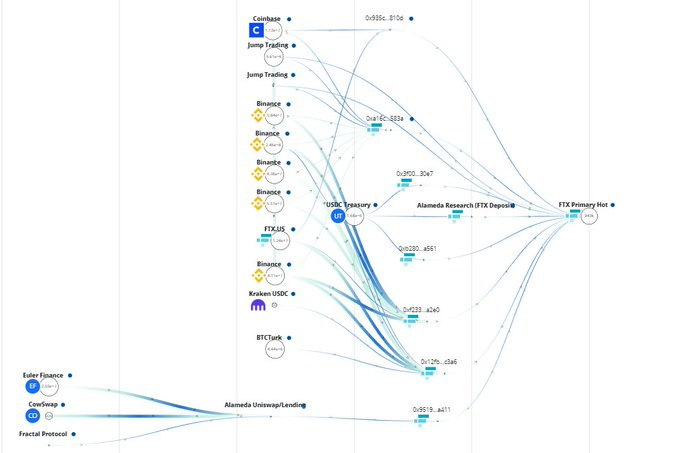

As withdrawals picked up on FTX's exchange - we noticed that Alameda's wallets started pulling stablecoins from everywhere to refill the FTX hot wallet:

As withdrawals picked up on FTX's exchange - we noticed that Alameda's wallets started pulling stablecoins from everywhere to refill the FTX hot wallet:

26/82

This meant there should have been no external funds needed in order to withdraw, as you retain title to your assets.

The balances that you see reported in FTX should remain in 1:1 in their possession at all times.

This meant there should have been no external funds needed in order to withdraw, as you retain title to your assets.

The balances that you see reported in FTX should remain in 1:1 in their possession at all times.

27/82

The one exception to that is USD, where they treat fiat (money in a bank account) and USDT, USDC, USDP and other stablecoins as one singular balance across all chains, meaning sometimes they have to trade them with market makers like Alameda to give you the one you request

The one exception to that is USD, where they treat fiat (money in a bank account) and USDT, USDC, USDP and other stablecoins as one singular balance across all chains, meaning sometimes they have to trade them with market makers like Alameda to give you the one you request

28/82

On the 6th, FTX claimed that was what was slowing their deposits, and why stablecoin balances were only being refilled by Alameda and not by a cold wallet used to store user assets.

But then the balances of ETH began to get low as well:

On the 6th, FTX claimed that was what was slowing their deposits, and why stablecoin balances were only being refilled by Alameda and not by a cold wallet used to store user assets.

But then the balances of ETH began to get low as well:

29/82

As that happened, people began to be concerned about their other balances and to withdraw their spot tokens from the exchange.

Which once again, should have always been 1:1 because users could only lose them if they opted-in to lending.

As that happened, people began to be concerned about their other balances and to withdraw their spot tokens from the exchange.

Which once again, should have always been 1:1 because users could only lose them if they opted-in to lending.

32/82

But as asset balances grew lower on the exchanges hot wallets, and users waited for an unidentified cold wallet to refill the balances - no such refill came.

But as asset balances grew lower on the exchanges hot wallets, and users waited for an unidentified cold wallet to refill the balances - no such refill came.

33/82

I then mapped out every wallet I could find of Alameda and FTX with transaction history going back multiple years

I then mapped out every wallet I could find of Alameda and FTX with transaction history going back multiple years

36/82

The $550M that Alameda claimed to have in order to be able to buyout the remaining Binance FTT had failed to hold the price.

How could a team who claimed to have $24B in assets, and an exchange with $10B+ in supposed user assets not complete their purchase?

The $550M that Alameda claimed to have in order to be able to buyout the remaining Binance FTT had failed to hold the price.

How could a team who claimed to have $24B in assets, and an exchange with $10B+ in supposed user assets not complete their purchase?

37/82

This is where the broader market began to become extremely concerned. It was clear something was wrong - and yet, still none of us realized how bad.

This is where the broader market began to become extremely concerned. It was clear something was wrong - and yet, still none of us realized how bad.

38/82

On an asset per asset basis, sometime on the night of November the 7th, FTX stopped processing withdrawals of many assets.

Users balances were entirely stuck.

On an asset per asset basis, sometime on the night of November the 7th, FTX stopped processing withdrawals of many assets.

Users balances were entirely stuck.

41/82

We were in shock.

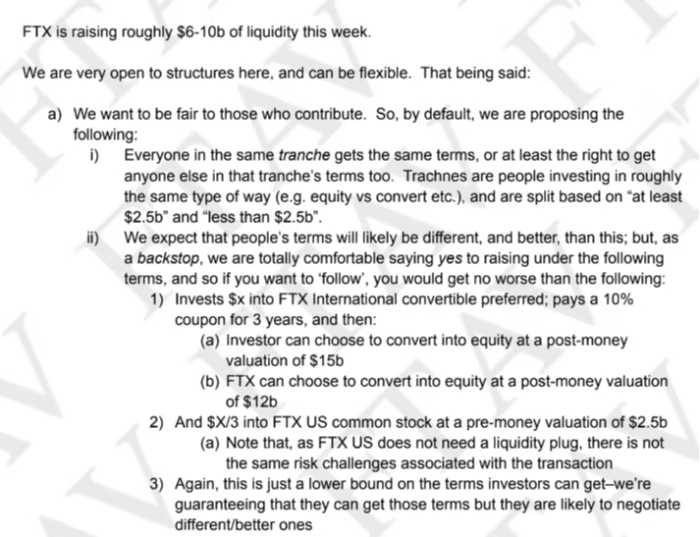

Just the day prior, both FTX and Sam had claimed the exchange and Alameda to be entirely solvent; and yet there was a full buyout on the table.

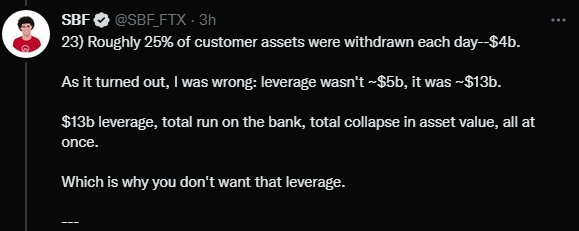

It came to light that they did have a hole somewhere between $5b-$10b in missing assets.

We were in shock.

Just the day prior, both FTX and Sam had claimed the exchange and Alameda to be entirely solvent; and yet there was a full buyout on the table.

It came to light that they did have a hole somewhere between $5b-$10b in missing assets.

42/82

After not more than a day, Binance pulled out of the deal, citing too many issues with regulation and the misuse of user funds.

One of the first confirmations that something illegal had been done.

After not more than a day, Binance pulled out of the deal, citing too many issues with regulation and the misuse of user funds.

One of the first confirmations that something illegal had been done.

43/82

Something that both Reuters and TheBlock were able to confirm on November 12th.

That SBF had built a secret 'back door' to lend Alameda user funds without it appearing in the FTX logs.

theblock.co

Something that both Reuters and TheBlock were able to confirm on November 12th.

That SBF had built a secret 'back door' to lend Alameda user funds without it appearing in the FTX logs.

theblock.co

44/82

Meanwhile, during the silence, Alameda continued to make bizarre onchain trades and bets, using funds that they now knew would be clawed back in bankruptcy proceedings.

There was a rare silence from Sam.

Meanwhile, during the silence, Alameda continued to make bizarre onchain trades and bets, using funds that they now knew would be clawed back in bankruptcy proceedings.

There was a rare silence from Sam.

45/82

During this time, Sam spoke to media outlets, letting them know he was "putting together funding" and claimed commitments from sources like Tether.

Which Tether, and all other entities denied instantly, while Sam continued to lie.

During this time, Sam spoke to media outlets, letting them know he was "putting together funding" and claimed commitments from sources like Tether.

Which Tether, and all other entities denied instantly, while Sam continued to lie.

46/82

Alameda's trading efforts only came to an end after Tether was required to freeze Alameda and FTX's balances at the request of law enforcement agencies

Alameda's trading efforts only came to an end after Tether was required to freeze Alameda and FTX's balances at the request of law enforcement agencies

49/82

SBF claimed he was set to work with the team to help put things right for customers.

But, as confirmed by an insider - after stepping down Sam went and did his own thing leaving others to pick up the mess.

SBF claimed he was set to work with the team to help put things right for customers.

But, as confirmed by an insider - after stepping down Sam went and did his own thing leaving others to pick up the mess.

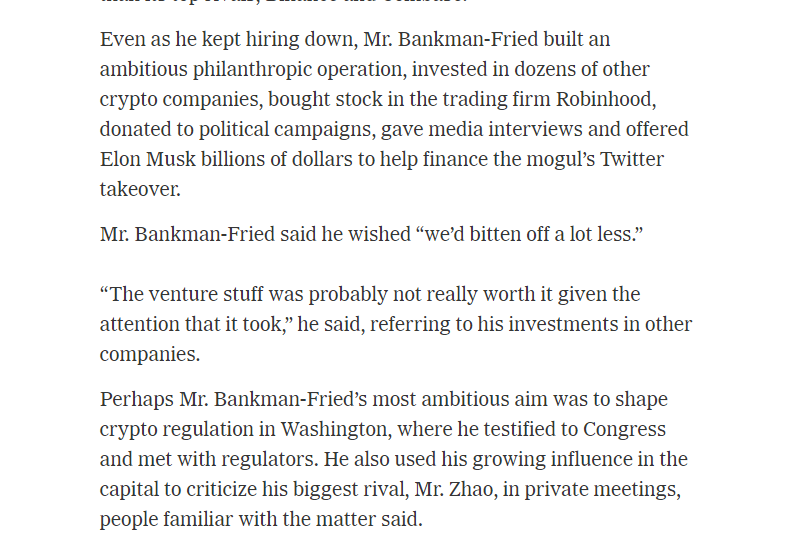

50/82

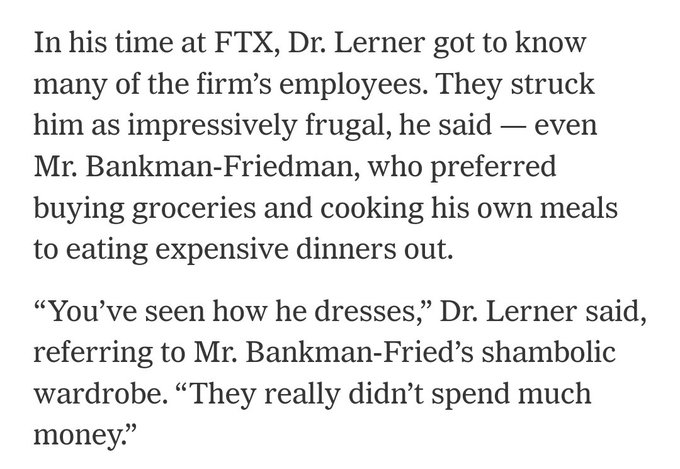

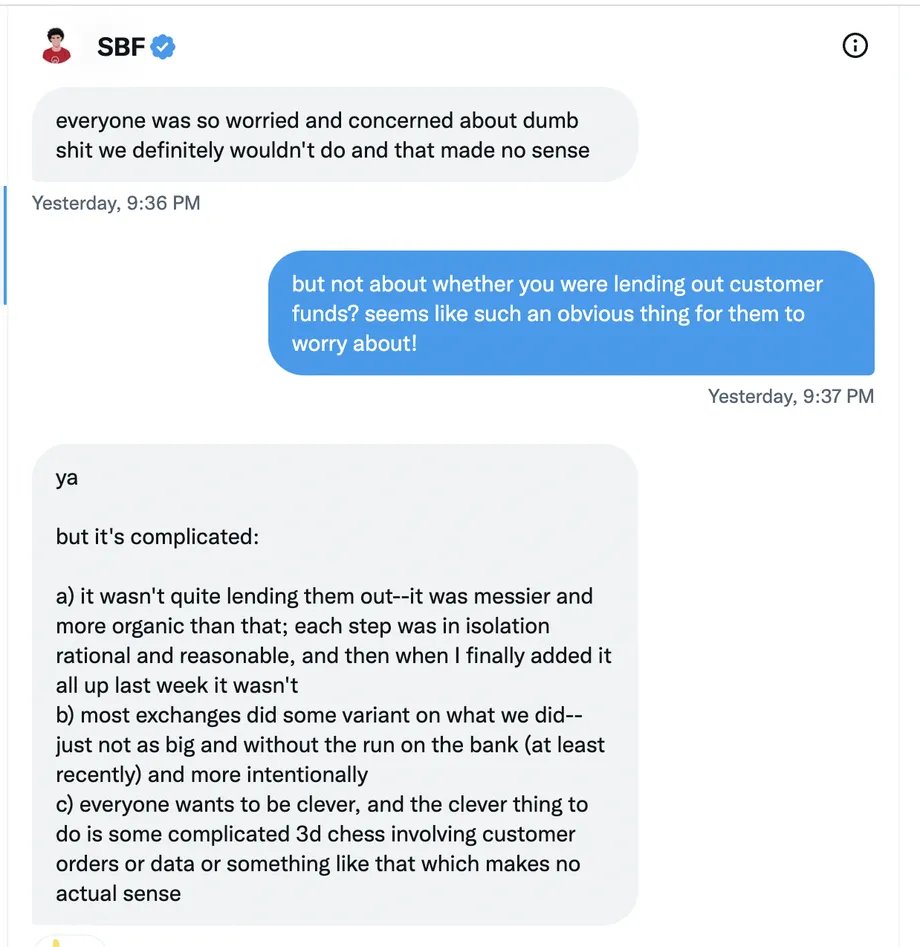

Over the next few days, Sam worked hard to get friendly media pieces written about him. Framing this blow up as "a mistake", that "they grew to big", that he was an "honest and humble" person and that this was the fault of "bad accounting" and a "rival"

Over the next few days, Sam worked hard to get friendly media pieces written about him. Framing this blow up as "a mistake", that "they grew to big", that he was an "honest and humble" person and that this was the fault of "bad accounting" and a "rival"

53/82

From putting their face on billboards, naming sports teams, buying up $30M luxury condos, building a giant office in the shape of their logo, and hiring 24/7 kitchen staff - the team was anything but frugal.

But that didn't stop this media ground game.

From putting their face on billboards, naming sports teams, buying up $30M luxury condos, building a giant office in the shape of their logo, and hiring 24/7 kitchen staff - the team was anything but frugal.

But that didn't stop this media ground game.

54/82

The goal was clear.

Paint SBF as a good kid, who fumbled a business that was growing too fast, when a rival attacked him.

Rather than a criminal who didn't care about taking risks with users money.

The goal was clear.

Paint SBF as a good kid, who fumbled a business that was growing too fast, when a rival attacked him.

Rather than a criminal who didn't care about taking risks with users money.

55/82

Then, that night, something odd happened at FTX.

The remaining wallets were hacked and user balances on the exchange were set to zero.

An update to the app was pushed containing possible spyware, but never confirmed.

Then, that night, something odd happened at FTX.

The remaining wallets were hacked and user balances on the exchange were set to zero.

An update to the app was pushed containing possible spyware, but never confirmed.

56/82

General Counsel Ryne Miller tweeted confirming that these withdrawals were unauthorized. That someone had walked away with more than $400M in remaining assets. Something you could only do if you had extensive system access at the highest levels.

General Counsel Ryne Miller tweeted confirming that these withdrawals were unauthorized. That someone had walked away with more than $400M in remaining assets. Something you could only do if you had extensive system access at the highest levels.

57/82

To this date (November 16th) FTX has not yet verified who is in possession of these assets or how they obtained access to them.

The hacker continues to access and swap these assets on chain.

To this date (November 16th) FTX has not yet verified who is in possession of these assets or how they obtained access to them.

The hacker continues to access and swap these assets on chain.

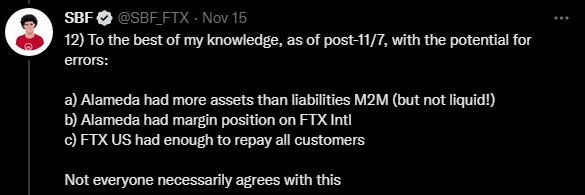

61/82

This meant simply that he was claiming that the $10B hole was created between November 7th and the point of bankruptcy.

But unlike centralized exchanges, blockchains keep incredible records that allow us to go back and validate this.

This meant simply that he was claiming that the $10B hole was created between November 7th and the point of bankruptcy.

But unlike centralized exchanges, blockchains keep incredible records that allow us to go back and validate this.

62/82

The data in fact shows how much FTX held prior to the 'bank run' they claim - and it was insufficient amounts to cover user deposits.

The data in fact shows how much FTX held prior to the 'bank run' they claim - and it was insufficient amounts to cover user deposits.

64/82

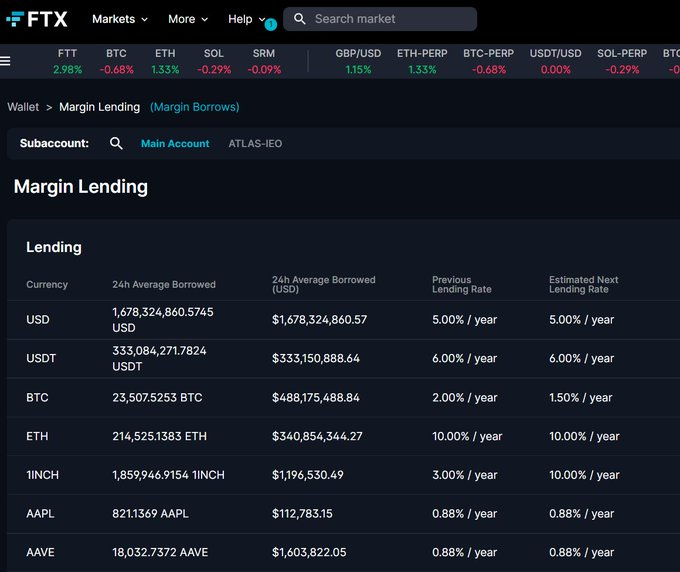

But, exchanges have coded rules in place.

Debt requires you to place collateral to take on leverage, and that leverage maxes out at 20x.

The debt also comes from somewhere, in the case of FTX it comes from their lending market, or Alameda backstopping.

But, exchanges have coded rules in place.

Debt requires you to place collateral to take on leverage, and that leverage maxes out at 20x.

The debt also comes from somewhere, in the case of FTX it comes from their lending market, or Alameda backstopping.

66/82

That $7B would also need around $1.4B in collateral to be borrowed against.

If that was the case, that also means that there was less than $1.5B in user assets in the exchange, despite them owing more than $10B in assets to users.

That $7B would also need around $1.4B in collateral to be borrowed against.

If that was the case, that also means that there was less than $1.5B in user assets in the exchange, despite them owing more than $10B in assets to users.

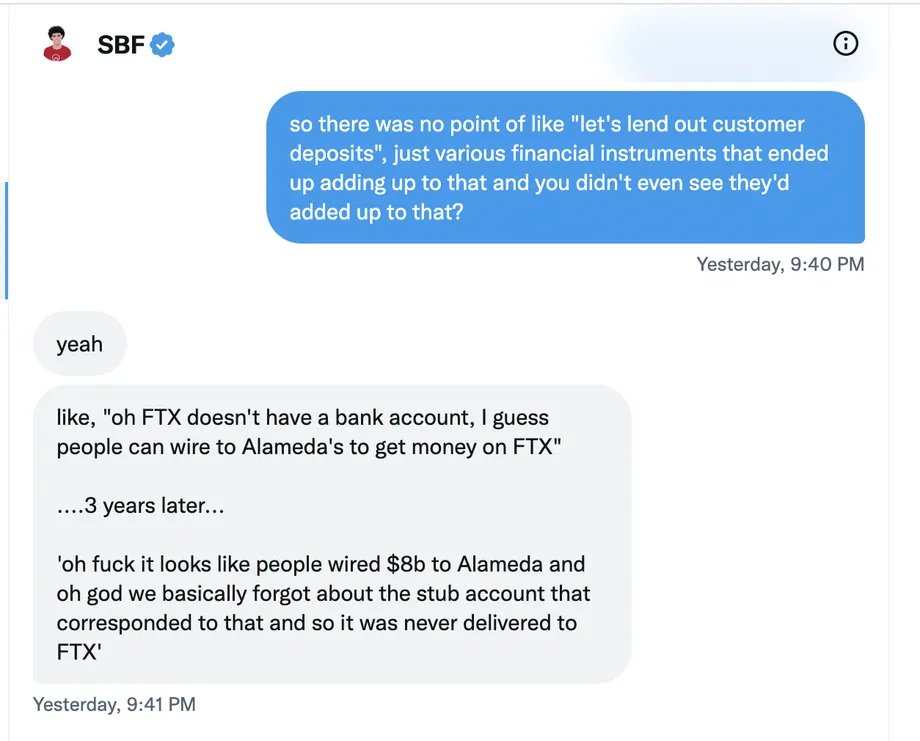

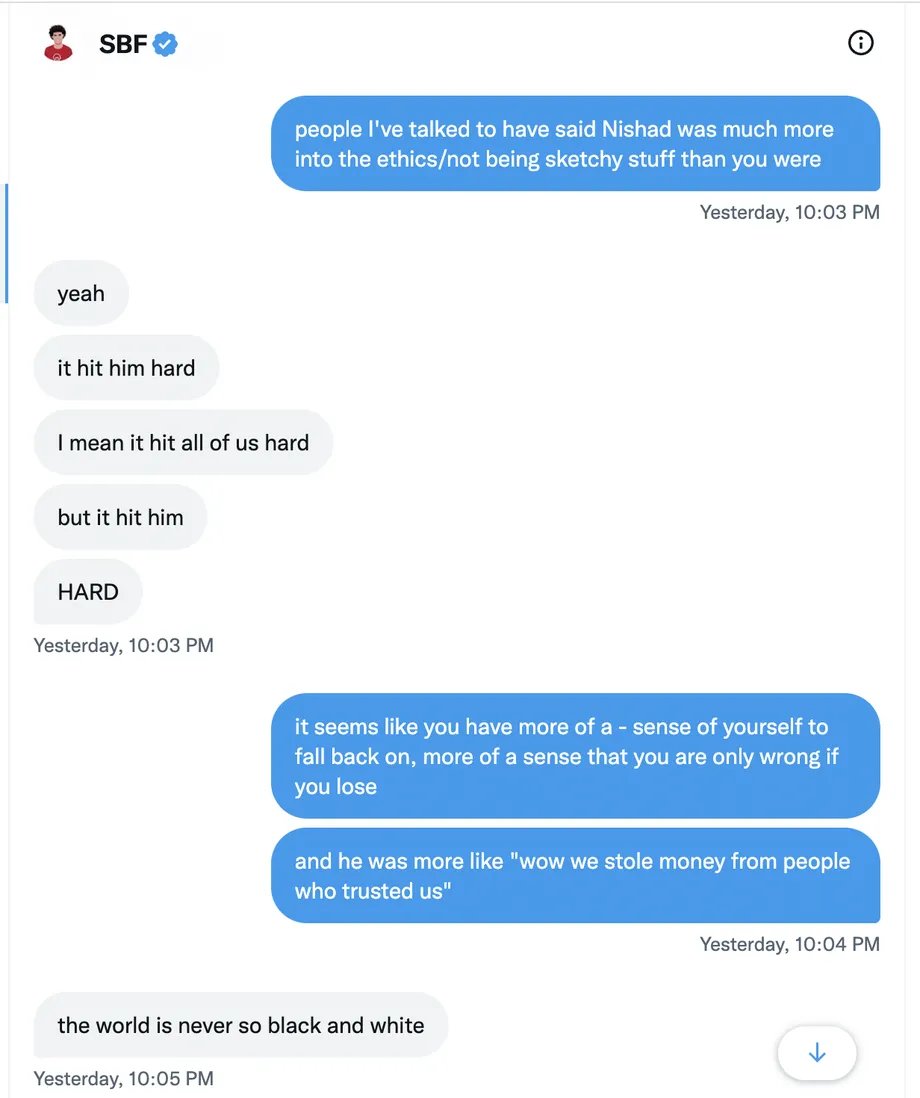

74/82

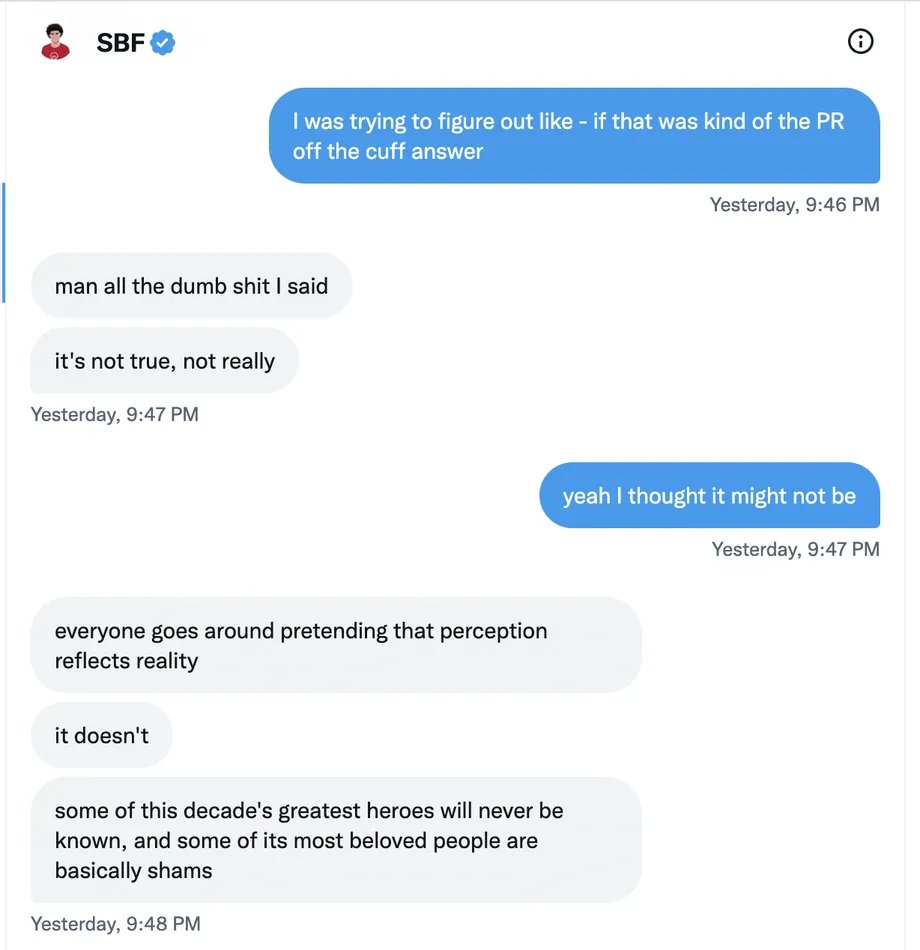

He doesn't care about users.

He flat out said, it isn't so black or white.

He doesn't care that he stole funds from people who trusted him.

He doesn't even care that he stole.

He doesn't care about users.

He flat out said, it isn't so black or white.

He doesn't care that he stole funds from people who trusted him.

He doesn't even care that he stole.

75/82

To him, this is some sort of perverse maximalist utilitarianism, where his actions are justified by the fact he was gambling big, and that others do similar things.

He'll just tell you out loud he stole.

To him, this is some sort of perverse maximalist utilitarianism, where his actions are justified by the fact he was gambling big, and that others do similar things.

He'll just tell you out loud he stole.

76/82

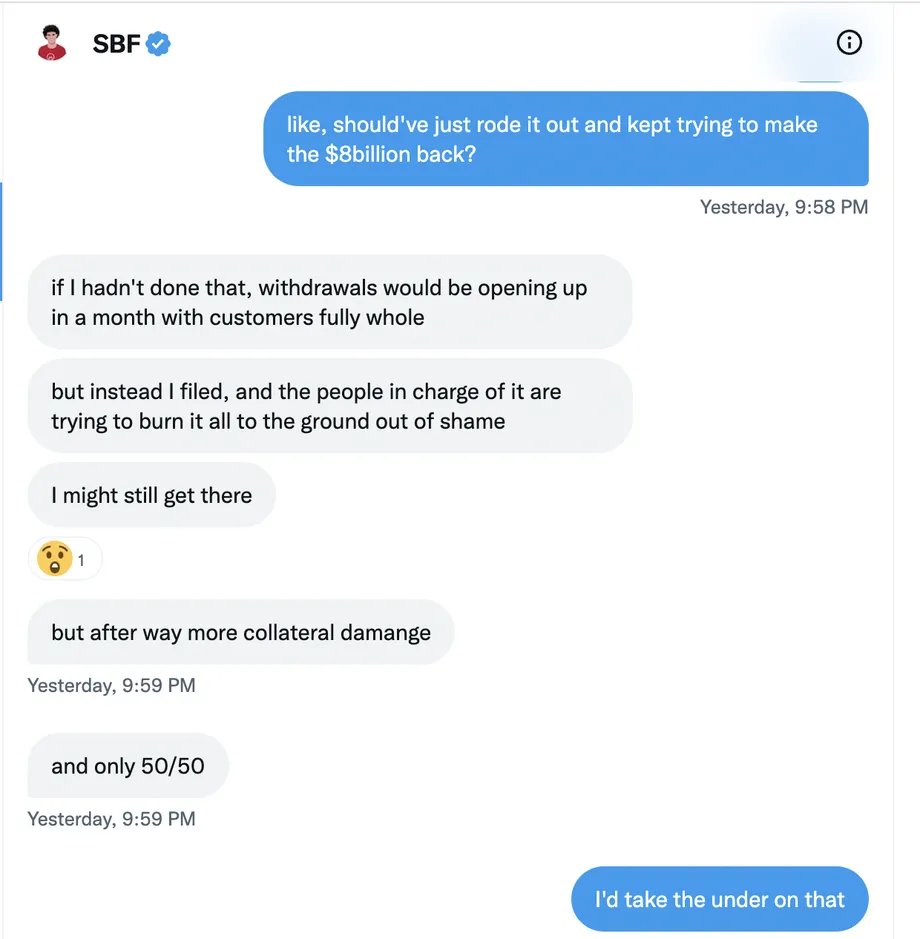

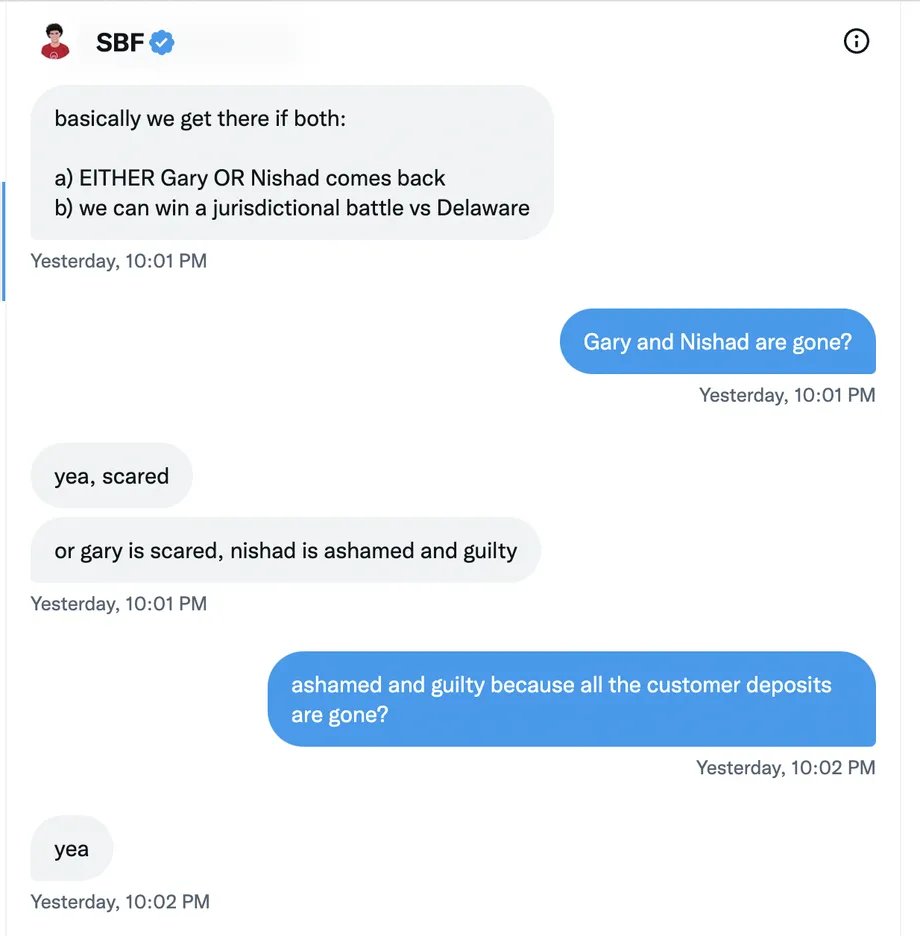

Meanwhile hundreds of people are hard at work, trying to guide the company through Chapter 11 and get as many dollars for the estate as possible to pay back creditors.

In the eyes of SBF, he blames his other founders.

It's their fault for caring.

Meanwhile hundreds of people are hard at work, trying to guide the company through Chapter 11 and get as many dollars for the estate as possible to pay back creditors.

In the eyes of SBF, he blames his other founders.

It's their fault for caring.

77/82

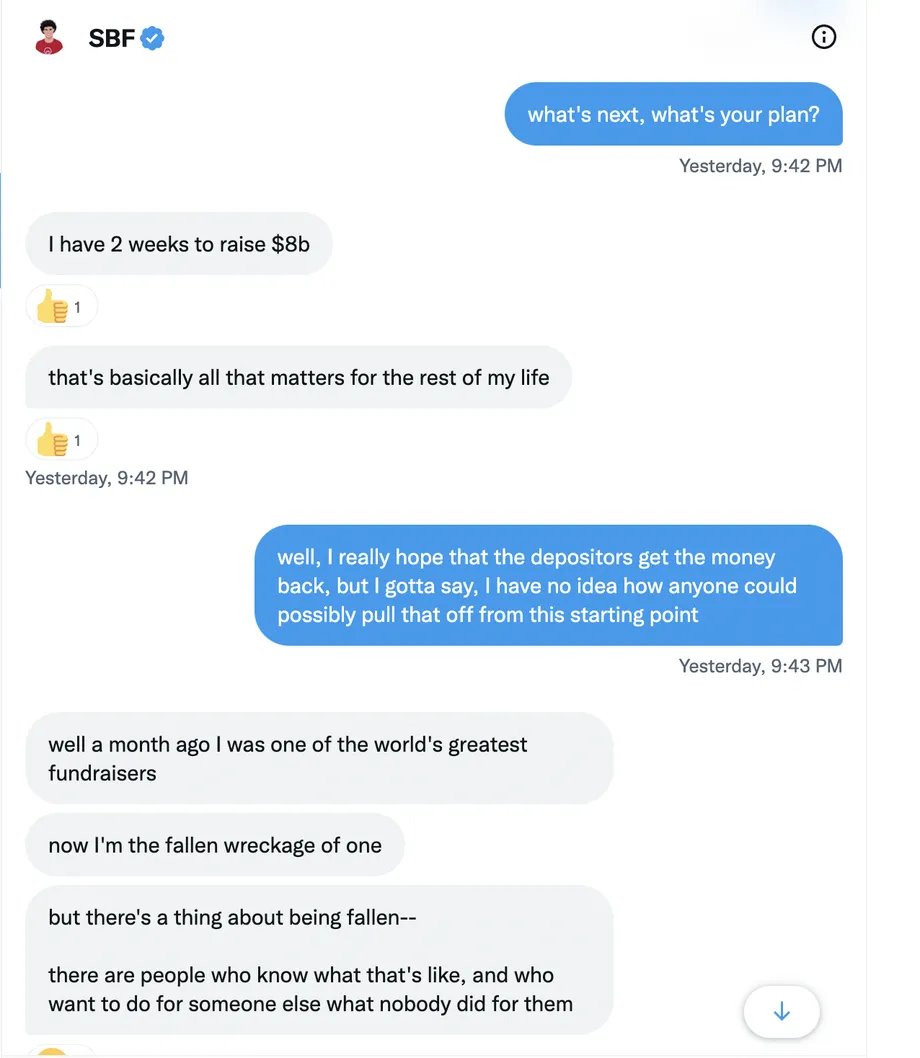

Meanwhile, he is focused on a media apology tour, to keep a clean enough brand to raise $8B.

Not for you.

For him.

So he can do it all again - and not go to jail.

Meanwhile, he is focused on a media apology tour, to keep a clean enough brand to raise $8B.

Not for you.

For him.

So he can do it all again - and not go to jail.

78/82

He lied to all of us, to our faces, right up until the bitter end of the exchange.

He tweeted lies and platitudes, and continued to change his story.

He slings arrows at "rivals" and cofounders, blaming them for his down fall.

He lied to all of us, to our faces, right up until the bitter end of the exchange.

He tweeted lies and platitudes, and continued to change his story.

He slings arrows at "rivals" and cofounders, blaming them for his down fall.

79/82

And I'm sure he will seek to discredit his critics, and continue to build a pristine image of himself along with the media to continue on the delusional quest of raising $8B.

We can't believe a single thing that he says at this point.

And I'm sure he will seek to discredit his critics, and continue to build a pristine image of himself along with the media to continue on the delusional quest of raising $8B.

We can't believe a single thing that he says at this point.

80/82

The scope of this illusion and fraud make the works of P. T. Barnum seem like an honest and ethical broker.

While I'm sure this story isn't over in its unraveling, I hope its over for him.

The scope of this illusion and fraud make the works of P. T. Barnum seem like an honest and ethical broker.

While I'm sure this story isn't over in its unraveling, I hope its over for him.

81/82

This is a man who lied to us, viewed it all as a game, thought of us as pieces on the chessboard, and continues to play the game, thinking he is above the ethics and the law.

This is a man who lied to us, viewed it all as a game, thought of us as pieces on the chessboard, and continues to play the game, thinking he is above the ethics and the law.

82/82

Make no mistake. This wasn't the actions of a caring altruist who messed up.

This was theft and fraud - with a bankruptcy that will scar this sector for a generation to come.

Decentralization and transparency matters.

That's what this industry is fighting for.

Make no mistake. This wasn't the actions of a caring altruist who messed up.

This was theft and fraud - with a bankruptcy that will scar this sector for a generation to come.

Decentralization and transparency matters.

That's what this industry is fighting for.

Loading suggestions...