Stanford University conducted a famous experiment in 2005.

They gave 41 participants $20 and asked them to make 20 rounds of $1 investing decisions based on a coin toss.

The catch - some of the participants had emotional brain damage. And they outperformed all others!🧵

They gave 41 participants $20 and asked them to make 20 rounds of $1 investing decisions based on a coin toss.

The catch - some of the participants had emotional brain damage. And they outperformed all others!🧵

In every round, the participants had two options - invest or don't invest.

If they didn't invest, they got to keep the $1 from the round.

If they invested, the researcher would take the $1 and do a coin toss - Heads they would lose the money, Tails they would get $2.5!

If they didn't invest, they got to keep the $1 from the round.

If they invested, the researcher would take the $1 and do a coin toss - Heads they would lose the money, Tails they would get $2.5!

What would you do in this situation?

Clearly, the best strategy here would be to invest in all the rounds since the expected value of each investment is $1.25.

50% probability of winning x $2.5 per winning bet = $1.25 expected value

But, the results of the experiment were stunning.

50% probability of winning x $2.5 per winning bet = $1.25 expected value

But, the results of the experiment were stunning.

The participants without any emotional brain damage invested only 58% of the time. But participants with brain damage did much better - investing 84% of the time.

Normal investors did so poorly because of how they reacted to a loss.

Normal investors did so poorly because of how they reacted to a loss.

Instead of evaluating the decision completely rationally, the emotionally sound group feared losing twice in a row.

They invested only 41% of the time after a loss.

The fear, emotional pain of recent loss, and irrational risk avoidance prevented them from maximizing returns.

They invested only 41% of the time after a loss.

The fear, emotional pain of recent loss, and irrational risk avoidance prevented them from maximizing returns.

The participants who had suffered brain damage in key emotional centers of the brain had no such fear and maintained the same betting pattern after losing the coin toss.

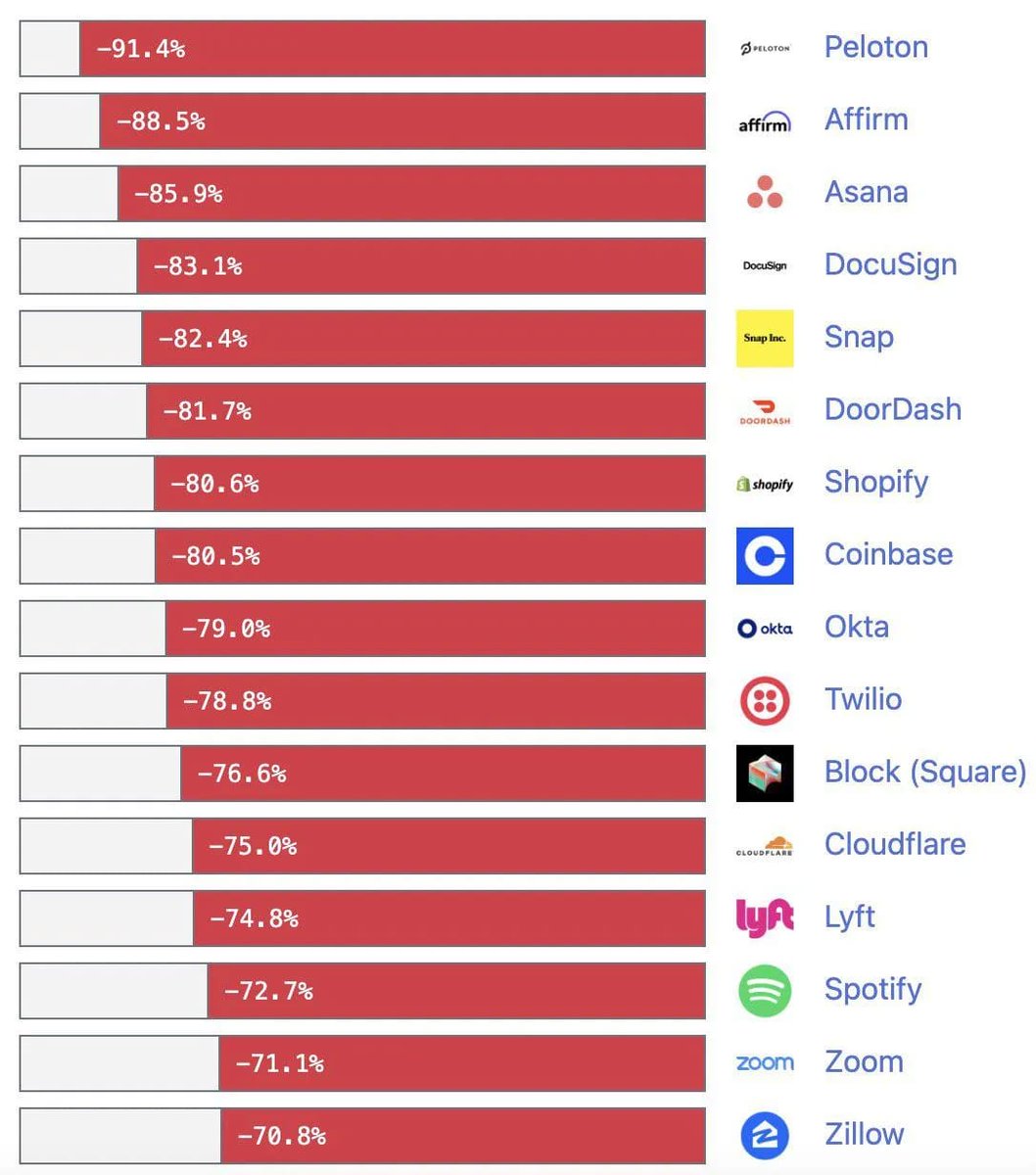

This is exactly why buying the dip does not work in real life.

This is exactly why buying the dip does not work in real life.

The best time to invest in stocks would be also the hardest time.

Think how many of us invested during the peak of the 2008 crisis or even the 2020 covid crash.

Sentiment associated with the news cycle is so negative that staying out of the market will look like the best bet.

Think how many of us invested during the peak of the 2008 crisis or even the 2020 covid crash.

Sentiment associated with the news cycle is so negative that staying out of the market will look like the best bet.

If you think you are among the select few who have the skills to identify a crash, and the temperament to see the crash through to invest at the very bottom, you will make an absolute killing in the market!

For the rest of us, DCA is the best choice.

marketsentiment.substack.com

For the rest of us, DCA is the best choice.

marketsentiment.substack.com

Follow me @mkt_sentiment for content that will make you a smarter investor.

Like and RT the first tweet if you found it insightful.

Like and RT the first tweet if you found it insightful.

Loading suggestions...