1/ Creating your own stablecoin is basically free money for the protocols.

Just allow users to borrow against their own or external positions and charge a few % annually and/or minting/repayment fee.

Just allow users to borrow against their own or external positions and charge a few % annually and/or minting/repayment fee.

2/ This is what a lot of protocols have realized and already deployed their own stablecoin or are in the process of deploying.

For example, @AaveAave has announced its own stablecoin $GHO.

For example, @AaveAave has announced its own stablecoin $GHO.

3/ Currently, there are almost $1B of stablecoins borrowed at Aave, if we assume that $GHO will take 1/5 of the Aave stablecoin market share at 2% APR, it will result in an extra $4M revenue per year.

During a bull market, the revenue can go up significantly higher.

During a bull market, the revenue can go up significantly higher.

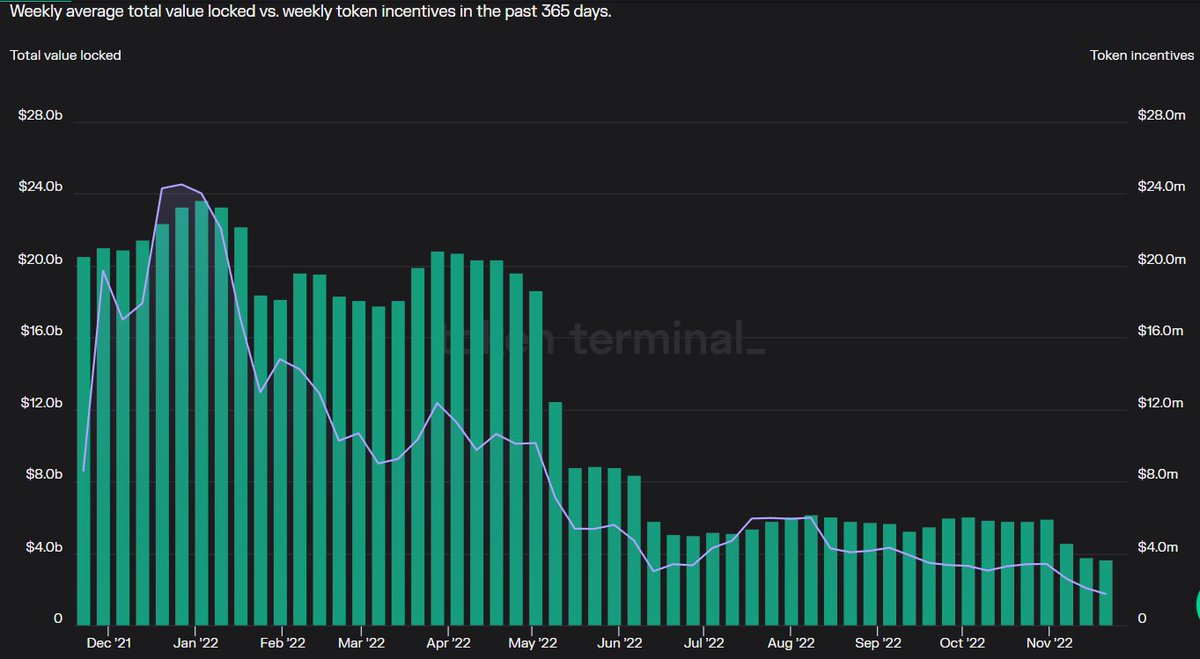

4/ But @CurveFinance didn't need another CDP stablecoin. It wouldn't change the situation when TVL is dropping with the price of $CRV.

Source: @tokenterminal

Source: @tokenterminal

5/ With less liquidity swaps become less efficient ->

-> less trading volume

-> less fees generated

-> $crv becomes less attractive

-> less TVL ... you already know what happens next.

-> less trading volume

-> less fees generated

-> $crv becomes less attractive

-> less TVL ... you already know what happens next.

6/ Curve had to solve the problems how to:

• Get more liquidity

• Increase trading volume

• Increase revenue for $veCRV

All of the goals will be accomplished with $crvUSD design.

• Get more liquidity

• Increase trading volume

• Increase revenue for $veCRV

All of the goals will be accomplished with $crvUSD design.

7/ How can $crvUSD solve these problems?

Since Whitepaper does not clarify all details there will be a few assumptions in the analysis below.

Since Whitepaper does not clarify all details there will be a few assumptions in the analysis below.

8/

• Get more liquidity

It is not clear yet against what collateral $crvUSD can be minted (looks like only ETH from the beginning), but I assume LP positions (3crv, tricrypto, etc) will also be available later.

• Get more liquidity

It is not clear yet against what collateral $crvUSD can be minted (looks like only ETH from the beginning), but I assume LP positions (3crv, tricrypto, etc) will also be available later.

9/ Introducing a CDP stablecoin with liquidation-deliquidation mechanism creates a big crypto/stable liquidity by itself.

Additionally, allowing liquidity providers to borrow against their positions will attract even more TVL to Curve liquidity pools.

Additionally, allowing liquidity providers to borrow against their positions will attract even more TVL to Curve liquidity pools.

10/

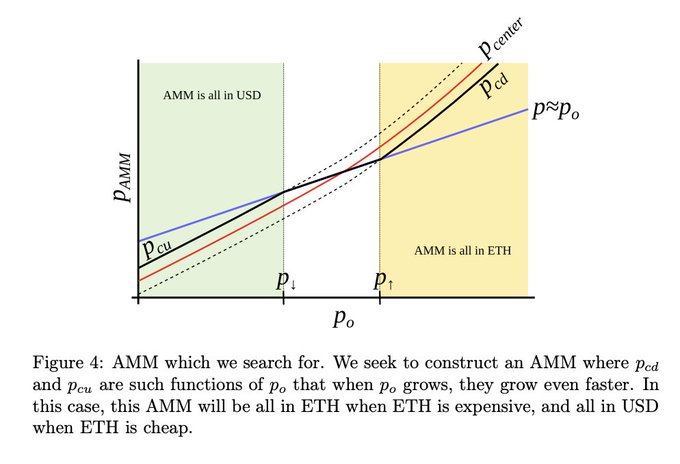

• Increase trading volume

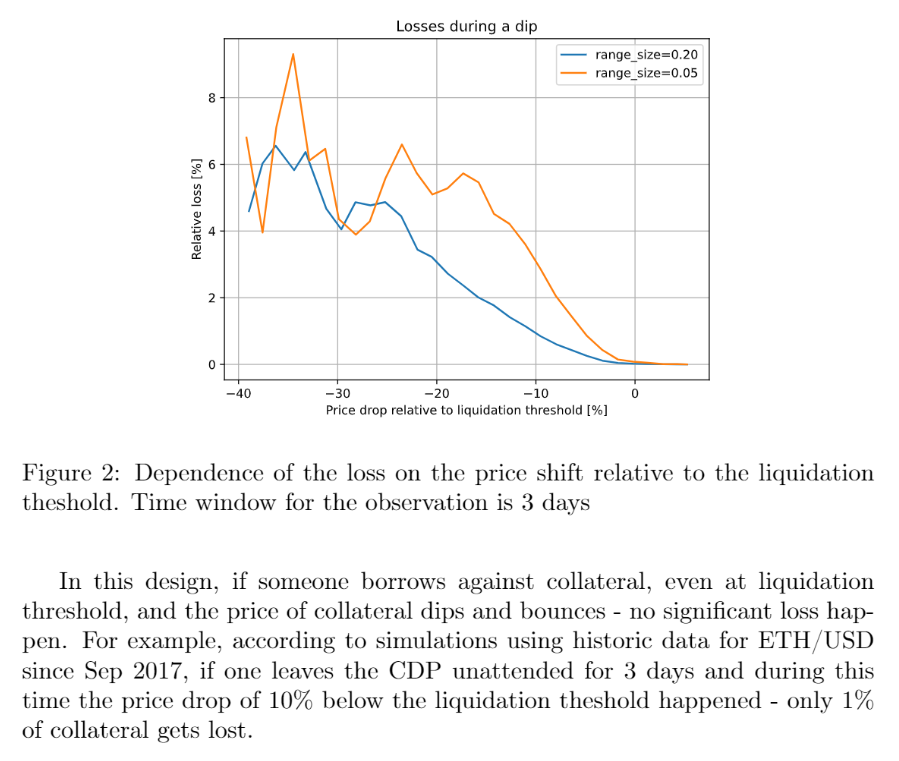

The unique lending-liquidating AMM algorithm (LLAMMA) allows users to borrow against collateral without the risk of liquidation

At the same time, constant rebalancing is increasing trading volume in the pools and fees generated.

• Increase trading volume

The unique lending-liquidating AMM algorithm (LLAMMA) allows users to borrow against collateral without the risk of liquidation

At the same time, constant rebalancing is increasing trading volume in the pools and fees generated.

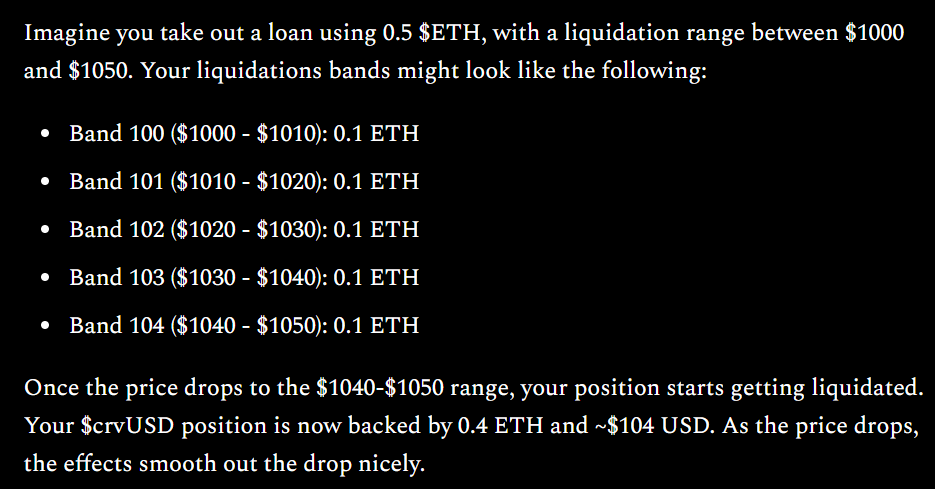

15/ It is achieved by dividing collateral price into the bands. Instead of having a specific liquidation price, your collateral has a range of liquidation prices.

Credit to @CurveCap

Credit to @CurveCap

13/ This is very different from traditional liquidation engines (aave, compound, maker, etc):

• price ⬇️ > your collateral gets sold

• price ⬆️ > you're bagholding USD at the bottom

in LLAMMA:

• price ⬇️ > your collateral gets sold

• price ⬆️ > your collateral gets bought

• price ⬇️ > your collateral gets sold

• price ⬆️ > you're bagholding USD at the bottom

in LLAMMA:

• price ⬇️ > your collateral gets sold

• price ⬆️ > your collateral gets bought

14/ However LLAMMA also has its drawbacks:

Auto-rebalancing systems are subject to permanent loss. In simple words, LLAMMA will be selling low and buying high every time when rebalancing happens.

This is a trade-off for not losing the whole collateral instead.

Auto-rebalancing systems are subject to permanent loss. In simple words, LLAMMA will be selling low and buying high every time when rebalancing happens.

This is a trade-off for not losing the whole collateral instead.

16/ As Curve is also known for high gas costs, there is another unclear question:

• How will the gas and slippage from the constant rebalancing be paid?

• How will the gas and slippage from the constant rebalancing be paid?

17/

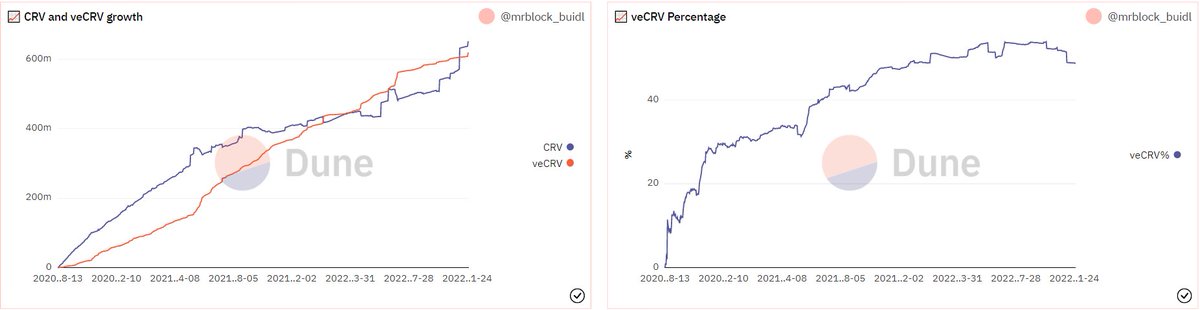

• Increase revenue for $veCRV

Curve is very dependent on $crv and it needs people to lock as much $crv as possible to reduce high selling pressure coming from ~530k $crv daily emissions.

• Increase revenue for $veCRV

Curve is very dependent on $crv and it needs people to lock as much $crv as possible to reduce high selling pressure coming from ~530k $crv daily emissions.

19/ With the introduction of crvUSD there will be new sources of fees for veCRV holders:

• crvUSD borrowing fee

• increased trading volume due to LLAMMA

• crvUSD borrowing fee

• increased trading volume due to LLAMMA

20/ In the next thread, we will go through the numbers more in-depth to understand if crvUSD can significantly increase the revenue for veCRV holders.

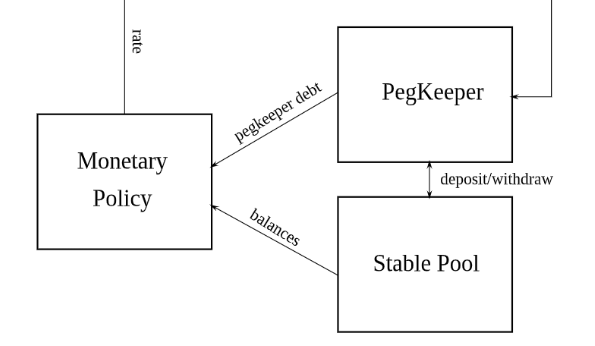

21/ Another important point is how crvUSD stabilizes its peg.

For example, LUSD is always trading above peg and there is no mechanism to satisfy demand without people minting more LUSD against ETH.

For example, LUSD is always trading above peg and there is no mechanism to satisfy demand without people minting more LUSD against ETH.

22/ While Beanstalk is expanding the supply when the peg is > 1$, but can not reduce the supply when peg is < 1$ and depends on the credit to restore the peg.

24/ This way Monetary Policy allows keeping the peg without big PSM, reliance on third-party arbitrageurs, credit, fractional reserves, etc.

25/ Conclusion

I am amazed at how @newmichwill delicately found a way not to create another stablecoin, but to create a stablecoin with a unique design that Curve truly needed.

I am amazed at how @newmichwill delicately found a way not to create another stablecoin, but to create a stablecoin with a unique design that Curve truly needed.

27/ Now it is time to wait for the deployment of crvUSD and hopefully for LP positions as collateral.

Until then you can check the first part if you have not yet.

Thank you and stay safe!

Until then you can check the first part if you have not yet.

Thank you and stay safe!

28/ That’s a wrap.

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Loading suggestions...