In this Detailed Thread 🧵 I'll Analyse Siyaram Silk Mills in Details. Each and every neeche information about Siyaram Silk will be covered in this Thread from this Business, to its Product Mix, to its Fundamentals & Financials, to its Management, to its Chart

#SiyaramSilk

#SiyaramSilk

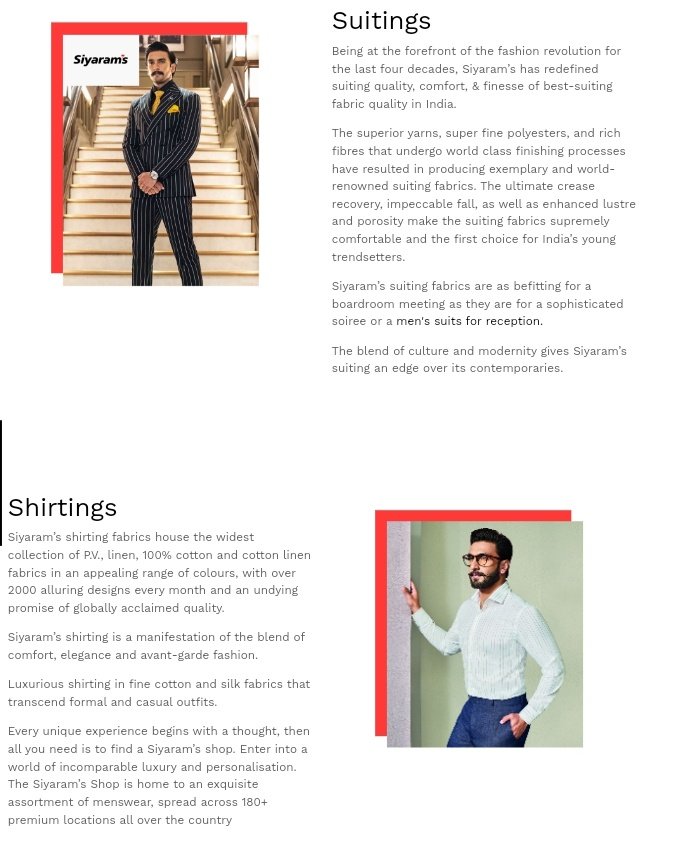

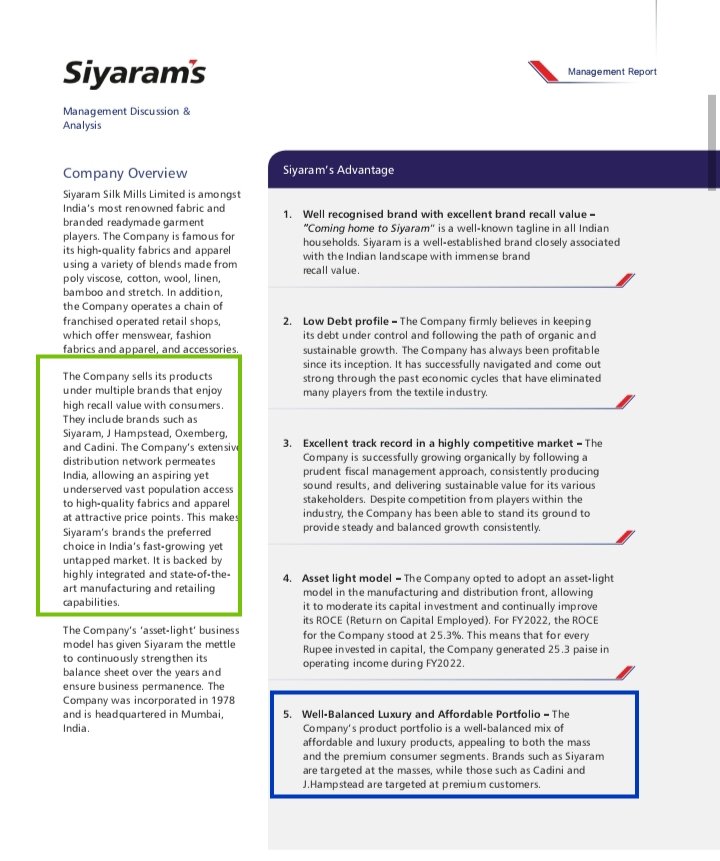

men’s wear section.

✅The Company exports to countries like Abu Dhabi, Australia, Bahrain, Bangladesh, Cambodia, Canada, etc.

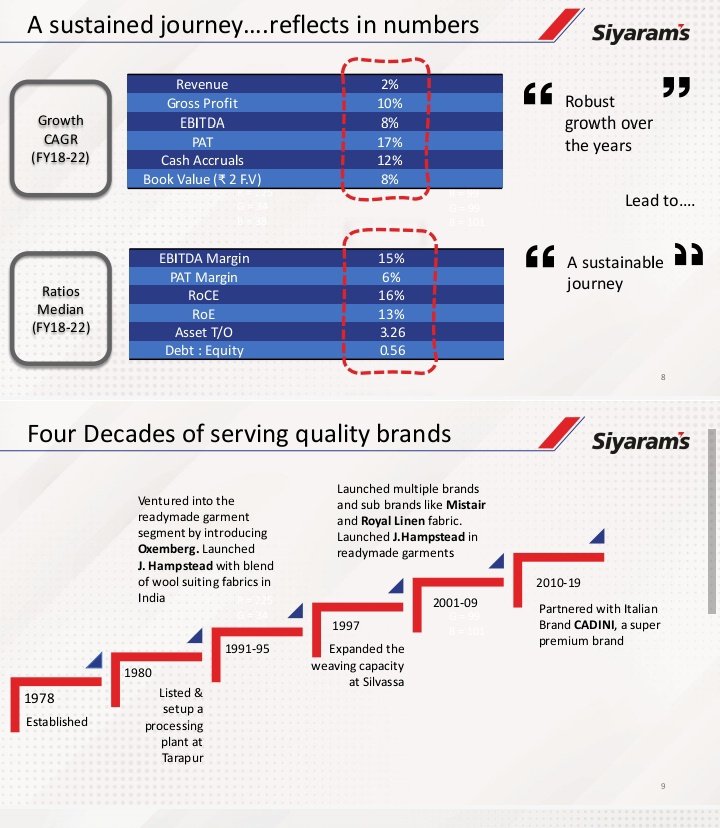

🎖️Company History

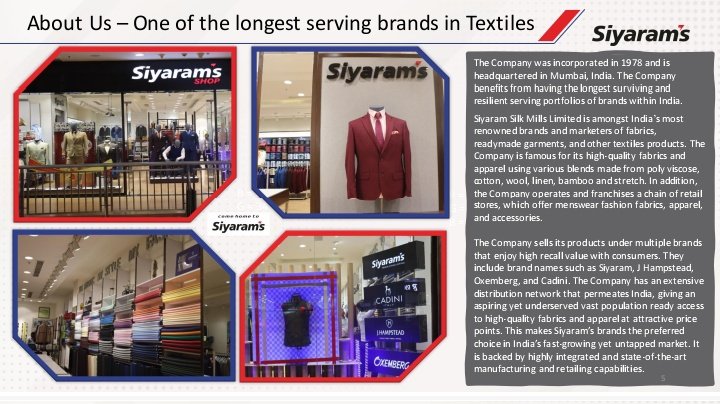

✅The Company was established in 1978 and promoted by Late Shri Dhara Prasad Poddar.

✅The Company exports to countries like Abu Dhabi, Australia, Bahrain, Bangladesh, Cambodia, Canada, etc.

🎖️Company History

✅The Company was established in 1978 and promoted by Late Shri Dhara Prasad Poddar.

✅Currently, the business is managed by his son Mr Ramesh D. Poddar as Chairman and MD.

✅In 1984, As a part of backward integration it set up a manufacturing plant for textured yarn at Patalganga, In 1991 it entered into the readymade garment segment by introducing

✅In 1984, As a part of backward integration it set up a manufacturing plant for textured yarn at Patalganga, In 1991 it entered into the readymade garment segment by introducing

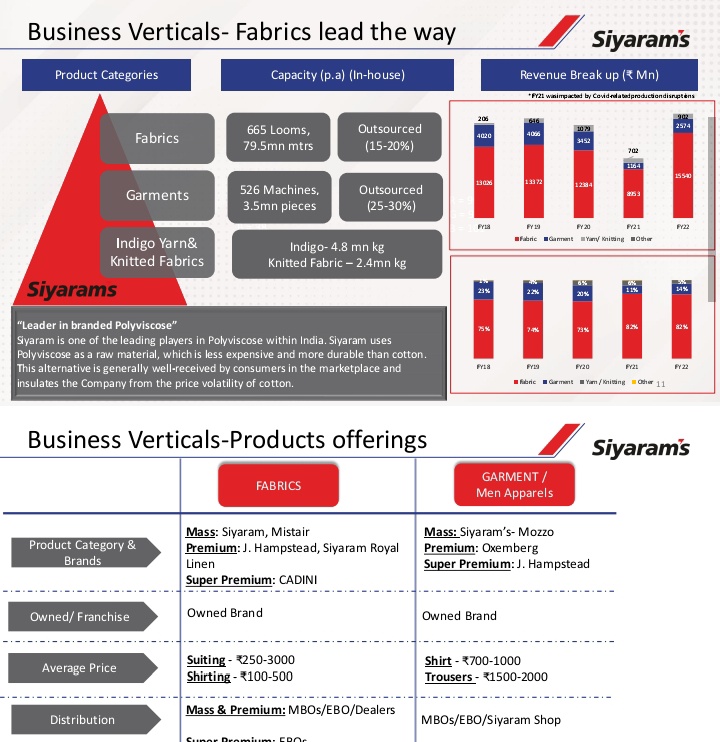

with designs including international, Regional, Ethnic, Retro.

🪙Institutional - Under this segment there is a varied range of garments, including formal wear, casual attire, corporate uniforms and home furnishing fabrics.

🪙Yarns - Poly/Viscose/Cotton Fabrics, Poly/Wool

🪙Institutional - Under this segment there is a varied range of garments, including formal wear, casual attire, corporate uniforms and home furnishing fabrics.

🪙Yarns - Poly/Viscose/Cotton Fabrics, Poly/Wool

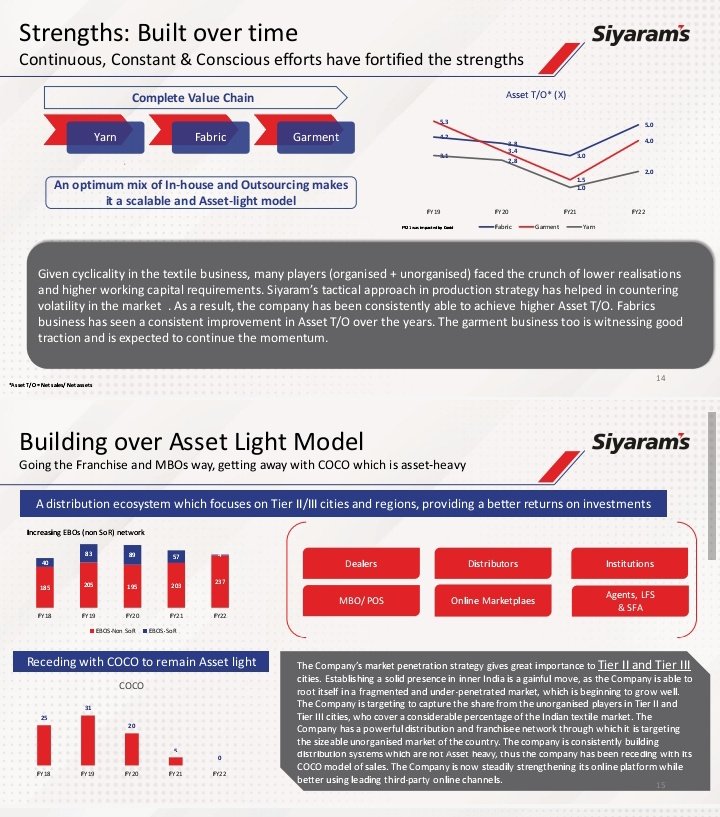

🎖️Manufacturing Facilities

✅Weaving Unit - 3 plants in Tarapur, Maharashtra and 1 in Silvassa.

✅Yarn Unit - 1 in Tarapur, Maharashtra

✅Readymade Garments Unit - 2 Plants in Daman & Diu.

Dyeing Unit - Tarapur, Maharashtra

Indigo Yarn Dyeing - Amravati, Maharashtra.

✅Weaving Unit - 3 plants in Tarapur, Maharashtra and 1 in Silvassa.

✅Yarn Unit - 1 in Tarapur, Maharashtra

✅Readymade Garments Unit - 2 Plants in Daman & Diu.

Dyeing Unit - Tarapur, Maharashtra

Indigo Yarn Dyeing - Amravati, Maharashtra.

🎖️Fundamental Analysis

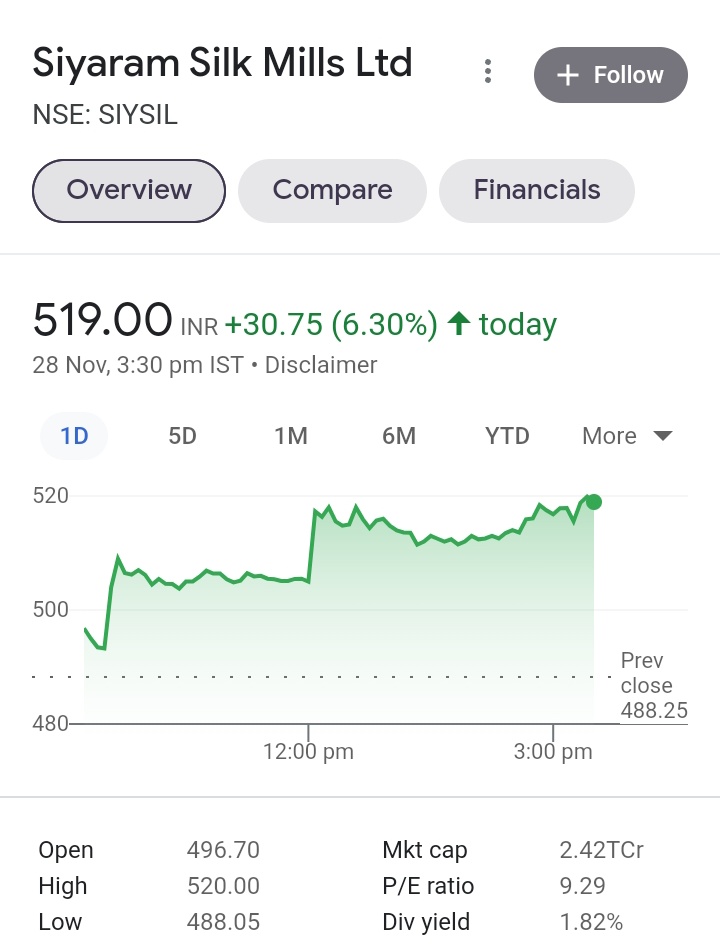

✅Market Cap:- Rs 2427 Cr

✅Stock PE:- 9.27(Undervalued)

✅Industry PE:- 15

✅Book Value:- Rs 221

✅Intrinsic Value:- Rs 437

✅Graham No:- Rs 523

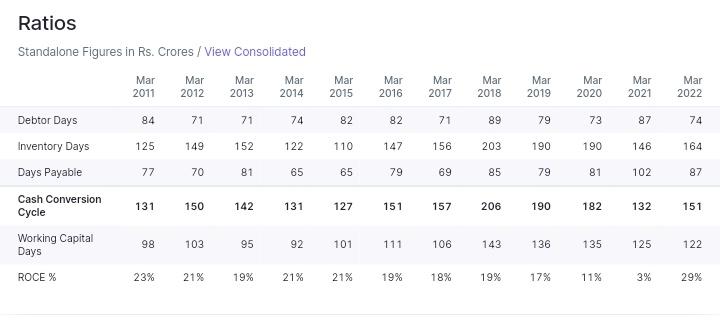

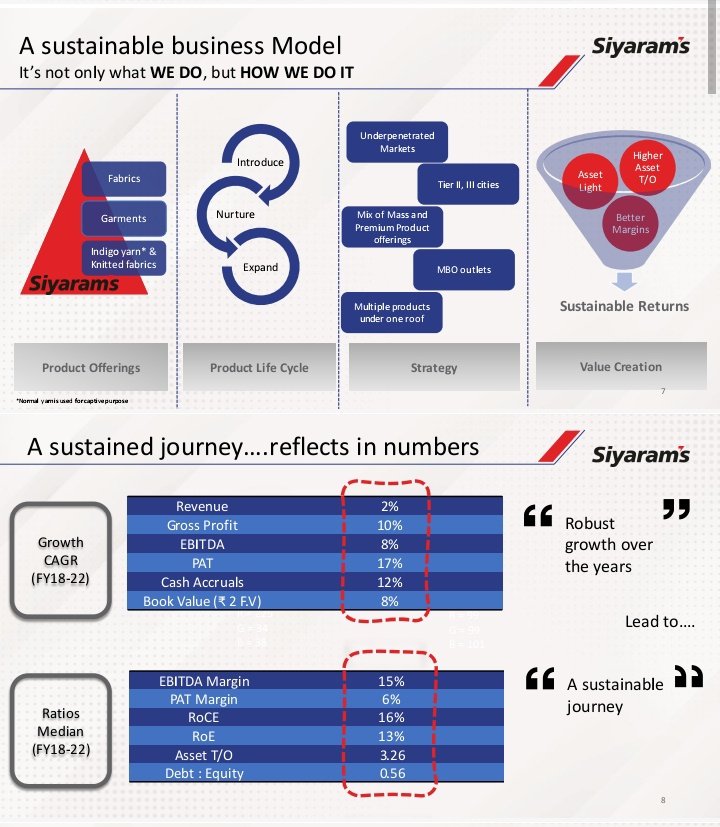

✅ROCE:- 29.2%

✅ROE:- 24.7%

✅Dividend Yield:- 1.78%

✅Debt to Equity:- 0.24

✅Reserves:- Rs 1025 Cr

✅Market Cap:- Rs 2427 Cr

✅Stock PE:- 9.27(Undervalued)

✅Industry PE:- 15

✅Book Value:- Rs 221

✅Intrinsic Value:- Rs 437

✅Graham No:- Rs 523

✅ROCE:- 29.2%

✅ROE:- 24.7%

✅Dividend Yield:- 1.78%

✅Debt to Equity:- 0.24

✅Reserves:- Rs 1025 Cr

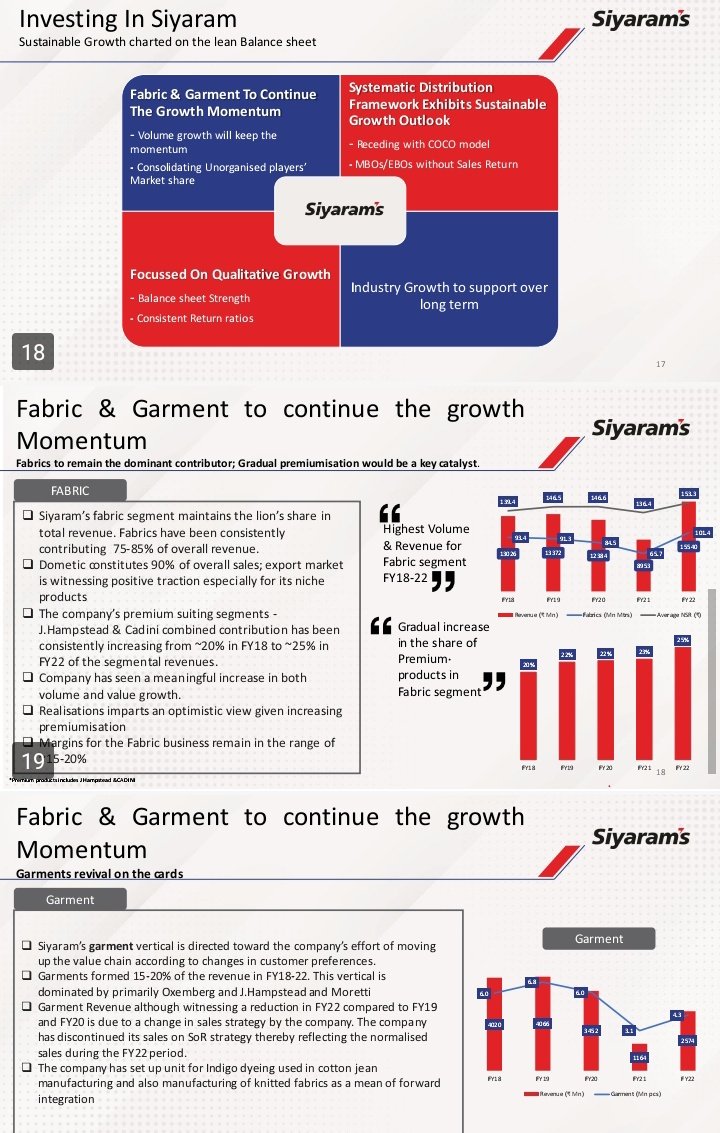

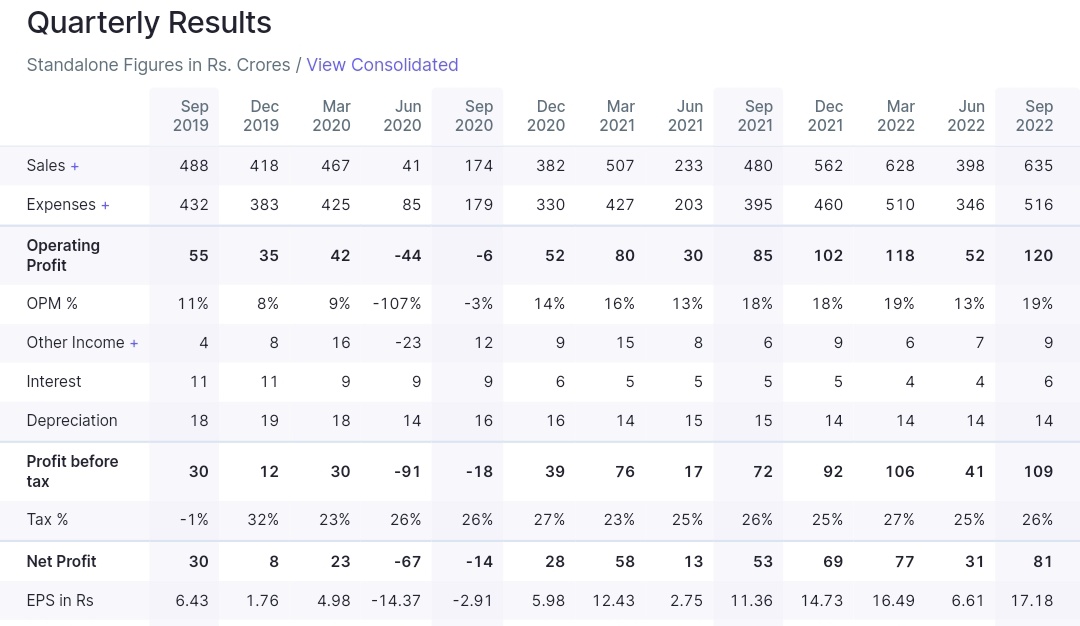

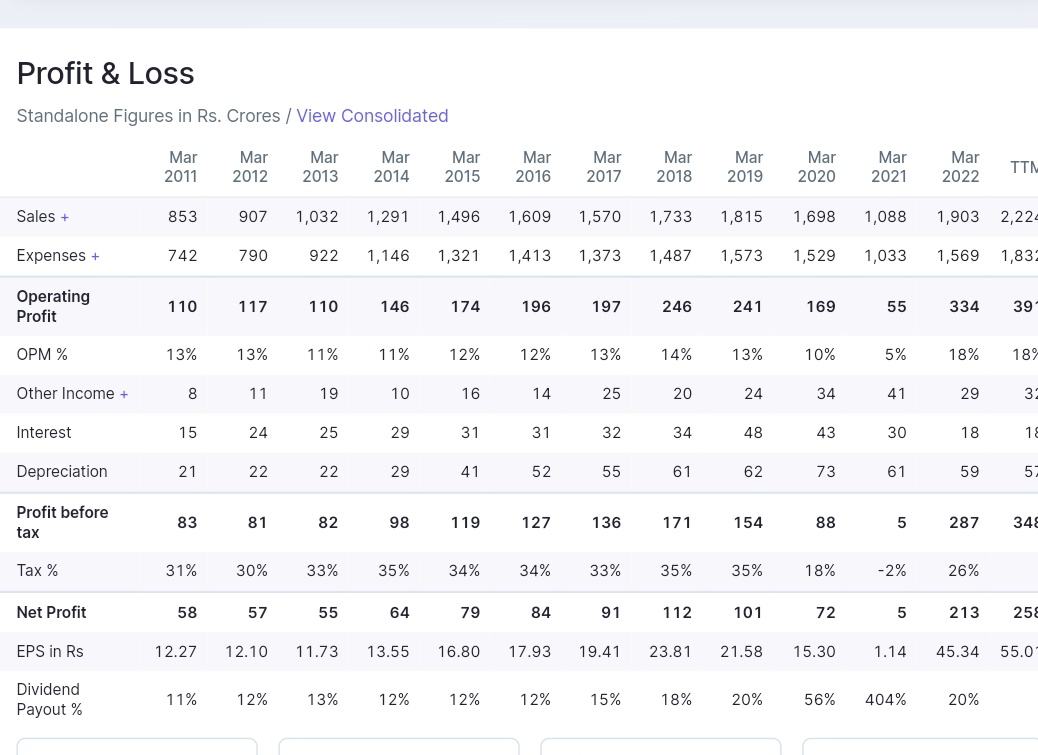

Rs 1033 Cr(Rs 308 Cr+ Rs 635 Cr). Lets assume that company does maintains Rs 600+ Cr Sales for Q3+Q4 too then on expected lines Siyaram Silk Sales can be at Rs 2233 Cr for FY23

✅Net Profits of Q1+Q2 has been at Rs 112 Cr. Lets assume that Siyaram Silk does pull offs

✅Net Profits of Q1+Q2 has been at Rs 112 Cr. Lets assume that Siyaram Silk does pull offs

Rs 75 Cr Net Profits for Q3 and Q4 too. So, NP of FY23 can be at Rs 262 Cr. As a investor we've to be optimistic with the company in which we're investing and we've to assume that company can do this much amount of Sales and Net Profits.

✅So, if Siyaram Silk is able to do

✅So, if Siyaram Silk is able to do

Rs 2200 Cr Sales and Rs 260+ Cr Net Profits for FY23 it means that it means that Siyaram Silk Forward EPS will be at 56 and it is currently available at a forward PE Ratio of 9.25

✅If Siyaram Silk acheives said Sales and Net Profits target 🎯🎯 then it will be its highest ever

✅If Siyaram Silk acheives said Sales and Net Profits target 🎯🎯 then it will be its highest ever

Sales and Net Profits in a Financial Year.

✅Siyaram Silk was Trading at Rs 799+ levels. This peak came in Q3-Q4 of FY18

✅Mentioning one thing Siyaram Silk Sales of FY18 was only at Rs 1733 Cr and Net Profits was at Rs 112 Cr. It means that at that point of time it was trading

✅Siyaram Silk was Trading at Rs 799+ levels. This peak came in Q3-Q4 of FY18

✅Mentioning one thing Siyaram Silk Sales of FY18 was only at Rs 1733 Cr and Net Profits was at Rs 112 Cr. It means that at that point of time it was trading

at 24-25 PE Ratio.

✅If Siyaram Silk does Business for next quarters efficiently and effectively and acheives the said Revenue Target of Rs 2200 Cr then it means that its Rev will increase by 27%💹💹 from 2018 Levels

✅If Siyaram Silk acheives said Net Profits target

✅If Siyaram Silk does Business for next quarters efficiently and effectively and acheives the said Revenue Target of Rs 2200 Cr then it means that its Rev will increase by 27%💹💹 from 2018 Levels

✅If Siyaram Silk acheives said Net Profits target

Then its Net Profits will increase by 132%💹💹 from 2018 levels and its EPS will increase from Rs 23.81 to Rs 55-56

✅There's a clear valuations Gap in this stock if market rewards it with 15-16 PE Ratio then it can break its ATH. At 15 PE Ratio its price will reach at Rs 825

✅There's a clear valuations Gap in this stock if market rewards it with 15-16 PE Ratio then it can break its ATH. At 15 PE Ratio its price will reach at Rs 825

and at 16 PE Ratio its price will reach at Rs 900+.

So, here my analysis ends about Siyaram Silks👔👔👕👕 I've presented all the facts about this company. Don't jump and Buy due your own analysis properly. I'll not responsible for your profits or loss. If you liked this analysis

So, here my analysis ends about Siyaram Silks👔👔👕👕 I've presented all the facts about this company. Don't jump and Buy due your own analysis properly. I'll not responsible for your profits or loss. If you liked this analysis

Please try to retweet♻️♻️ it. It took me 6 Hours to make this report in details.

Loading suggestions...